In this week’s edition of Option Flows, Tony Stewart is commenting on the very active holiday season, and what to expect from here.

Cliche, but was today the calm before the storm?

After such an active holiday season, yesterday’s strong rally, vol squeeze, and exit unwind of the BTC Jun65k+Jun85k Calls; today saw a couple technical trades, but otherwise a relaxation in Spot, Vol and funding.

BTC

2) BTC+ETH flows have consistently observed bullish Call (+spreads) ahead of next week’s ETF decision.

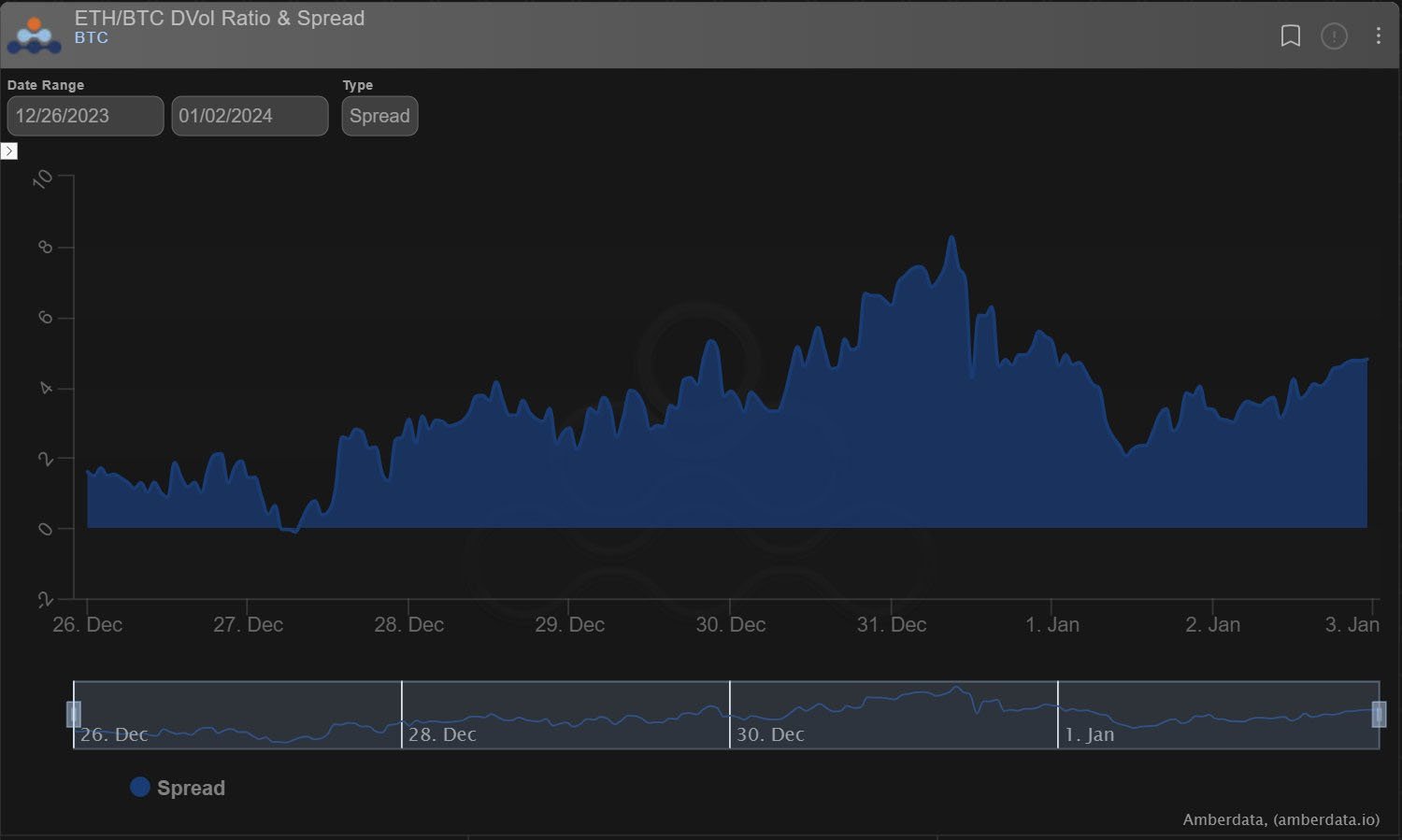

IV has been pushed higher on the expectation and risk management of the event, widening the IV-RV premium.

3) Some end-of-year selling of Delta occurred but was swallowed up by a large spot buyer.

Likewise, the Jun 65k+85k Call longs that signaled such optimism unloaded most if not all of the remaining position, $125k+ net vega, but other than impacting far upside had little impact.

4) Today, only an opportunistic BTC Mar60, Jun70k Call calendar buyer of the Jun took advantage of depressed far OTM Jun upside Skew (Jun65+85k seller)…and a Jan26 54-60k 1×2 Call spread bought OTM convexity.

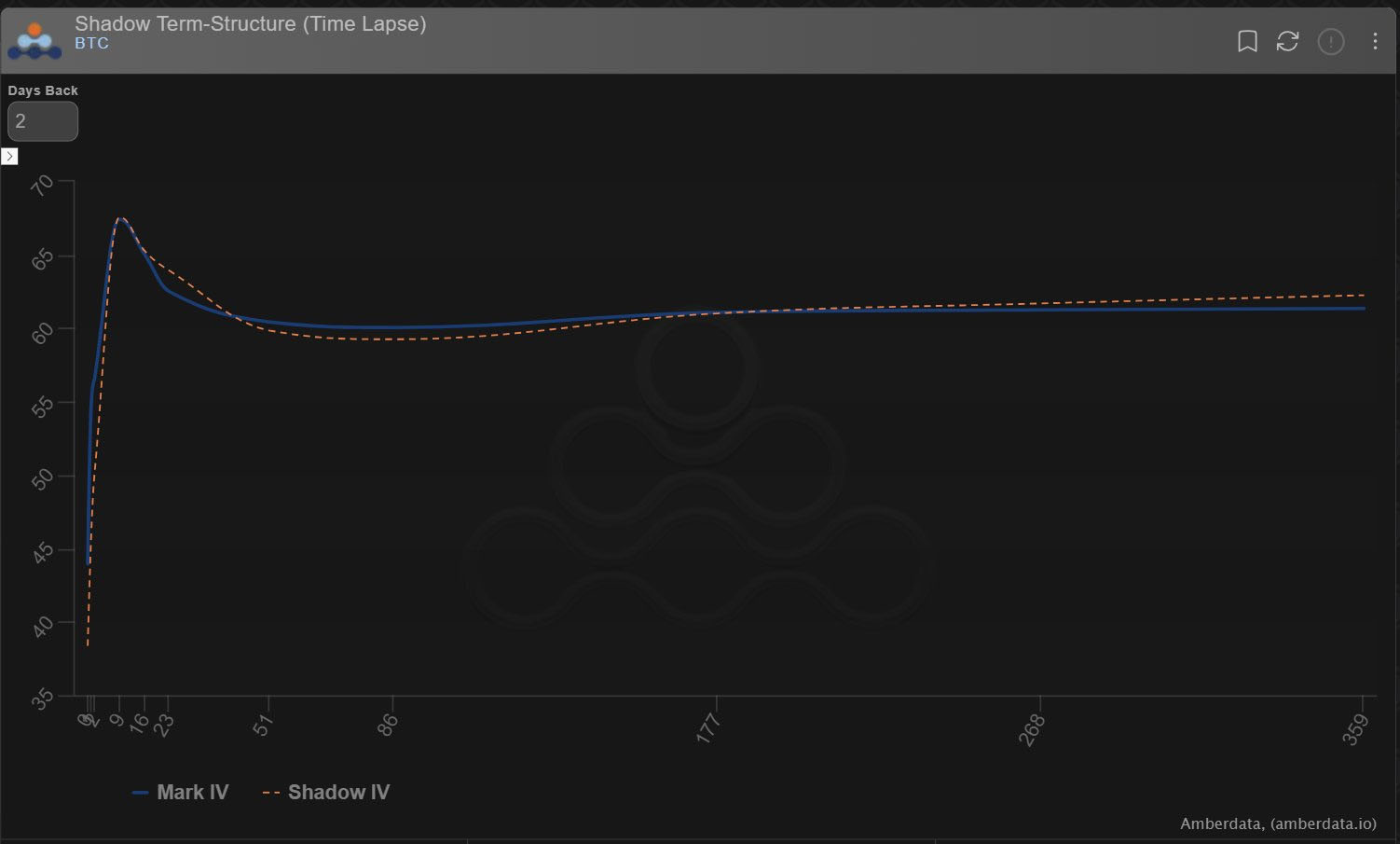

IV drifted.

NB BTC focus, but BTC Dvol discount to ETH: 64% cf 69%.

View Twitter thread.

AUTHOR(S)