In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Mixed Fast-Money and near-dated Fund flows as Oct 70k Calls added, but Oct 57-67k RR initiated hedging.

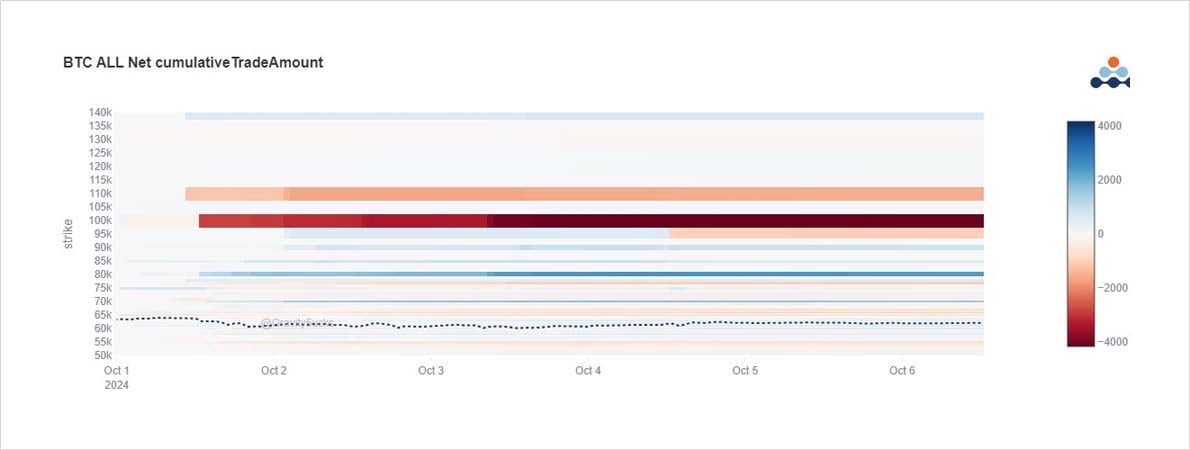

Significant volumes were observed with post-election Nov-Mar restructuring and bullish exposure; the most prominent being a sale of a chunk of Dec 100k OI to Dec 80k Calls.

2) Chart shows ~4k Dec 100k Calls moved to a smaller amount of Dec 80ks, with additional Dec 90+95k Calls, some moved to the 75k Strike. Some Nov 78k Calls were funded by selling Mar 110-140k Call spreads, some Dec 90+95k Calls bought funded by Mar 100-110k Calls. Mar 90ks added.

3) This complicated movement of Dec+Mar upside essentially continued to keep a bullish post-election bias but illustrated a more conservative expression than on previous occasions, with an increased recent use of strategies rather than all-in OTM Call sweeps. Thus Dvol moderated.

View Twitter thread.

AUTHOR(S)