In this week’s edition of Option Flows, Tony Stewart is commenting on the latest market movement including the latest D1 volatility.

April 27

Conspicuous huge D1 volatility but disproportionate Options activity. Large Funds forced to deal with former as a priority.

Initially, Apr+May 30-32k Calls bot on the rally.

Then nr 30k, Put Skew bought via Jun 27-33 RR.

Later alerts, D1 Fund sells+liqs.

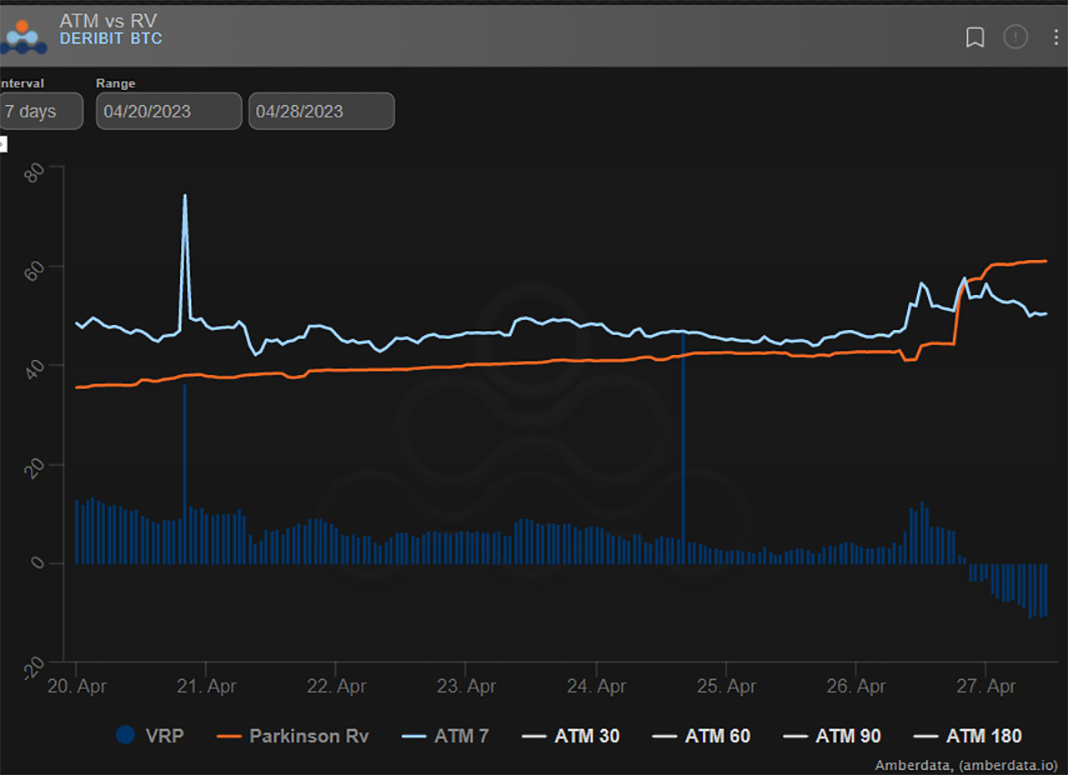

RV>IV.

Missed opps.

2) While the European session was sane, the US session became deranged as alert rumors circulated of US govt selling compounding an active seller into accelerating liqs.

With Spot ranging >>10%, IV should have surged, but very little Options flow created only a feeble response.

3)

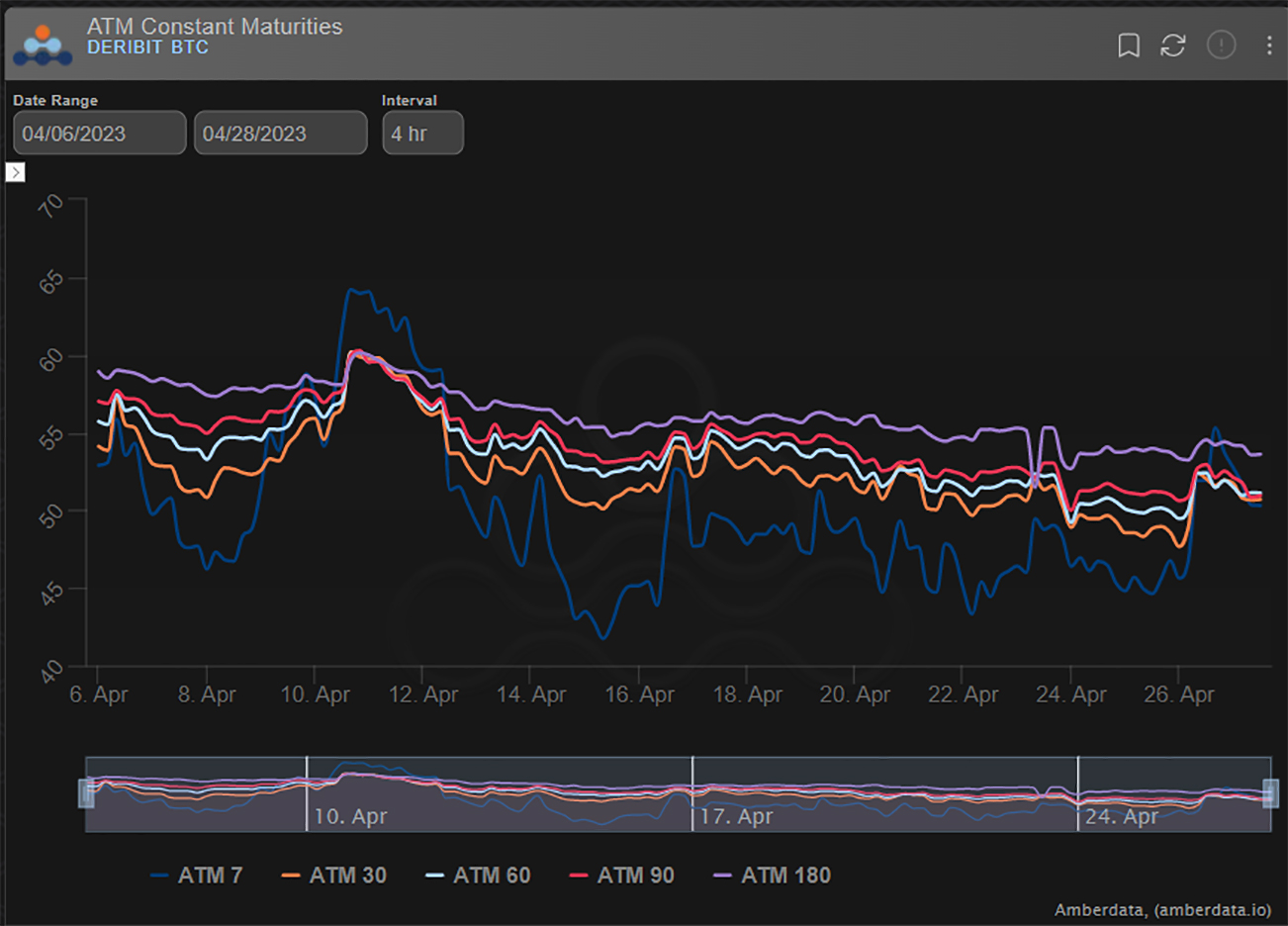

Only sub-2week expiries reacted measurably as retail adjusted and MMs dealt with Apr28 Strike risk.

Barely anything traded >1month expiry, given the large underlying move.

Huge opportunities were missed to accumulate Gamma for the day as Spot 29k-30k-27k-29k with BTC vol <55%.

View Twitter thread.

AUTHOR(S)