In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

CPI produced a sharp upward move and Call buyers before JPow hardened the line and bearish narratives pushed Crypto lower again.

Calls unwound, Dec 60k-100k RR added hedge, Fast money bought Puts and Spot broke <65k/3.4k.

Then ETH ETF timeline optimism! 3.5-3.7k Calls lifted.

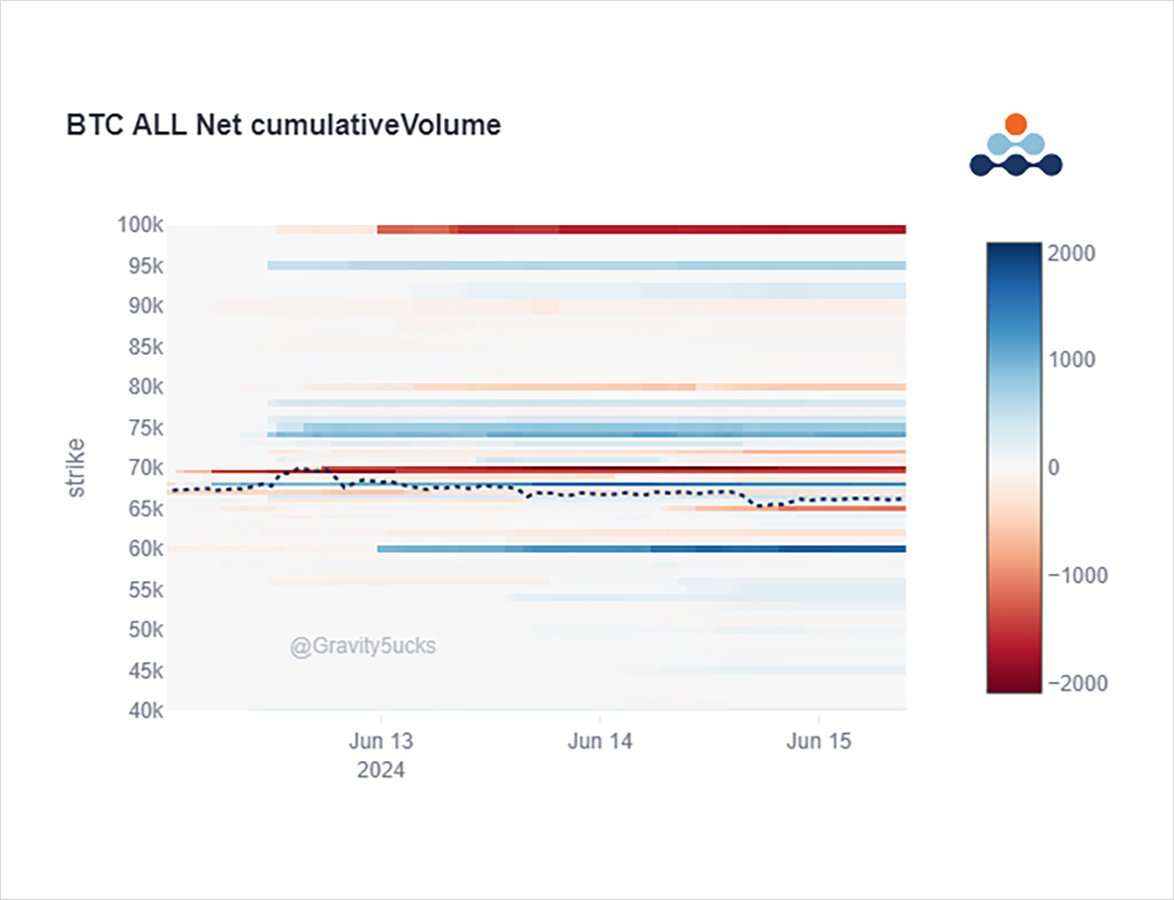

2) On the CPI bounce, buyers of Jun 70k+, Jul 74k & Dec 95k Calls added exposure, but the move to 70k was brief.

A sharp retrace led some Call holders to unwind, even some mid-term holds such as Sep 100ks.

100k Calls in Dec also sold via a Dec 60-100k RR.

July Calls over-written.

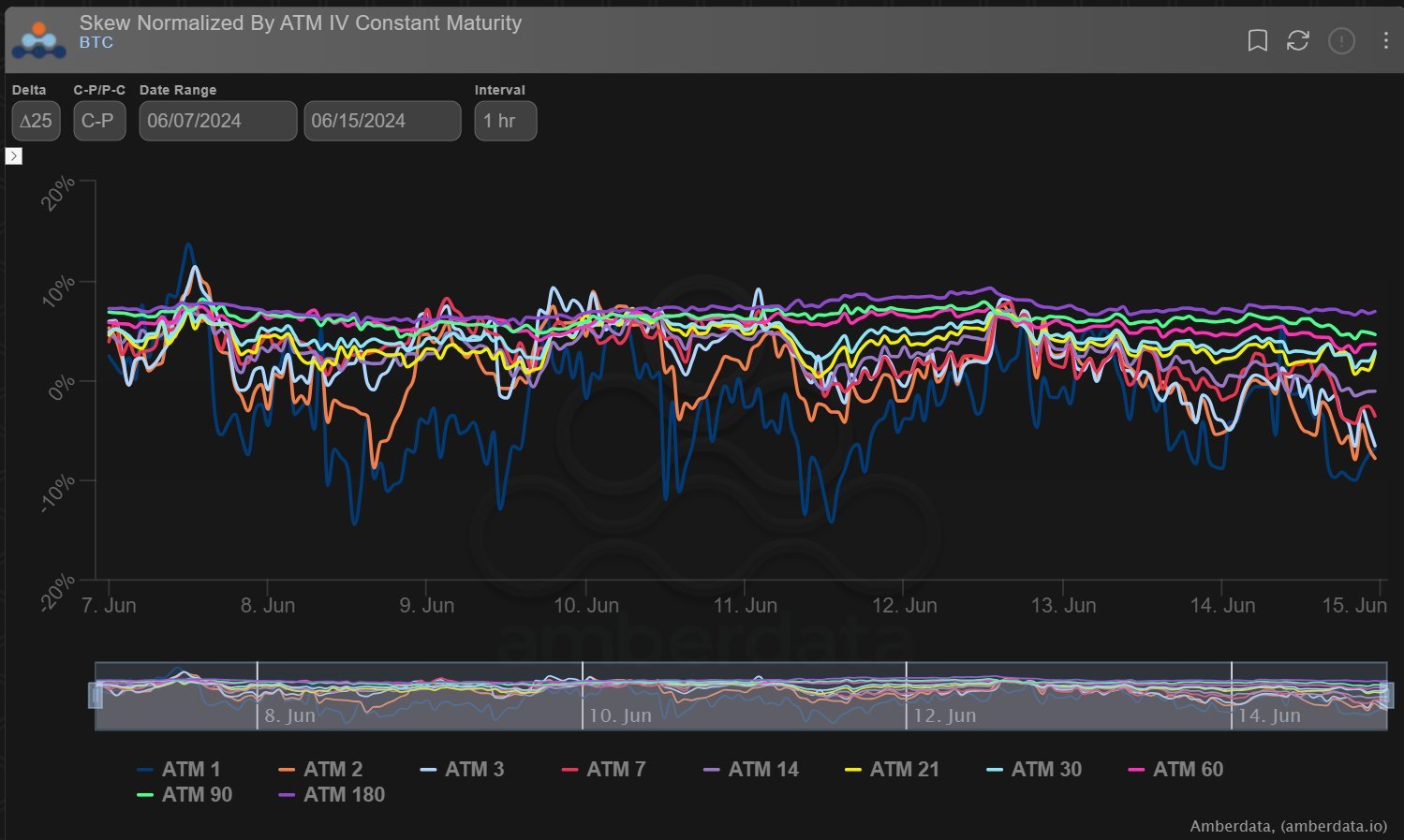

3) So much selling of Calls (and some buying of Puts) dampened Call Skew, and in addition with the upcoming weekend lowered Vols.

BTC Dvol reached 48%, ETH 58%.

2week ATM touched 42%, and 52%, which fell below realized.

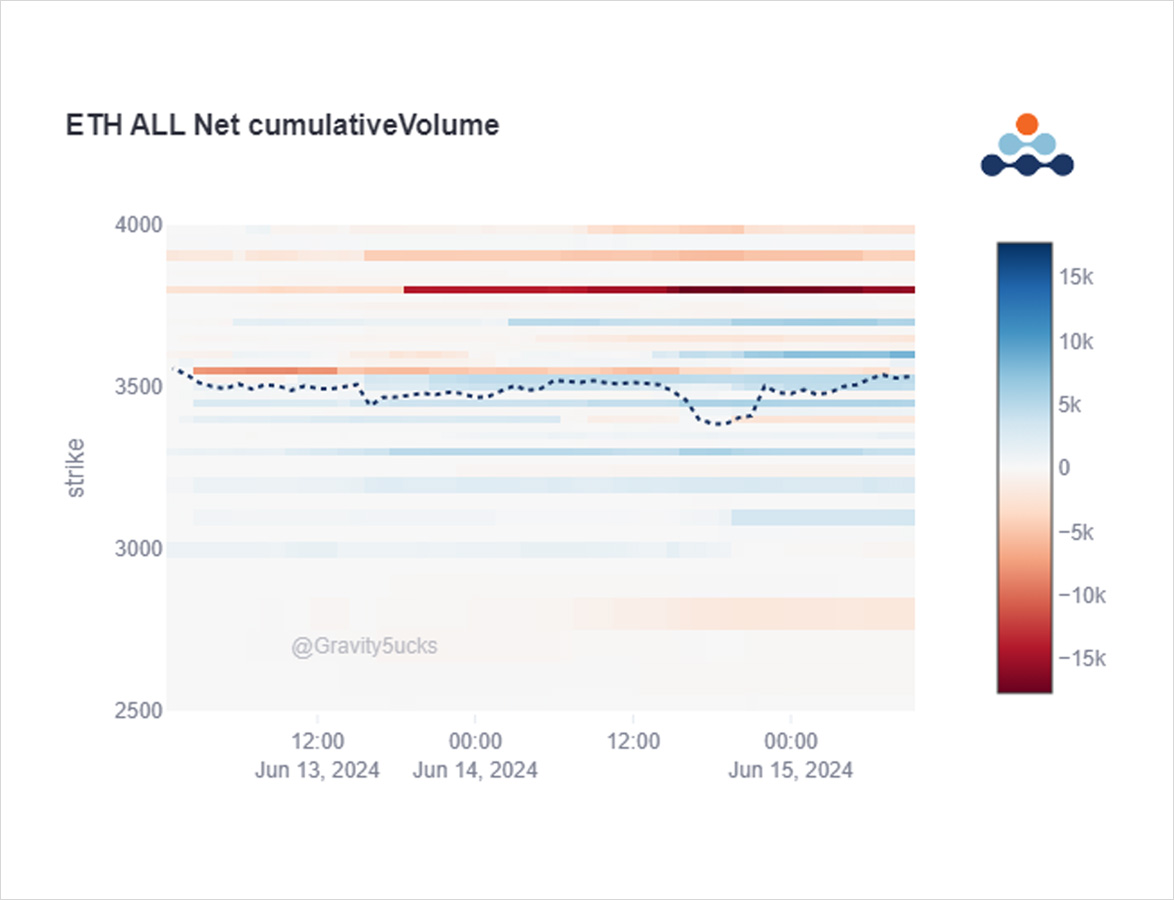

4) But then as US markets closed and the weekend set in, respected parties gave evidence of promising news relating to S1 ETH ETF approvals, bringing the timeline closer with greater certainty.

ETH immediately bounced from 3360 low.

Those quick enough bought Jun21 3.5-3.7k Calls.

5) The opportunity was perfect to buy Calls, with Spot on the low, Short positions, Call Skew being hit, and Implied Vol depressed below Realized Vol.

Short-term Vol +Dvol bounced back, as did Spot up to 3550, and 3525 as I write.

Next week we will observe if this is sustained.

View Twitter thread.

AUTHOR(S)