In this week’s edition of Option Flows, Tony Stewart is commenting on the market movements after days with CPI, FED Minutes, and ETH Unlock.

April 13

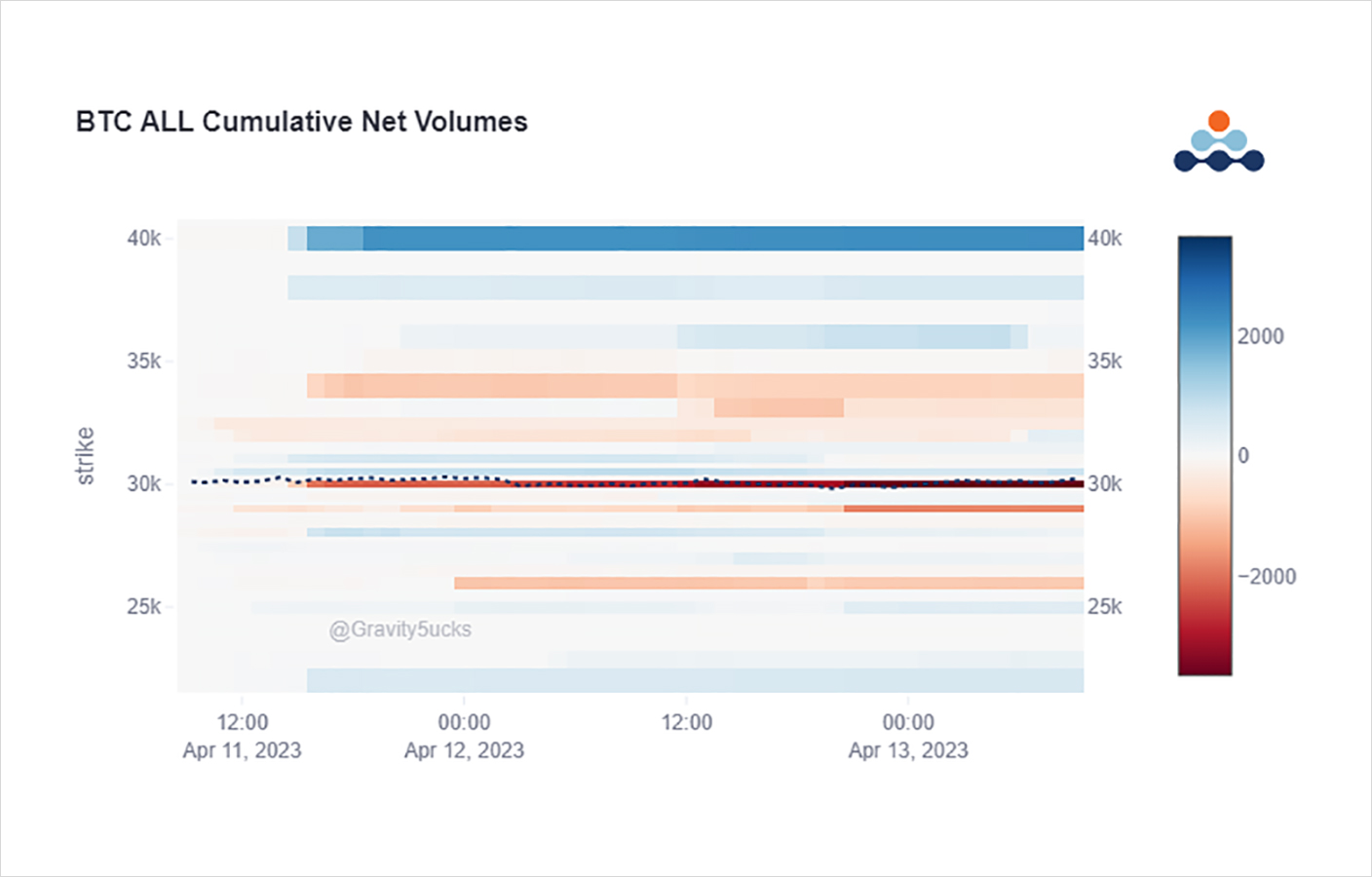

T-1 days pre-CPI/FEDminutes/ETHunlock, large derisking BTC via Apr28 28-34 RR bot Put x1k, May 30-40k Call Spread sold 1.5k, Jun29k Calls sold, Apr25k Puts bot, but opposing (but smaller) buying of ETH Calls.

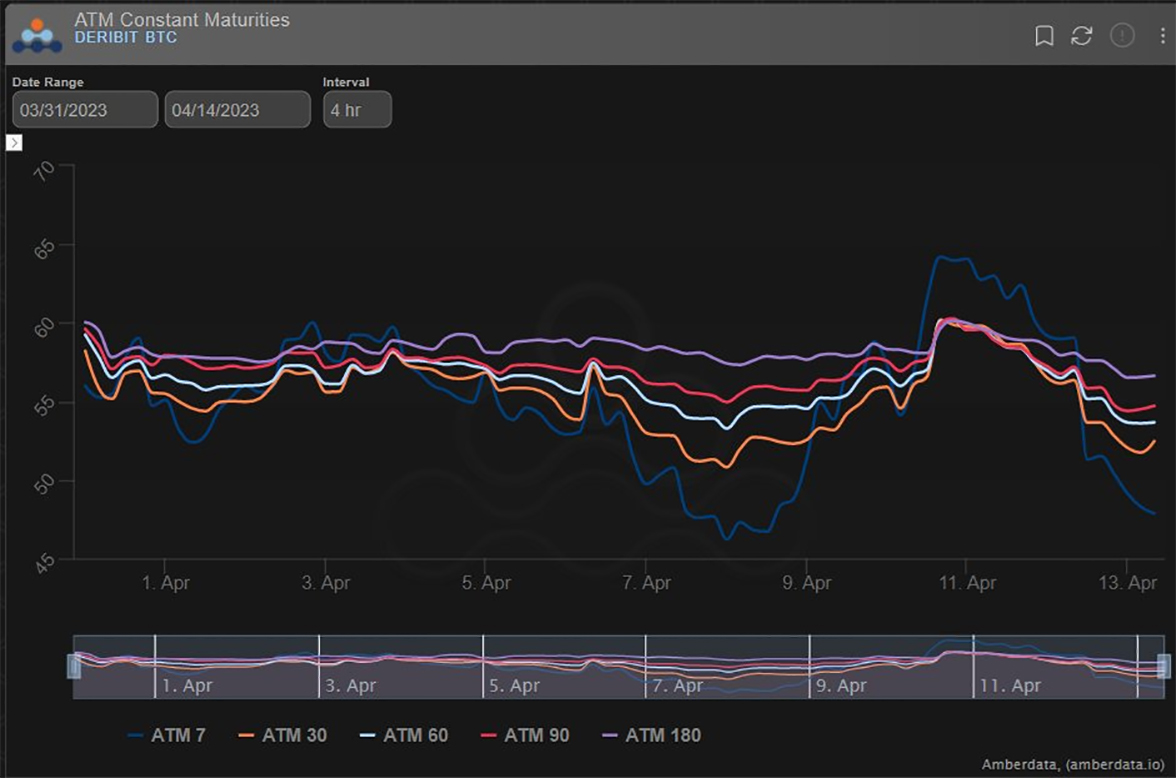

T=0, Fund+MM dumping Vol pre-events in May-Sep.

T+1 day, Add-risk?

2) While Spot tested 30.5k again, large sellers of Spot dumped into buying, and unwinds of Risk + Hedging AUM was employed pre-event uncertainty.

Further exit of Vol, but with some Wing Convexity added was the big picture.

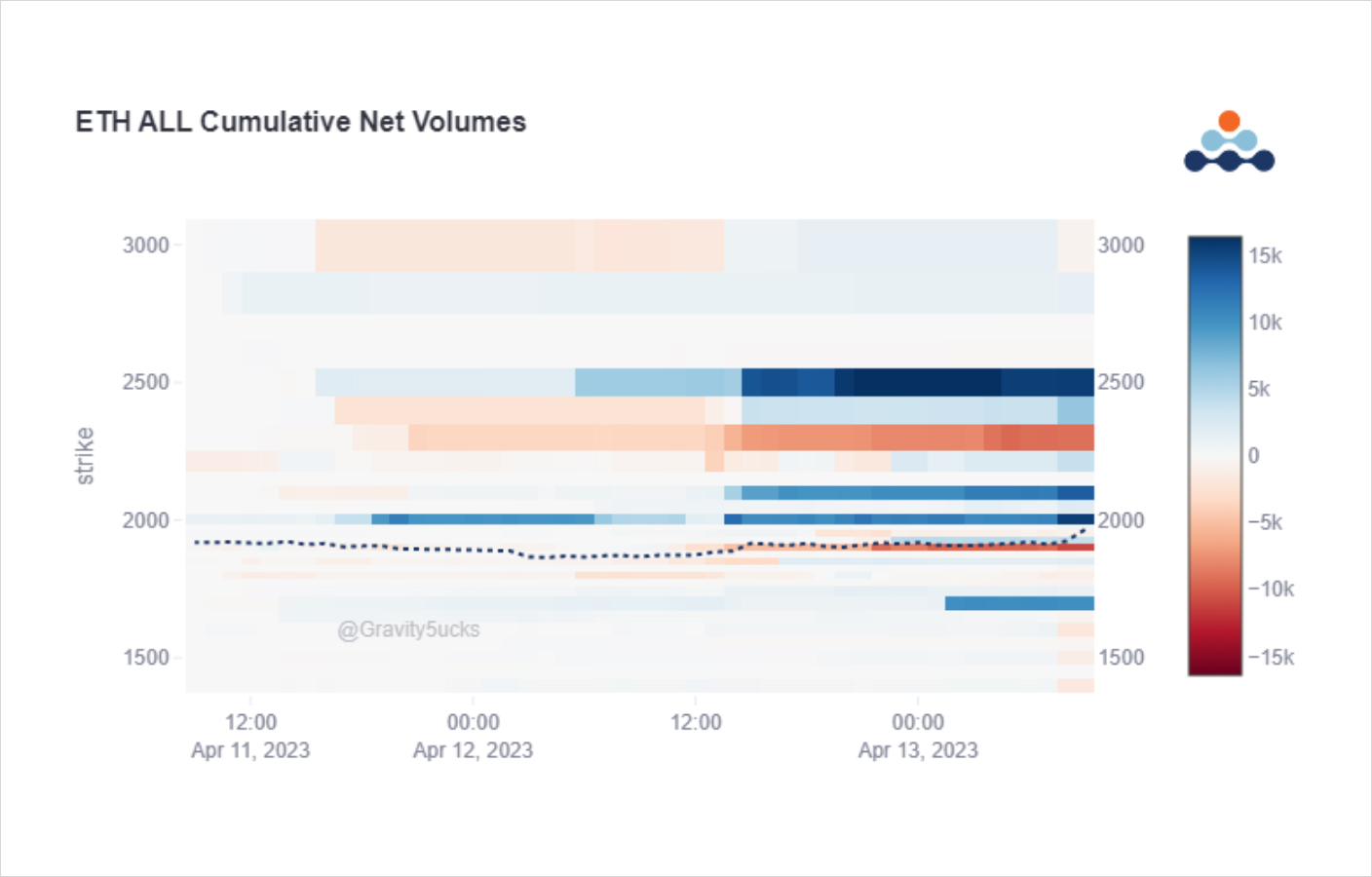

3) Meanwhile in ETH, IV also suffered from CPI non-event, but Option flows were more constructive, some to Hedge, but more to buy upside ATM+OTM Call zones.

4) ETH/BTC DVOL bouncing from lows on the back of this, but still low (6% ETH>BTC) in absolute values due to the recent BTC outperformance.

The question now is which has a more impactful narrative.

5) Another question to ask now, is that with CPI+FED minutes benign, and ETH transition without incident, will we see the risk via Spot + Calls (at this lower IV) added back.

BTC 30.5 and ETH 2k are within touching distance.

View Twitter thread.

AUTHOR(S)