In this week’s edition of Option Flows, Tony Stewart is commenting on the sudden change of the market caused by the latest Grayscale vs SEC news.

August 30

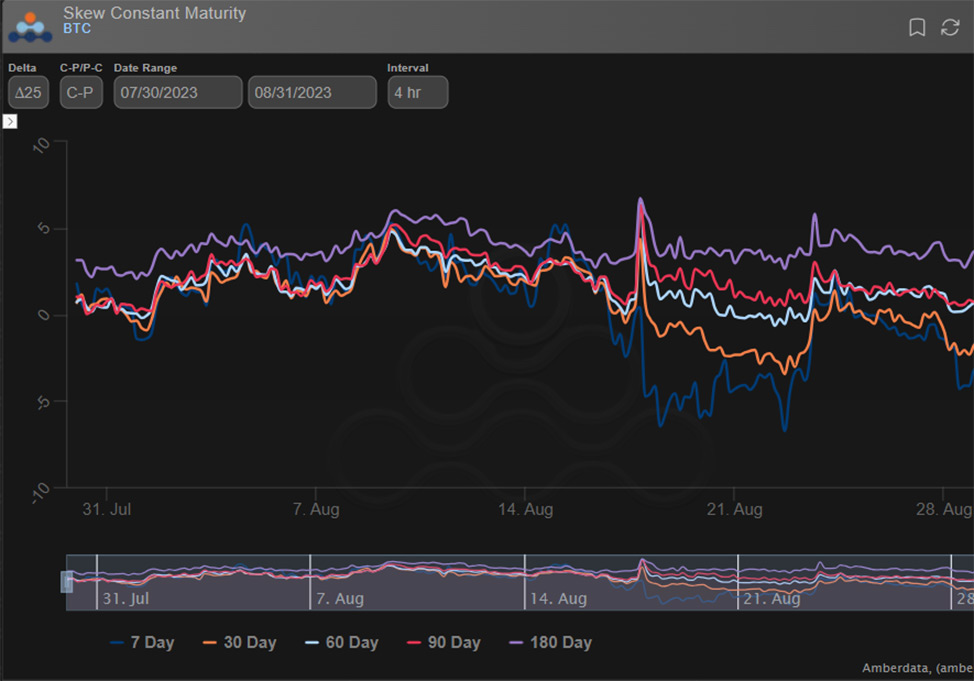

The last report was filled with mixed flow signals.

Buyers Sep1 out to Nov, Dec, & Jun ATM Calls outweighing conspicuous hedging+downside plays.

The downside plays accumulated and more Calls were offered on DSOB for yield.

Then the Grayscale-SEC news and everything changed.

2) A subtle but large covering of ETH 2k Calls over the last few days has been the only trade of note prior to yesterday, but it became significant.

Otherwise, market sentiment was feeling bereft of energy, with Put spread(+collars), downside Puts on BTC accumulated, Calls sold.

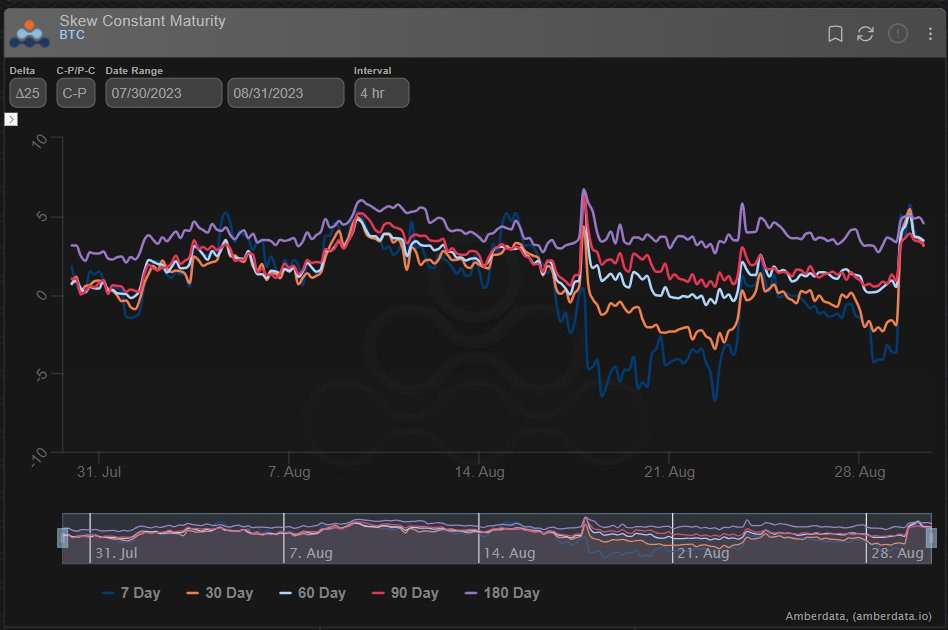

3) Release of the Grayscale victory vs SEC news powerfully polarized flow to the upside.

1k of Oct 28k+Nov 30k Calls offered in the order book at that moment got snapped up at ~40vol before the offers could pull as Spot surged.

An unfilled bid on 1k Gamma Calls was left behind.

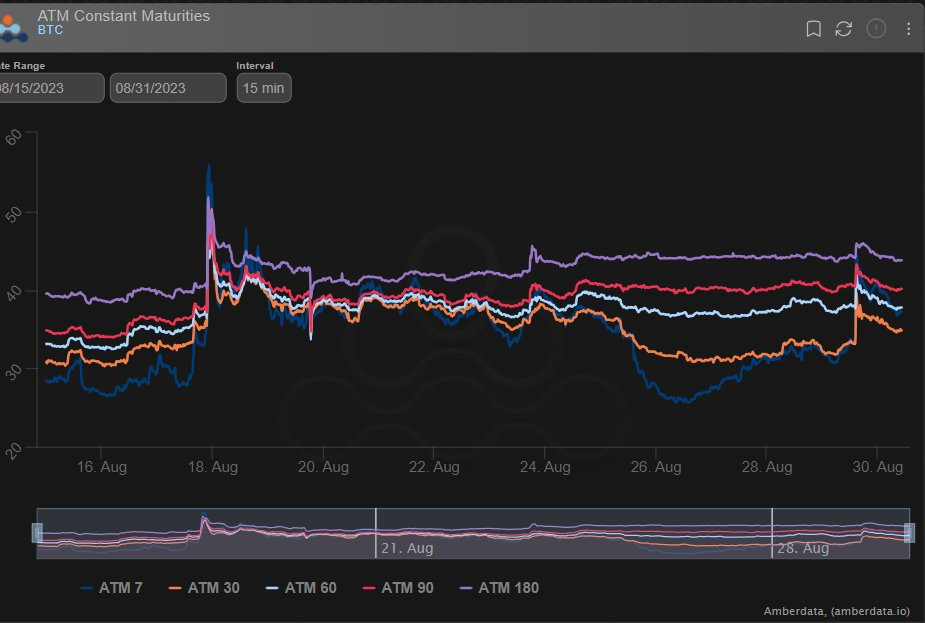

4) Scrambling for Gamma on ETH Sep 1.9+2k Calls to cover what MMs had sold, and Fast money buying of Sep-Oct 28-31k Calls (+spreads), with a Fund following up buying Gamma in the Sep28+29k Calls, led to a near-date pump in IV while Spot rallied to 28150.

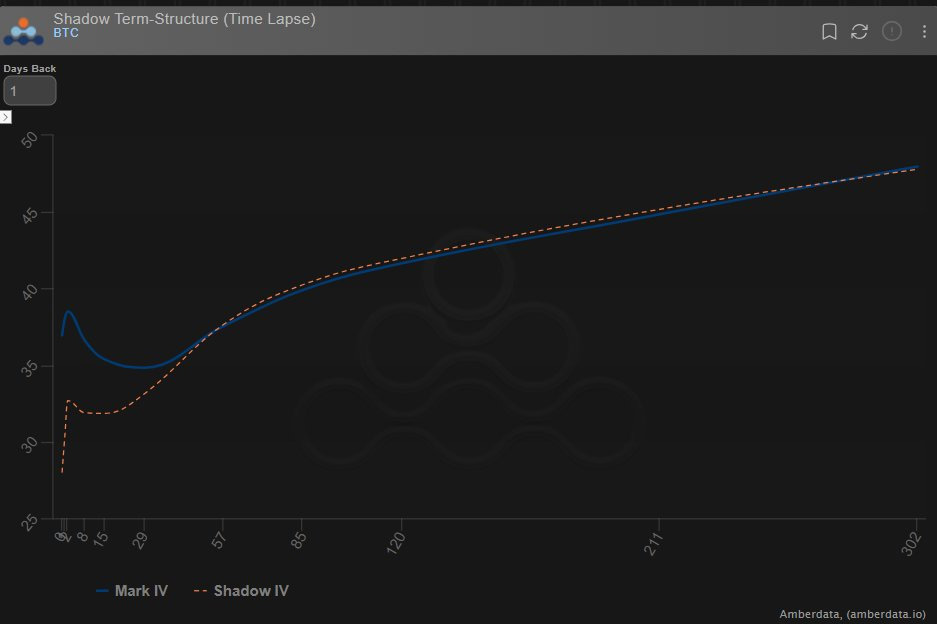

5) Initially 60-120dte IV followed (but lagged) the Gamma buying, as actual demand was fully focussed in the <60dte maturities.

At most Dec strike vol, as a proxy, was no more than 3vols higher on the day.

Spot having retraced & momentum purged, 30dte+ IV has fallen <yesterdays.

View Twitter thread.

AUTHOR(S)