In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

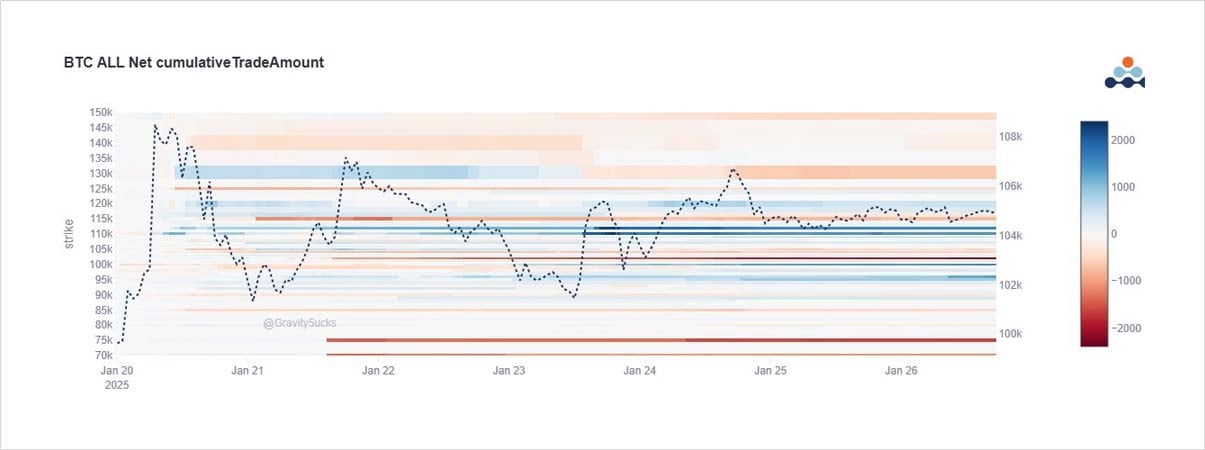

This became a week of expectations v reality.

The inauguration out-of-the-way, no SBR mentioned.

Impatience set in, manifested by Vol selling (via Feb+Mar Puts and Calls).

Lummis teased, Jan 110k+ Calls manically lifted, Trump EO.

Only to disappoint: Calls purged, Puts lifted.

2) Feb 70+75k Puts dumped.

Additional Vega sold via Mar 110-130k Calls + ATM Strangles.

Short-term Bulls betted on Jan105-115k Calls, accelerated and squeezed shorts on Lummis tease+ EO expectations.

But SBR turned out to be investigative.

Calls purged. Jan+Feb 95+100k Put buys.

3) Observe the impact of Option flows on the Implied Vol chart. Note the IV drift when the crypto community’s patience was running thin, options were decaying and nothing said.

Then the 23rd Jan spike, on Lummis+Trump EO, lifting Jan 110k+ Calls and against the flow Jun140k Call.

4) A similar pattern can be seen on the Skew charts.

The Call buying shifting Call Skew higher on the 23rd.

Then not only Calls sold, but Jan+Feb 95+100k Puts bought on the 23rd+24th, flipping short-dated Skew back.

Despite the change in Option flow sentiment, Spot holds at 105k.

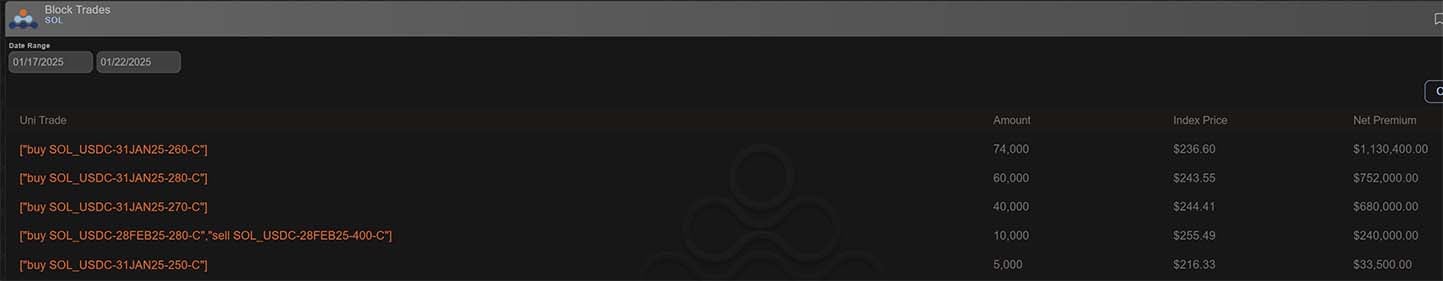

5) SOL had its week, even dominating ETH flows in terms of conspicuous and outsized trades.

Well-timed large buying of SOL 250-300 Strike Calls were blocked and bought on DSOB when Spot was trading 235-245 early in the week, before pushing highs mid-week on related news.

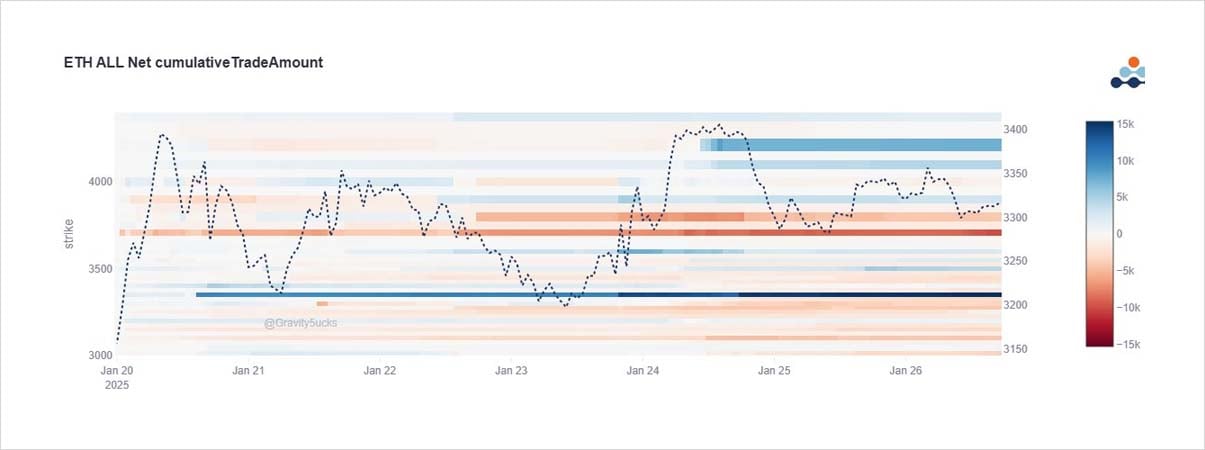

6) ETH saw limited flows despite large fluctuations in sympathy with BTC, but also ETH foundation news releases.

Most Option flows were dominated by Call selling in Jan 3.7-4k Strikes, and some protection via risk-reversals in Feb+Mar 3.3k Puts bought.

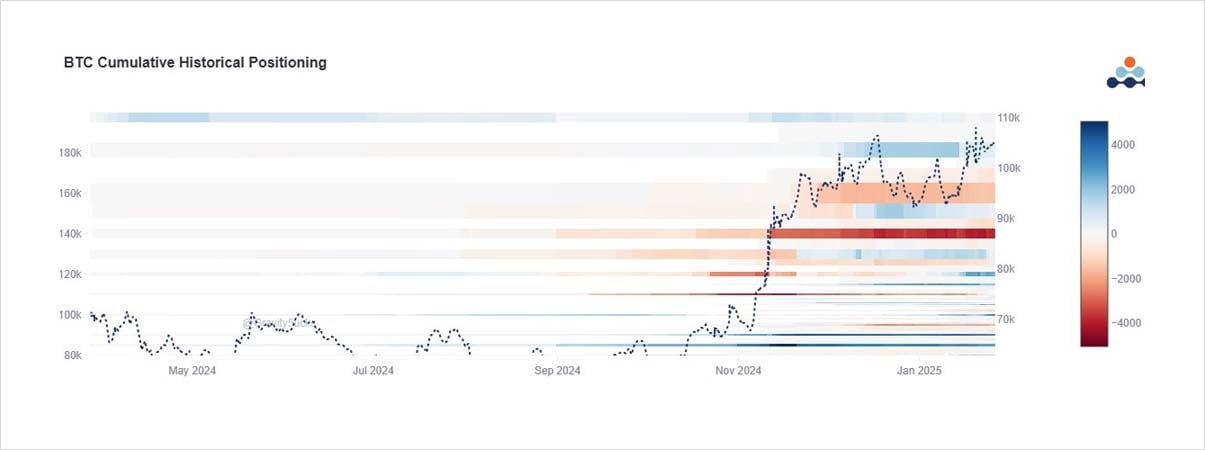

7) Back to BTC historical positioning, there has been a ramp-up of OI since the election, particularly on the upside.

This week’s realization has lightened the blue long Calls. (Much of the upside red shorts are part of Call spreads.)

Upside acceleration is less clear in timing.

8) Attaching the correct historical BTC positioning.

View X thread.

AUTHOR(S)