In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Trump’s bond-market-crisis fueled tariff-walkback flipped the vocal narrative from aggression to capitulation, and the markets from capitulation to aggressive bounce.

Protective/Bear play BTC 75-78k Puts were dumped, and 85-100k Calls were lifted as BTC surged from 75-85k.

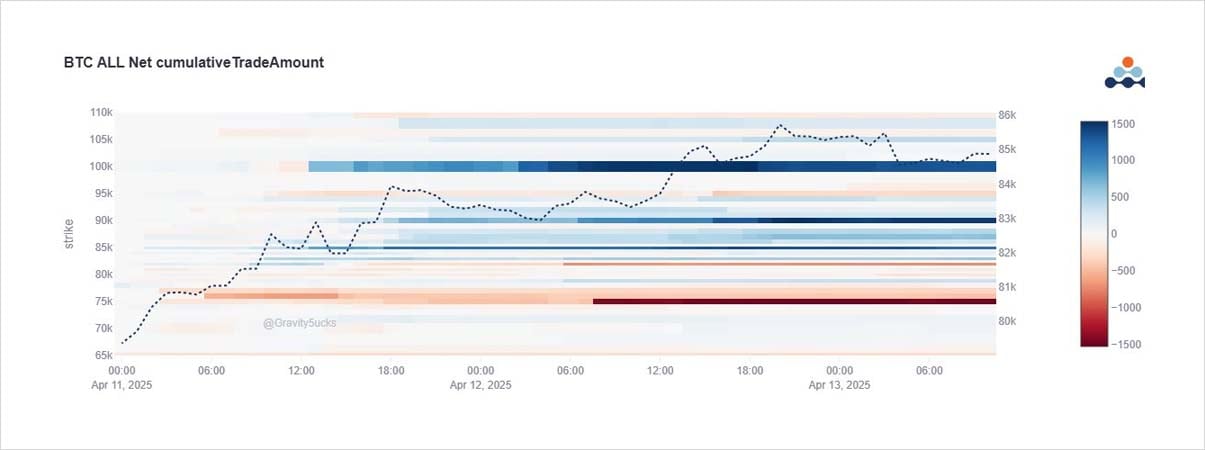

2) This data-picture is clear.

Red dumping of 75-78k Puts, and flipped narrative to buying of 85-100k Strike Calls.

Within the picture there was a fair amount of 2-way business as initially short Calls were covered and continued rotation in the May+June buckets (downside+upside).

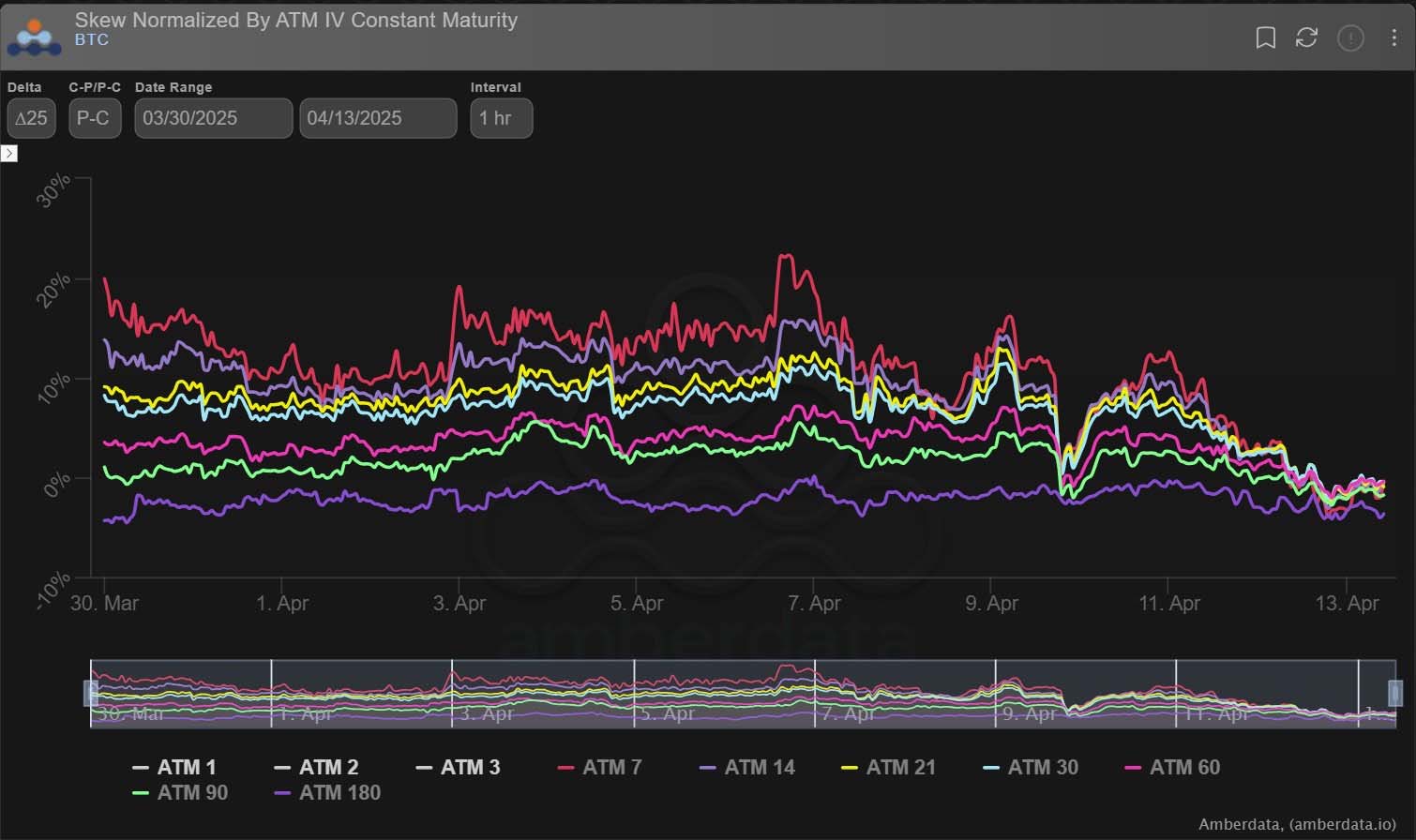

3) With Put Skew having been elevated for a period now, the Calls offered decent value into an obvious flip.

Clear buying of 85k-90k Calls in April+May and dumping of 75-78k Puts has moved the Skew back down to flat.

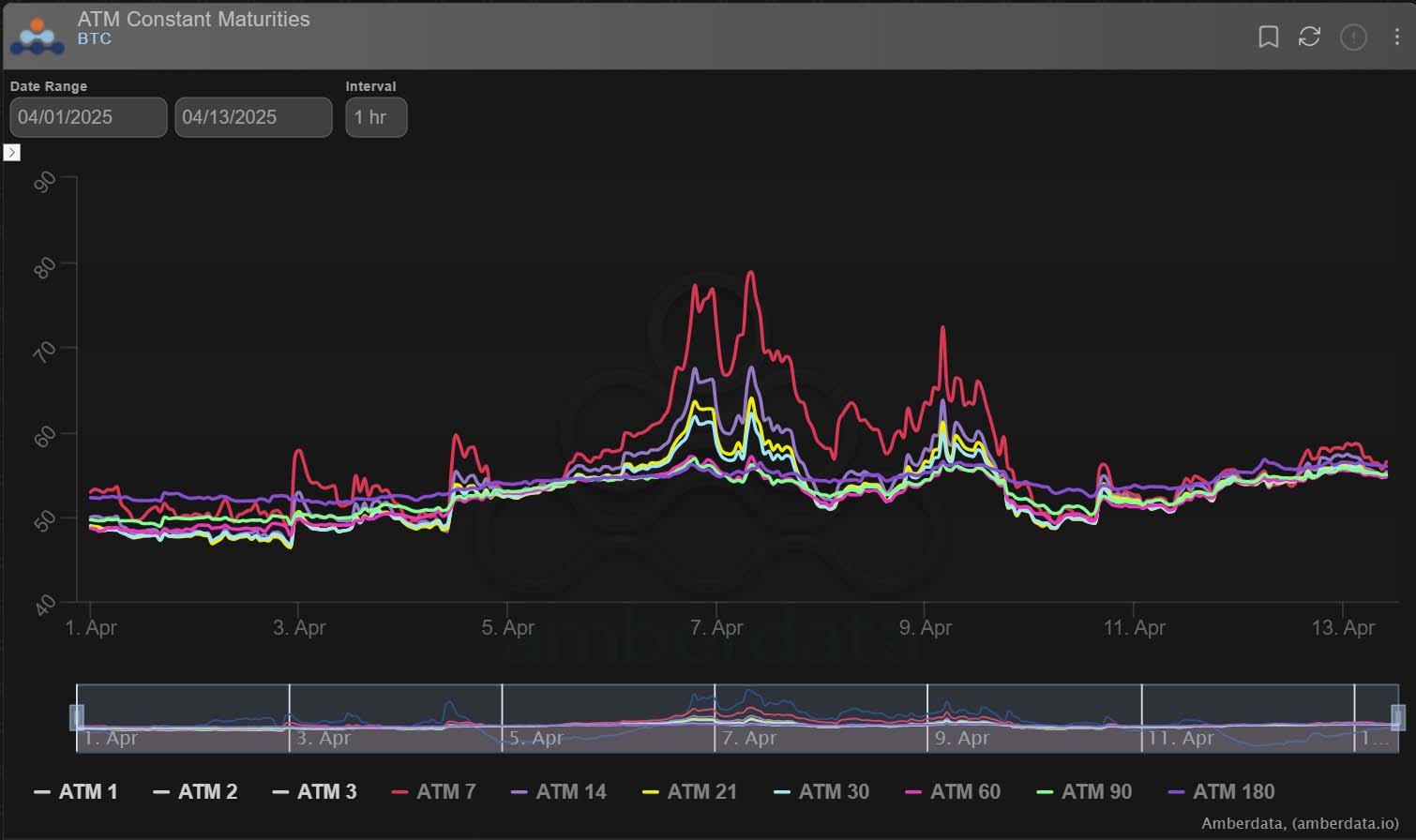

4) When markets started rallying, the immediate response was to dump optionality, as downside plays seemed off the table; DVol proxy fell back from 62% to 52% on BTC.

But S&P VIX held firm, and with RV outperforming IV on BTC, non-insular thinkers bought upside IV; Dvol now 57%.

5) But elevated VIX (still >35%) and Dvol at 57% are representative of expected continued high Realized Vol (up+down).

Within the last few days, Trump’s actions forced a strong bounce as imminent crash fear dissipated.

The market will digest the consequences, and stay responsive.

View X thread.

AUTHOR(S)