In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

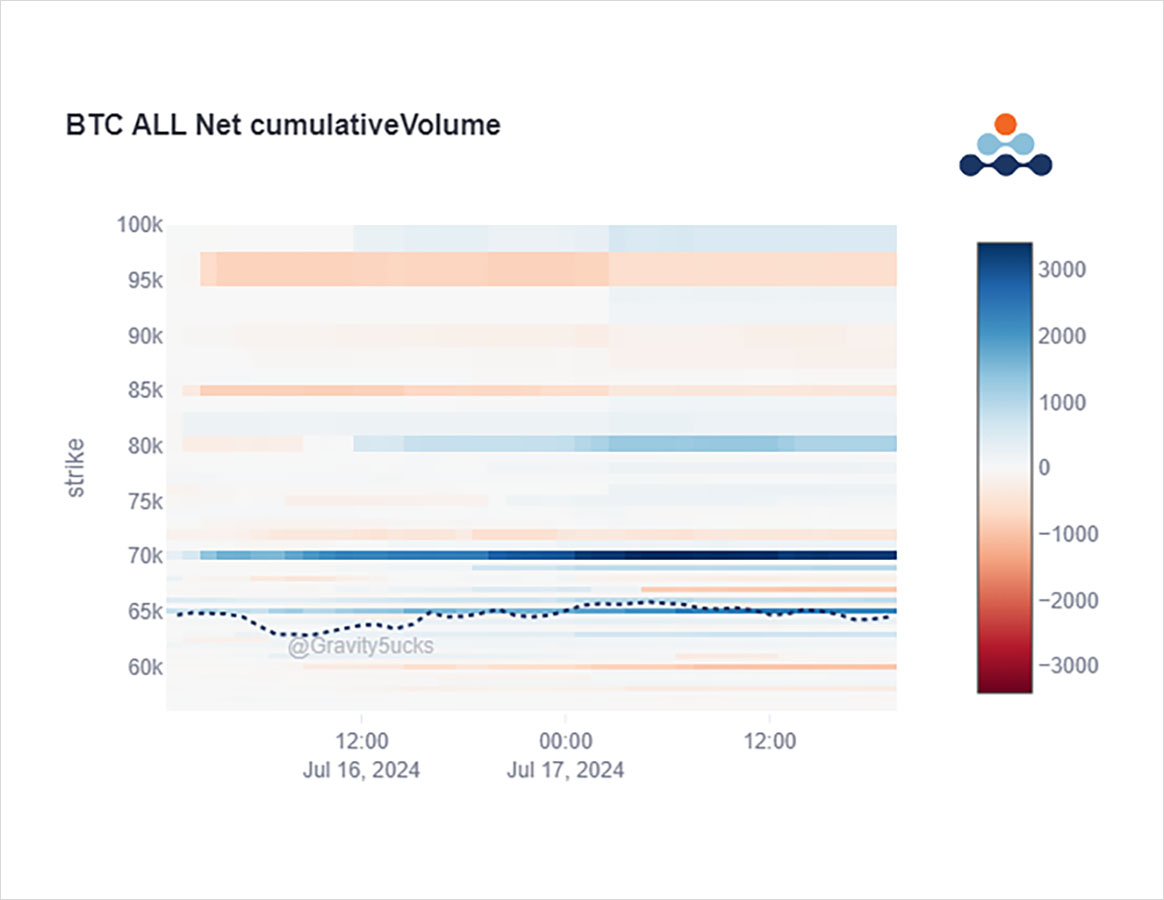

The Kraken note to Mt Gox creditors of 7-14days until BTC repayment appeared to cause one Fund to shift their Dec 85k Calls to an Aug 65k Straddle to play Gamma in either direction.

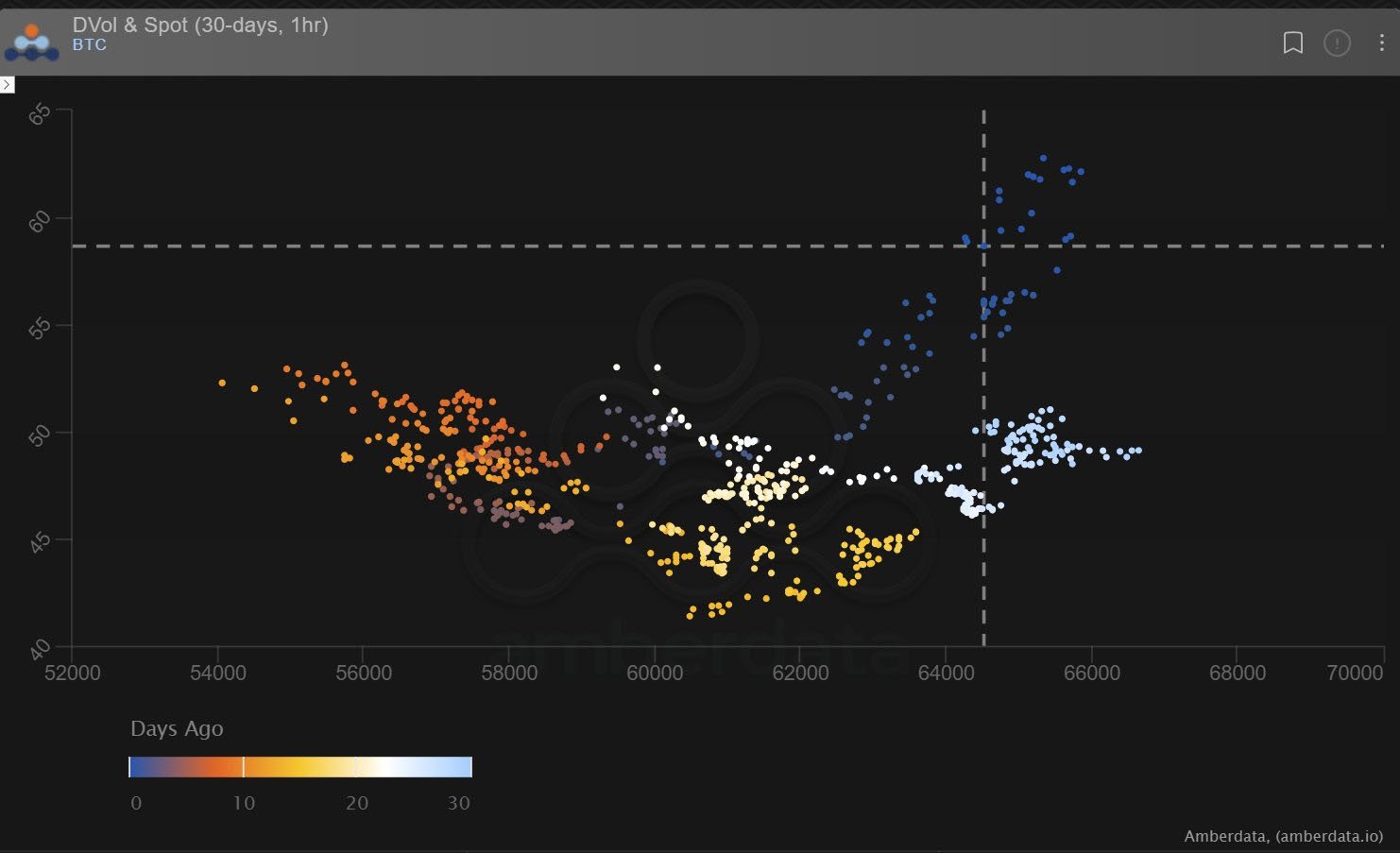

Spot after first selling off to 63k, powered-up and forced short-covering of Calls, Delta & IV.

2) Can’t be co-incidence that $4.5m was released from a sale of Dec 85k Calls, and that exact amount ploughed into the Aug 65k Straddle. Similar purchase of Aug 70k Calls funded by Dec 90k Calls too. $10m was spent on Jul+Aug 66-72k & Sep 75+80k Calls by Fast money+Funds.

Gamma!

3) This inflow of premium was a combination of underperformance FOMO, short covering & fresh exposure, after the Germain govt coins ran out and the market soared way past many expectations >66k.

IV surged higher on demand and Gamma performance.

July 67k Calls TPd at the highs.

4) ETH ETF indication of 23rd July trading also stimulated a strong rally on ETH.

Fast money bought July+Aug 3.6-4k Calls, but Funds still remain quiet, given the scale of what could be.

ETH IV also rallied, but the spread between BTC and ETH (ETH over) narrowed from 15% to 8%.

View Twitter thread.

AUTHOR(S)