In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

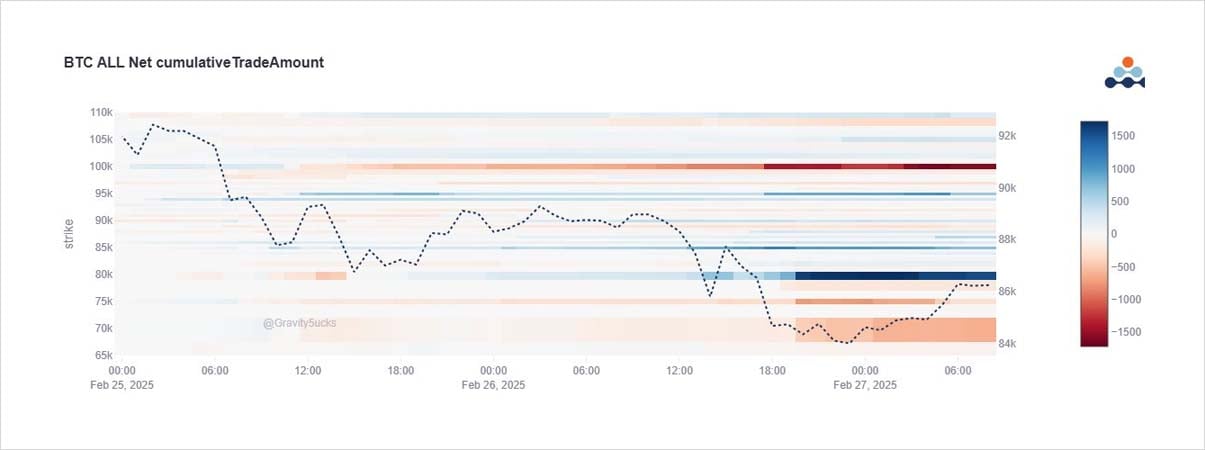

Clear aggressive Call selling on BTC Mar+April 95-100k Strikes at the start of the week, pushing IV lower.

Gamma opportunities.

Then as 88-90k was breached, decent buying of Feb+Mar 75-85k Puts, covering/protecting/bear bias.

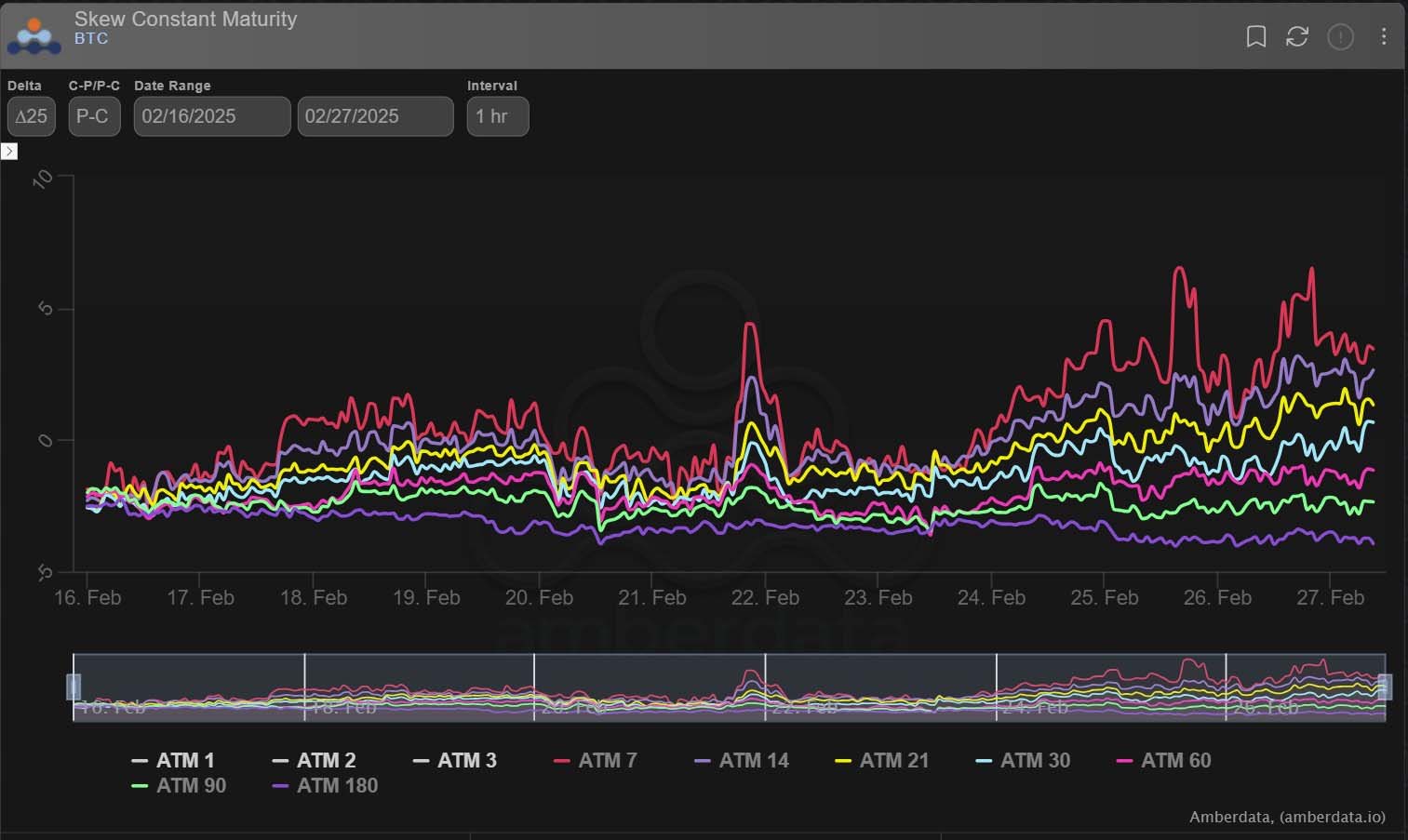

Gamma tenor IV+Skew firmed. Vega tenors converse.

2) Calls sellers on every bounce at the start of the week; likely long exits.

Focus on 100k sales as can be seen below.

Since stopped. Some relief.

Feb+Mar 80+85k Puts buying on the drop <88k, most outright, some via Put spreads to take advantage of increasing Put Skew.

3) Due to Vega selling in Apr+Jun options, the only months that materially responded in terms of IV were the very short-term.

This left opportunities in the mid-range to acquire gamma optionality at almost unchanged levels but during hugely volatile realized days of activity.

4) On the back of flows and sentiment, Put Skew significantly increased at the front end.

But due to positioning and lack of material flows in Jun+ maturities, the reverse was true.

In these types of markets it’s often all about the sub-30day maturities where Fast+Funds collide.

View X thread.

AUTHOR(S)