In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

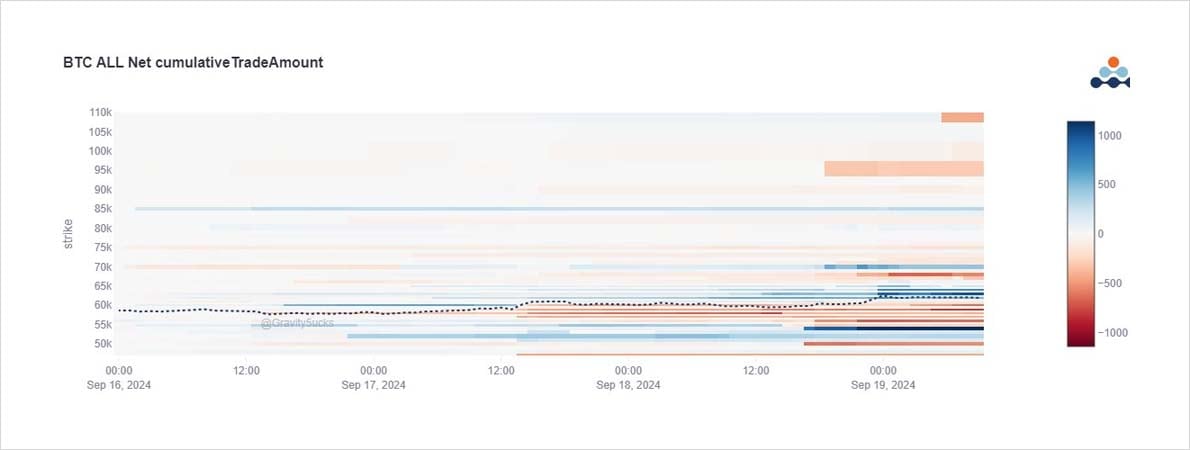

Gamma squeezed into FED decision, with Sep 54-50k Put spreads adding protection just prior.

A 50bp cut lifted Spot but hit IV as MMs dropped offers.

Fast money happy to absorb Calls from those pressured by MMs. A Fund bought Nov 70-95k Call spreads.

Another sold Mar 110k Call.

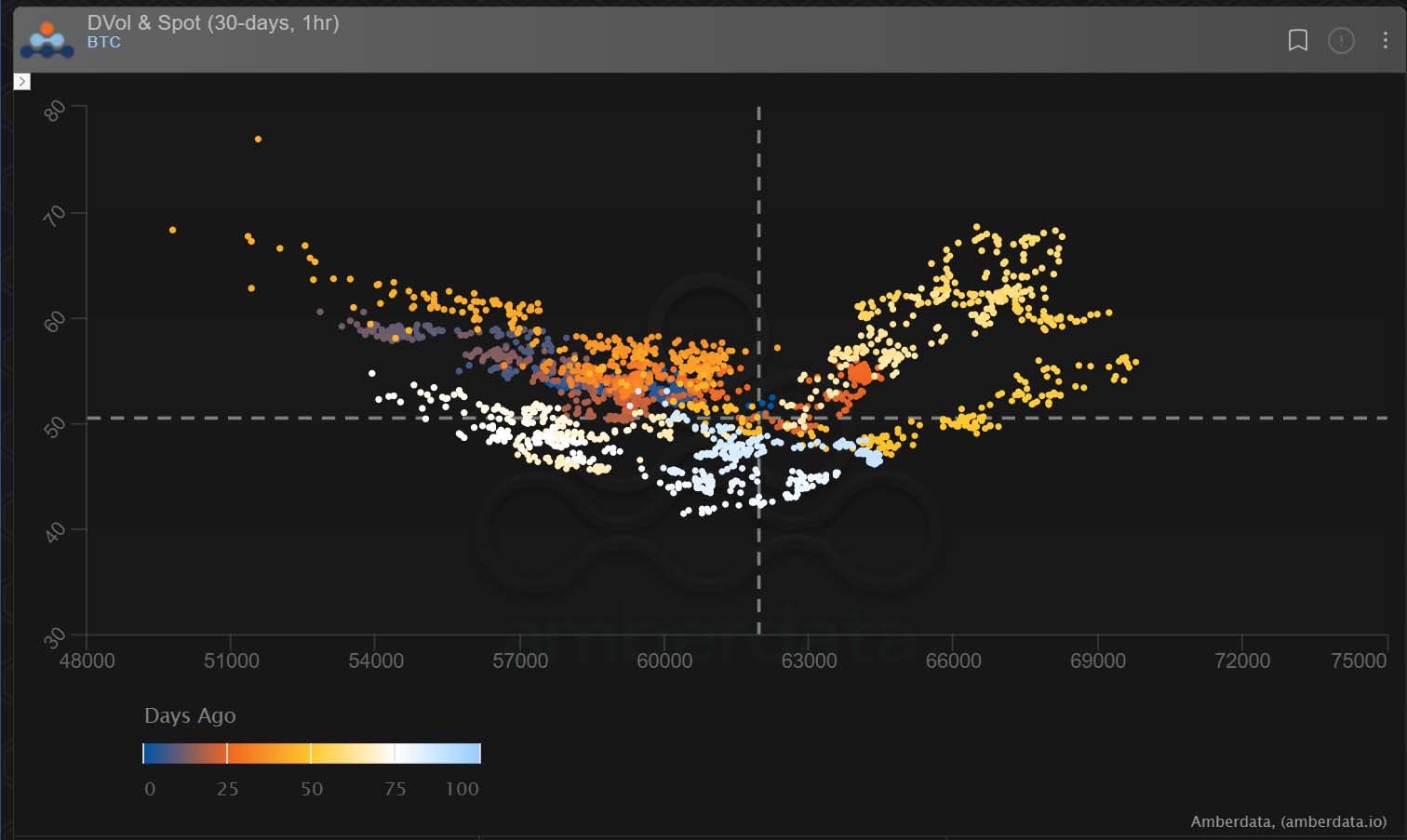

2) The chart shows the near-dated squeeze in Implied Vol, as participants used Options to hedge and/or express views, while MM pulled back aggressive offers.

It is then clear from the drop in IV where MMs lowered offers to attempt to question longs after the FED’s 50bp decision.

3) After absorbing some weak longs, Fast money then entered and bought Sep 63-66k Calls, and a Fund bought the Nov 70-95k Call spread.

During APAC BTC rallied from 60.5 to 62.5k.

During European hours a Fund dumped 500x Mar 110k Calls, another accumulated more Nov Call spreads.

4) Vol has drifted as Spot has rallied from mid-50s.

This is against the norm of Spot/Vol correlation. It is possible that the current 62.5k Spot is a comfortable level where Funds don’t feel they need hedges or upside outperformance.

Or there is apathy.

BTC Dvol 51%, ETH 61%.

View Twitter thread.

AUTHOR(S)