In this week’s edition of Option Flows, Tony Stewart is commenting on the latest market movement with most of the sentiment pressure continues to weigh on Spot.

Sentiment pressure continues to weigh on Spot, with 3days of net ETF outflows (IBIT contributing zero inflows), and a Crypto ETF DTCC collateral rule change.

Neither sufficient impact to concern BTC Vol sellers, as Calls continued to be sold, outpacing Put demand.

IV purge.

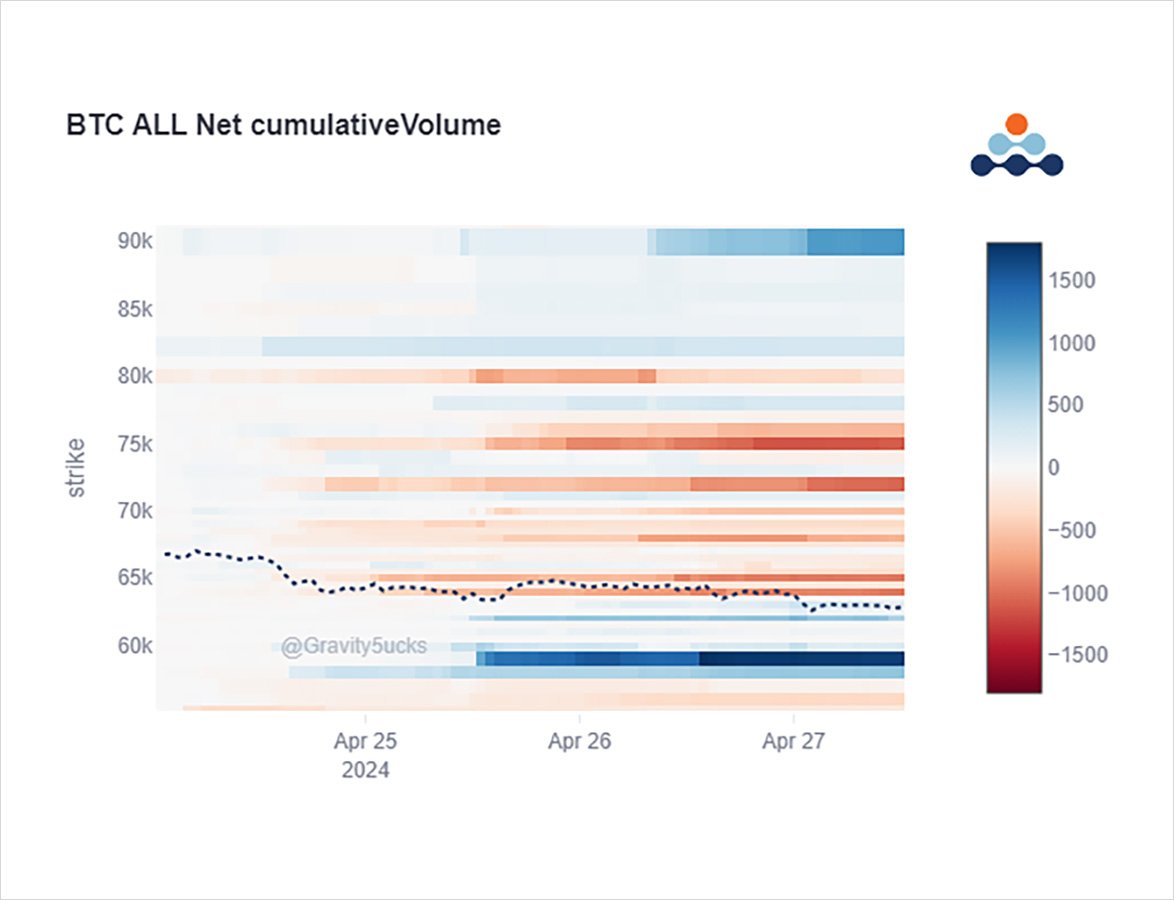

2) BTC Option flow has been straightforward.

Call (+spread) sellers across the tenors (some giving up on longs, and additional sales from over-writing Funds).

Add to this Put buying around the 59-60k Strikes – previous pico-support – and directional message bias is crystal clear.

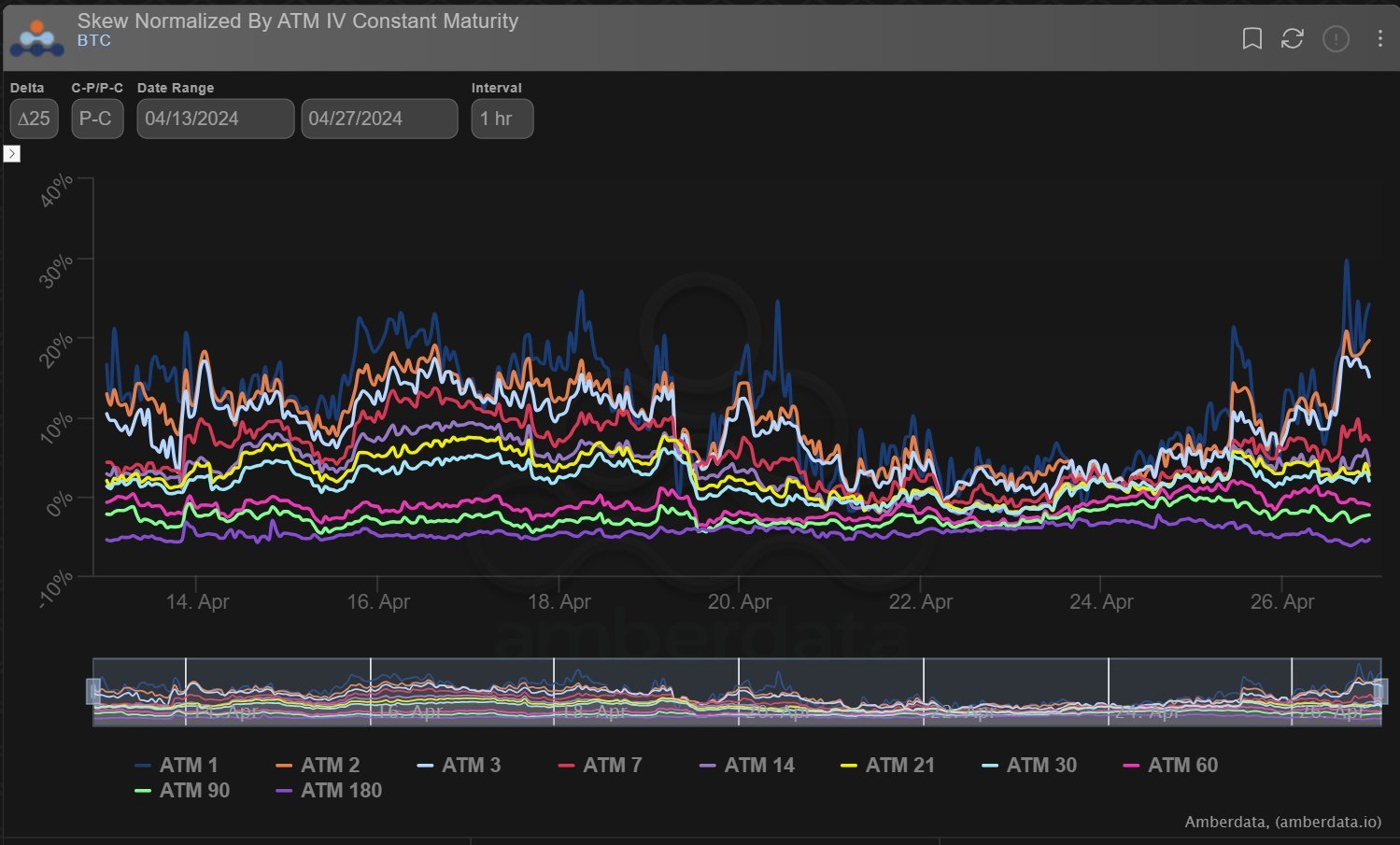

3) Due to the overwhelming Call selling and lower Realized Vol due to the market chop, the Implied Vol (cost of options) has plummeted. BTC Dvol 55%.

Note however 2-way flows on ETH have sustained Dvol at 65%.

Directional BTC Optionality therefore has become more attractive.

4) Put Skew, having drifted back lower after Middle-East tensions subsided, has now firmed back up on ETH and BTC, as concerns over <60k and <3k once again seem to be the critical levels that longs do not want to test, and bears are more than happy to trigger.

View Twitter thread.

AUTHOR(S)