In this week’s edition of Option Flows, Tony Stewart is commenting on this weeks Macro and Crypto Regulation Events.

June 13

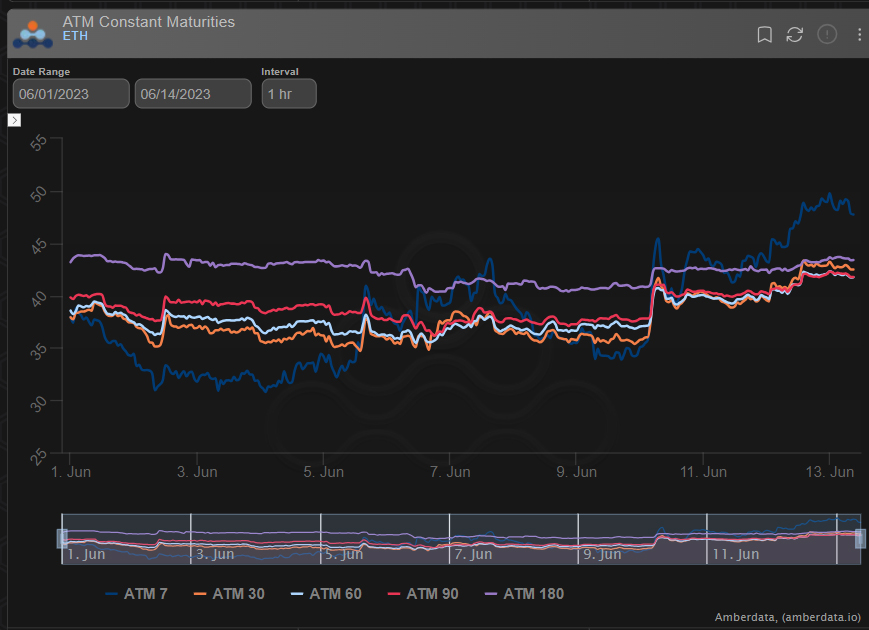

Sales in targetted Alts triggered a Spot sell-off in ETH and some firming in Gamma at the weekend.

Then Call buyers bought up Deltas, noticeably Sep1.9k x11k, Sep2.1k x6k, and on BTC short-dated 14-16th +23Jun 26k Calls x2.5k on DSOB.

Big week Macro+Crypto Regulatory ahead.

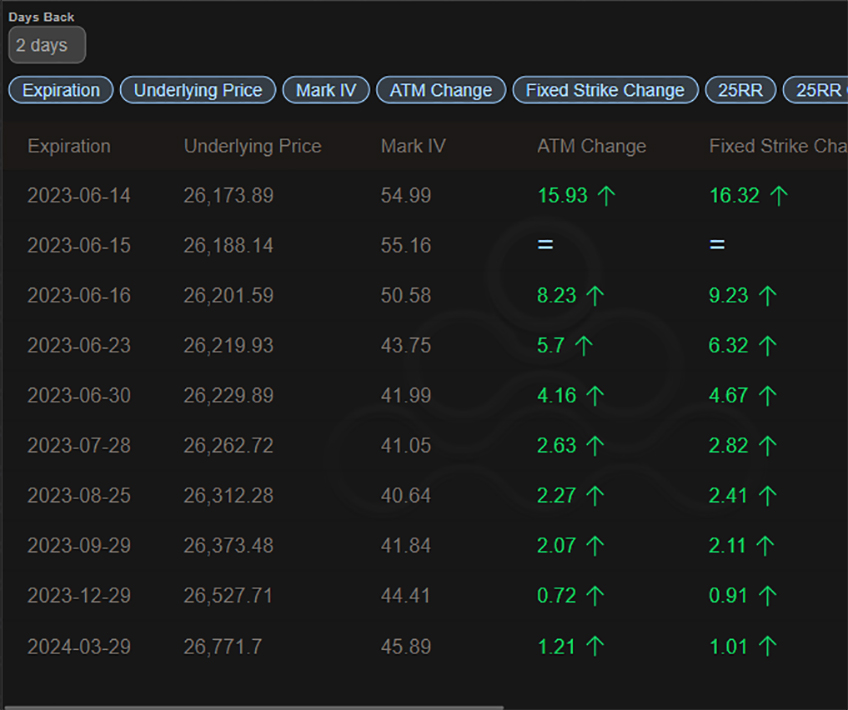

2) The Option buying ahead of a Macro week including headliners CPI+FOMC, and Crypto SEC v CB response and Binance TRO was to be expected and with IVs historically low a cheap alternative to D1.

Refreshing to see actual (though limited) buyer of not just Gamma, but ETH Sep Vega.

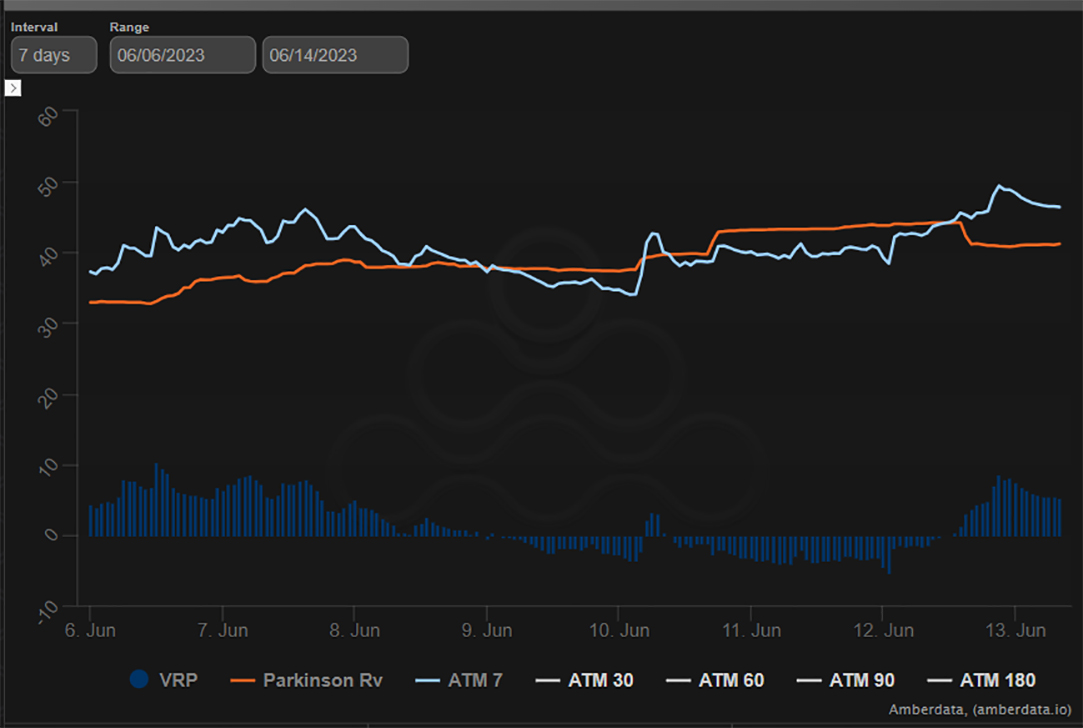

3) In BTC, the drive for IV rising has been more Gamma-focussed, with fronts active even pre-wknd as 16th Jun ATM Strangle traded firm 2way, and a buyer of Jun29k Gamma.

Then Jun26k Call buyer on DSOB bidding the fronts higher.

Vega sympathetically follows with only sparse buys.

4) IV now trades at a premium to RV, and the usual reaction as data/info gets released is to soften as uncertainty fizzles.

More interesting than normal is that there is not just Macro but a fair amount of Crypto-specific legal/regulatory info which may or may not clear the air.

View Twitter thread.

AUTHOR(S)