In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Minor Jan protective/bear plays were TPd as BTC hit 91k, but the bounce was more indicative of true believers.

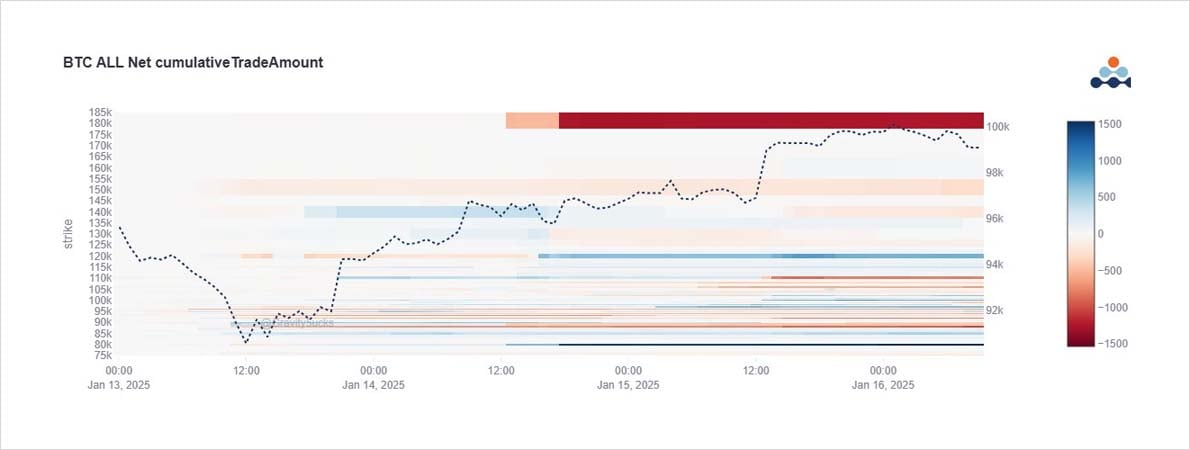

The entity holding Feb+Mar upside added to the Mar120k Calls $5m premium, Jan24 102-110k Call spreads bought, and an optically smart Dec25 80-180k RR hedged long AUM.

2) Jan 88-93k Puts TP’d fully, and some 93k Puts rolled down in case of further Spot slippage as Spot traded 91k.

On the bounce Mar 120k Calls bought >1k on DSOB.

Interesting Dec25 80-180k RR took advantage of longer-dated forward +Call Skew premium to create optically strong RR.

3) PPI+CPI numbers helped BTC Spot higher on the macro front. And the March 120k Calls, bought when BTC was trading 95k pushed IV higher as they were accumulated.

But since, IV has drifted back, Dvol 60%.

US holiday and Inauguration on Monday, the two offsetting any Jan24 bump.

View X thread.

AUTHOR(S)