In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Hopes of a relaxing summer dashed by opportunities.

Trump BTC reserve currency rumor, Biden steps back. BTC ETF inflows. Mt Gox tests. ETH ETF tomorrow.

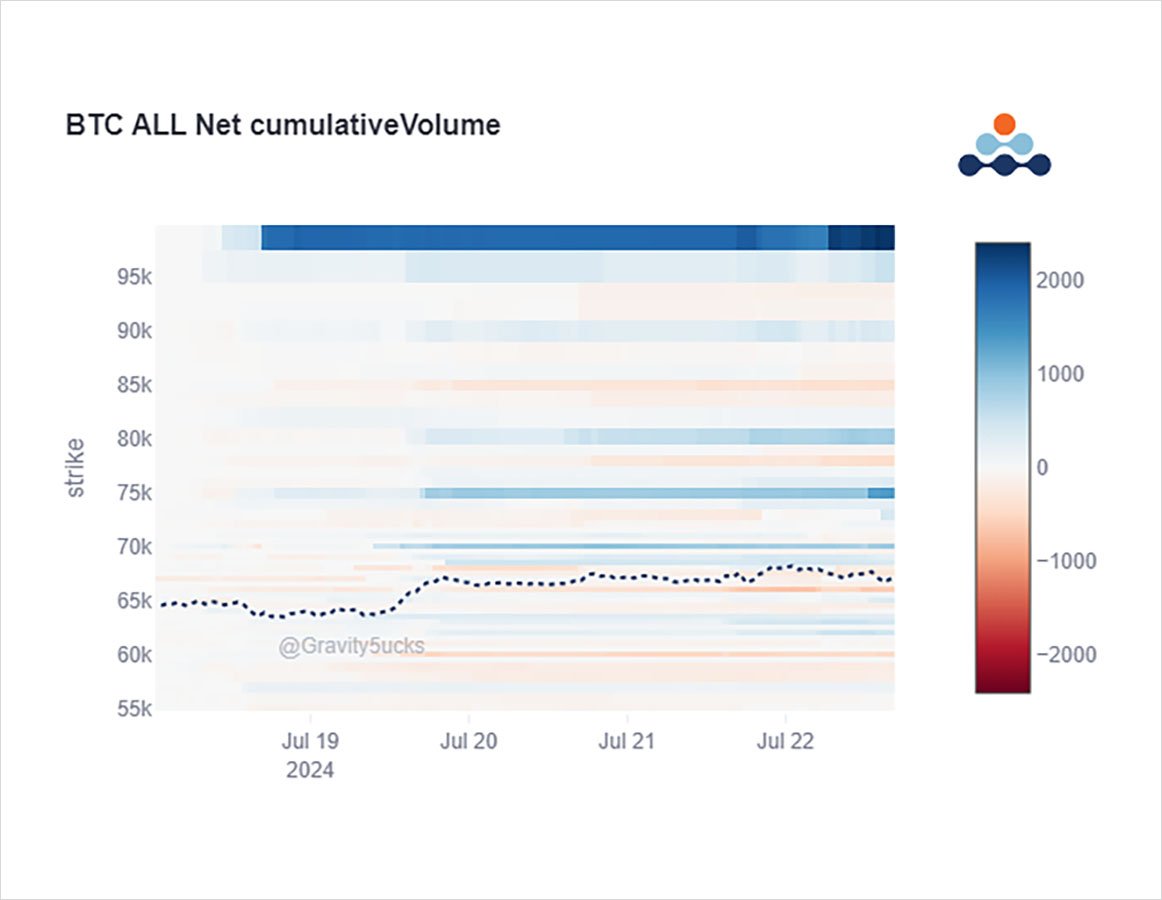

Last weeks desperate Call buying Option flow transposes to strategic Call buying: Jul75k, Aug2 70+80k, Sep90-100k, Dec 100k.

2) Buying Calls extended through the weekend as BTC spot rallied 7% to a high of 68.5k.

Funds blocked >$6m premium of July 75k, Aug2 70k, Sep90k, Dec 100k Calls.

A equally decent chunk mirrored (much probably covered) on DSOB with the addition of Sep 95+100k, and Aug2 80k Calls.

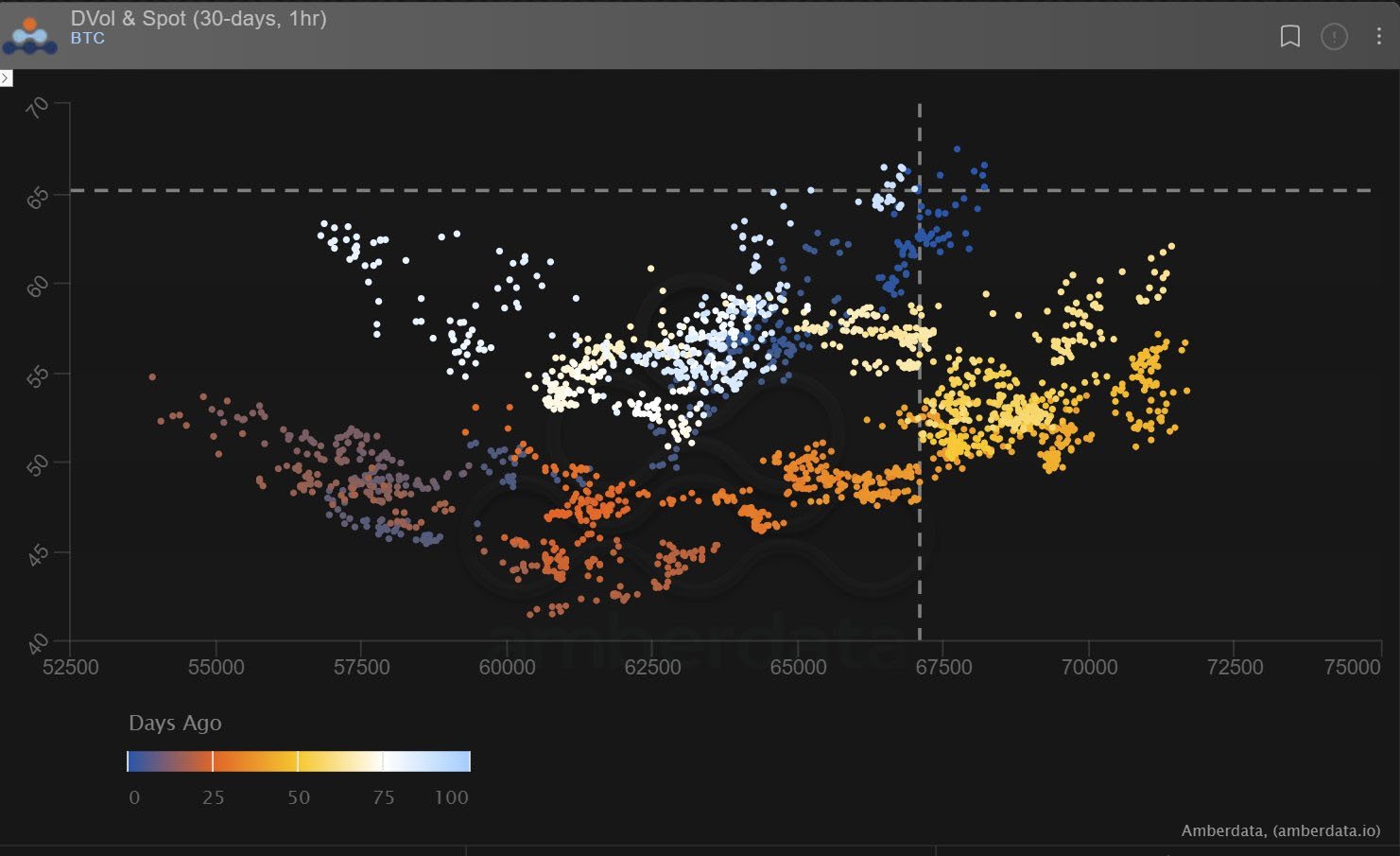

3) IVs across all tenors squeezed higher due to the demand and realized Gamma.

High Spot-Vol correlation continued.

Only when Spot fell back below 68k from the highs did we observe some TP on OTM Calls (from July to Dec) and slight retrace in Dvol.

Demand has picked back up.

4) ETH ETF is scheduled to start trading tomorrow.

But Fund Option flows are still disappointing and non-committal. Funds have sold a little ATM Calls into the rally, Fast money seems more optimistic.

Dvol spread further tightened ETH>BTC to 4%.

Pre-ETH-ETF Option positioning:

View Twitter thread.

AUTHOR(S)