In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

A huge $900m BTC ETF inflow day prompted upside Option activity as BTC >71k. $4m premium spent on Jun28 74-80k, Jun21 78-82k, Jul 92-100k Jul 75-85k Call spreads.

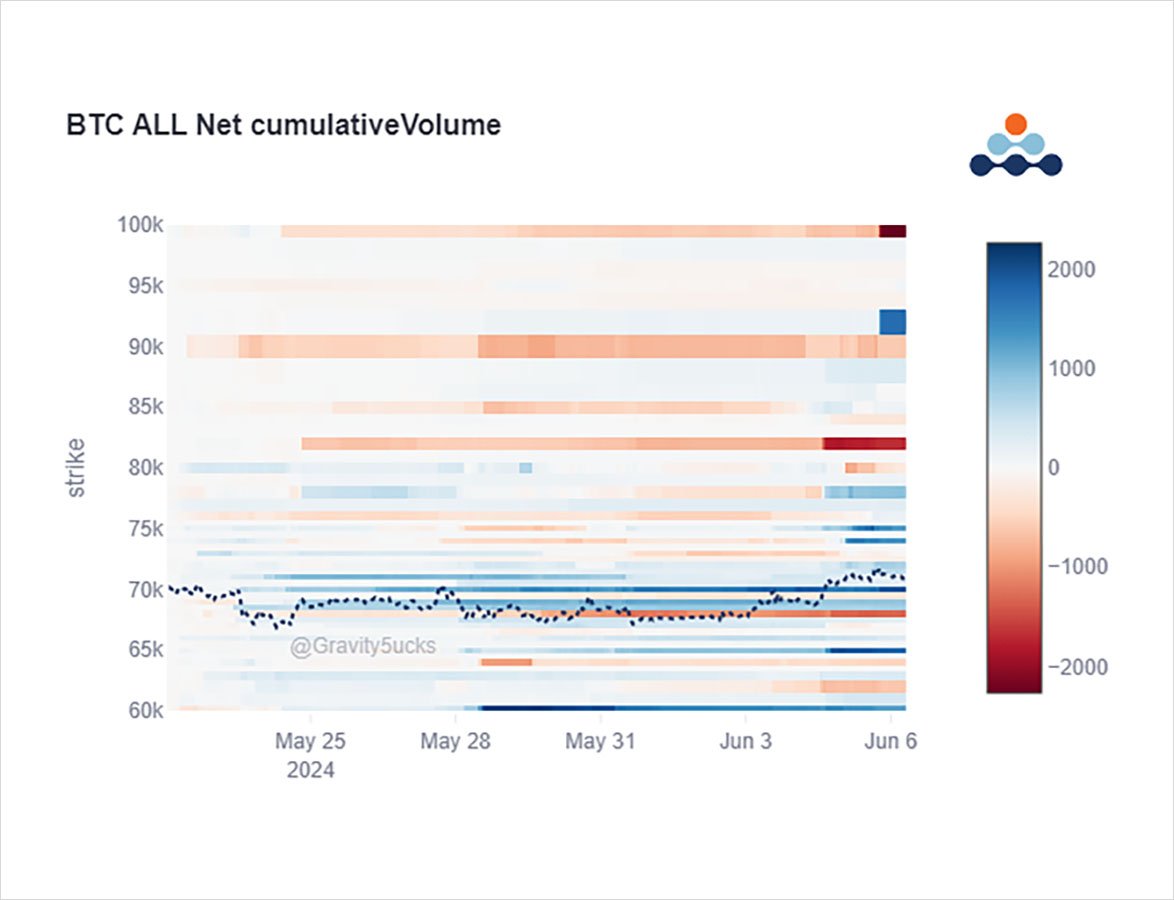

A continuing writer/sale of Jun78-85k Calls kindly providing upside Gamma to MMs. $500mn BTC ETF again yesterday.

2) Positive momentum from BTC ETF flows providing an underlying confidence to BTC, and squeezing a crowded long ETH-BTC spot trade.

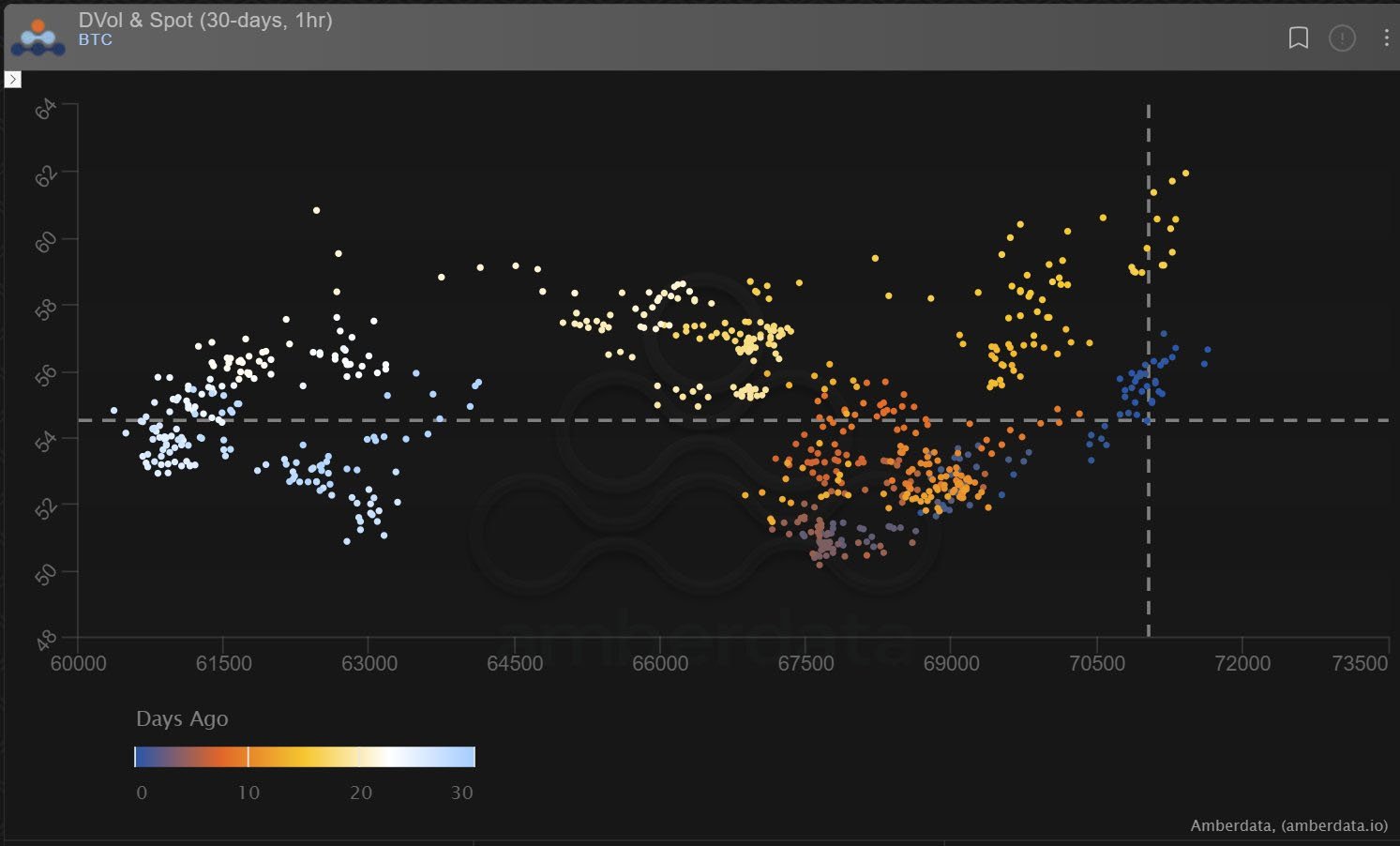

With BTC Dvol hovering at 50% while ETH Dvol at a 15% premium (in anticipation of ETH ETF, but RV not performing), BTC IV looked relatively cheap.

3) And so, Funds took the opportunity to buy Call spreads in June and July maturities, and MMs took the opportunity to cover this Gamma by buying Jun upside 78-85k Calls which have been clip-fed into the market on DSOB over the last week.

4) IV continues to have a positive Spot correlation

But perhaps due to an anticipated Summer lull, IV have been lower on this run up >70k than they were on prior occasions. Quiet ETF flow in Jun/July?

[See chart – orange/blue dots recent IV on this rally, cf yellow prior move.]

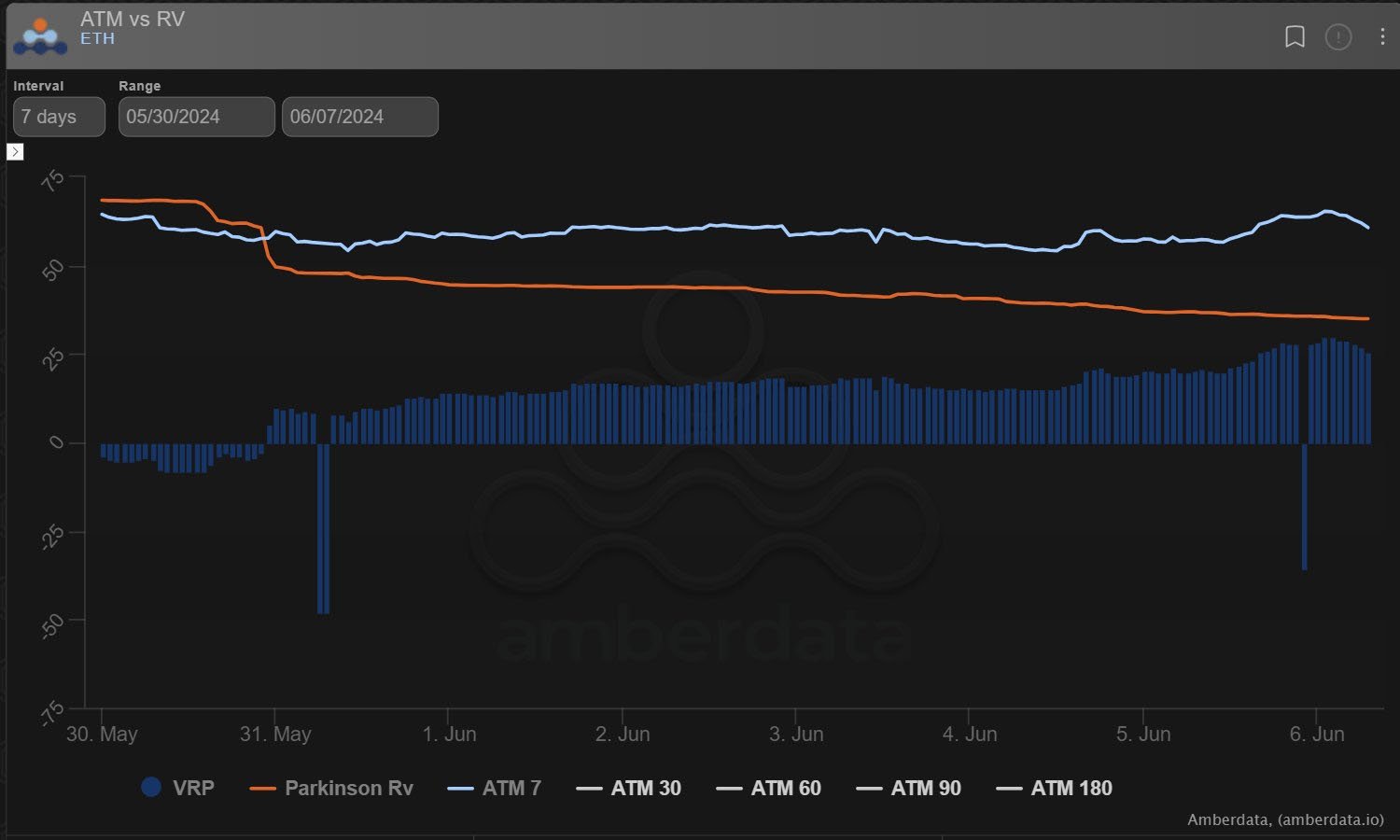

5) Meanwhile ETH IV continues to trade at a widening premium to RV, as IV currently holds steady in the hope of the anticipated ETH ETF news materializing soon.

But Fast money outright Call purchases becoming exhausted; Funds still own upside Jun-Dec Call spreads mitigating time.

View Twitter thread.

AUTHOR(S)