In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Against the backdrop of equity+risk plunge, BTC has held up.

Bulls argue BTC is discovering its digital gold features.

Bears argue BTC is lagging and will soon follow lower.

Options flows clearly support the latter theory, via overwhelming Put buying, either to bet or protect.

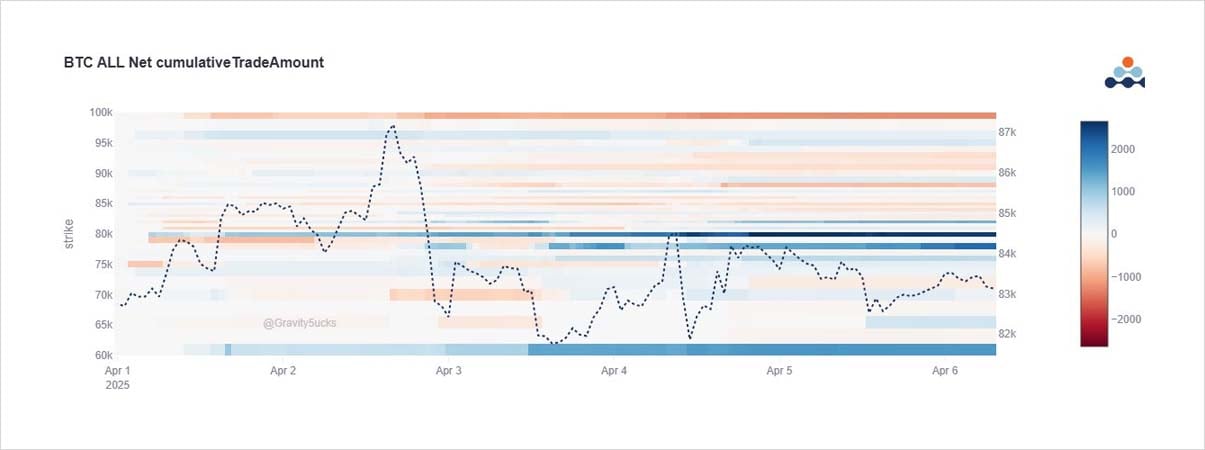

2) On BTC Spot dips and bounces, Put buying continues to dominate. Heavy blue areas illustrate Apr 82-76k as the main play. But this stretches down to the April 60k Puts, and further out to Jun 60-75k Puts net +ve Vega within some 2-way May-Jun downside rotation.

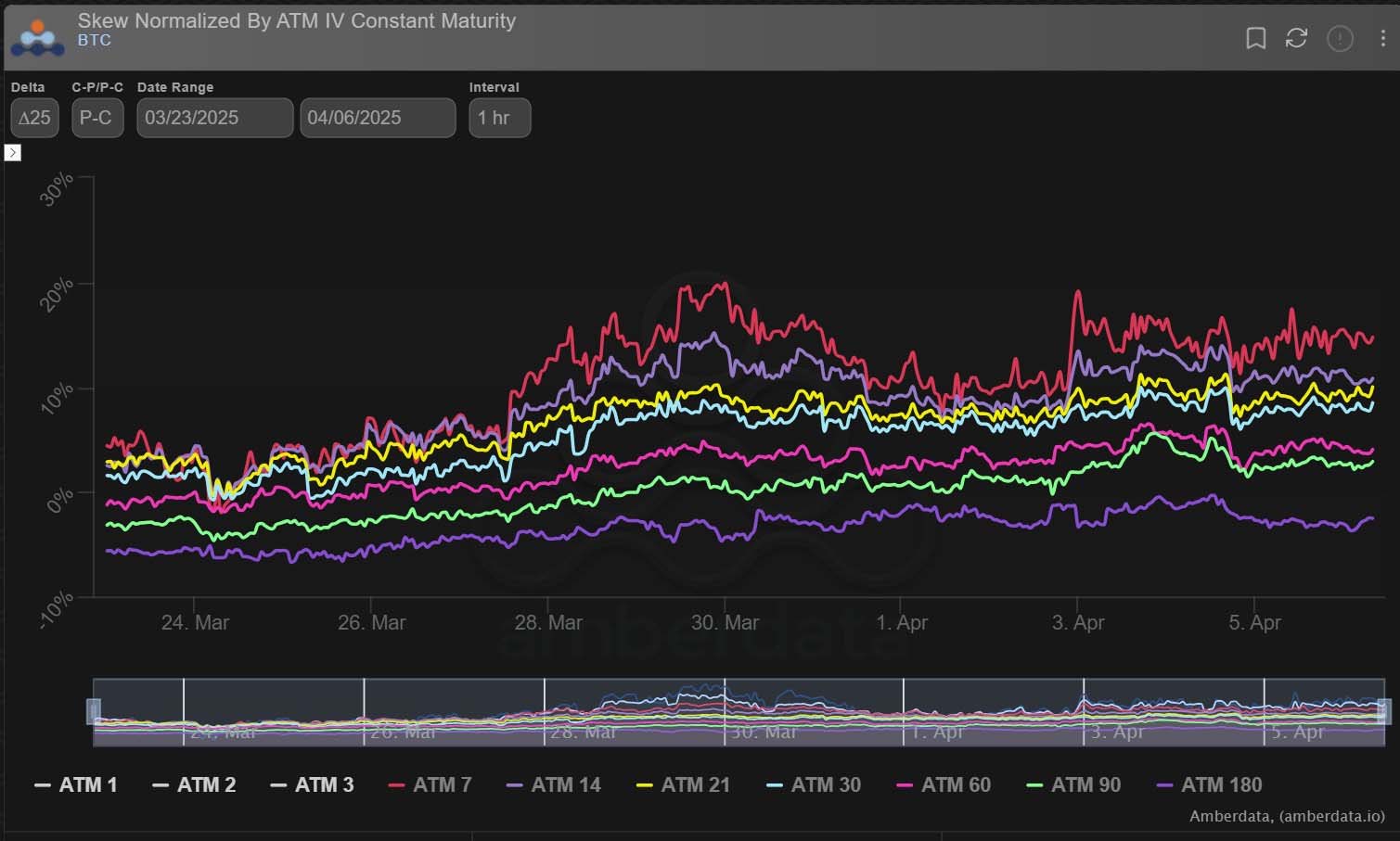

3) Put Skew therefore continues to hold at elevated levels. Calls have mostly been used to fund Put purchases or to yield.

Only one material trade has bucked the trend; a buyer of 1k May 95k Calls ($3m premium spent), taking advantage of lower Spot and depressed Calls.

4) Implied vols have been pushing higher with demand outstripping supply.

Even the weekends, normally dearth of realized activity have not brought active sellers of Optionality and Theta collectors.

The concern of market-moving Tariff news and Monday NYO keeping sellers at bay.

View X thread.

AUTHOR(S)