In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Trump’s debate performance disappointed.

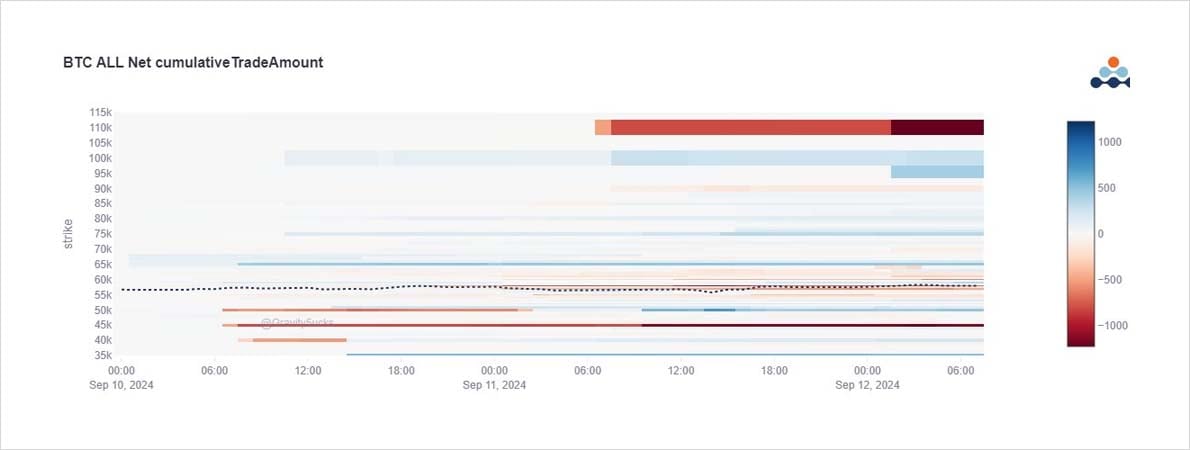

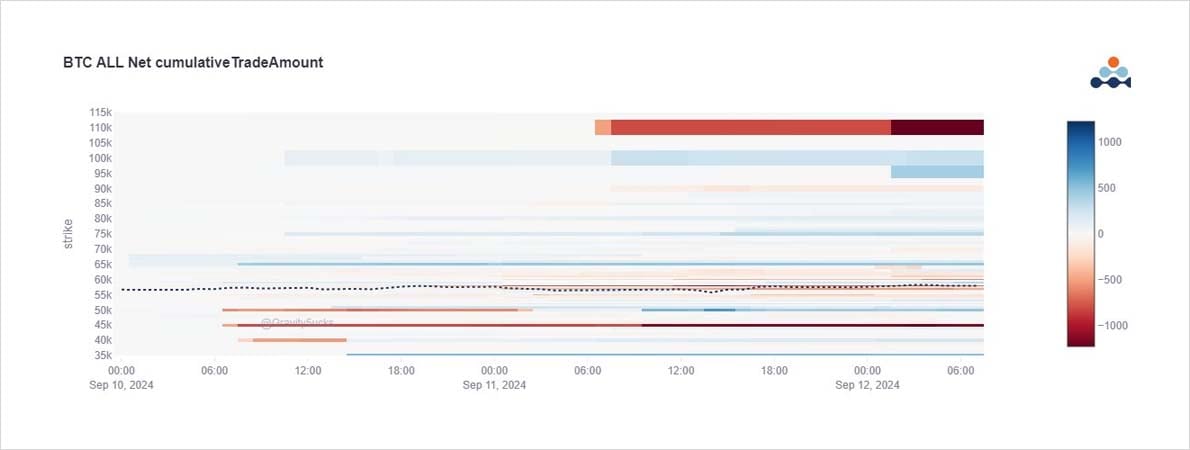

Perhaps linked, the Mar 110k blowout Calls were sold just after the conclusion and redistributed to an accumulation Vol buyer via the 100k Calls.

Fast money added bearish bets.

But a CPI+risk squeeze off 55.5k reversed flows bullish.

2) Trump’s crypto alignment impacted prices & election expectations. Mar 110k Calls were dumped into MM hands, who then passed flow to an ongoing OTM Vega buyer.

At first bearish bets via Sep Puts were added but US markets digested CPI favorably: risk on, Sep+Oct Calls squeezed.

3) On the bounce off the lows and further squeeze higher in Spot, BTC Sep+Oct 50k Puts were dispensed with, and Sep 58-60k + Flat Oct Call Skew were bought up.

On ETH a Dec 2.4-3k Call spread was accumulated over the day, totalling 10k.

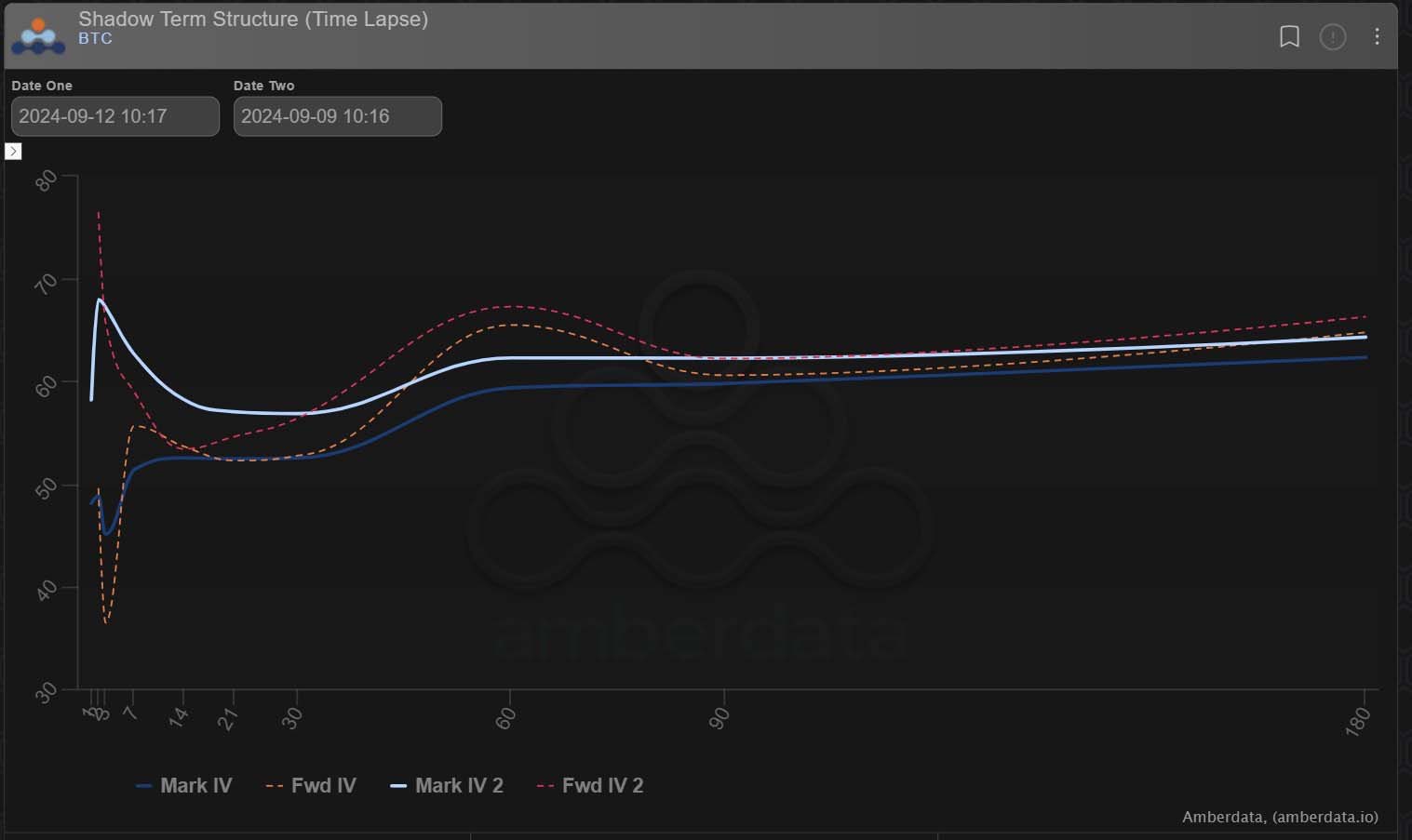

4) Vol was taken out across the curve, with the front end retracing pre-debate bids, and the back-end impacted by the clip of Mar Calls sold, plus drift. Despite that, near-dates are holding up well – no shift to contango.

Gamma has been in demand from the continued mkt swings.

View Twitter thread.

AUTHOR(S)