In this week’s edition of Option Flows, Tony Stewart is commenting on BTC’s $30k wall, and the ETH Foundation selling.

May 8

BTC Call(+spread) buyers can’t catch a break as 30k wall insurmountable, ‘Sell in May..’ resonates, and ETH foundation sells $30m.

Buyer May19 29.5k Calls x1.5k, Jun30k Calls x1k, TP Jun ITM Calls to 2x not. Jun+Sep ATM C (+sp).

Adverse ETH, sales Sep+Dec Calls, Jun Put bot.

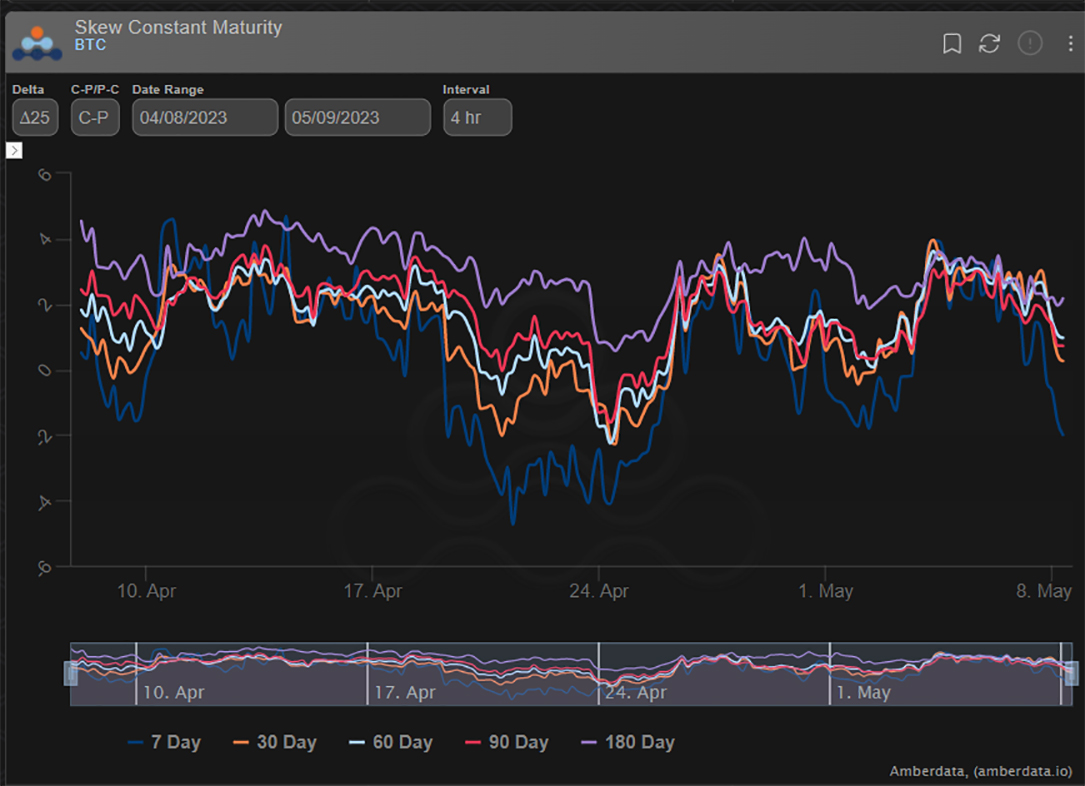

2) BTC Call buying continues to be spot correlated and as such Skew, firming as Calls bot on rallies. FOMO on 30k breach.

But lack of material increase in RV results in plentiful supply and stable IV.

Not all Call (+structures) may be bullish though; simultaneous D1 selling.

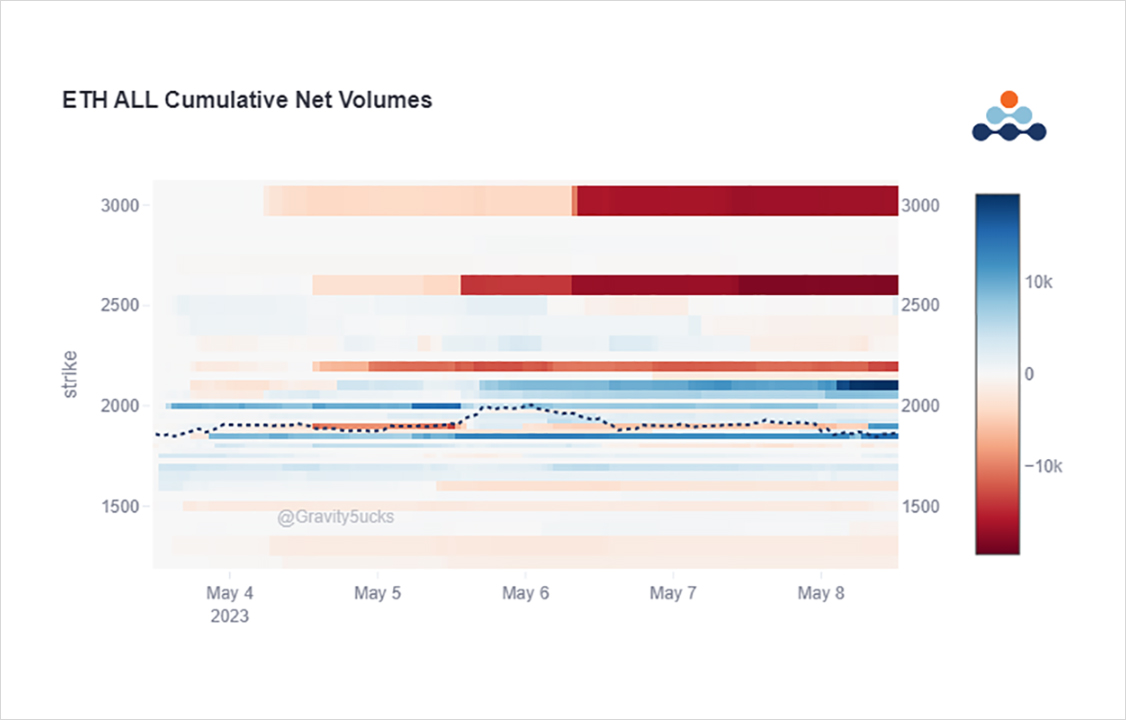

3) The record of ETH foundation sales compelled large unwinds/D1 selling, and in the Option space the directional plays followed.

Sales of net 25k Sep2.6k+Dec3k Calls further added pressure to ETH IV, DVol still in-line with BTC.

And today, a buy of ETH1.9k Puts x15k observed.

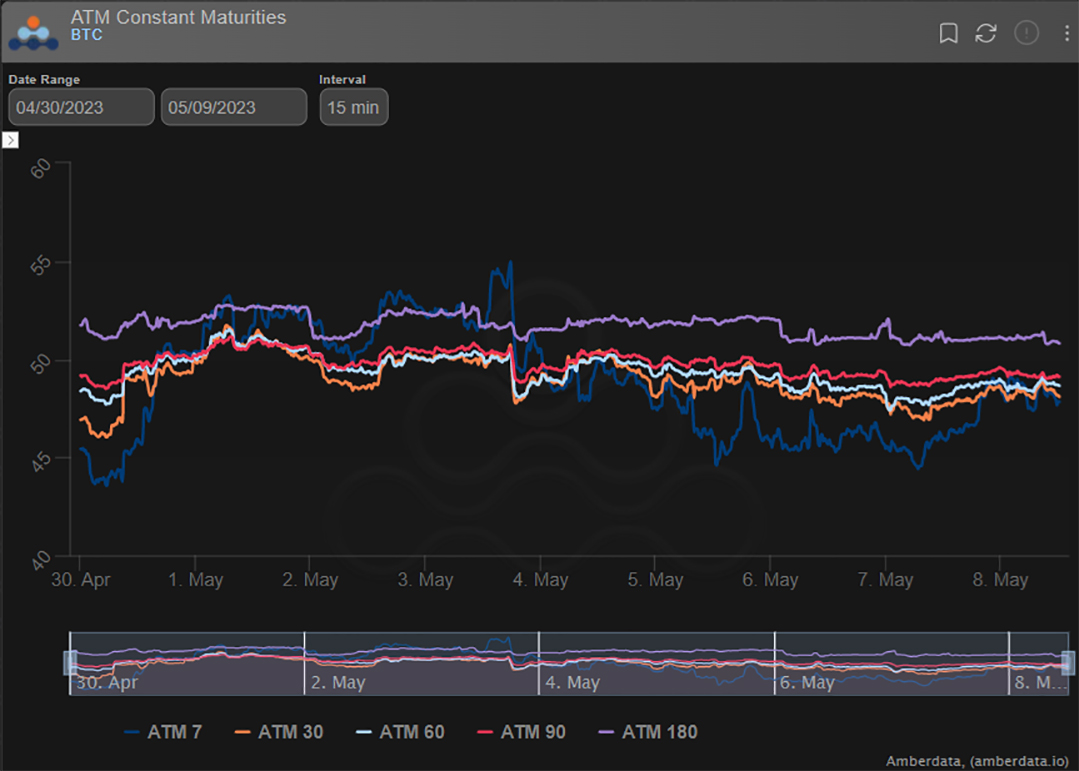

4) Without a break of 27k/31k Spot, or a material IV-induced Option flow trade that would suck supply, perhaps on the expectation of a large move, IV continues to drift lower.

Small sudden variations in the sub-10d maturities reflect more retail-based +fast money demand/supply.

View Twitter thread.

AUTHOR(S)