In this week’s edition of Option Flows, Tony Stewart is commenting on why some traders are feeling the pressure.

February 21

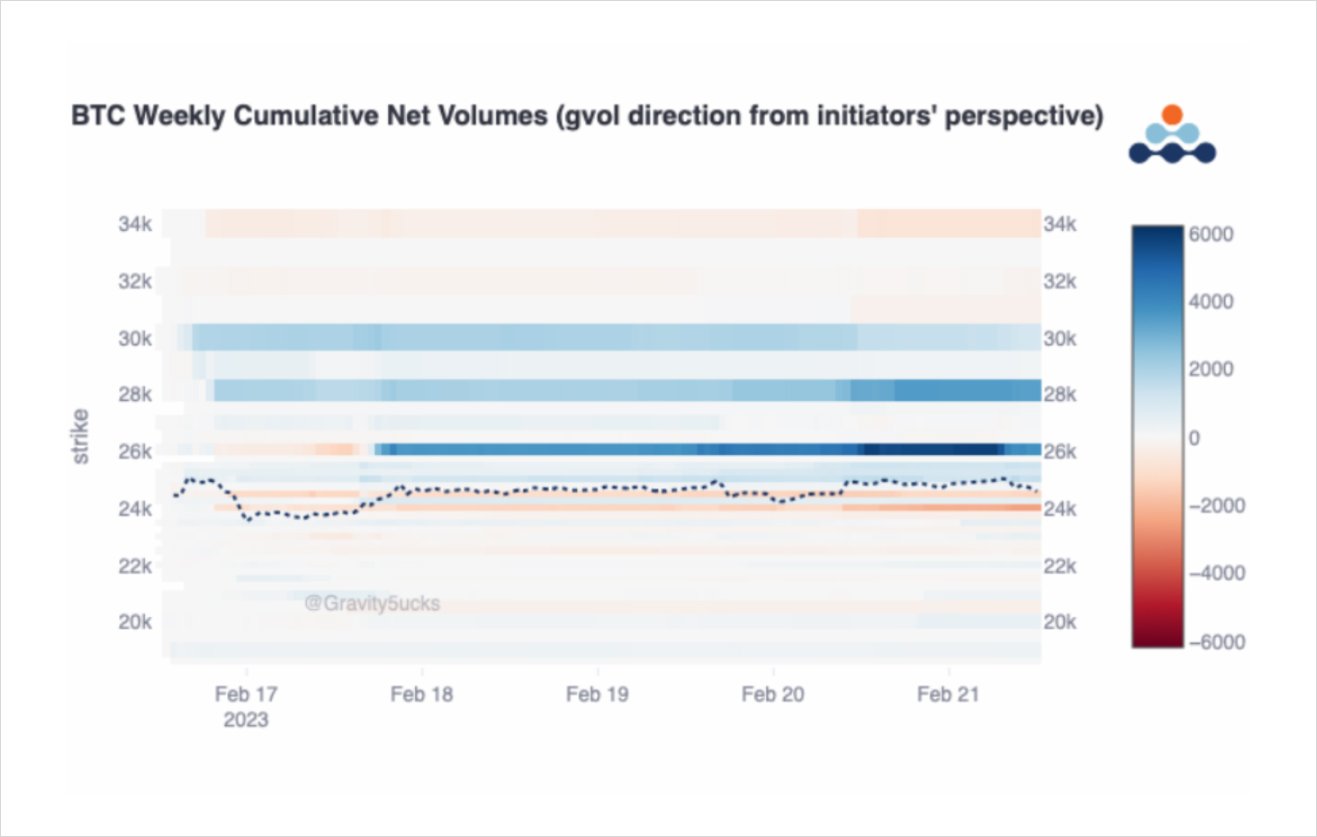

Frustration for Bulls + Long Call holders became too much for one entity as ~1.5k of the Feb24 26k Calls was sold into the market as 25-25.3k failed to breach +hold yet again.

Strangle sellers added pressure to IV as Spot relaxed.

IV sellers vs Long Calls battle conviction.

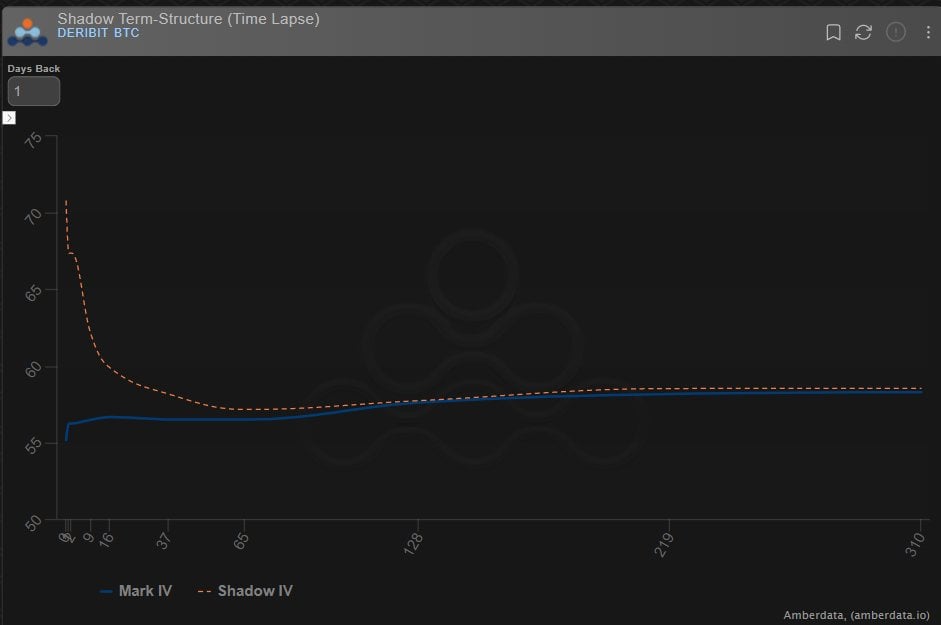

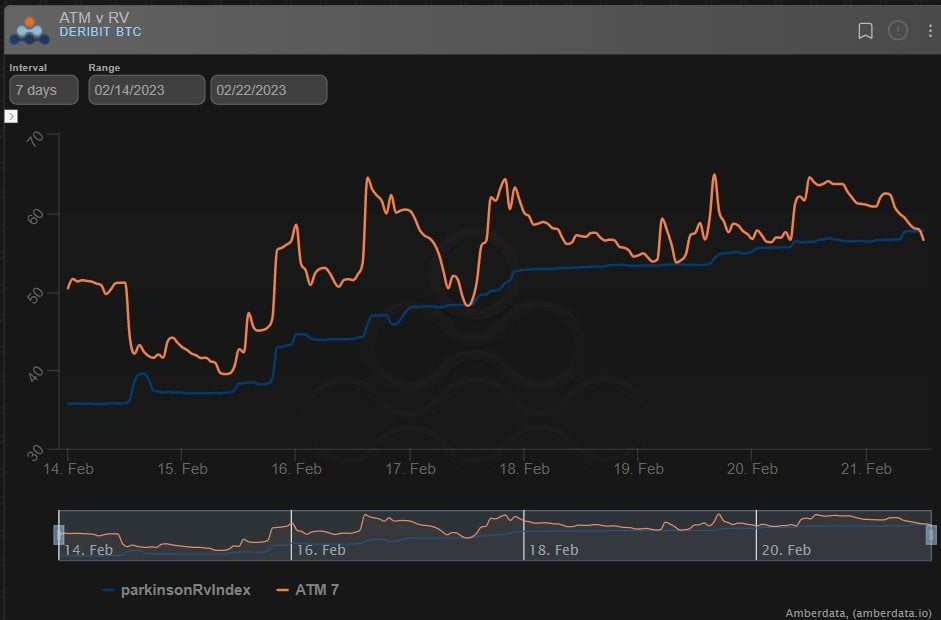

2) The continuous selling of front-dated ATM Strangles/IV and partial unwind of Feb24 26k Calls was sufficient to take the juice out of the Gamma maturities, taking back IV in-line with 7-10day RV.

Noticeably this selling pressure has for the most part come in <45day Options.

3) Pressure from Feb24+Mar31 tight Strangles [24-26k Strikes] and sales of ATM Put spreads (Mar+Apr) have purged the front end while IV traded at a premium from the Call buyers.

The Feb24 26k Calls were bot at ~75% IV, but now sit at 62%. The IV+Theta impact is the outright risk.

4) But, this unwind of Feb24 26k Calls, and continued ATM pressure has merely repriced IV and RV nearer fair.

Painful for existing longs.

New opportunity?

When will Shorts cover?

The sale is but a blemish over 7days of Call accumulation.

‘The game is afoot’ – Sherlock Holmes.

5) Thanks once again to @Gravity5ucks @genesisvol for calibrating their proprietary data.

View Twitter thread.

AUTHOR(S)