In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

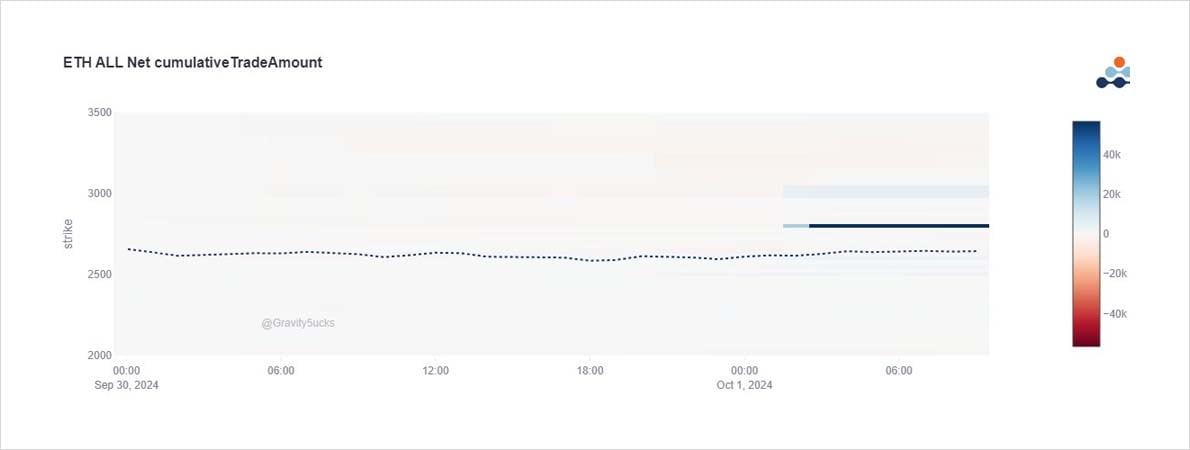

If historic seasonality is to be relied upon, then ‘Uptober’ has started with robust intentions, at least on ETH where the Oct11 2.8k and Oct18 2.8k Calls were bought x55k ($2.8m outlay).

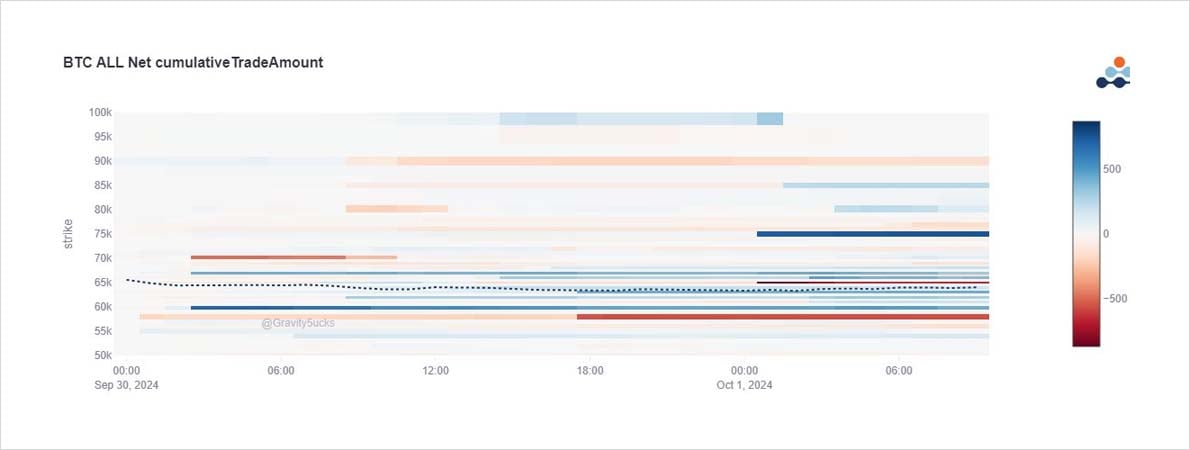

BTC showed no power plays, but still an array of smaller bullish plays through Oct-Mar.

2) The ETH 2.8k Call purchase could not be more conspicuous in recent days.

This trade joins the existing Dec 2.4-3k Call spread as a positive Fund play, put on a couple of weeks back.

MMs absorbed the demand well with 14day IV rising only 3% at the point of trade, now drifting.

3) BTC flows were less clear-cut after JPow’s comments yesterday.

Oct11 66k Calls sold, Oct25 66-71k Call spread bought, along with Dec 80k Calls.

Then some restructuring of Dec 65+70k Calls up-and-out to Mar 70+75k Calls.

Puts are still being sold to fund some of this upside.

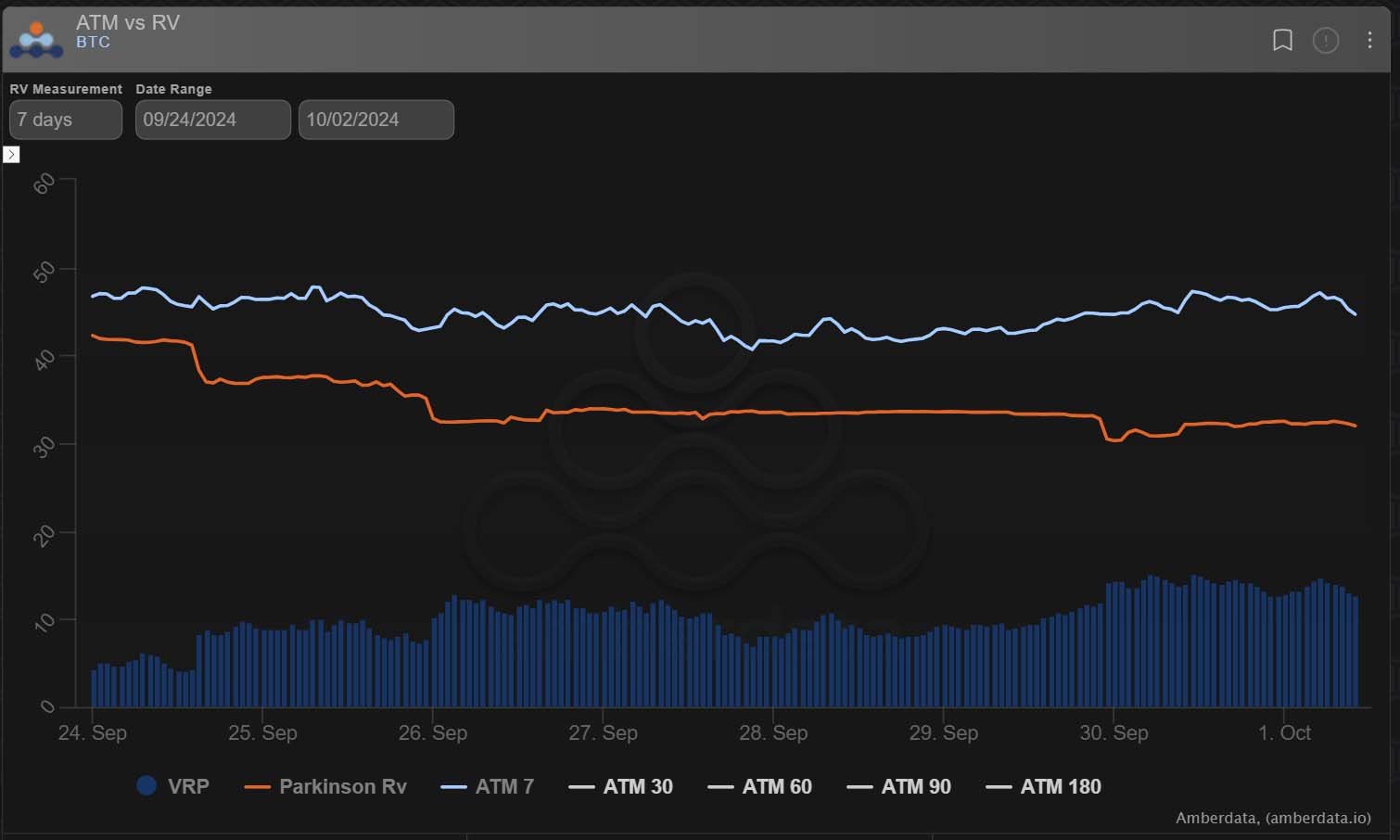

4) We recently spoke of some apathy in Vol+Call Skew on this rally. Dvol has now bounced from the lows and as we’ve seen some decent action on the upside has come through the last few days.

While 30-day Dvol IV holds ~30-day RV, there is a significant 7-day VRP to be aware of.

View Twitter thread.

AUTHOR(S)