In this week’s edition of Option Flows, Tony Stewart is commenting on the market still being in a waiting position.

December 21

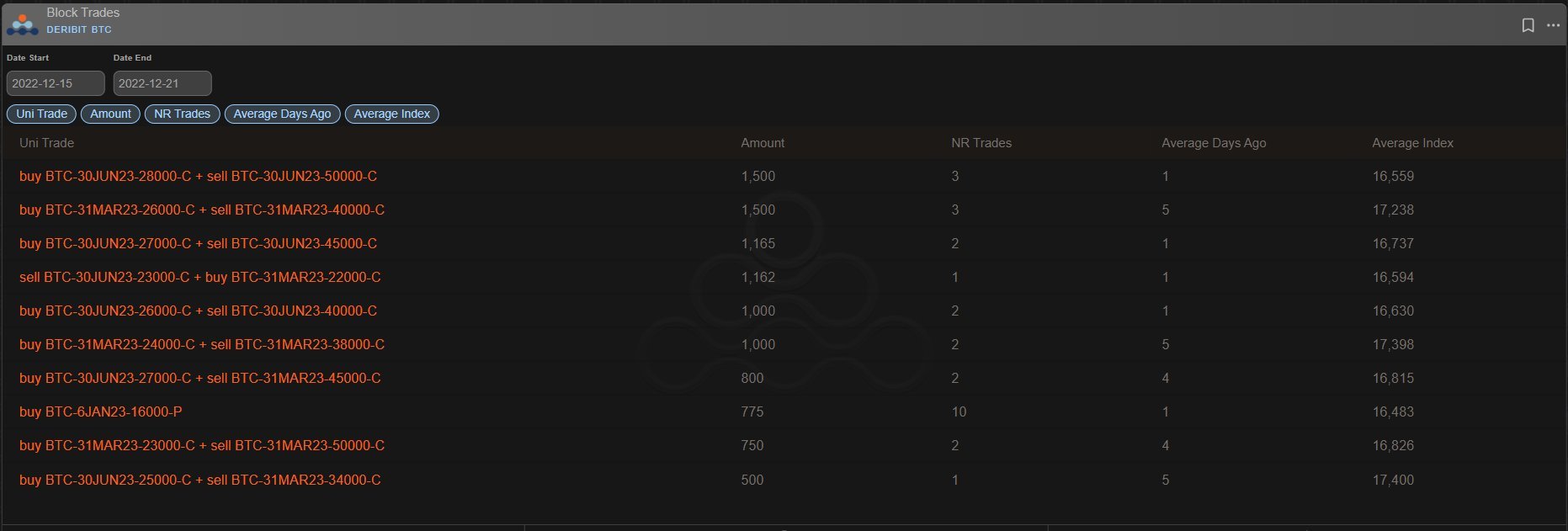

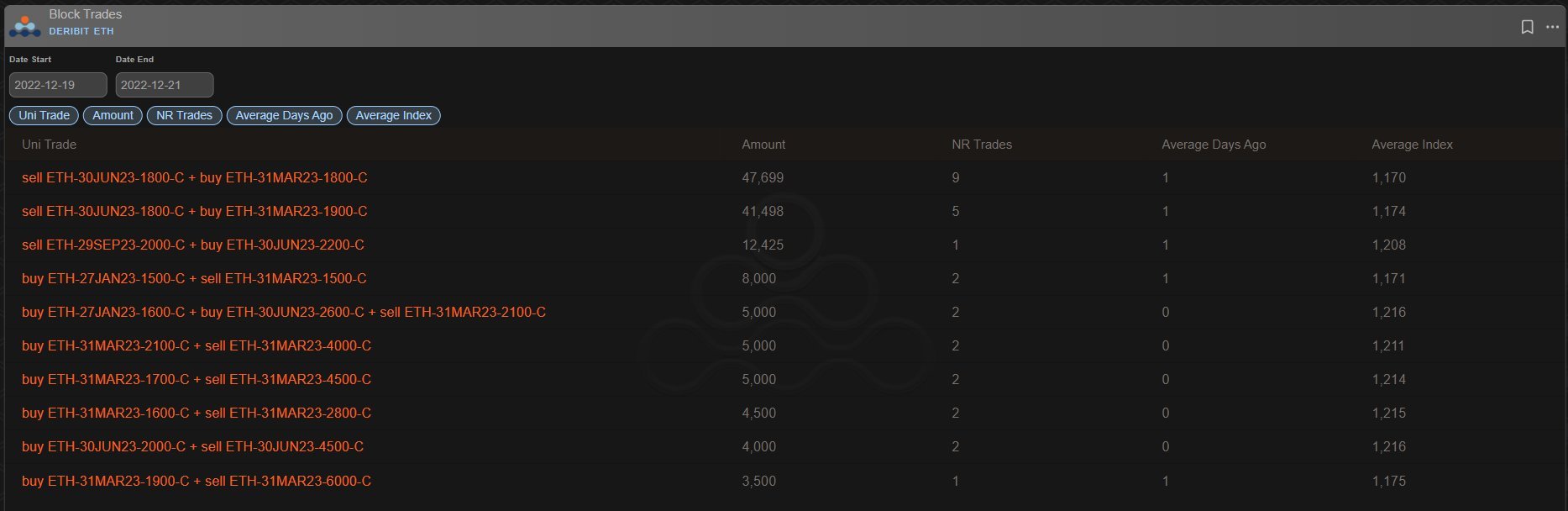

While Options activity at the front end of the curve matches Realized Vol lethargy, the medium-dated Vol buying via Call spreads continues with conviction, not just in BTC but now ETH.

Strikes vary:

BTC buys 23-28k, sells 34-50k.

ETH buys 1.6-2k, sells 2.8-6k.

NB Delta-Neutral.

2) There are quite a few points to query relating to these Call spreads:

– Delta Neutral to assist MM, or intended to hold?

– Note DN choice via perp not mar/jun future.

– Strike variety a deliberate play to increase liquidity?

– is this a hedge vs some known end-user-OTC buyer?

3) …following on:

– OI is net increasing, and new risk at the primary buying Strike, but mixed/reduction top Strike.

– we discussed last thread the efficiency of buying low part of Call smile and selling high section.

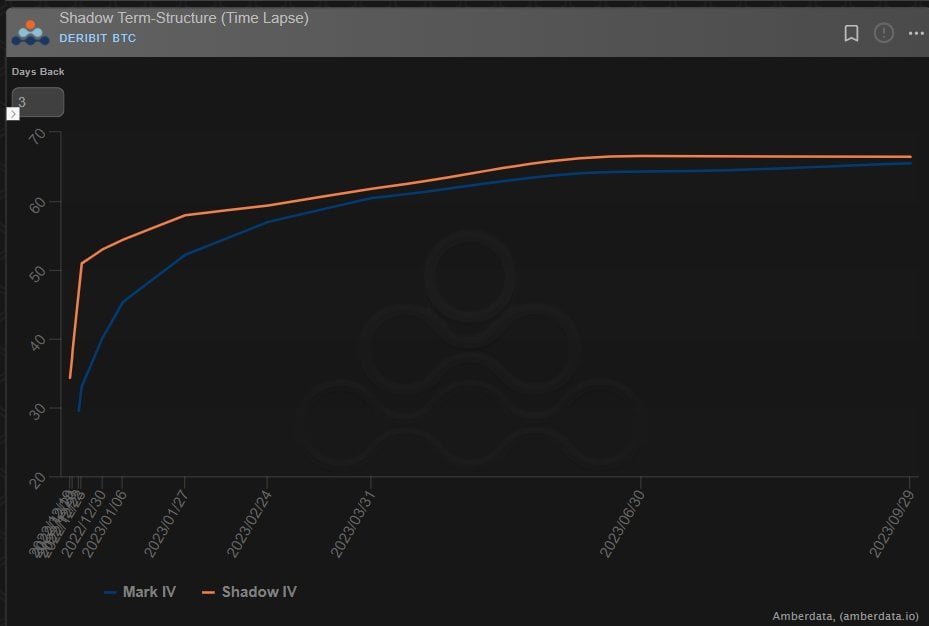

– overall in BTC this has been ~175k vega bought; IV unch.

4) 175k vega is the equivalent of 4-5k ATM Options.

On one day, this is significant but spread over a week where there have been other selling pressures, IV has been contained.

Complying seller at first was aggressive but has allowed more room, noticing only a few peers pricing.

5) Other re(structuring) trades noticed, taking advantage of liquidity pre-Xmas-NewY period.

MainlyETH:

– large seller of Jun-Mar time spread x90k.

– seller Sep-Jun OTM Call time spread x12.5k

– seller Mar-Jan time spreads via Mar-Jan ATM & Jan-Mar-Jun Call fly.

Looking to 2023.

View Twitter thread.

AUTHOR(S)