In this week’s edition of Option Flows, Tony Stewart is commenting on the current sentiment which remains cautious and a a quiet few days as a long US weekend just ended.

July 4

A quiet few days as a long US weekend allows more time to digest contagion risks and forward plans. Aside from continued low-commitment upside strategies alluded to previously, the sentiment remains cautious with ATM-upside Call Spread sellers and short-dated OTM Put buyers.

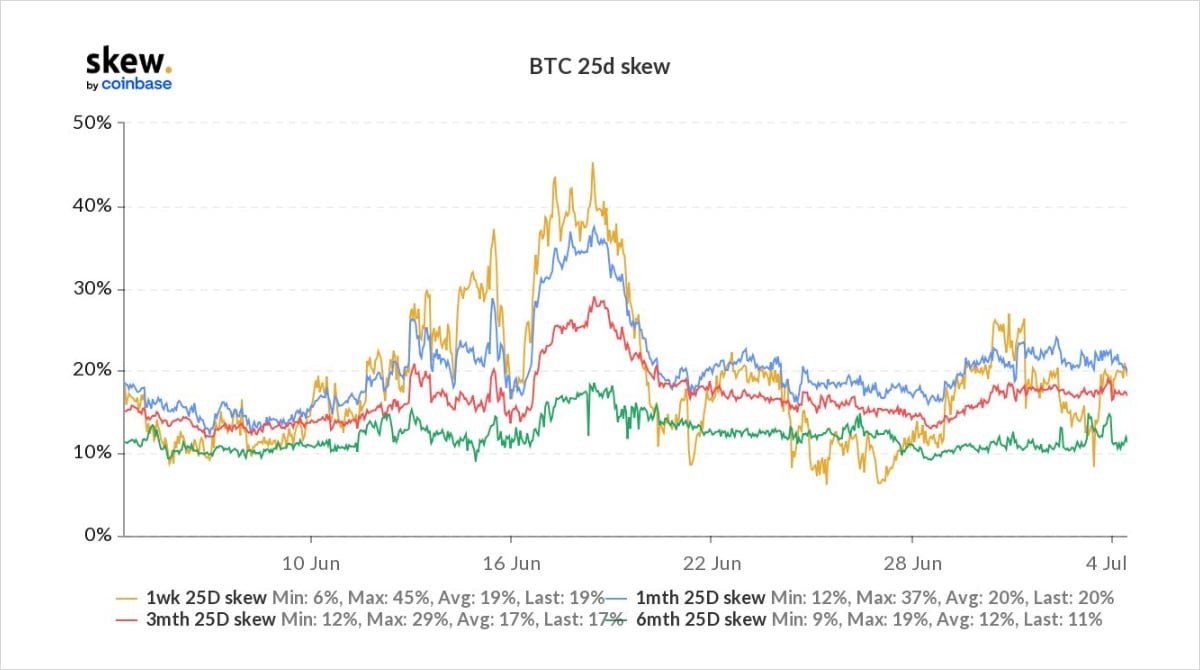

2) 1-week interest in the (low cost) Jul8 13-15k Strike Puts continues as exposure rolls off at the weekly expiries. Put Skew, after reaching extremes >40% has fallen back but seems to plateau at 10% Put>Call (using 25delta as proxy). Downside concern persists, but less panicky

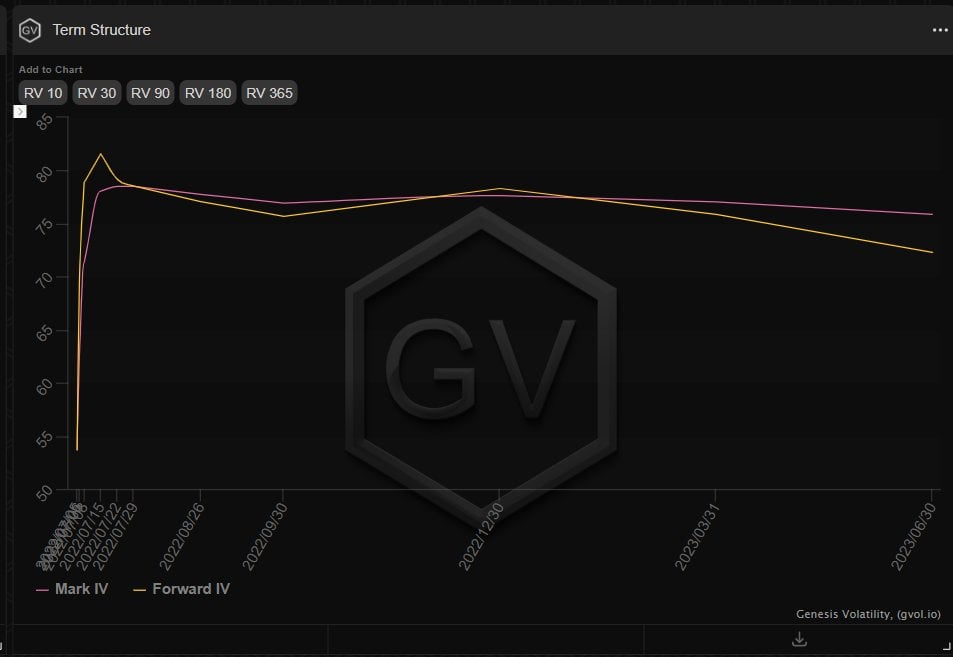

3) ITM Call spreads (July+Aug 20k-26-28k) were sold x 1k. More often we observe initiators buying this type of spread, so direction is conspicuous and anticipates static-mildly lower spot, and/or IV falling. But IV has held resilient despite RV dropping. Flat Term-structure 1w+.

View Twitter thread.

July 10

With SBF, CZ, SUN ready to step in, comments that worst likely over, panic subsided, downside threats more limited, Spot recovered >20k/1.1k and upside Option plays switched from timid to committed.

Buyers July 20-25k Calls, Dec Call spreads.

But at 22k/1.2k Calls+Gamma TPd.

2) Buyers Jul15-29 22+23k Calls +structures that rolled up 20k exposure to 21k+24k, a buyer of 800x July29 25k all playing the short-term bounce, while a buyer of Dec Call spreads in BTC25-35k +ETH ~1.2-2.4k looked for EoY exposure, flat fwd, less decay.

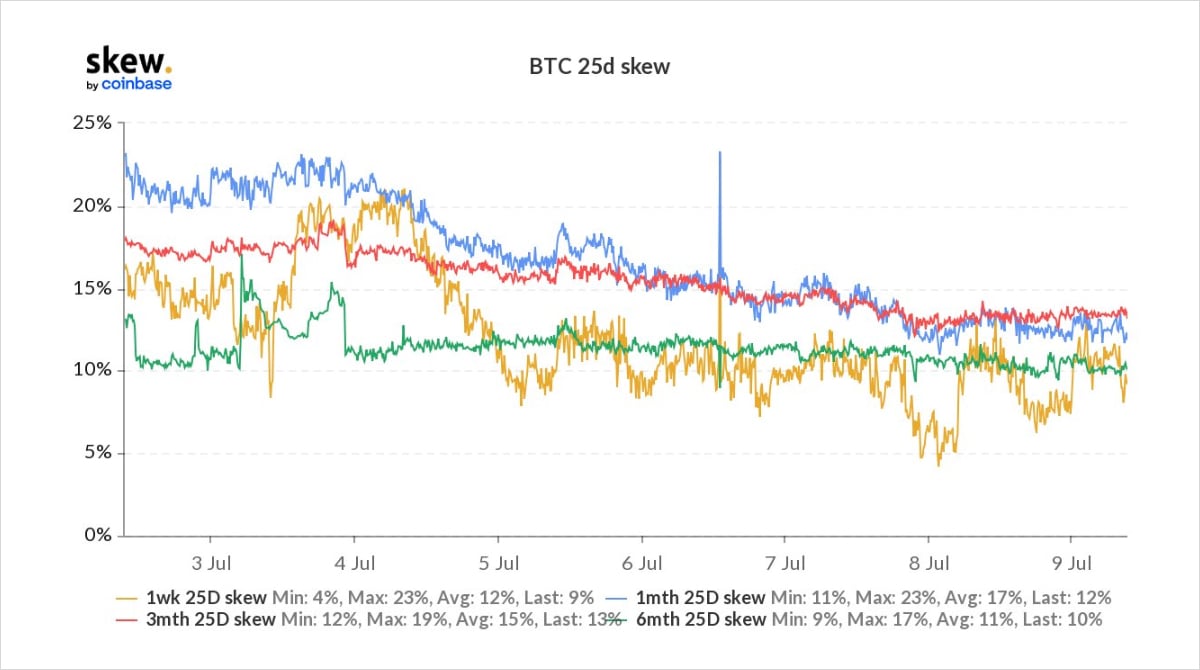

Less fear, Skew appeased.

3) While Put Skew softened as Puts neglected and Calls bought, there continues to be stories each day of a new protocol/company impacted, or lack of clarity surrounding risk unwind, so Puts haven’t been plunged.

Have observed Jul/Aug/Sep Strangle sellers, as some comfort returns.

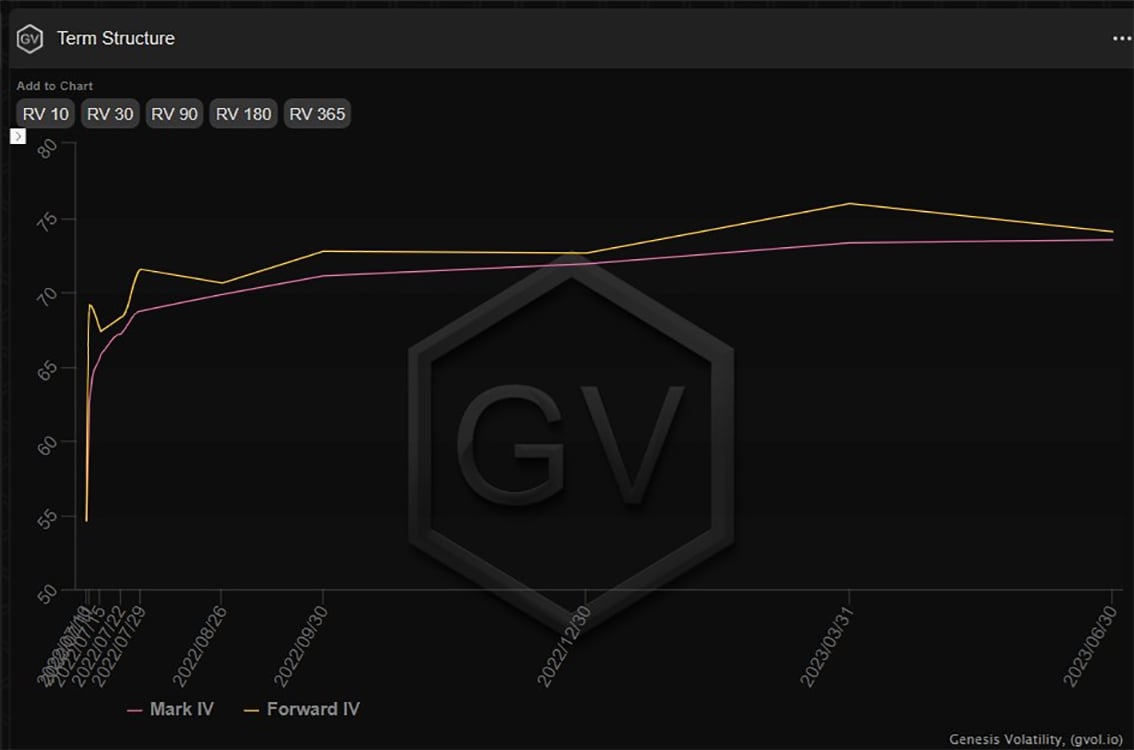

4) These Strangle sellers (tight strikes – BTC 19-24k) plunged IV.

Also the buyer of July29 25k Calls at $250 decided to TP for a 50% win. This would have been more but buying 73% selling 65% IV worked against the trade.

Calls TPd +DOVs sold front Gamma ahead of wknd.

Contango.

View Twitter thread.

AUTHOR(S)