In this week’s edition of Option Flows, Tony Stewart is commenting on BTC holding its pattern, Fast-money and IV spiked.

January 19

BTC holding pattern, ETH hits high>$1425.

ETH: Buyers ATM+OTM Call spreads for further upside, but also ATM Put spreads for protection.

BTC: Jan 52K+ Whale Call buyer not recently sighted.

Instead, protective/bearish flow bias: Feb 36 Put Fund bought x~1k, Jan22 35k x~1k.

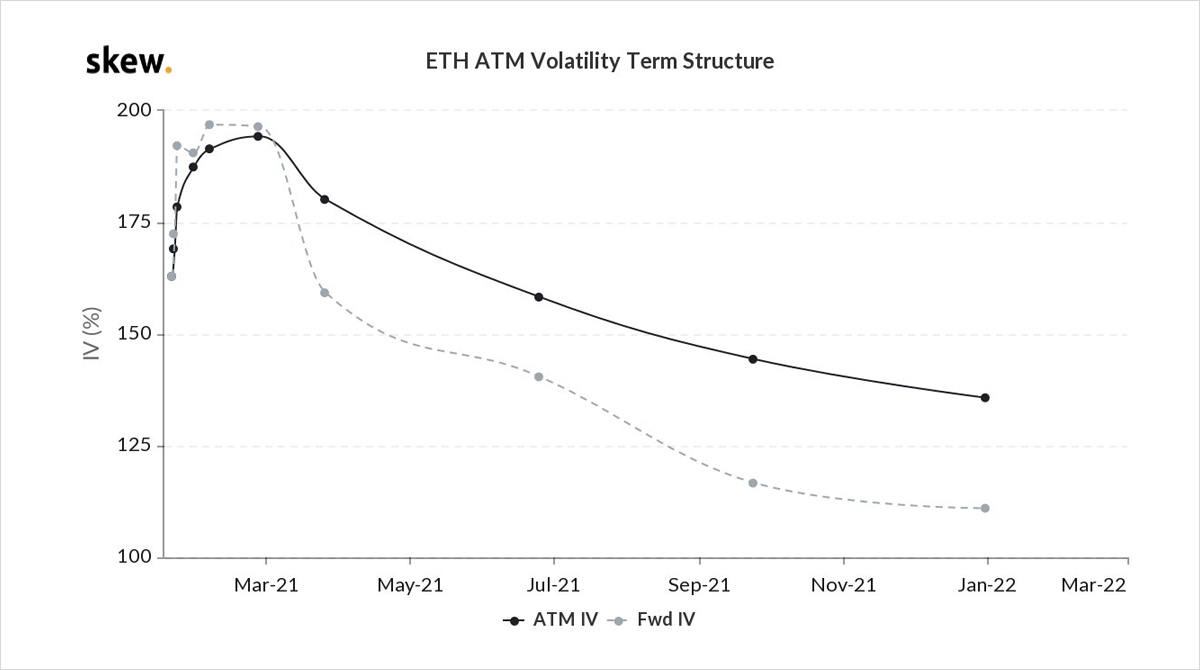

2) With ETH Feb IV at 200%, the Option Spreads traded today are structurally more efficient than Outright Options, as they lessen overall cost and vulnerability to high Vega.

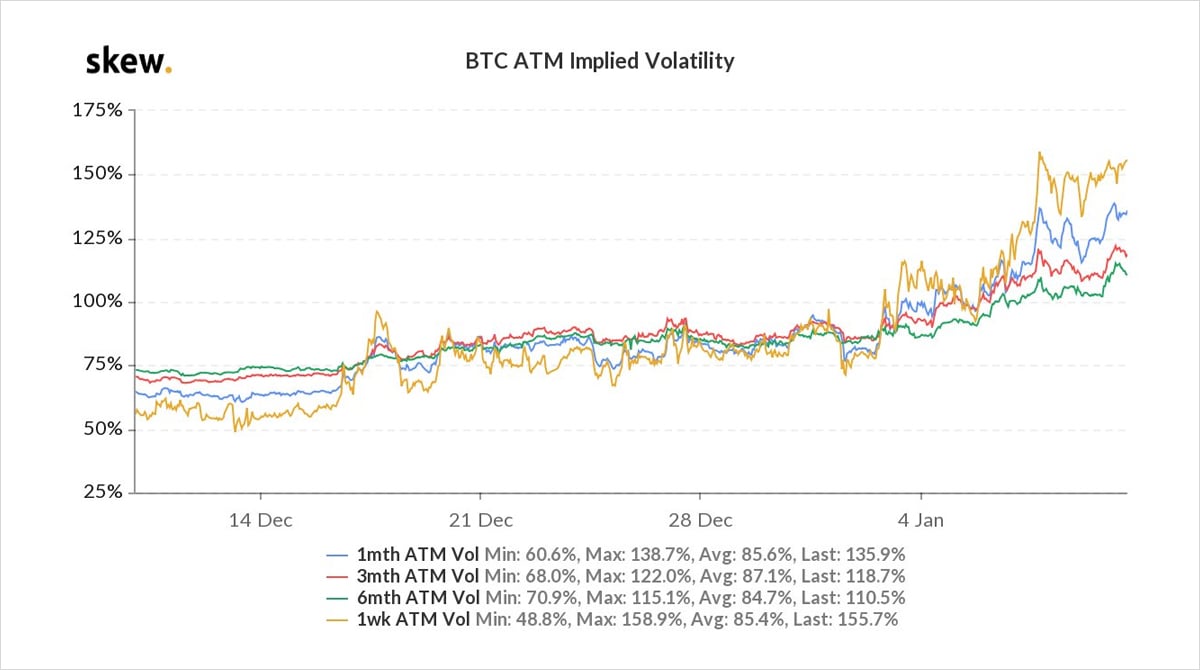

With BTC Feb IV drifting back to 130%, Outright Options or Spreads are both reasonable to gain exposure.

3) Conspicuous BTC<25k Strike Crash Puts bought over recent weeks; at >200% IV would perform only in that scenario.

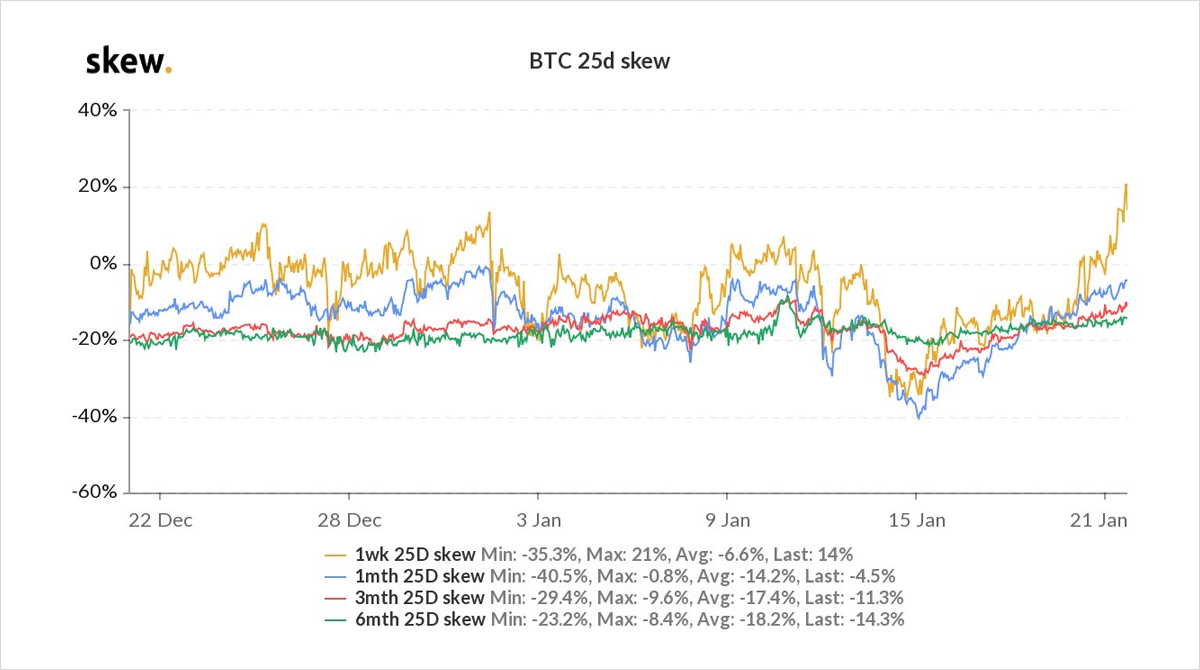

More judicious 32-36k area Puts bought today, opportunistically buying retraced 130% Vol levels and -ve Put skew – the result of wild Call demand.

Skew reverting.

View Twitter thread.

January 21

While near-dated BTC Put skew has firmed dramatically, inferring cumulative fast money fear of <30k, Paper hedging is largely absent on this leg lower.

In fact, Funds selling the 24k Puts across maturities x1.5k.

Also, sales Feb-Jun 56-72k Calls x1k, setting ‘safe’ boundaries.

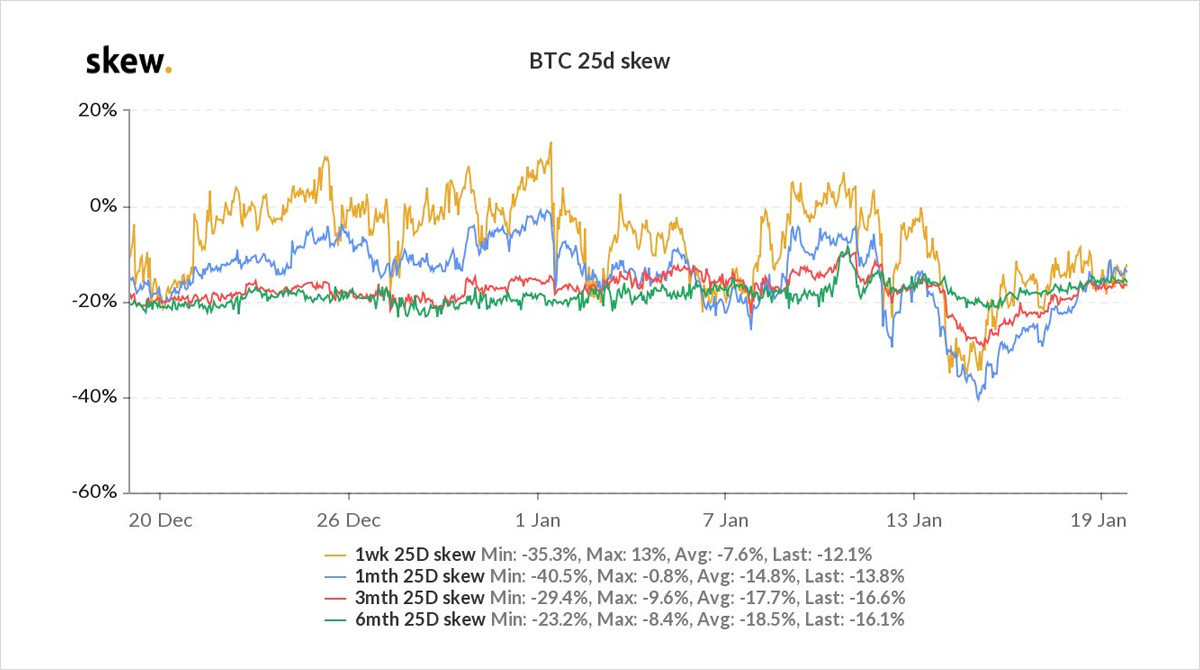

2) Below shows the severe move in 25d Skew.

This is a consequence of:

-Cumulative smaller ‘non-Paper’ buying Jan Puts,

-A move away from extreme OTM Short Calls (Jan52k+)

-Likely over-exposed ‘bull market’ participants.

-Market-Maker concern of possible large dip if 30k breached.

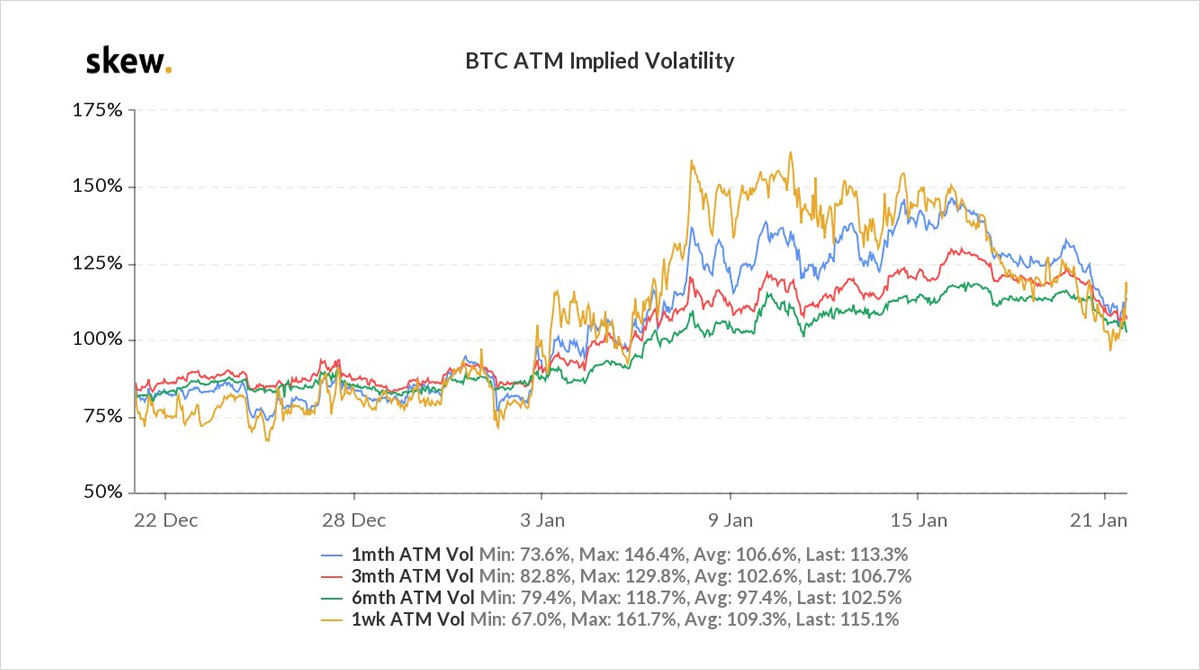

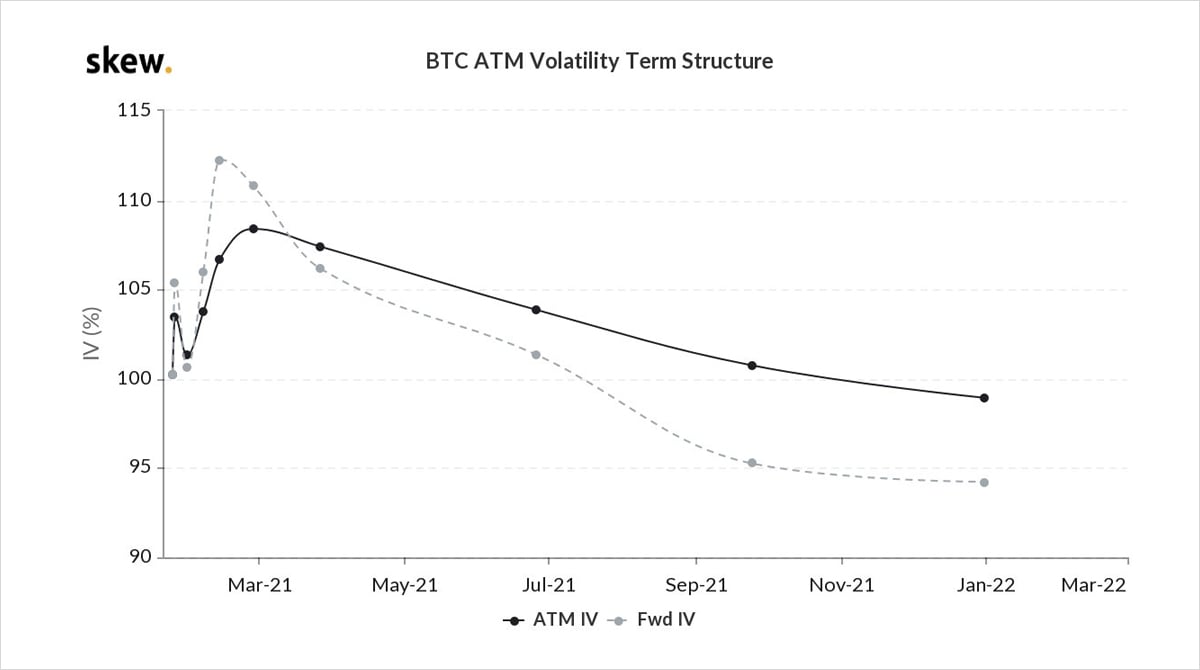

3) IV dynamic also interesting.

Prior to today, BTC maintained a moderate range, reducing RV, pressuring IV.

However, also a technical reason that hit IV further.

MMs short the Jan OTC Calls to Whale buyer, had to hedge with near-ATMs. As IV+spot fell, MM longer vega; vulnerable.

4) Today’s 10% BTC drop, has only barely firmed IV.

Indeed, as stated earlier, sales of Feb-Dec wings (but with material vega) has steepened the term structure into backwardation.

The relatively orderly BTC move 35k-31k prompted gamma firmness, but vega supply absorbed not bid.

View Twitter thread.

January 22

Fast-money Jan Put buyers proved astute, as BTC plunged <29k, but then dramatically bounced (now 32.5k), compelling hasty unwinds.

IV spike was rapid and short-lived, reassuring yesterday’s Fund ‘Strangle’ sales.

Jan IV retrace over-extending; one-way scramble to avoid decay.

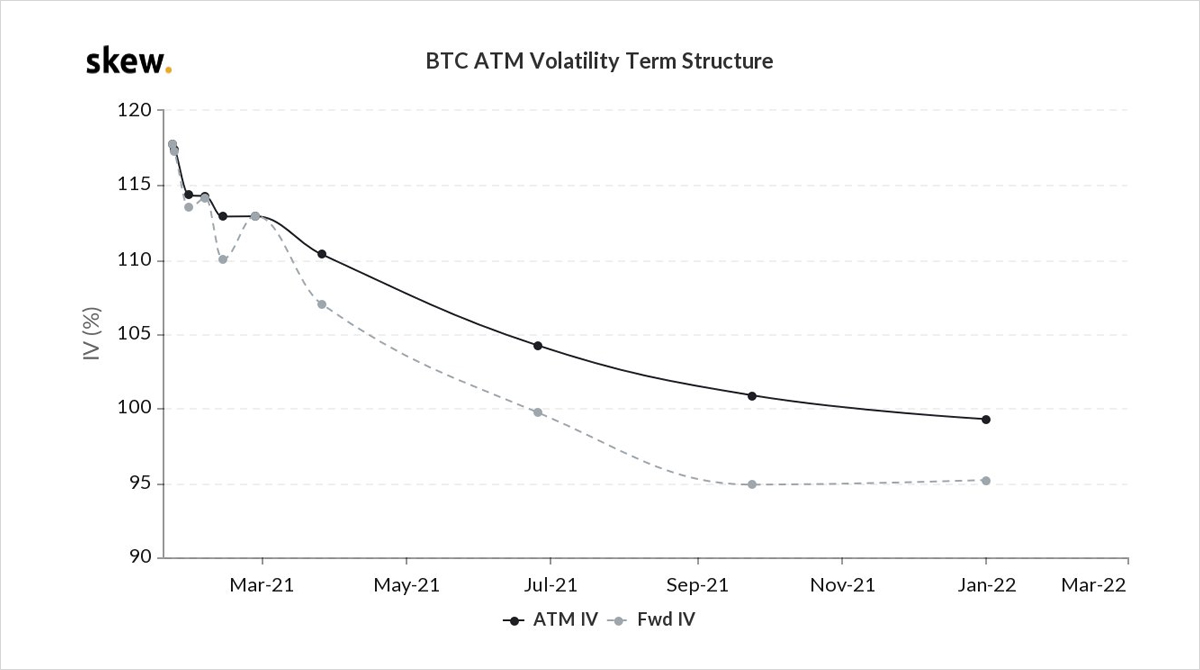

2) The resulting maturity curve discounts the near-end, suggesting the Options market is pricing a quiet weekend or predicts further IV drop.

Given that 10day Realized Vol is 125% and the Implied curve <110%, this is bold, but certain elements of downside fear have been resolved.

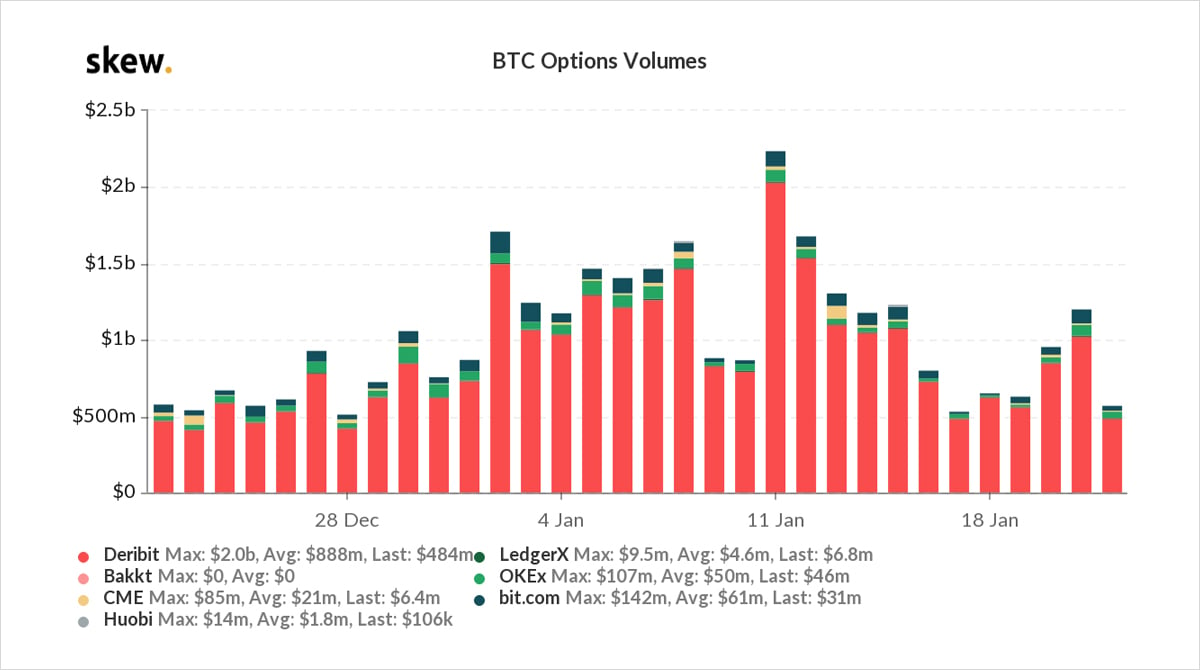

3) Interestingly, BTC Options volumes were subdued today, despite the large volatility and critical test of <30k.

While fast-money is active, large Fund trades have been limited, perhaps Funds happy to add exposure <30k, and that prior rallies illustrated underperformance angst.

View Twitter thread.

January 10

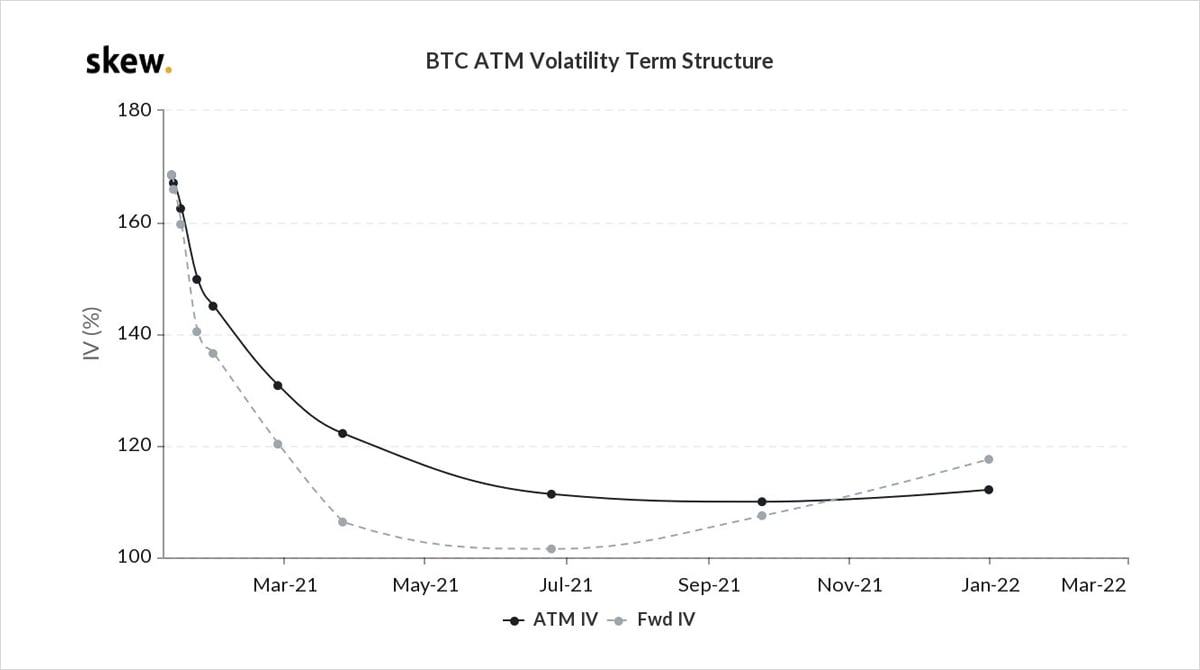

Short-closing Jan29 ITM Calls now up to 28k-32K strikes x1k+, squeezing vol up 20% at the front.

But the trade of interest printed in Dec21 100k+ Calls, net x2k of which was buying interest, initially via Jun64k-Dec100k+ CS, then outright Dec21 100k Call.

Several explanations:

2) The most exciting is that this originated from a large bullish OTC trade where the initiator bought large amounts of bullish long-term 100k+ Calls.

The listed trade that printed was covering that risk.

Weekend timing is perplexing but not a precedent.

3) The prints started with spreads: Dec100k+ Calls bought, Jun64k Calls sold. With inventory low in Dec21, often a good way to get exposure is by a spread, cover the illiquid leg first, then cover more liquid Jun (or close maturities), or spreading off existing long inventory.

4) Other explanations could be:

-Buyer is pricing a large OTC trade, knows will happen

-Buyer is covering a long-dated 100k+ Call legacy trade.

-Buyer likes long-term vol v medium-term vol

-Buyer likes Dec upside skew vol levels relative to ATM,

-Buyer likes 1yr forwards

etc.etc

5) How long-dated extreme wing Calls + skew should be priced is contentious. Expect to see continued arguments.

The result of all this near-dated short-covering + reticence to aggressively sell convexity+ long-dated Call buying has been to pump Implied Vols back to their highs.

View Twitter thread.

AUTHOR(S)