In this week’s edition of Option Flows, Tony Stewart is commenting on last weeks ETH July calls vs the upcoming Merge.

July 25

Last week’s ETH July Calls worked out nicely on Merge details becoming clearer.

This particular Fund tends not to roll exact Strike exposure, and so far this is true again.

Other Merge related Option exposure has been dominated by Sep+Dec Calls (+Spreads), Straddles +CFlys.

2) The Fund likely bought the ETH Calls on clarity over the Sep19th Merge date. Jul maturity choice was to take advantage of Funds underexposed ETH that would react immediately.

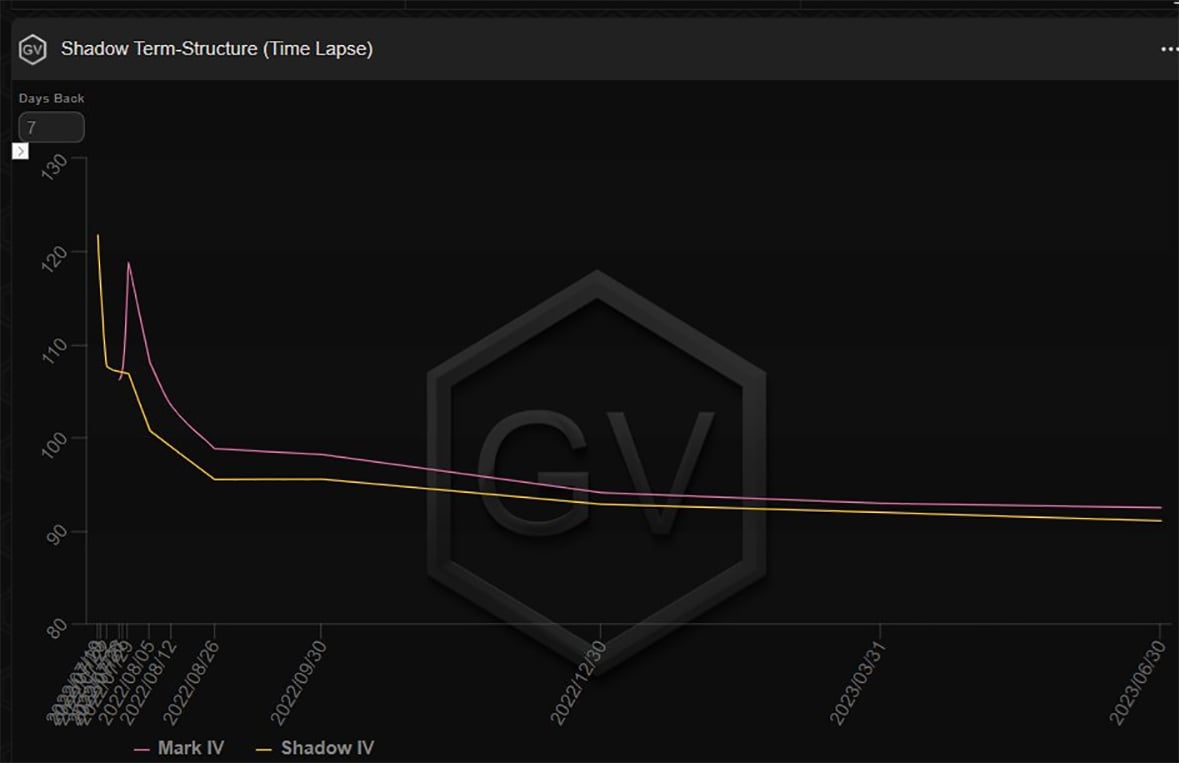

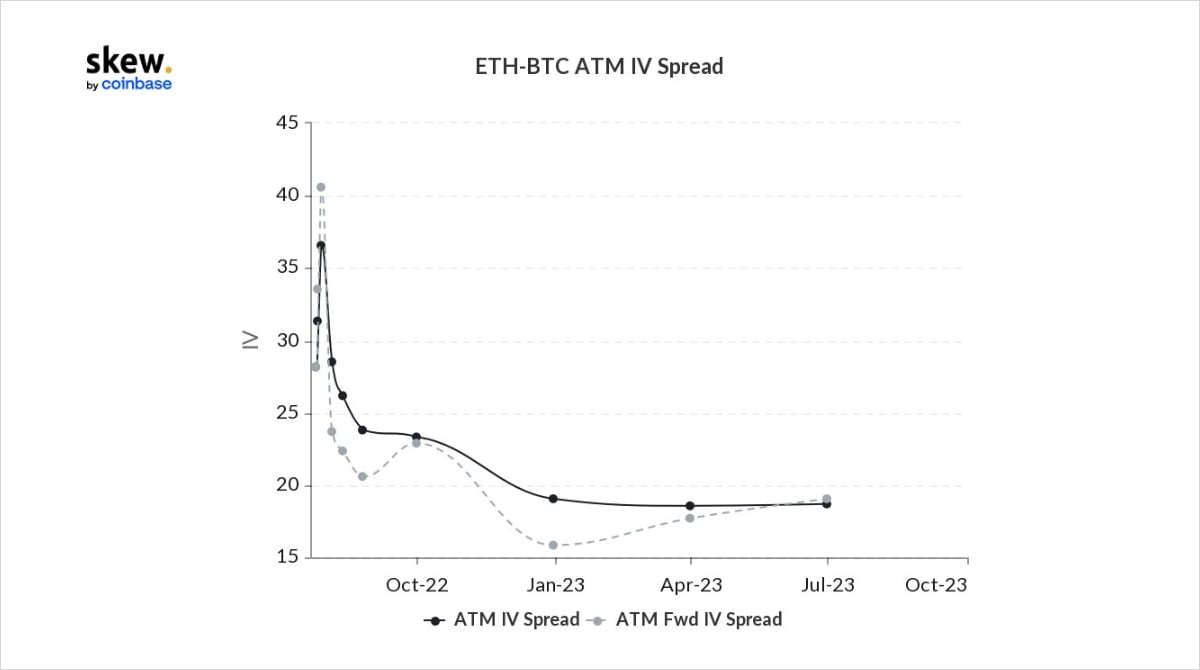

MM risk management+ large Spot moves sustained term-structure backwardation with fronts firmly >100%.

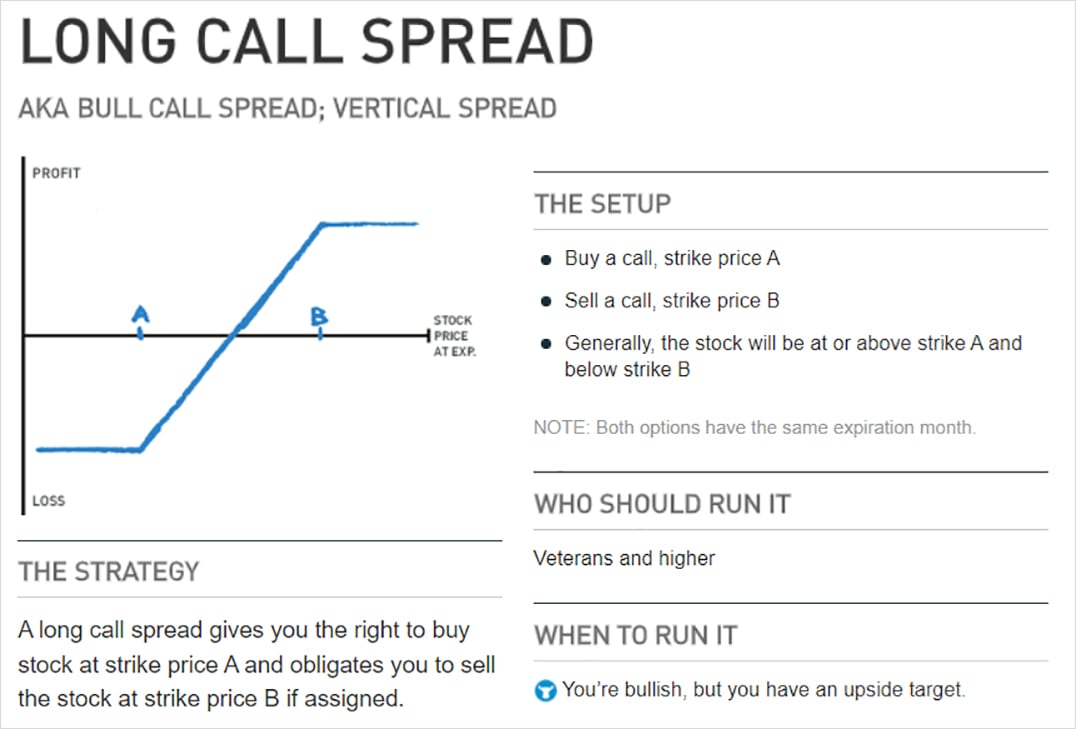

3) The volume Option trades after the July Calls were more Merge timing-specific.

Sep 1.6k Straddle, Sep-Mar 2.5k+ Calls, Sep+Dec 2.5/2.6-3k Call Spreads, and a large Dec 2.5-3-3.5k Call Fly.

Each has pro+cons; expanded below.

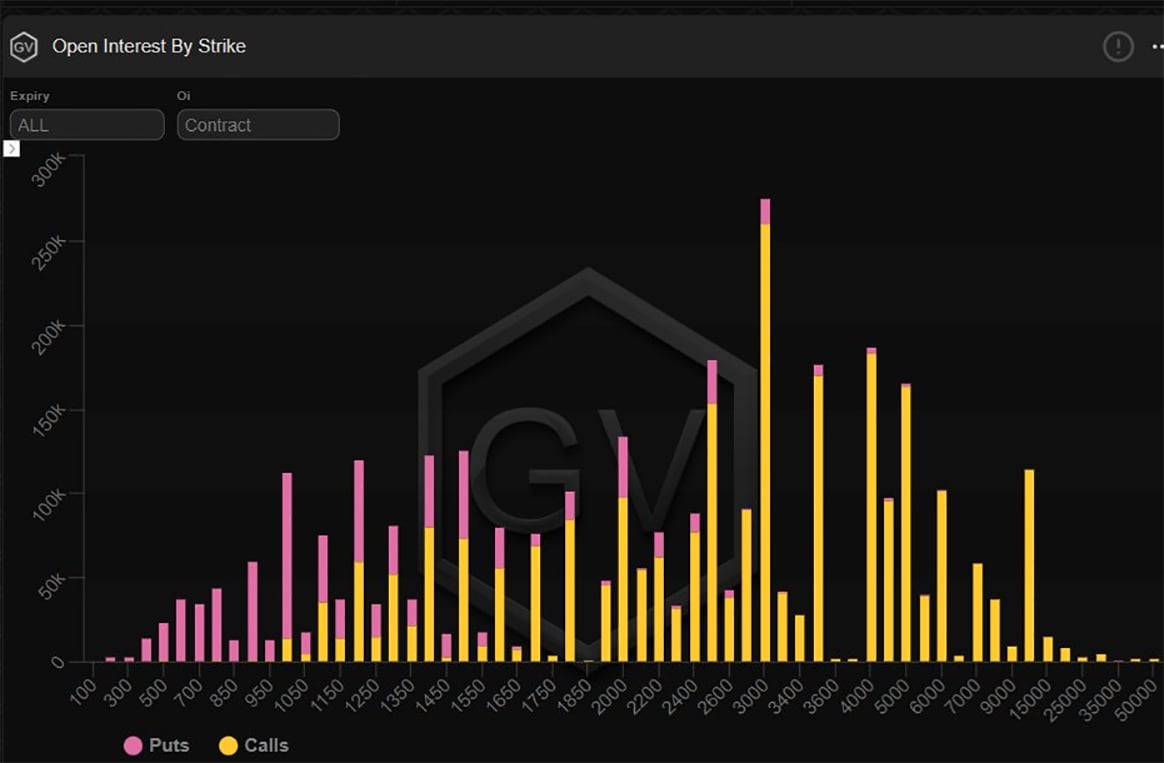

Effect to increase OI (and talk) from Puts to Calls.

4) Before expanding on the different strategies, it’s critical to recall that despite the current strong ETH narrative, Crypto is being buffeted by macro headwinds.

Inflation continues to exceed expectations and supply chains are struggling.

BTC Jul29 also elevated ahead of FOMC.

5) Straddles (ETH Sep 1.6k x5k) when hedged desire volatile markets and increasing IV, when unhedged prefer large one-way Spot moves.

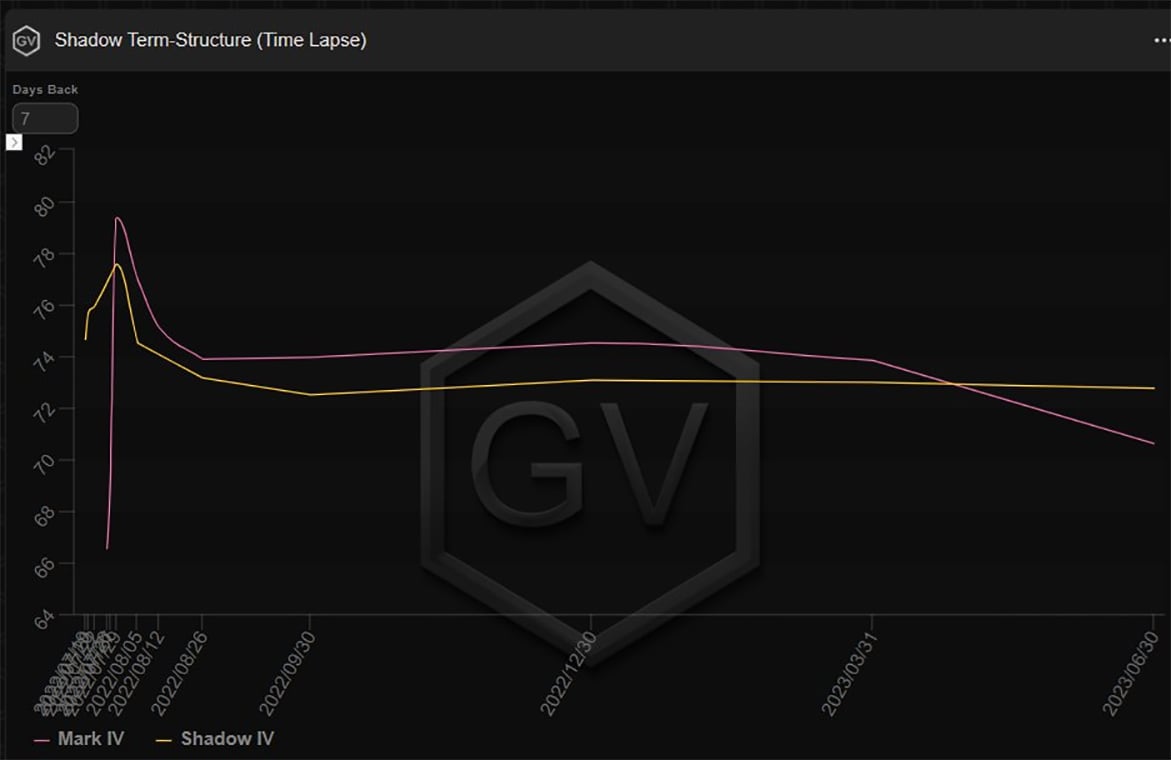

ETH Sep is on a 3rd plateau when looking at 3month history, so a little elevated. Merge may move the market, Summer can be quiet; unclear IV path.

6) Upside Calls bought through Sep-Mar are similar when hedged to Straddles, with respect to IV rewards, but obviously only benefit from one direction if unhedged.

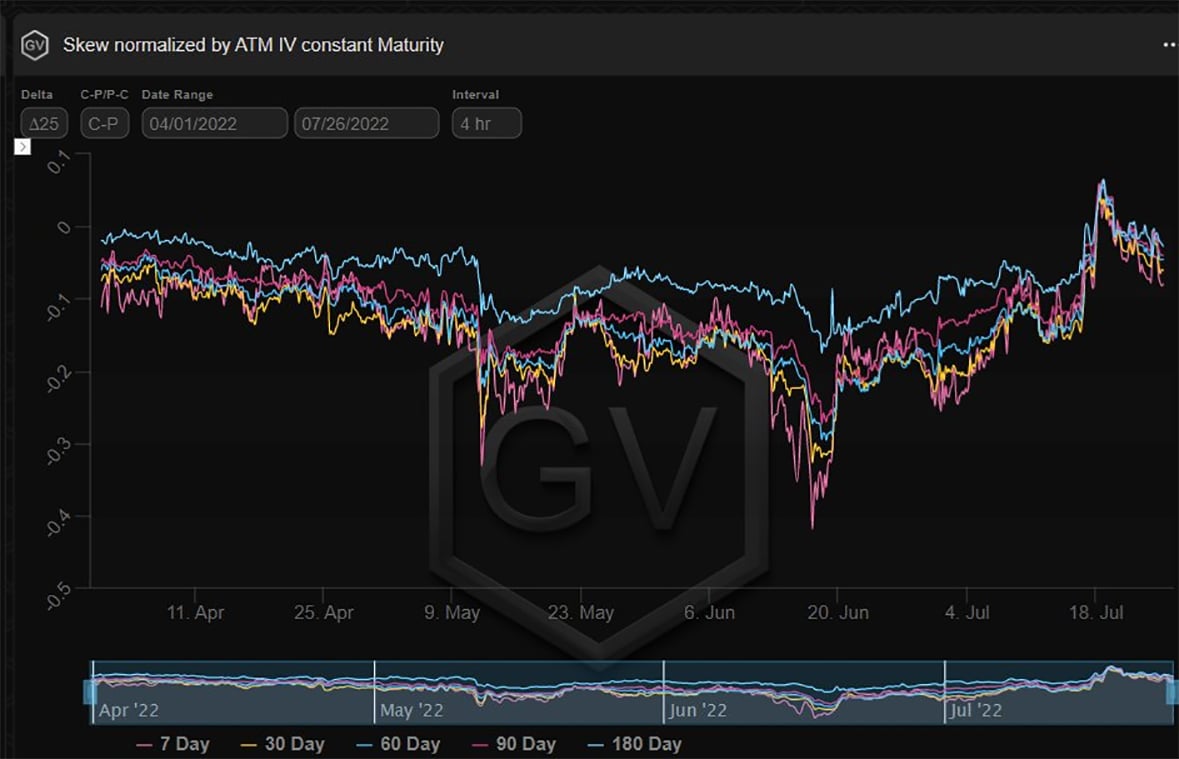

Advantage has been a -ve Call Skew making the Calls better purchases, but demand has now shifted the Skew upwards.

7) ETH Sep+Dec 2.5/2.6-3k Call Spreads were bought. These have the merits of lesser exposure to elevated IV, and reduced decay, so they behave better over a quiet summer and then a +ve Merge result.

However, their upside is limited by the higher strike (which can be bought back).

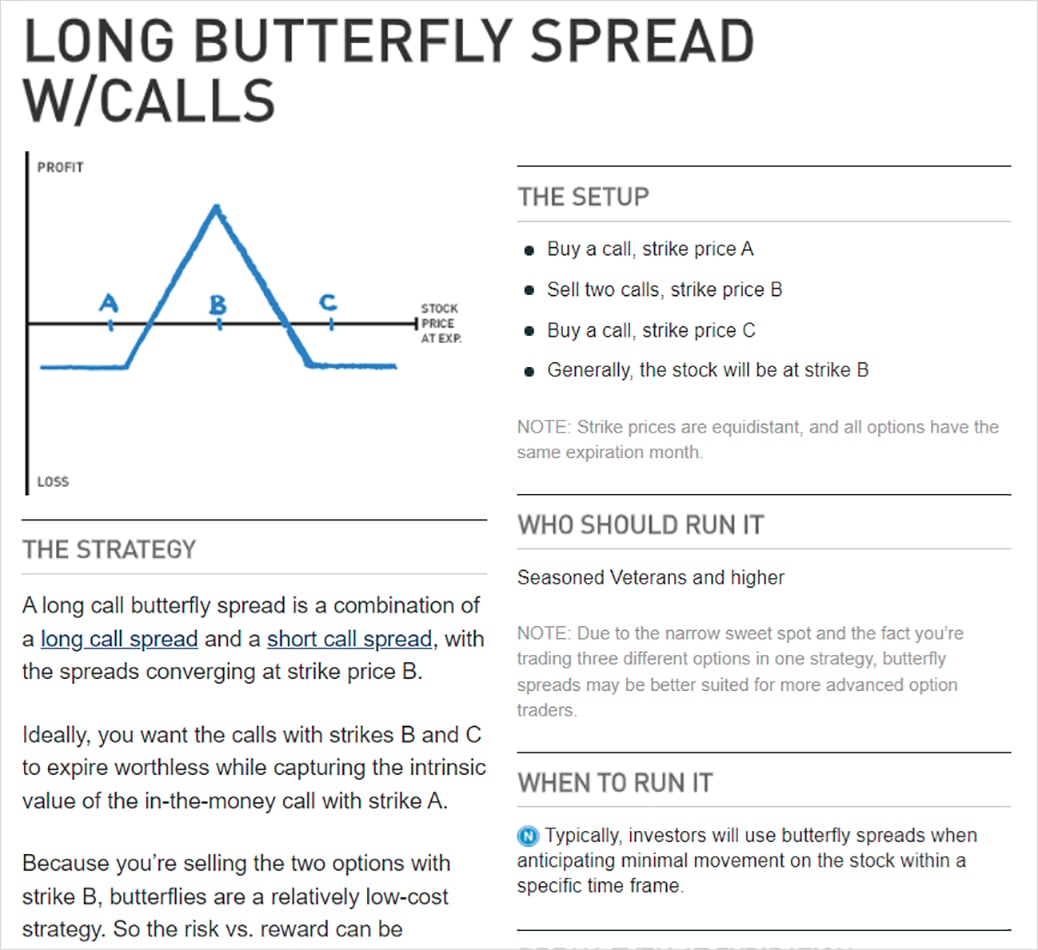

8) Biggest discussion this week has concentrated on the ETH Dec 2.5-3-3.5k Call Fly bought x75k+.

Frequent readers will recall Call Flys being bought before, often surrounding Merge talks, but this trade is the biggest block (over a couple days).

Bullish but complex in practice.

9) The advantage is a small upfront premium compared to Calls (+spreads) and negligible vega+theta, so good over quiet times.

But Delta+Gamma also small.

The hope is that Merge is not priced in and when close, ETH Spot accelerates fast upwards.

Optimum settlement at expiry is 3k.

10) But this is where theory and practice depart.

Imagine everything works out ahead of the Merge and in late August ETH rallies to 3k. A rally of this nature likely means IV surge and therefore results in short Vega as the long Strikes are 500points away.

11) Two main choices –

a) take profit, which will be decent, but because of high IV and a few weeks before expiry not the theoretical profit you’d been promised by your ‘quant’.

b) wait for IV to fall and/or Spot to settle as Expiry ticks down – hugely profitable.

12) Experienced traders will recognize b) as a huge short Vega+Gamma position, which keeps on increasing.

The worst result is ETH Spot rallying >3.5k (or dropping back <2.5k) when your initial play was correct.

-ve Gamma hedging can be mentally painful, so you reconsider a)!

13) There are some other options to add to a+b, but the point is that Call Flys are tricky in practice unless you have realistic expectations.

There is a reason why they are low cost to start.

All strategies are path dependent and need to be managed well, frequently before Exp.

14) We also observed BTC Dec 40-45-50k Call fly x2k bought. While this suffers the same issues, of course, a strong BTC rally in sympathy with an ETH Merge is likely to be less volatile and a smoother upward path; easier to manage.

ETH is already outperforming BTC, Spot, RV+IV.

15) Despite all the upside Call activity, the Merge is still a couple months away. Summers can be quiet in BTC+ETH, often focussing on other esoteric areas.

Option strategies have limited premium costs in case they’re wrong.

Puts have been sidelined, Skew is retracing to flat.

View Twitter thread.

AUTHOR(S)