In this week’s edition of Option Flows, Tony Stewart is commenting on MSTR results, MM short 5aug Gamma and more.

August 3

Pelosi in Taiwan, MSTR results, MM short 5Aug Gamma, kept BTC+ETH IV firm.

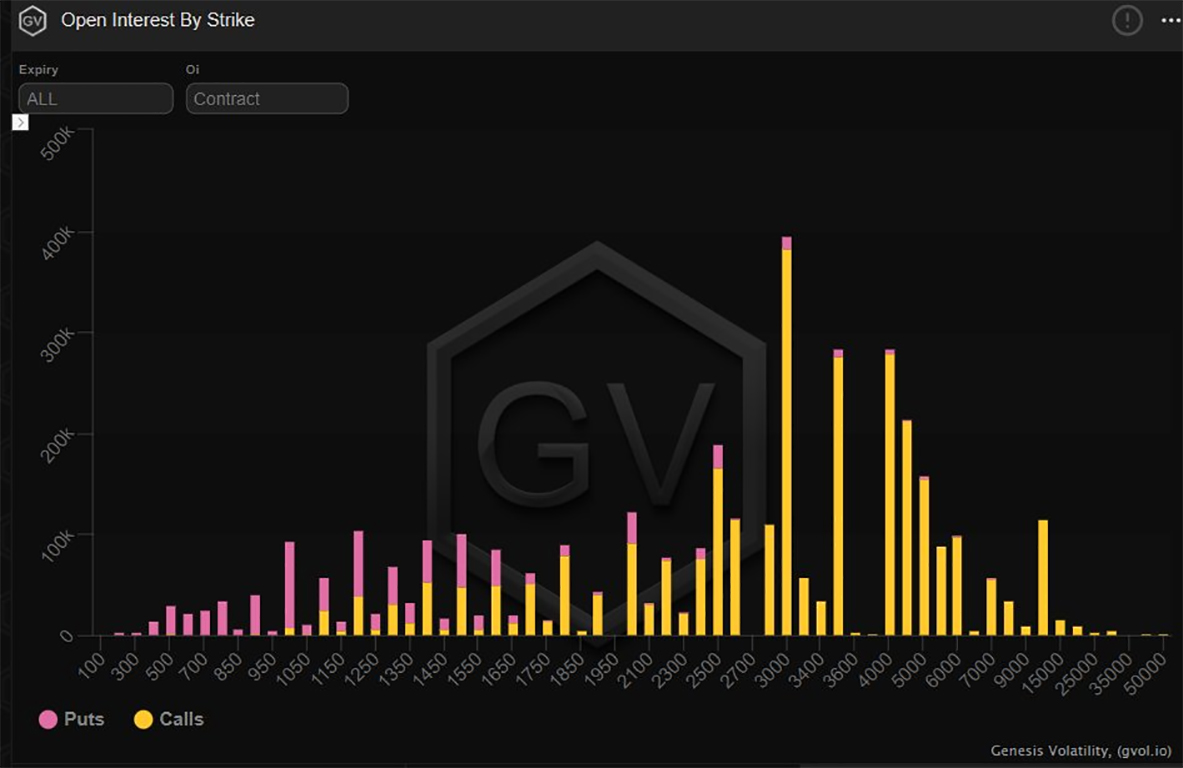

BTC saw demand for Options but limited and sprayed across tenors. Re-emergence of some Mar 40+50k Calls bought stood out.

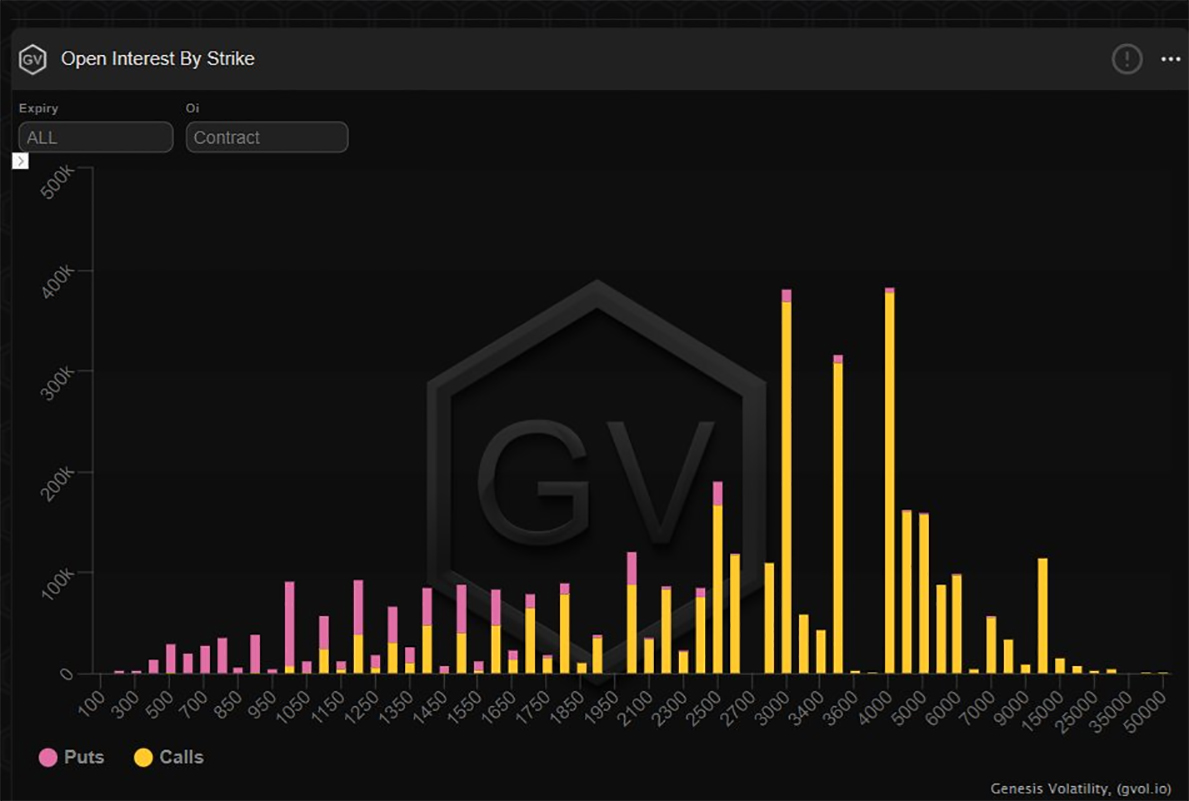

ETH dominated in volume with more Call Flys, now out to Mar 3.5|4.5|5.5k x75k+.

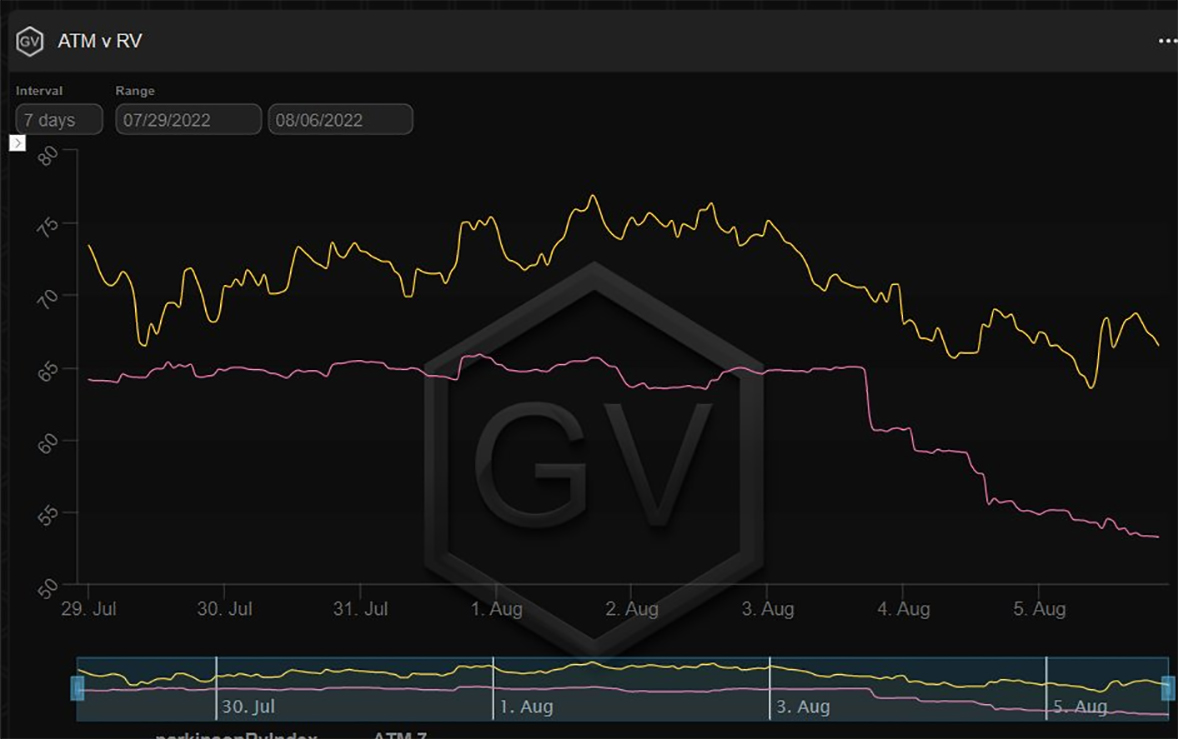

2) ETH IV~RV near 100%, but BTC IV >RV by 10%.

This BTC firmness could be explained by the 20% discount to ETH, the Friday Fund buyer of Aug5 Calls, and perhaps some of the external influences such as Pelosi and MSTR.

BTC flows were light, but biased to buy Options, more Calls.

3) After seeing ETH Sep Call Flys & Dec Call Flys over the past weeks, now is the time for Mar23 Call flys, specifically the 3.5|4.5|5.5 Call fly, trading 75k+

Given Sep19 Merge date, perhaps this is looking more into the future of a +ve impact.

Wider strikes give flexibility.

View Twitter thread.

August 6

With the BTC Aug5 25+26k Calls not working out for the Friday Call buyer Fund this week and a surprise NFP print dampening immediate upside, there was no return of the buyer today. But upside Sep28k and Mar36k Calls were added. In ETH no C-Flys, but a roll of Dec3k to Mar3.5k.

2) Summer apathy seems to have hit, with some big news events shrugged off, as many participants have flown off.

Realized Vol has suffered, but Implied Vol still trades at a premium in BTC and has just started to follow in ETH.

ETH has a Merge narrative so understandable.

BTC:

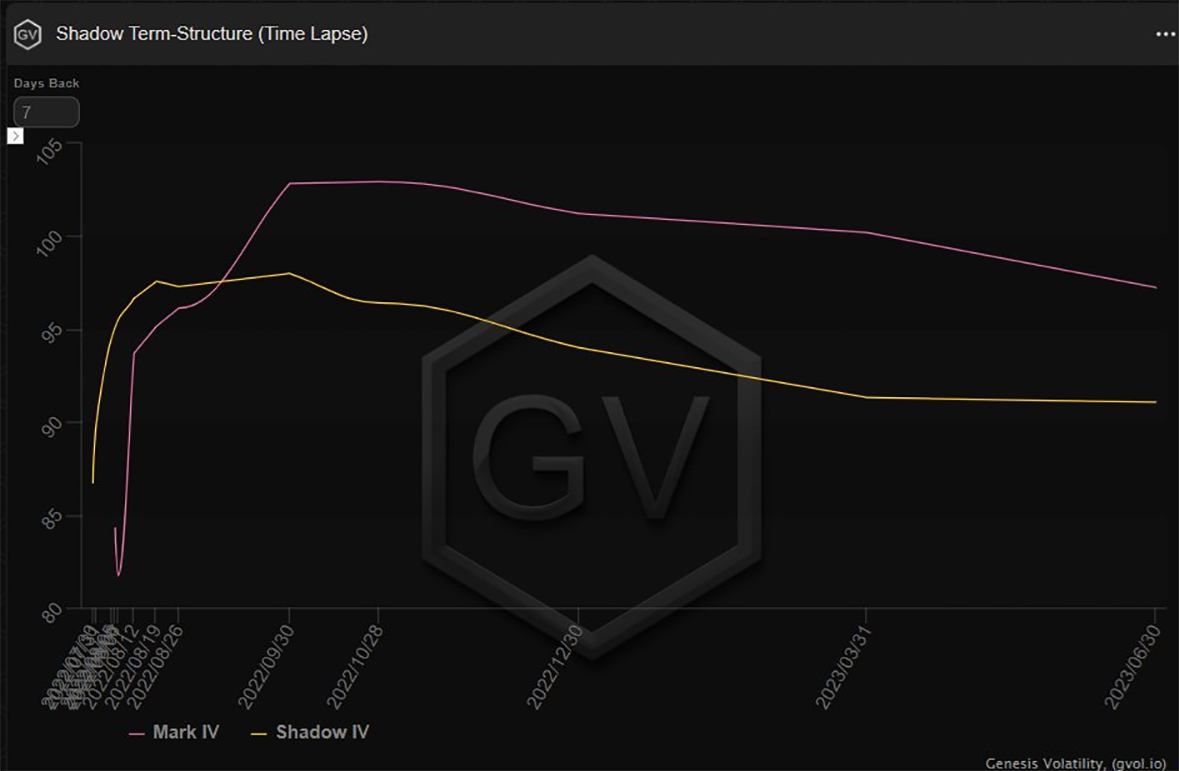

3) The ETH term structure has started to create pre-ETH and post-ETH separation, not so evident in BTC or other risk assets where Sep-Dec might naturally be bought and funded by shorting pre-Sep over summer.

Buying calendar spreads, or buying out-right Sep+ strategies is clear.

4) So seen the ETH Sep+Dec+Mar Call Flys, and BTC Sep+Mar OTM Calls bought, whereas seen selling of ETH+BTC Aug12-26 maturities.

ETH trade today was a roll of Dec3k Calls to Mar3.5k Calls x12k. Maybe purely to reduce strike risk from the Flys as LPs have it all on the same way.

5) Whether this Sep bump continues to exist on the ETH curve is dependent on Spot moves and uncertainty relating to the 19th Sep Merge date and FED meeting 20/21 Sep.

If summer remains quiet, that Sep bubble may pop. Arthur Hayes in his most recent article prefers a Dec 3k Call.

View Twitter thread.

AUTHOR(S)