In this week’s edition of Option Flows, Tony Stewart is commenting on Macro pressure on US markets, and the newly released CPI data.

October 11

IV weakness continued with DSOB sellers of Oct28 21k C and resting offers in Dec 17k,18k+19k Puts.

But as Macro pressure weighed on US markets, and as Spot drifted, sentiment flipped.

Nov 19k Puts bot, DSOB Dec offers lifted.

Nov 15-25k RR x500 P bot, Oct 17-18.5k P bot x3k.

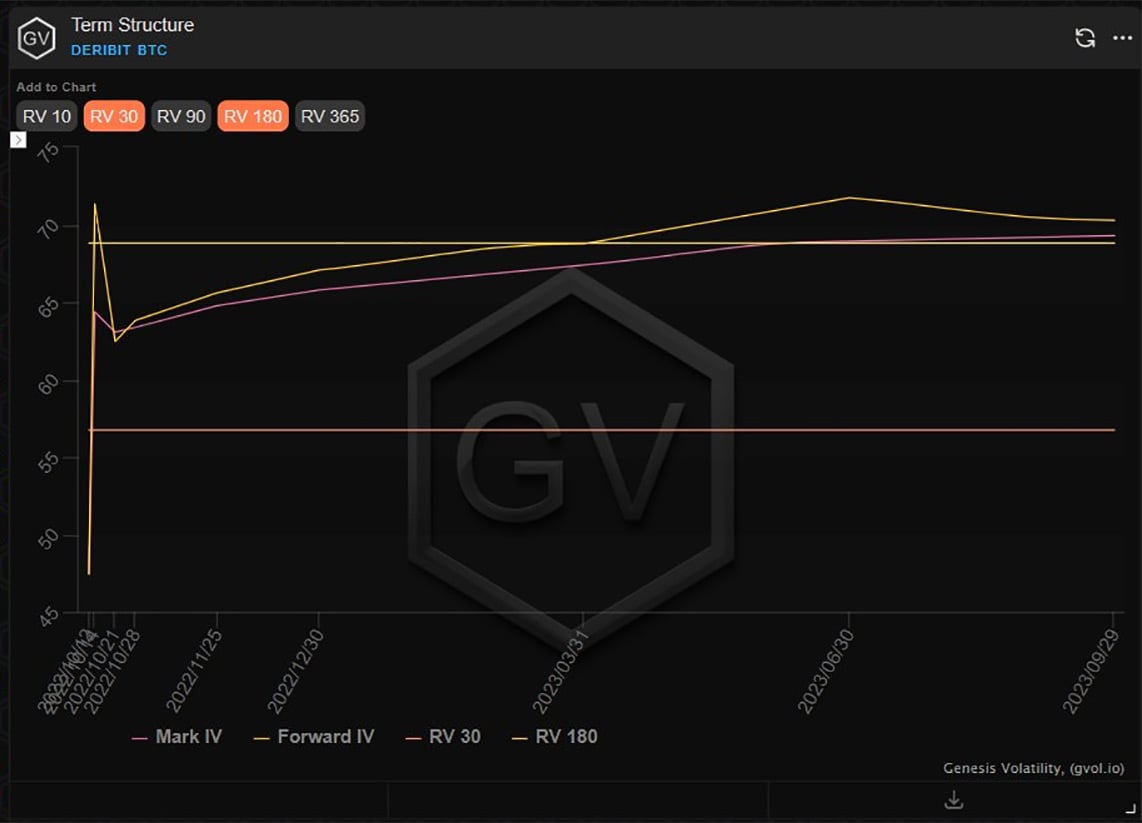

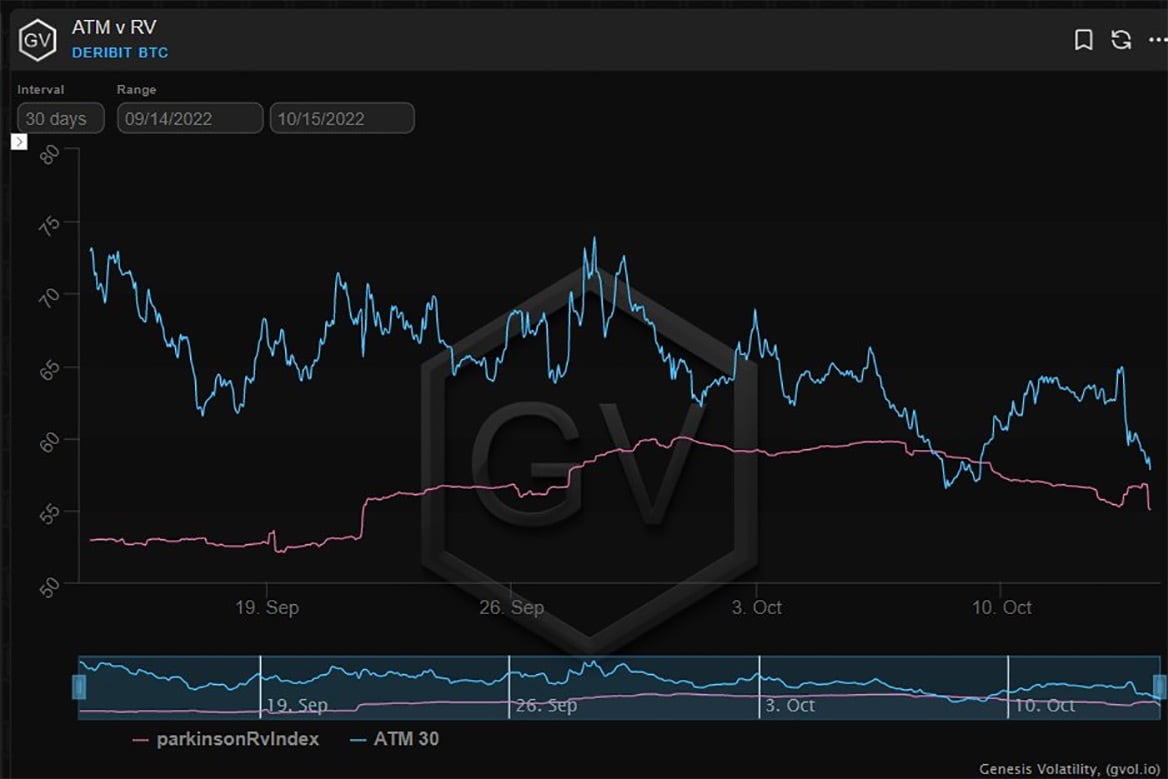

2) While near-RV still trades at a discount to IV, a reminder that RV is backward looking.

RV defines the observed environment, but if the psyche of traders adjusts, that can result in a change in the perceived environment.

This can convert to buyers of Risk premium (Skew+IV).

3) Note in the above chart, the 30d RV is trading at a severe discount, and the 180d RV is trading in-line.

Buying of near-ATM Puts focussed at the front end, where IV had been hit hardest.

4x 500 blocks of Oct21+28k 17-18.5k Puts lifted in US hrs, 1k of Oct28 17k Puts Asia hrs.

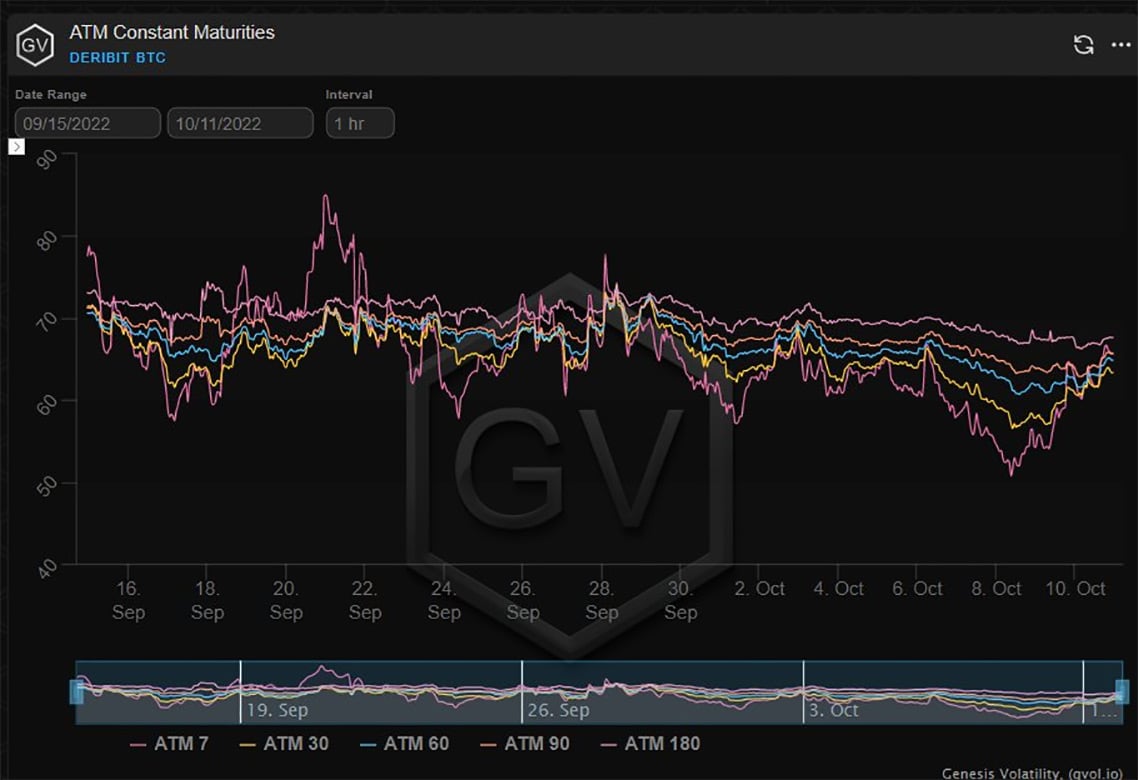

4) While these buys pushed 7d IV higher by 10%+, 1m by 7%+, further dated barely adjusted.

These rises simply mean-reverted IV back into its recent range after the weekend dip.

Likewise, Put Skew which had been beaten up, reset higher as Put purchases and Nov 15-25 RR impacted.

View Twitter thread.

October 14

Unremarkable CPI data created a remarkable day.

Pre-print Oct Straddle sales anticipated IV to reset lower after the news, but didn’t foresee the lost Gamma as S&P hit 3500, BTC 18k, ETH 1150, before incredibly surging back to 3700, 20k, 1325.

Option flow messy. IV crushed.

2) Immediately post the much-awaited CPI, IV was marked down. But as Spot hit major supports and held, Option Put longs TPd and crushed the front months 10%+.

2-way DSOB action in Nov+Dec 21-23k Calls on the rally very messy as long delta exposure conflicted with long vol exits.

3) Further Call sales came from bears and over-writers that believed while a rally was acceptable, there was a limit, and these sellers also sold 22-25k Call strikes.

This was not only at the front-end but in March too, as 19-26k Call sales x1.5k hitting the 3m+ maturities hard.

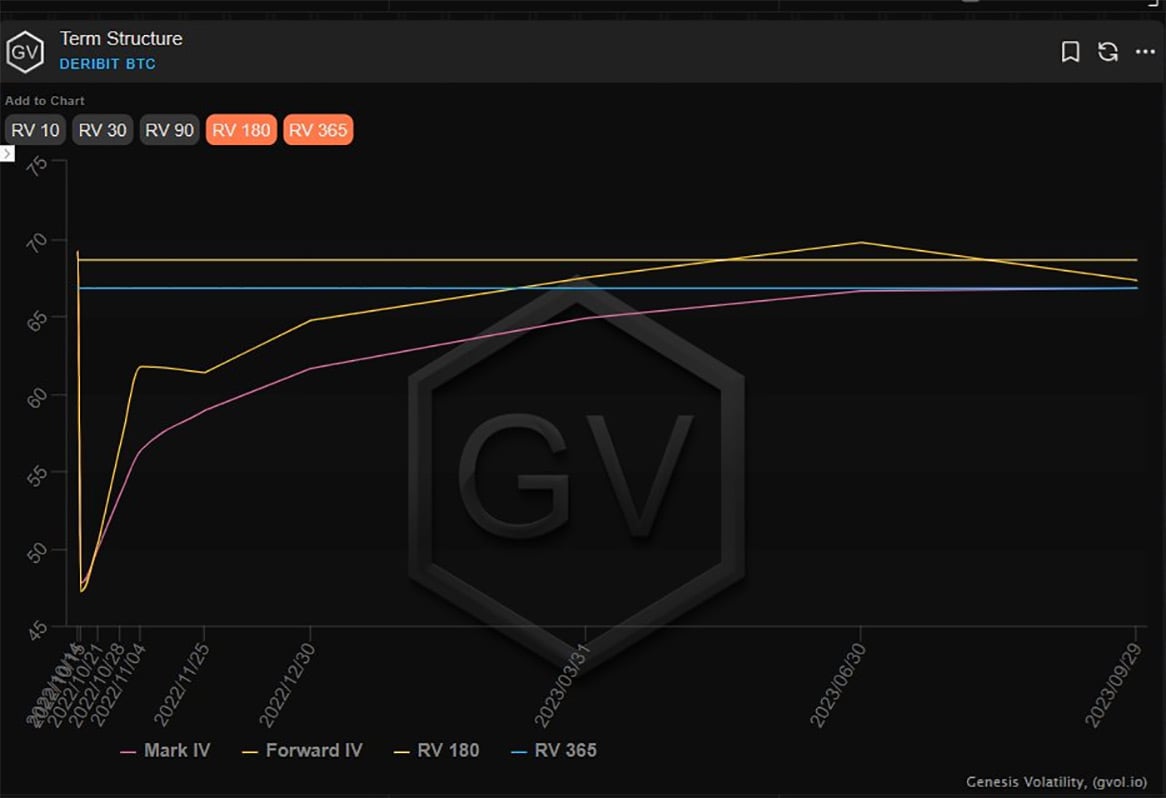

4) Longer-dated sales are quite infrequent but have been accumulating over the last couple weeks, starting in Jun ATM straddles+Mar near-ATM Strangles ie pure IV plays.

Cf 180d+365d RV these are now inline, but perhaps this is some admission of high-beta macro where IV is lower.

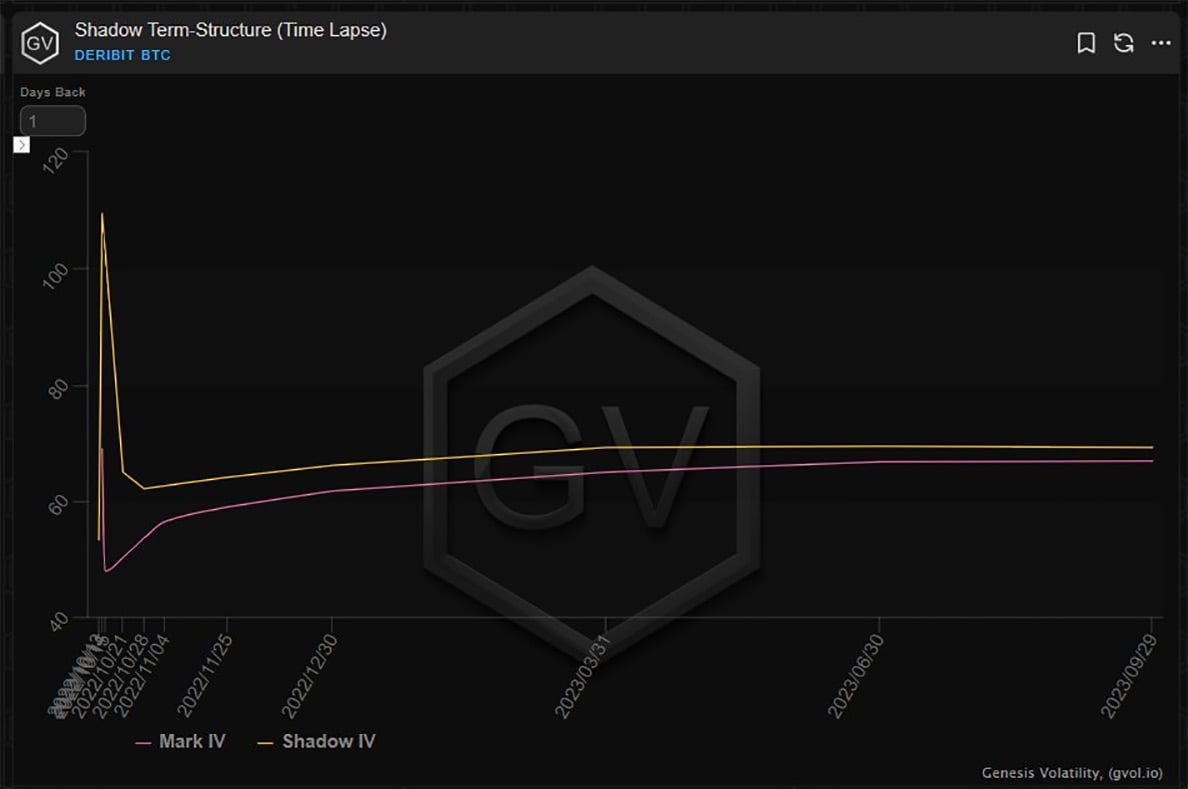

5) Post yesterday’s IV obliteration, IV still trades at a premium to RV (1m chart below), but differential has narrowed.

In the last 24hrs Spot on BTC+ETH has fluctuated 10%, yet IV prices 1m at 3% future moves.

1w IV is now 50%.

The impact of pre+post events are opportunistic.

View Twitter thread.

AUTHOR(S)