In this week’s edition of Option Flows, Tony Stewart is commenting on Powell’s hawkish words at FOMC meeting wich incl. a 75bp raise.

November 3

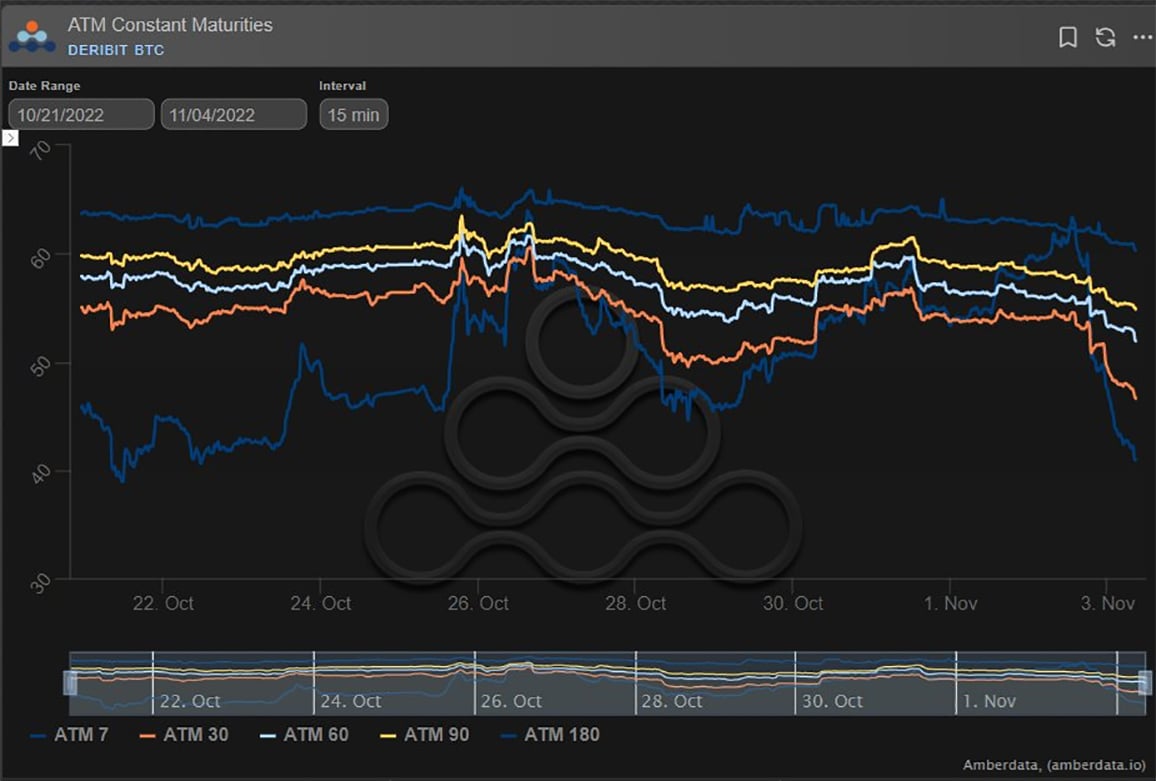

With FOMC 75bp expectations clear this month, IV only squeezed in the <1week tenors tied to Gamma surrounding Powell’s conference comments.

That didn’t stop IV from being crushed post-event.

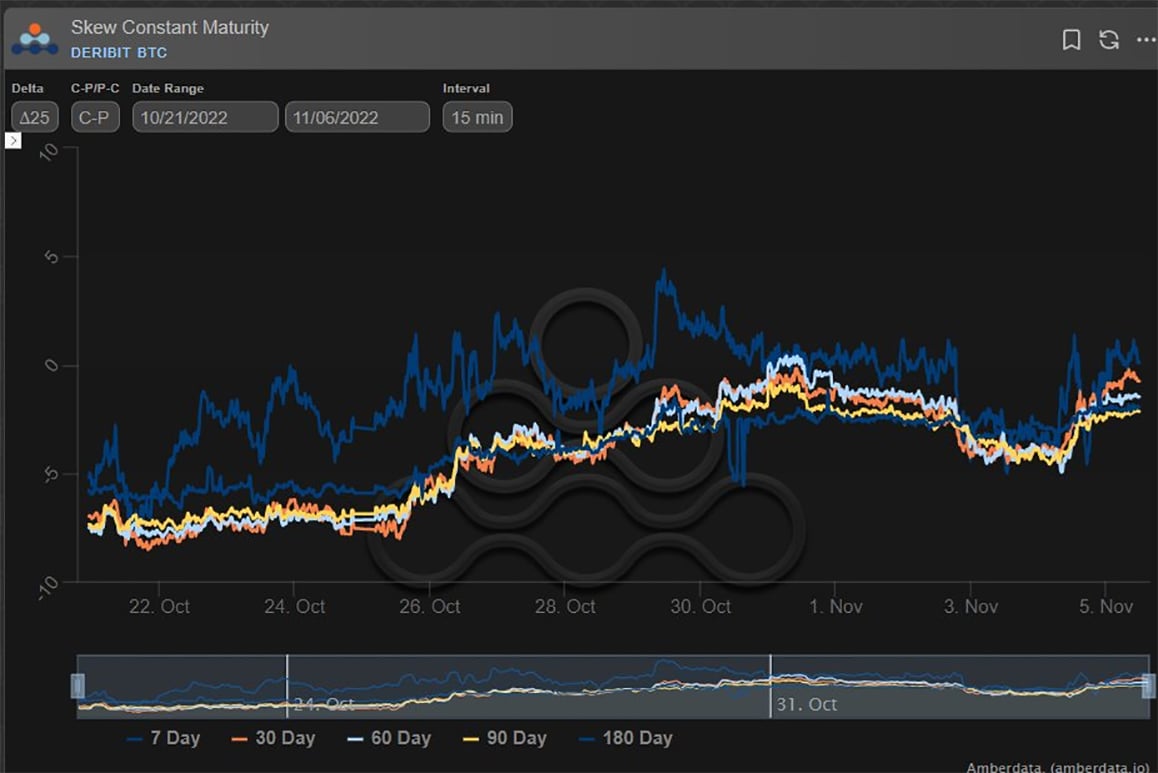

And with Powell’s hawkish words, Spot fell, Calls purged, Bear Collars Puts+ bought.

2) BTC 20k straddles sold aggressively first x750, then as the market interpreted Powell’s comments biased hawkish, Dec 24+25k Calls sold on DSOB were amongst the more aggressive hitting bids x500+.

Those that needed/played bear exposure bot Dec 18-24k Collar (bot Put) +similar.

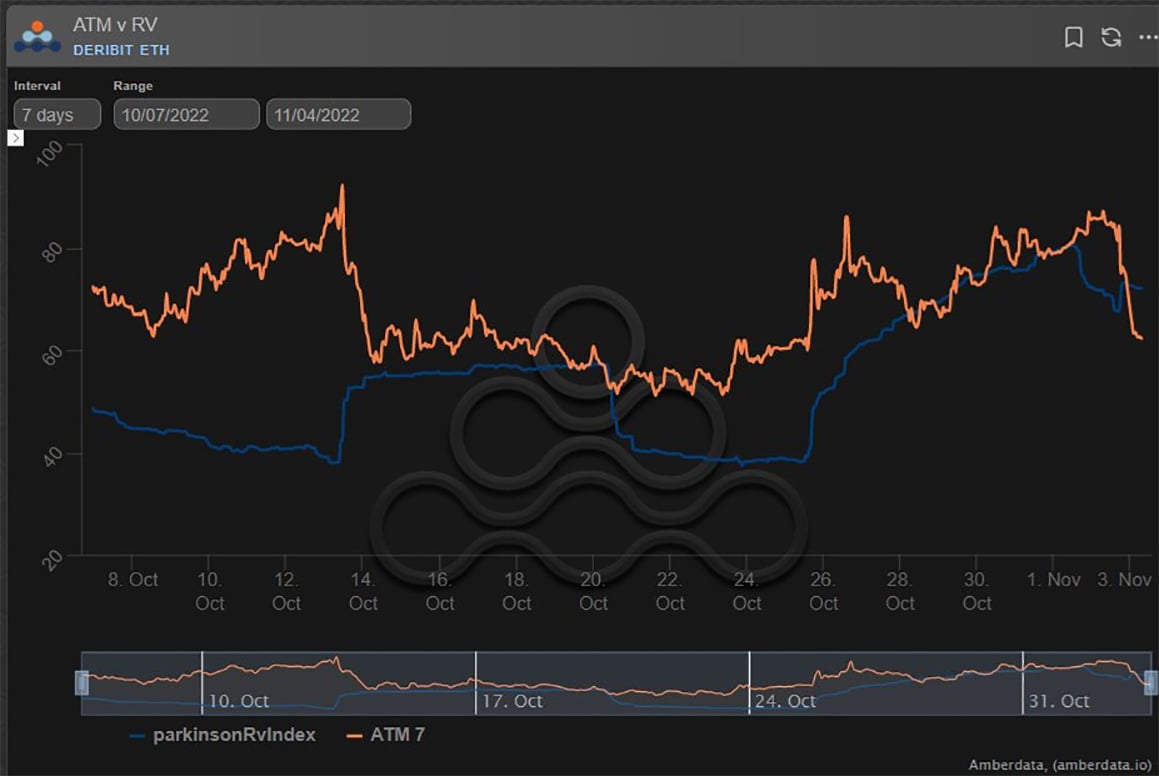

3) ETH followed a similar IV trace pattern.

ETH gap 20% DVol IV > BTC, due to ETH realized vol performing better.

Whereas BTC IV still trades at a premium (note diminishing at 5%) to realized, ETH IV now trades at a 10% discount, on the 7day comparables.

View Twitter thread.

November 5

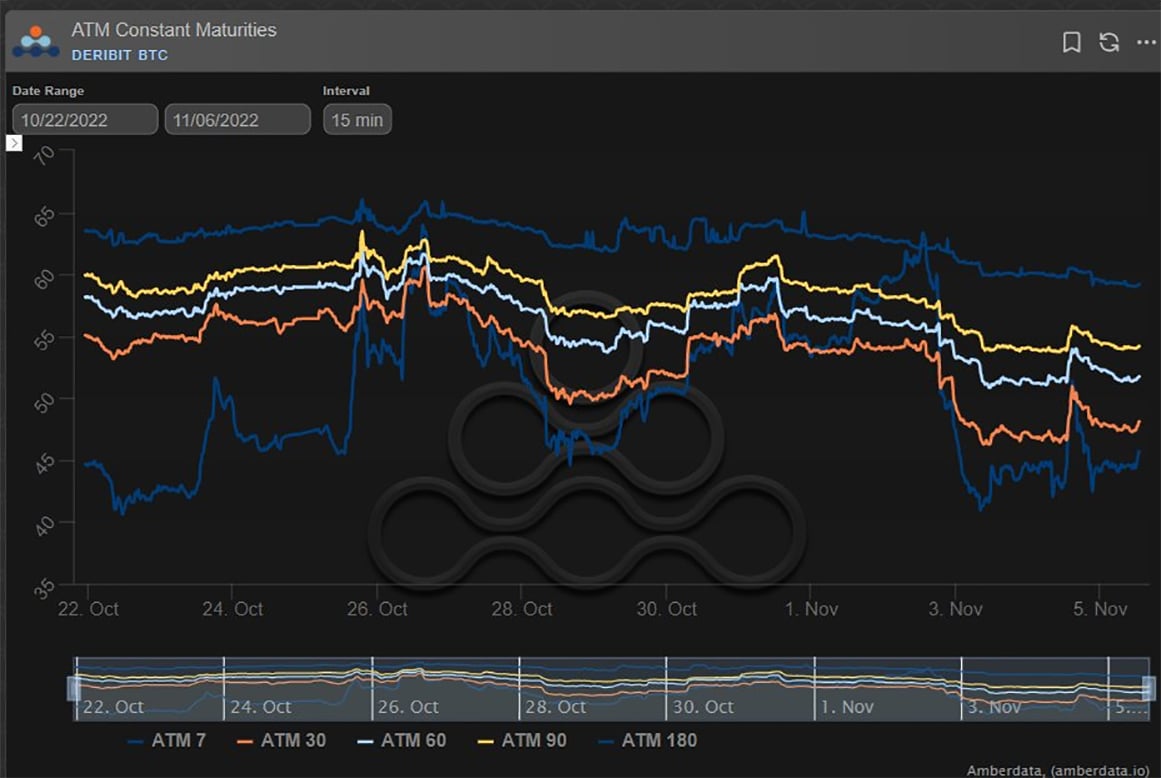

With IV pummelled post-FED and ahead of DOVs+wknd, there was complacency prior to NFP.

IV post-expiry held (a rare occurrence), even firmed, with DSOB buyers of ~1k Dec 17-20k Puts, and <1week Options (Puts+Calls) ahead of NFP.

A relatively benign Print rallied Risk assets.

2) With BTC breaking 21k, ETH >1.6k, IV stayed bid, with buyers of Calls (BTC Dec 24k+ upside on DSOB, Nov 22-23k) cumulatively 1k+; not overwhelming volume.

It wasn’t until US equities started to pull back and Crypto followed <21k, that IV suffered some retrace.

IV unch on day.

3) WIth 21.4k being a decent Fib level resistance, there is some thoughts that an upside breakout could firm IV, a retrace back <21k into the recent ranges would keep on the IV pressure.

Call Skew still steadily rising, approaching flat.

Sentiment is certainly more optimistic.

View Twitter thread.

AUTHOR(S)