In this week’s edition of Option Flows, Tony Stewart is commenting on ETH and BTC retracement from ATH.

November 6

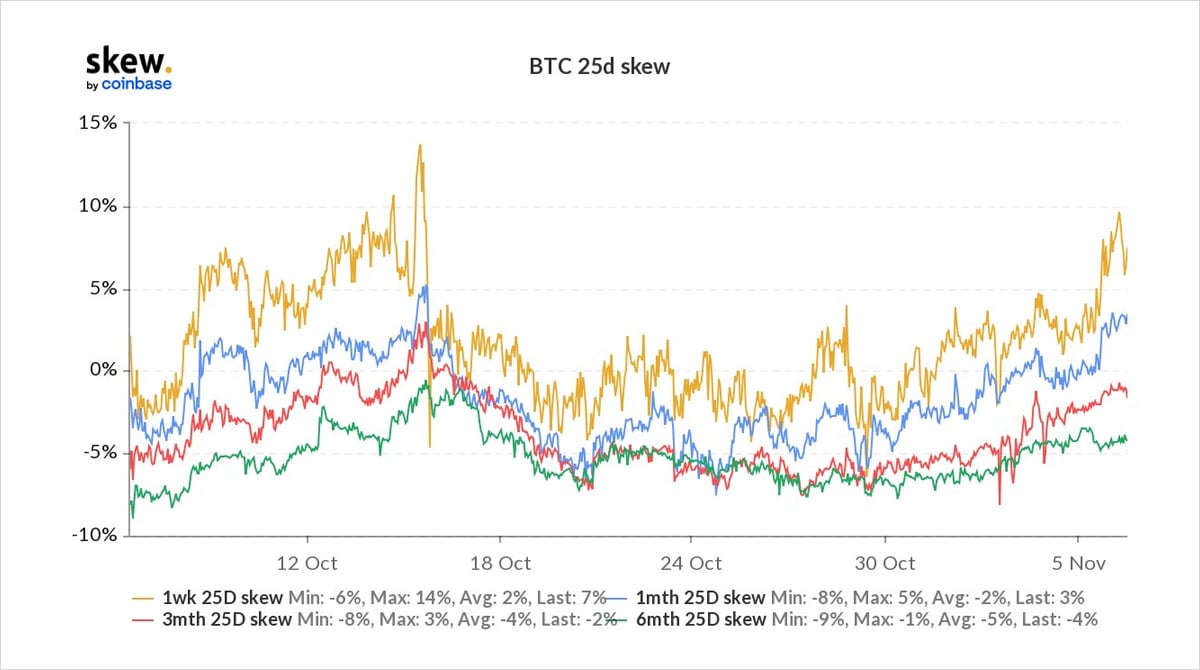

As BTC + ETH retrace from ATHs, a change in flow emerged, with BTC risk-reversals in Nov+Jan, initiator buying 50-60k Puts funded by Calls; in ETH opportunistic sales of high Vol Calls.

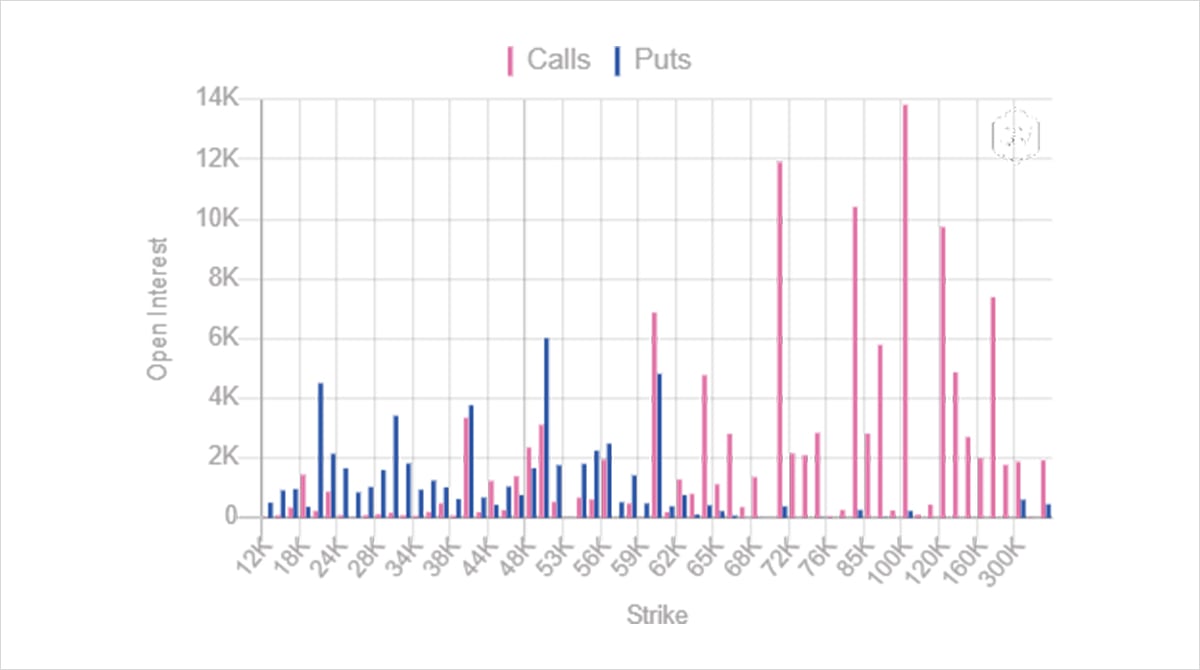

Option OI is still dominated by bullish bias, but RV and spot drift challenging voracity.

2) BTC Nov26 56k+58k/68k and Jan 50k/100k Risk-reversals bought for the Puts, outweighed a buyer of Nov19 60-66k Call spreads as BTC sold off <62k post expiry. Both trades led to an increase in near-dated Skew, Put>Calls, but remain in a comfortable range.

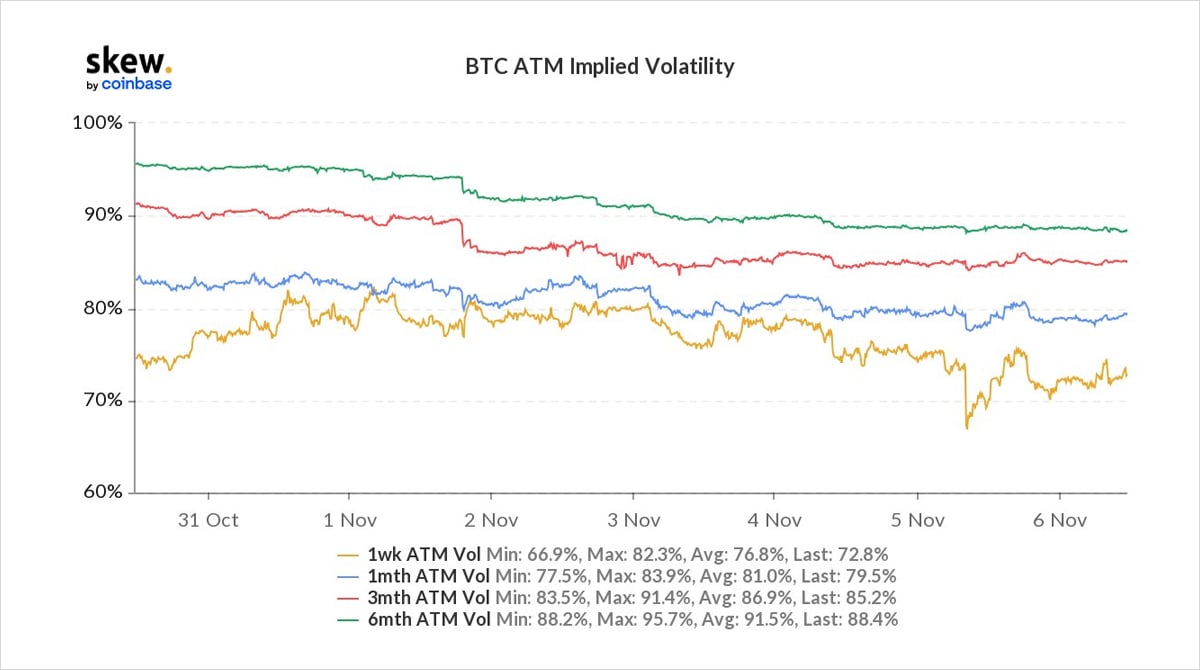

3) BTC Implied Vol has been softening all week with Long Option plays suffering from theta in a relatively tight range.

Indeed 10d RV is 50%, 1month is 60%, a 20% discount to Implied Vol.

Generally, IV tends to trade > RV, but the degree here is likely connected to 60k proximity.

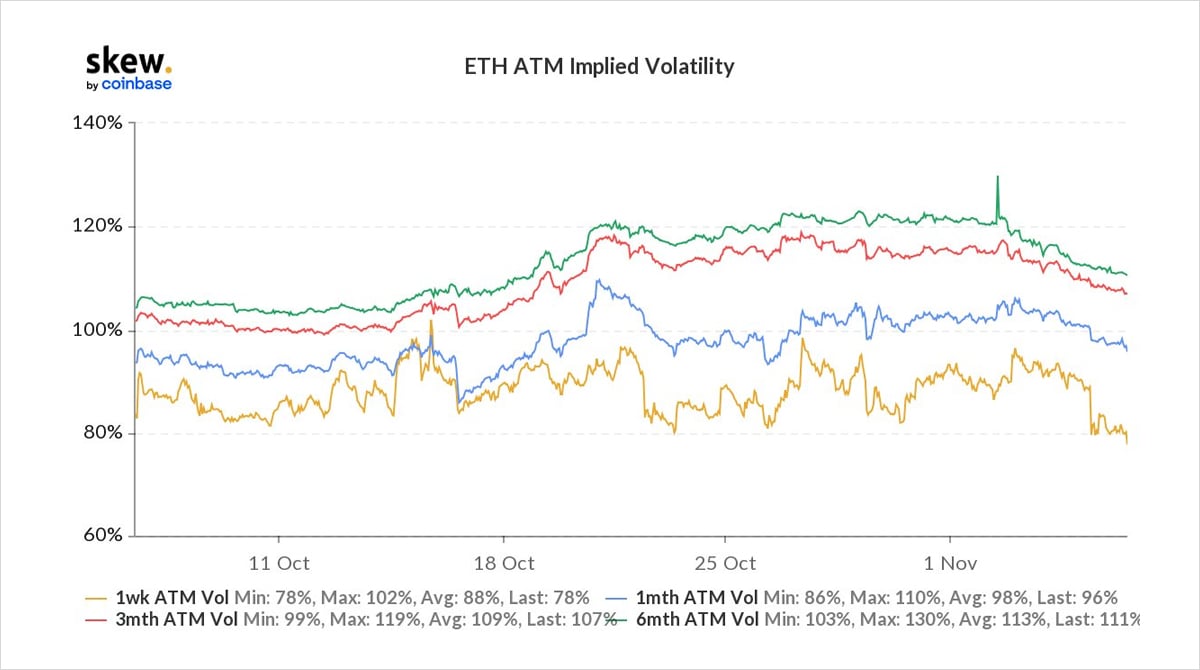

4) Of note also is the ETH/BTC Implied Vol differential at >20% on all time frames.

This elevated reading has offered opportunities to short ETH IV and long BTC IV when compared to current 1month RV at ~5%.

A simpler and observed trade has been to sell high IV exuberant Calls.

5) The trades executed this week have been less retail, more Fund driven and have wisely avoided materially buying elevated IV (cf RV) by choosing spreads + risk-reversals or by shorting IV when selling ETH upside.

Buying IV in low RV environments mean you have to be very right.

View Twitter thread.

AUTHOR(S)