In this week’s edition of Option Flows, Tony Stewart is commenting on the volatility on the markets caused by Alameda and FTX.

November 9

Initially, Vol mkts focussed on Alameda+FTX tokens held/collateral, not insolvency.

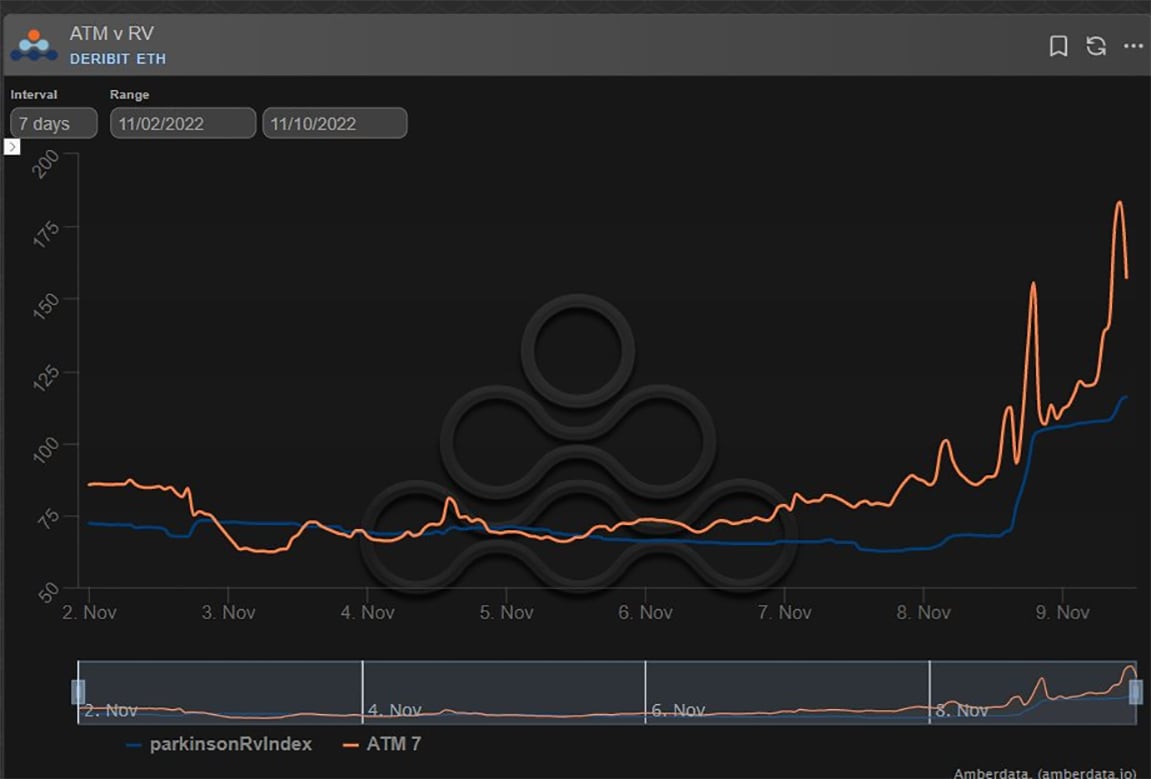

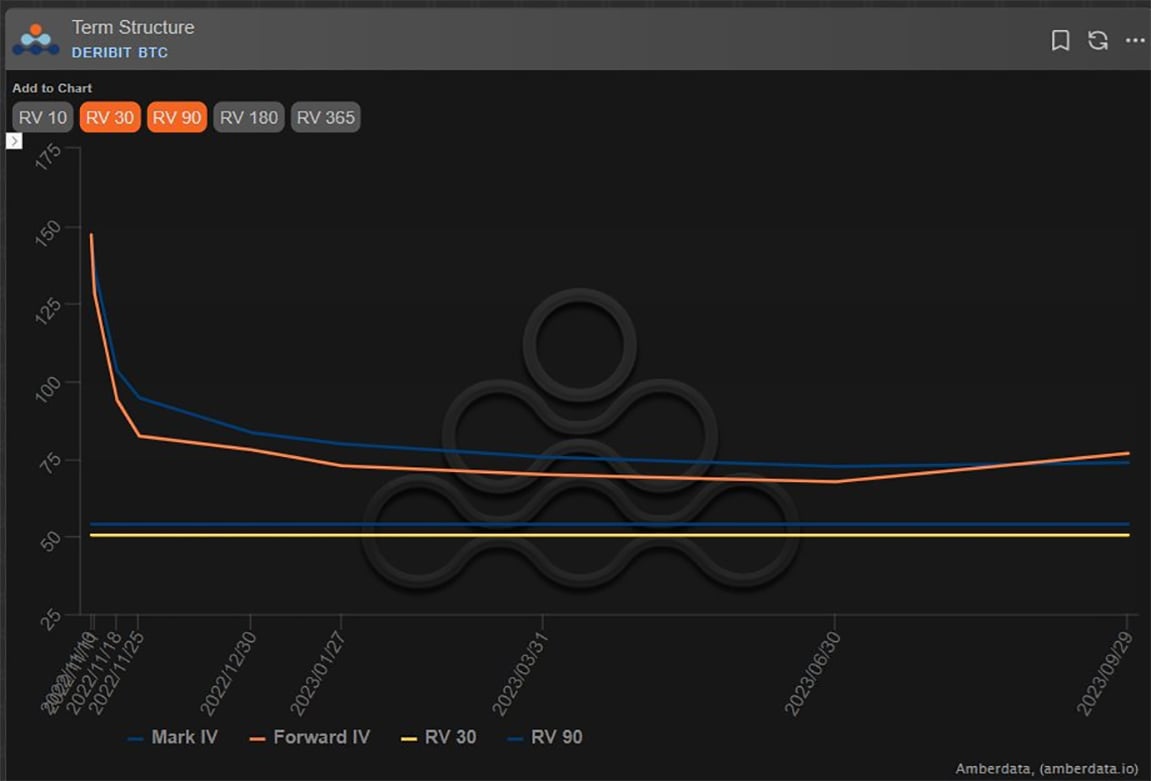

IV elevated, but RV dependent:

SOL x2 IV to 140%, ETH +10%, BTC just a few %.

High probability insolvency would have surged IV.

Plenty of opportunity to hedge/play the downside.

Forced later.

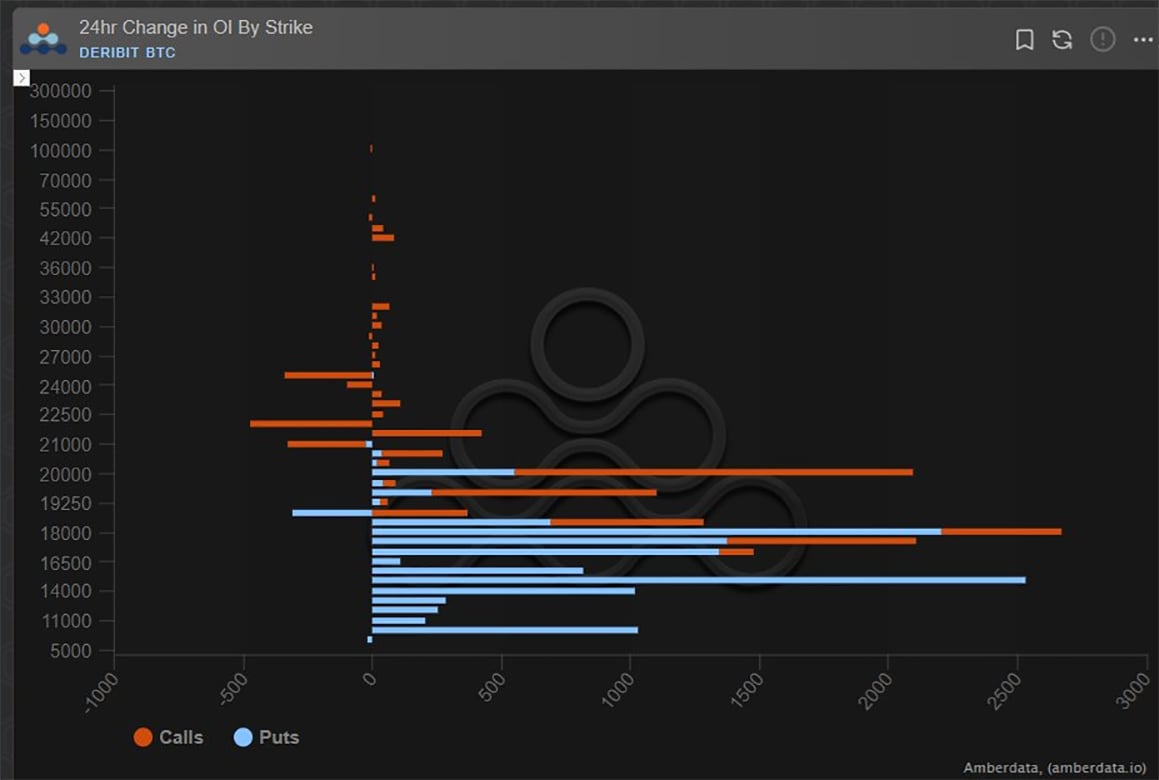

2) As rumors swirled and downward pressure on FTT compelled FTX to make announcements on its position, Option flows were still 2-way with Puts & Collars bought and sold.

With the uncertainty, IV firmed, with block buyers of BTC Nov18k Puts, offset by DSOB sales of Dec15-16k Puts.

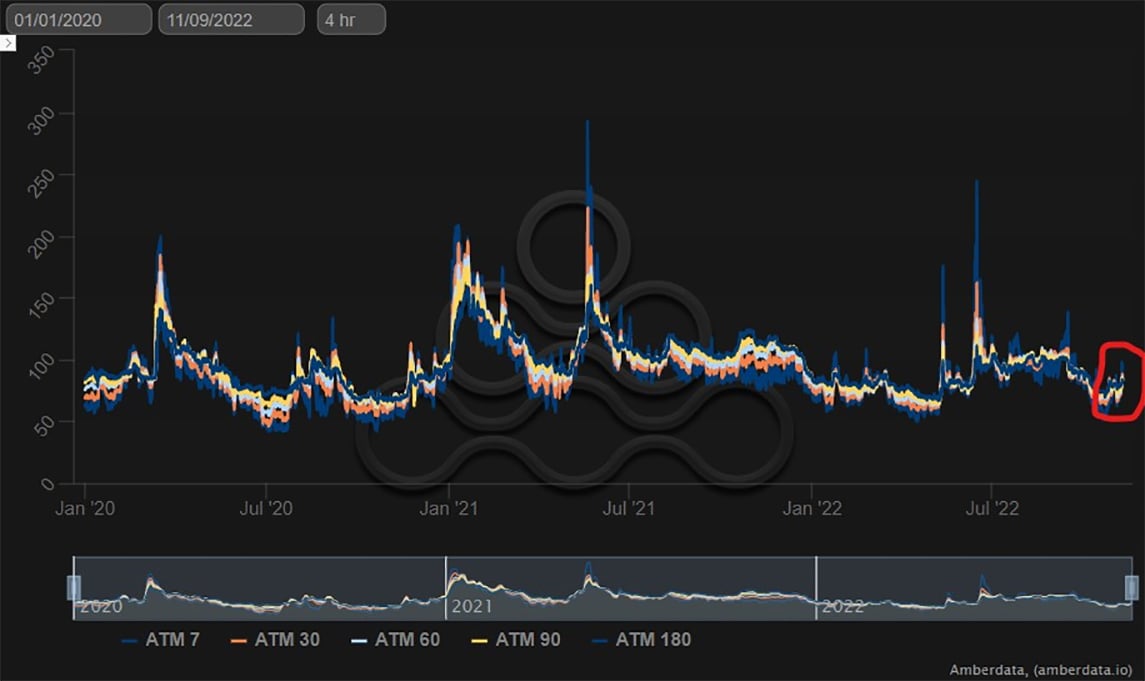

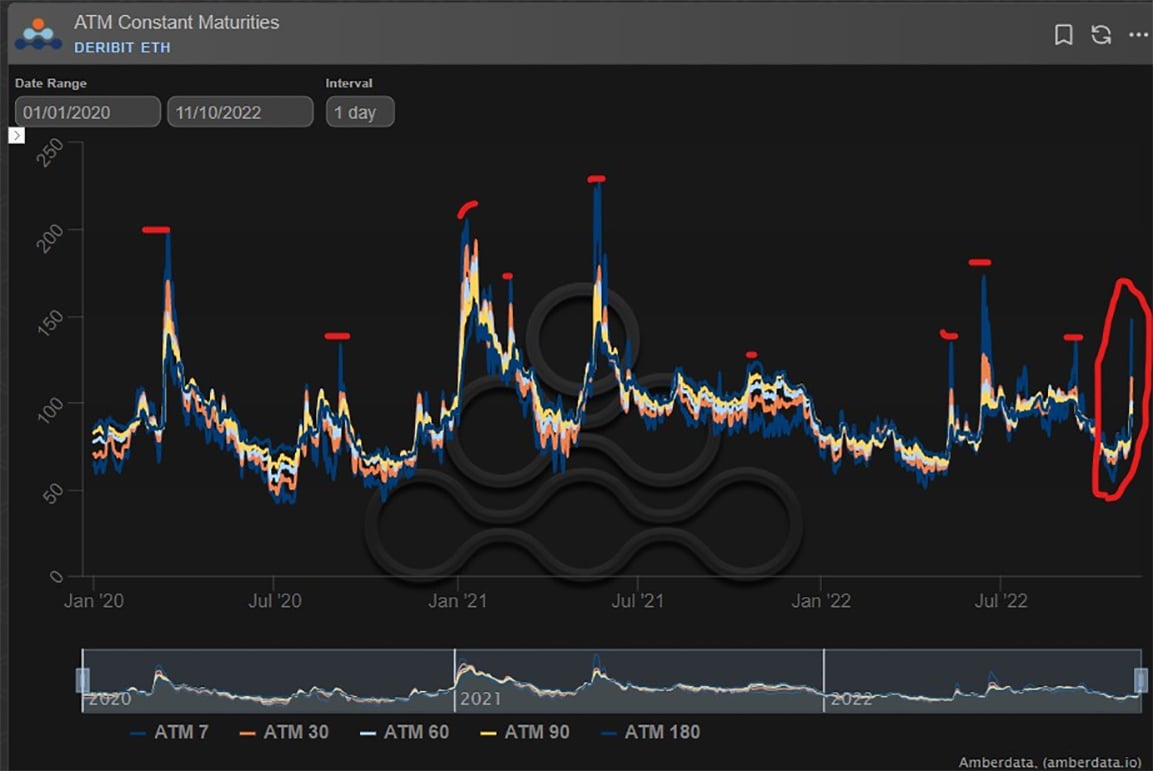

3) The above chart shows ETH vol since 1/1/20 and how insignificant a blip and low probability the majority of market players were treating what was to come.

The market rallied hard on the Binance deal, and long Vol holders aggressively looked to exit.

This became a mistake.

4) Option flows then escalated fast as the market assessed the reality of the situation and DD process.

ETH 1k Puts bot 20k+

ETH Dec Collars bot (P+) ~10k

BTC Mar15k+Dec 17+18k + more Nov 18k P bot x2k+

BTC Nov 21k + Dec 23-25k Calls sold. ~1.5k

BTC Dec 15-10k Put spread bot 1k.

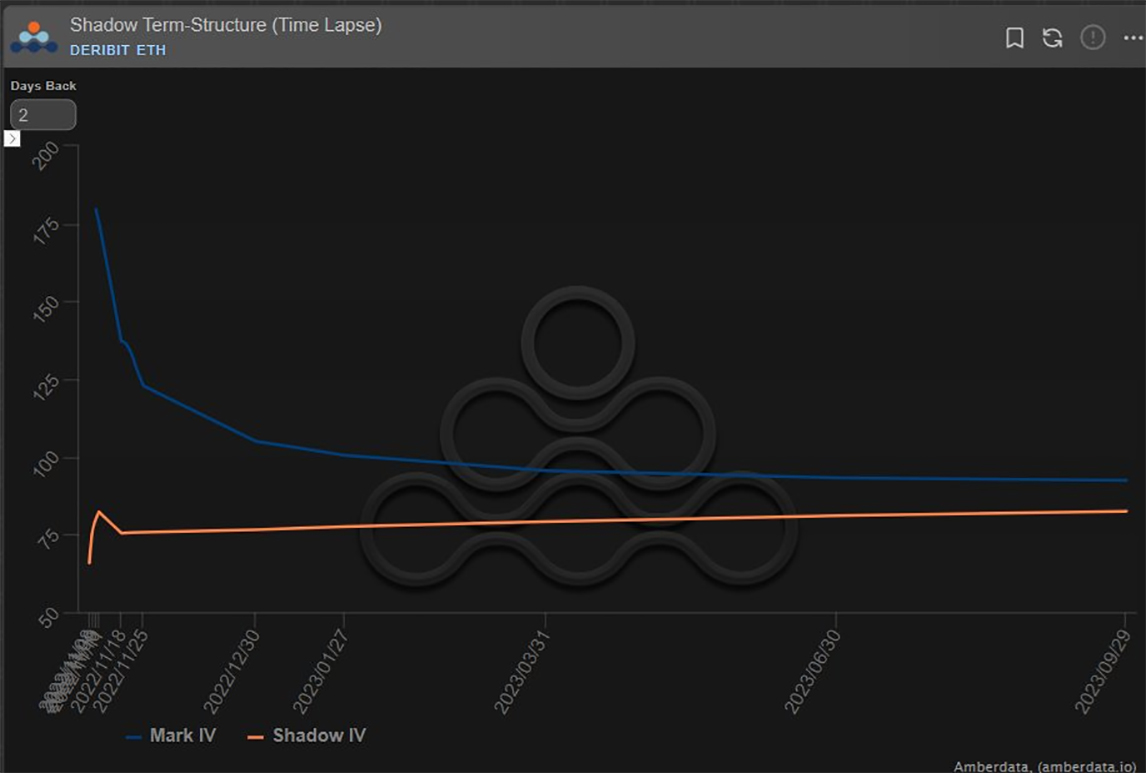

5) With the Put buying and Call selling, the Skew pumped from flat to +30% (25delta) near-dated.

There had been signs of Put Skew firming prior to the Binance deal, which was a tell that some Funds were hedging themselves just in case the worst outcome emerged, but not via IV.

6) As demand for Options quickly sucked the supply out of the market, Block pricing (for size) became less reliable than under normal markets and some Funds were forced onto the DSOB to execute necessary risk management.

DSOB Option engines flipped to bid higher to cover shorts.

7) Looking now at the Implied Vol chart over the last 2years, the event is now recognized appropriately.

But as there are now doubts surfacing over Binance’s interests, this is far from over.

8) Note, however, how brief these elevated Implied Vol periods can be. This is usually because a situation is resolved and the market rallies.

Should a resolution be forthcoming, previous behavior has taught us that upside IV could get hit hard after an initial large Spot move.

View Twitter thread.

November 11

Tough conditions.

Those hedged or that played for scenario, TPd on ITM Puts x2k near the lows, and as BTC 15k looked to hold, buyers of Calls (BTC Nov18+19k, Dec21+23k, Mar22k, Jun 24k x4k) +Call spreads.

US CPI was risk-on.

But FTX news saw 15k Puts bot, Nov+Mar Calls sold.

2) At this point the market is in shock.

Option flows in these times can be read as they appear, but can also be forced rather than wanted.

Some DOVs have withheld auctions this week.

MMs are seen to be less aggressive and low risk.

But DSOB is orderly.

Risk pricing softened.

3) Skew, a similar picture:

Off extremes, but very high illustrating fear of the unknown on the downside. Should a favorable resolution present itself, this will likely flip.

The Call buying off the lows, took advantage of low Call Skew.

ITM Put sales, +15k Put buys = firm Skew.

4) Stay Safe. Risk Management is critical.

View Twitter thread.

AUTHOR(S)