In this week’s edition of Option Flows, Tony Stewart is commenting on the massive cascading spot+futures liquidations.

December 8

Massive cascading spot+futures liquidations at the weekend, coincided with only minor options closures.

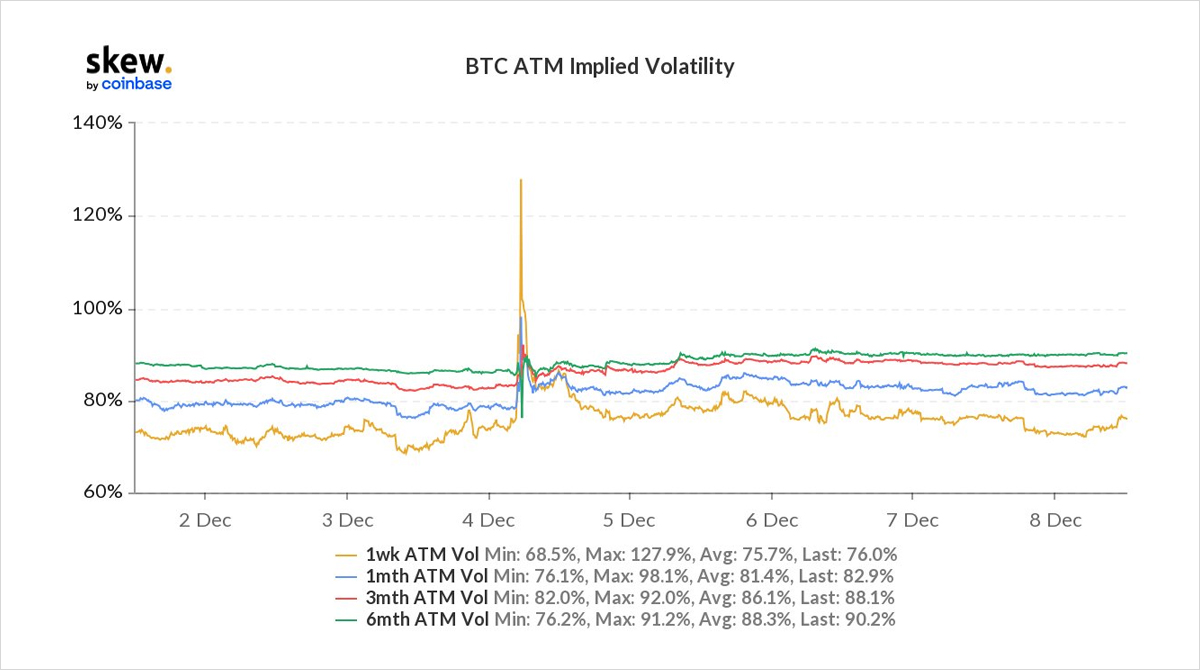

Subsequent reaction in IV supports view that many large players had used derivs and Options as a prophylactic measure.

Short deltas perhaps covered.

Options flows unsettled.

2) After the first IV spike and retrace, we would normally expect to see IV initially bid as risk management prioritizes and optionality is often at a premium to express views.

IV has held firm at best.

No material Option liquidations, no material Opening Option bets as of yet.

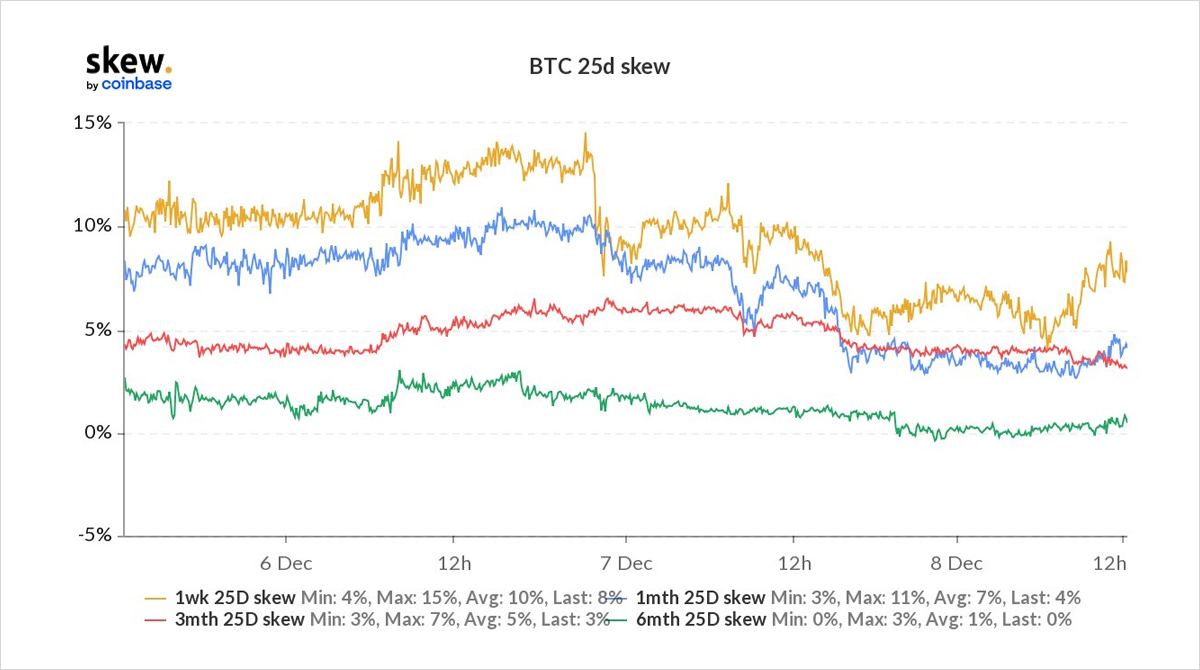

3) While funding and large CT influencers evidenced positivity, Option Flow+Skew less convincing.

Call buyers EoY Dec 60-65k strikes x1k, and a seller of short-dated 49k Puts, offset by Put buyers of wide zero cost Risk-Reversals in Dec+Mar.

Note pre-existing hedges not-unwound.

View Twitter thread.

AUTHOR(S)