In this week’s edition of Option Flows, Tony Stewart is commenting on how the Crypto Market has reacted to the latest macro development, and how traders approached.

Marts 13

Pre-EU+US Open Option dynamic overview:

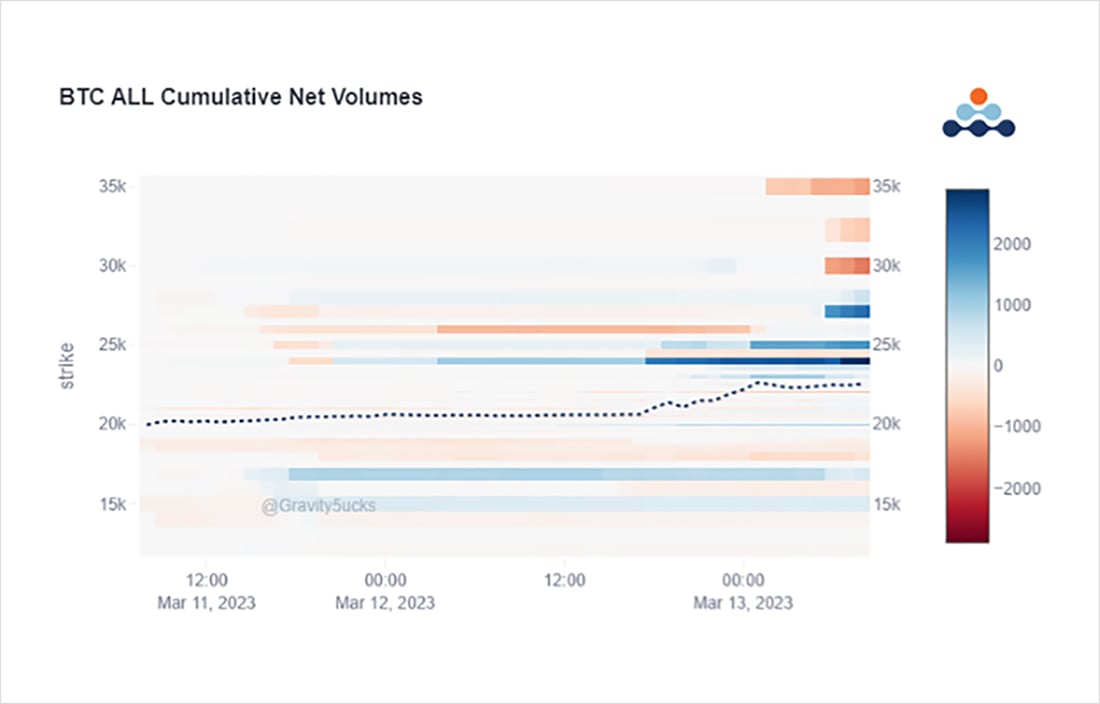

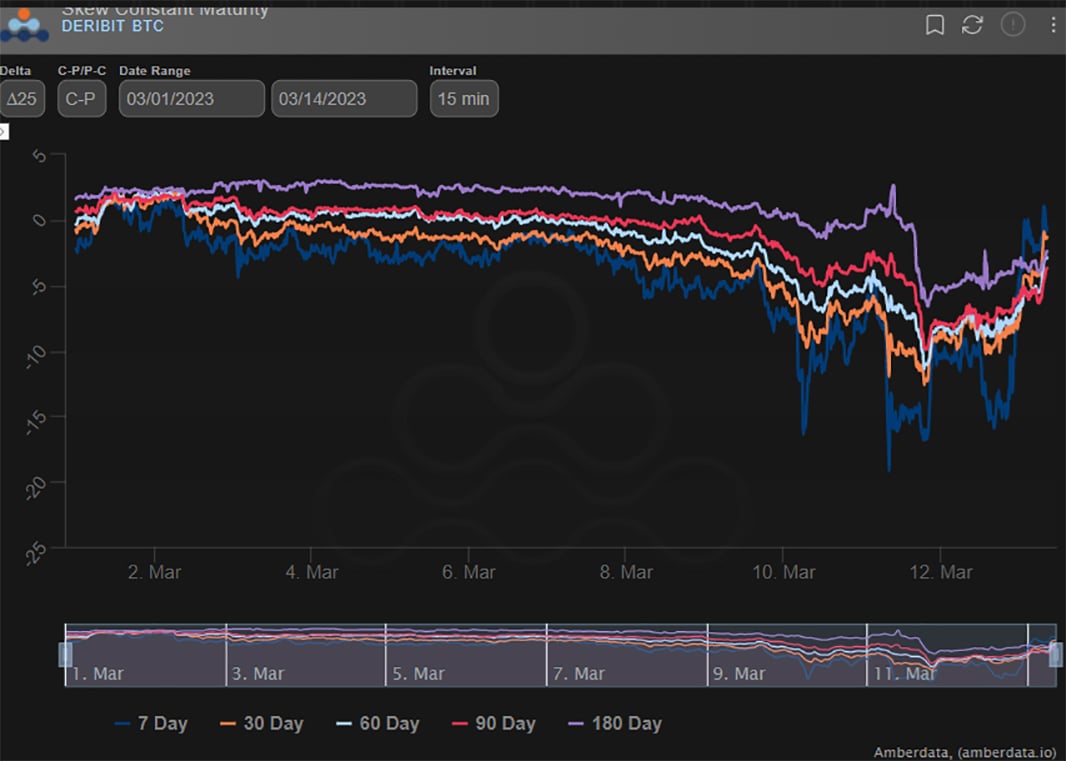

Deep fear+uncertainty late last week with Funds Hedging downside – Puts, Put spreads, Put Fly bot.

Put Skew pumped.

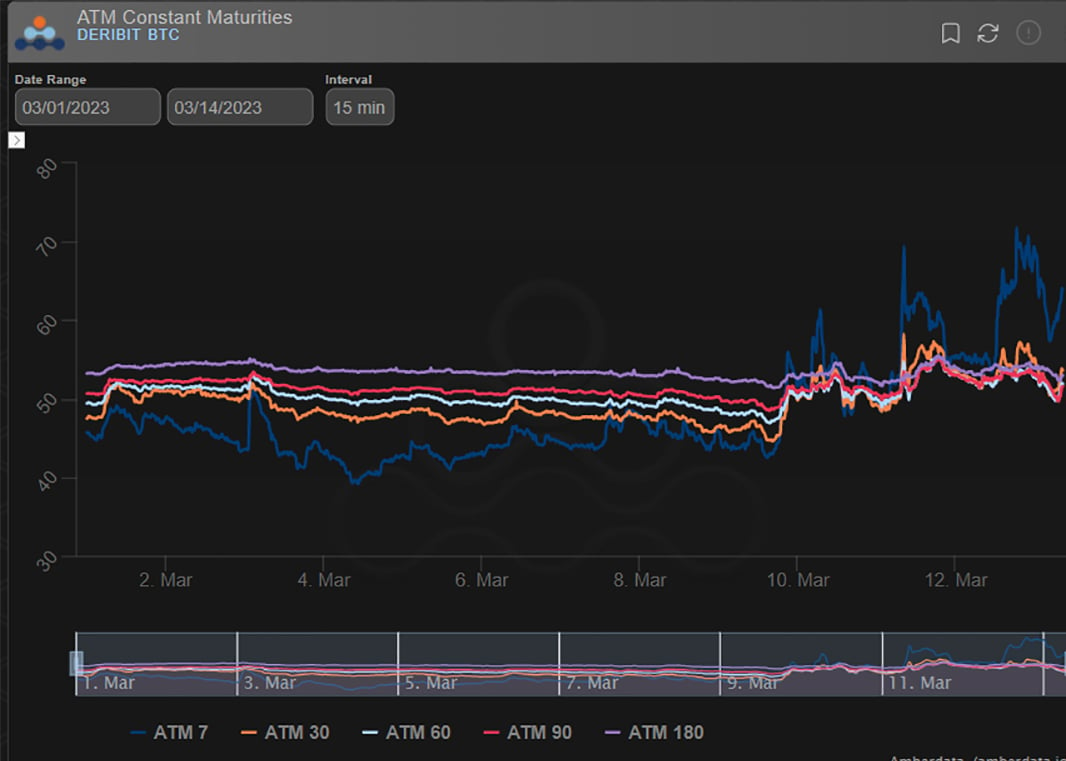

IV contained but squeezed Sat+Sun.

FED injected confidence.

Call buyers – Mar25k+Apr24+25k.

Skew flip.

2) Over the last 48hours, on the expectation and confirmation of solutions, we have observed large upside buying:

Mar 24+25k, +Apr 24+25k Calls bot x6k

Apr 27-30/32k Call spreads bot 2k.

Strangle+Straddle sellers from last week dormant.

3) The adjustment from downside Put fear to Call euphoria/FOMC has flipped Skew from heavily Put biased to back close to flat.

4)

IV understandable increased, with wild gyrations at the front as weekend Theta dynamics wrestled with reduced liquidity and uncertainty.

The question is now how markets react to larger implications of the FED backstop, banking arrangements.

Do we continue to see volatility?

View Twitter thread.

AUTHOR(S)