In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

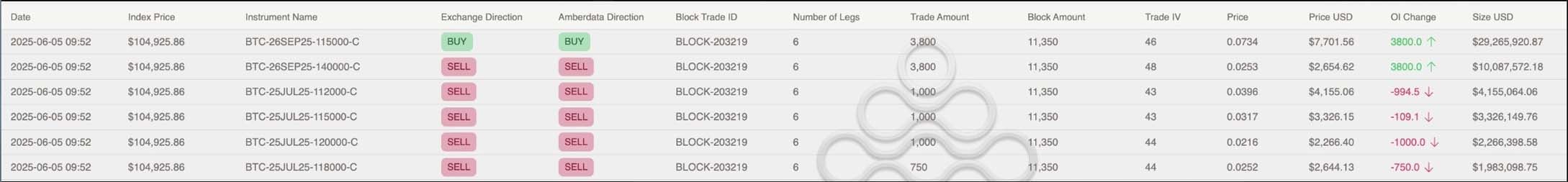

$1.2b notional block dominated options flow.

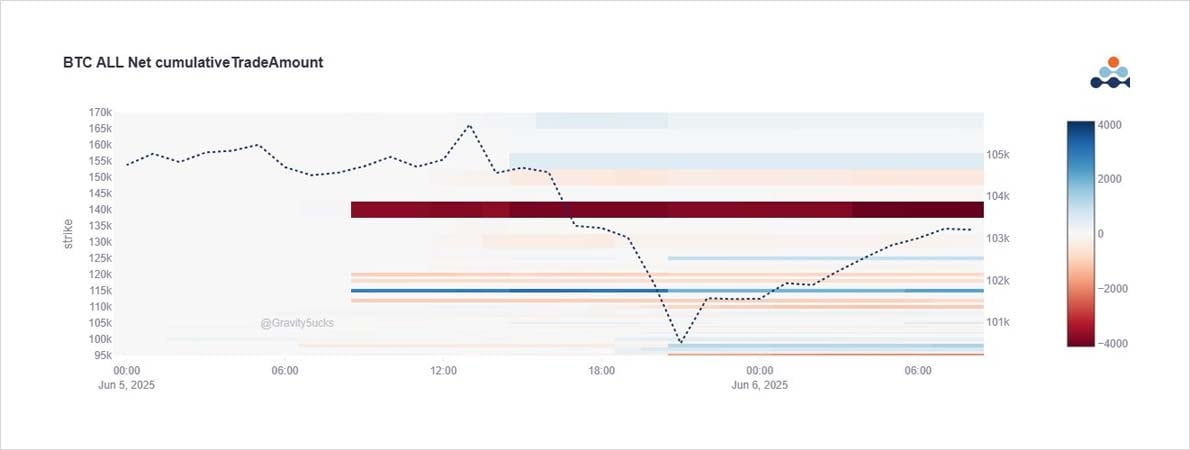

Composed of a strip sale of Jul 112-120k Calls to fund a Sep 115-140k Call Spread; delta was small, but prefers a quiet summer and then surge.

The MM absorbed a chunk of Gamma+Theta, needing an imminent move in a quiet market.

Elon.

2) Jul 112+115+118+120k Calls sold, generating $11m premium, helping fund a Sep 115-140k Call spread $18.5m cost. Net outlay $7.5m spent.

Sidelined were sales of Jun20 115-120k and Jun27 120-125k Call spreads, an ongoing delicate buyer of Dec 170k Calls, and Jun <100k Put 2-way.

3) Normally, we would expect this rotation to come from the selling of existing Jul longs, rolling out to a further dated upside Call/strategy.

But looking at the OI (h/t @Gravity5ucks @Amberdataio) most r fresh.

Thus, if isolated, the trade prefers a grind-up summer, then rip.

4) The counterparty MM took this trade competitively and took the risk of $150k Calendar Theta a day, offset by Gamma, and $225k of Calendar Vega.

In a quiet market and before the weekend, this looked risky. The MM needed an imminent BTC move and consequent catalyzed Vol buyers.

5) Then Elon and Trump started a spat.

BTC dumped from 106k to 100k support, while IV was priced at a 2% move.

A large TWAP in European hours this am, has propelled BTC back to 104k

Good Gamma, if scalped even modestly.

6) But the MM was not fully rescued.

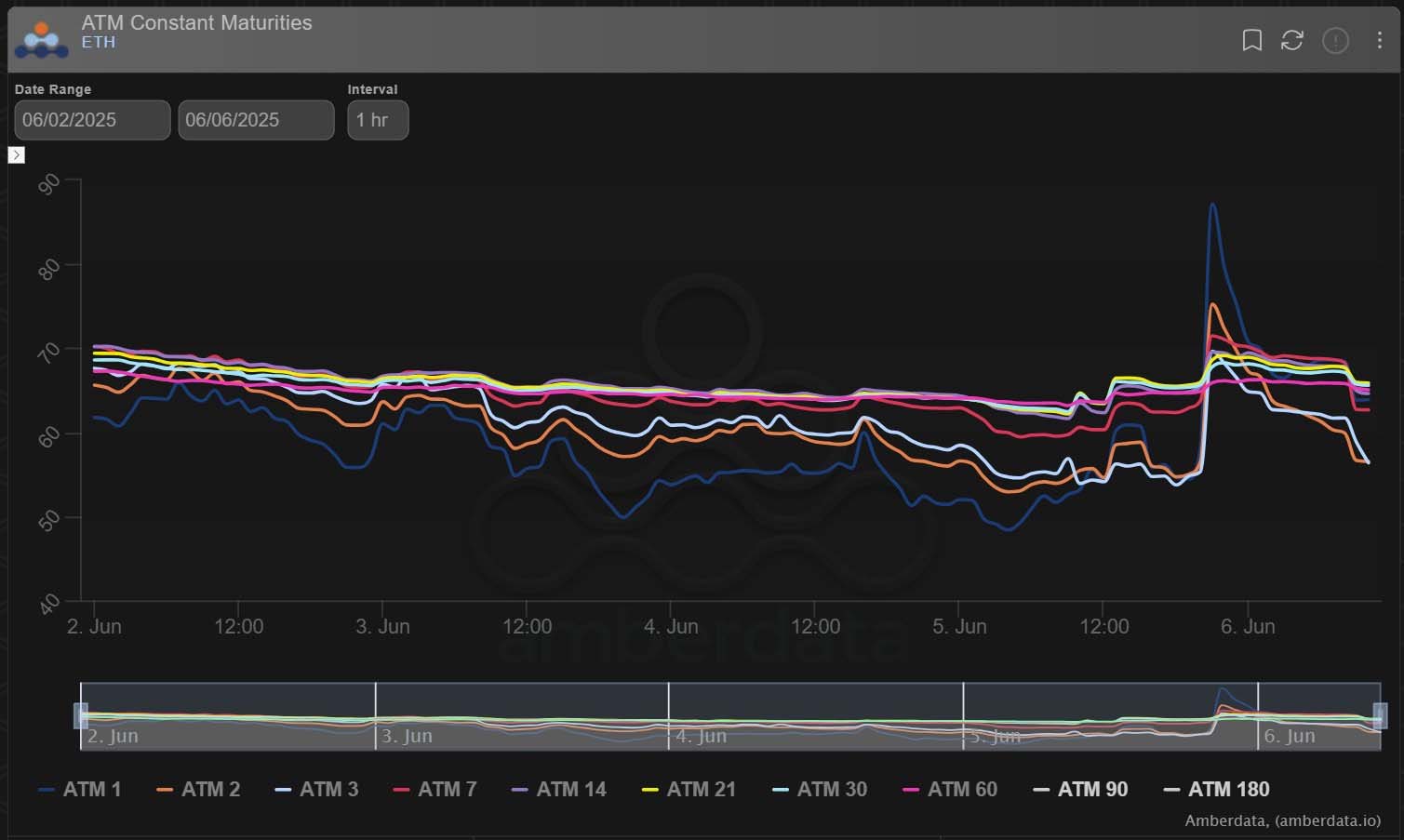

Much of the Gamma reaction was in the front 10day maturities – see the reaction far right.

The MM was long Jul Gamma (see top Pink line), which barely budged.

Good Gamma; not the IV reaction the MM would have hoped for.

NFP firmness prevails.

7) The MM could have sold out some Jun Gamma v their Jul as one option.

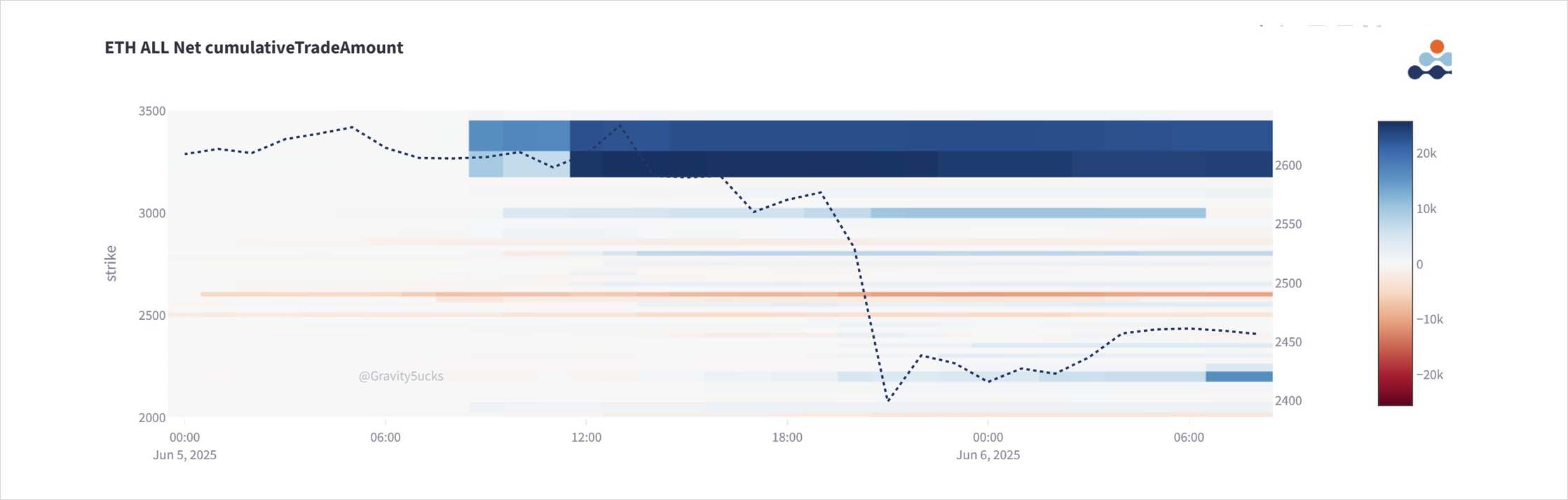

Or with BTC IV on its lows and at a 28% discount to ETH Dvol, some might think that selling ETH Gamma could be an option.

That play hasn’t been an easy one to manage recently with ETH experiencing volatility.

8) But if the MM was compelled to go down that route, there were certainly opportunities yesterday with large ETH Jun Call buyers – 50k of Jun27 2.8,3.2,3.4k Strikes, early in the day (Spot 2600+), elevating the front end of the ETH term structure.

9) ETH IV reaction by comparison:

Whereas the BTC trade was blocked, the ETH Jun Calls were bought on the DSOB.

Both BTC and ETH have retraced their Gamma shock moves, and await Elon-DJT day2, after NFP is dispensed with.

View X thread.

AUTHOR(S)