It’s that time of the year again, the time when the annoying kid on campus plasters his face all over campus asking for your vote. You read the list of promises on the campaign flyer and wonder why anyone bothers going for these student government positions (I know because I was once that kid on campus). The game is stacked against any form of governance working:

- No one really cares about the decisions made, except a handful of people

- The real power is held by the few — the teachers and administrators

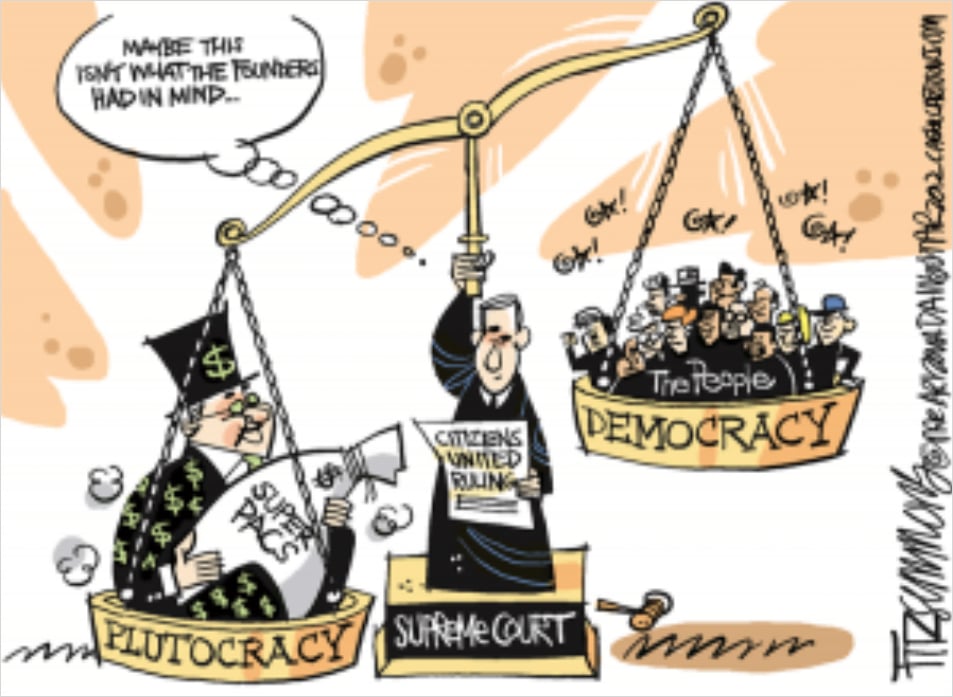

Much like school governments in high school, DeFi governance is mostly treated as a ruse to convince participants that the process is democratic (coined by Tina He). In reality, a lot of the decision making is generally made at the top and at the expense of end users. A system that forces the aristocrats to be ‘angels’ is generally not one where there is long term viability of decentralized governance.

*Disclaimer: I’ll be using real-life examples of governance in crypto and while critical or praiseworthy, my views on the governance process does NOT have any bearing on the rest of my outlook for a project or protocol. This is only meant to be a helpful guide on historical examples and how to remedy the issues that arise from DeFi governance.

Decisions, decisions..

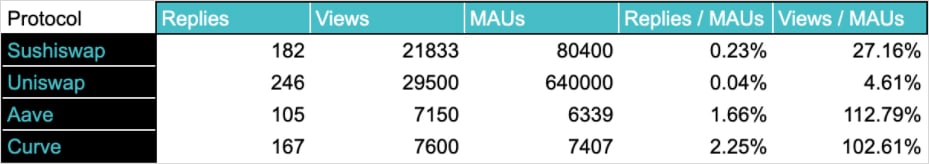

Staring outside at the election campaign speeches, you realize that most people really just can’t be bothered with what’s going on around the campus. A plethora of town halls held for causes you just don’t really care about or don’t have the bandwidth to attend. In its simplest form, crypto suffers from the same problems as the rest of the world and primarily from small (student) governments. The overwhelming majority of people simply just can’t be bothered and the data corroborates that:

Source: Forum pages, duneanalytics.com

The most glaring problem with current protocol governance is the benefit to the end voter, why should they spend their time voting? In general, most people have some incentive to participate in governance

whether it stems from an economic or moral guideline. In the same way, protocols that want to achieve better governance results should start to think of active ways to incentivize good governance. Simple solutions include using small amounts of the token treasury to incentivize dedicated members of a protocol to vote on key matters and contribute in finding meaningful ways to understand new proposals.

One of the primary issues regarding protocol resolutions comes from the poor execution of mass proposals. The benefit of anyone participating in governance is that they may all propose changes to the core protocol’s functionality. The problem that arises from this is the mixed bag of nonsensical and interesting proposals that are clumped together in the endless barrage of governance proposals. In the end there are just too many proposals for most to care about them. Instead what may be beneficial is to have the incentivized members reach a type quorum for new proposals and to sift through the list of resolutions.

Finally, the issue of gas costs and smaller users. In general, token founders and DAOs should aim to minimize the barrier to entry of the smallest participants as much as possible and this includes gas transaction costs. At the base level, founders can subsidize the cost of gas fees for delegators that are below a certain threshold by using part of their token treasury to incentivize good governance.

The Oligarchy

Oligarchies and aristocratic forms of governance seem to be one of the most common natural forms of original government. The idea that the commoners should divest their voice to the elite and those that are knowledgeable is an attractive idea (to the monied) in any society but seldom yields better results for the majority. DeFi is no different, as Ric Burton has also mentioned.

Like any new sector, much of early DeFi has been bootstrapped by venture capitalists looking to bolster a new form of financial technology. But accompanying the growth and development of DeFi have been some structural issues regarding the real decentralization of protocols, mostly stemming from their inability to have coherent governance that doesn’t end up operating like a cartel.

In DeFi, governance is usually done in a voting manner where proposals must reach a certain threshold of votes in order to pass.These votes are generally assigned by token ownership. The more tokens an entity holds, the more votes it has and thus a stronger means to sway. On paper, this seems like standard democracy. But this simple mechanism contains the seeds of DeFi governance’s malaise.

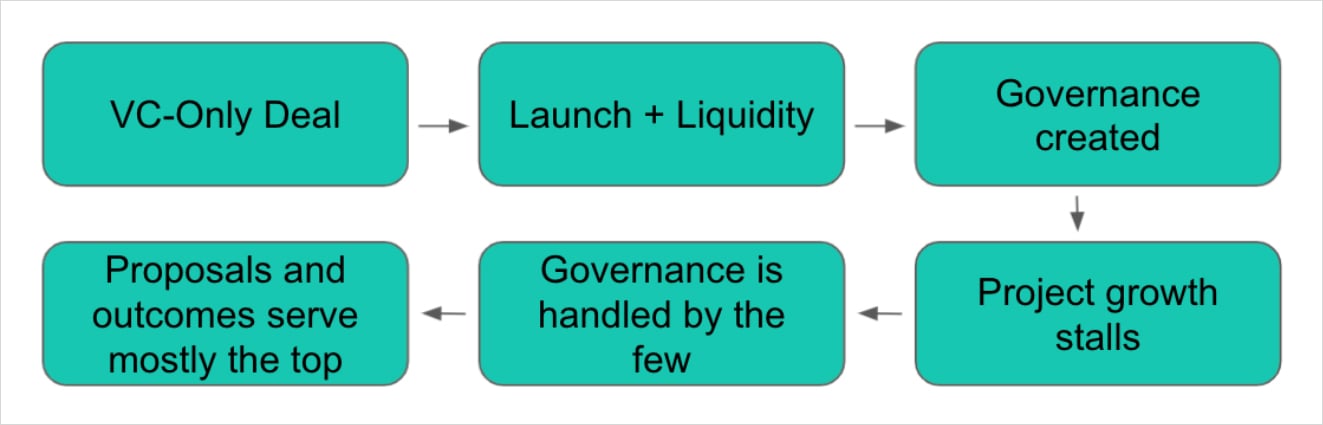

The flow of tokens and development is as follows:

Now this isn’t applicable to all tokens (‘fair’ launches, airdrops etc) but generally the tokens move to the hands with the most resources. The problem is that this process generally stifles the smallest users, even if they may find the protocol or project the most useful.

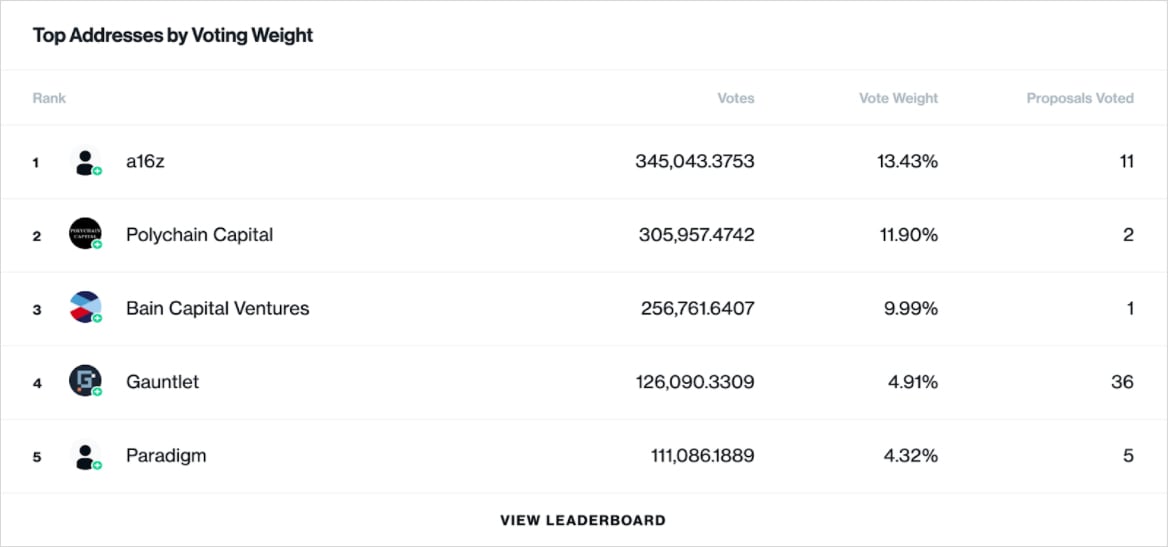

A simple solution to this problem is something that Compound has created with their vote delegation to governance politicians. The idea here is that the community can delegate their votes to certain politicians that will act on their behalf for governance purposes, and smaller users can pool their votes. The problem is that in today’s world, governance for Compound still very much reflects a very top heavy voter class where 4 of the largest 5 holders are venture capitalists.

The problem is that the measure still doesn’t actively make it easy enough for small protocol users to rally behind a few users and still results in a few users having a lot of voting power. Interestingly enough, in some governance structures, large holders of tokens still don’t participate in governance forums, rendering a large bloc of votes useless or easily swayed by other users in contentious proposals. In total, the process has alienated the majority of users at the expense of those on the “in”.

Proof of Devotion

Instead of focusing on the largest holders of tokens, protocols should seek what is known as Proof of Devotion but instead of being a consensus mechanism, the term should apply to governance weighting. Theoretically, governance should be structured in a way that both focuses on the primary users who are the most engaged in the community as well as the largest token holders. A simple mechanism for this may be that governance can be split past just token allocations and instead issued like multi-class stocks, whereby ownership and voting rights aren’t equally distributed. This process can be done in a way that caps both votership rights from diluting large inactive players as well as prioritizing a minimum on smaller voting blocs for new proposals. In addition to this, protocols can leverage their longest holders / stakers to receive more or less voting tokens / credits in order to incentivize long-term players to take the governance problem more seriously.

Conclusion

DeFi is still very much in its infancy and a fledgling part of our ecosystem that has ramped up to meet much of its demand and usage. Along the way, challenges such as governance and the people’s participation are to be expected and welcomed as a sign of significant growth. If the sector can take adequate steps to create a streamlined process towards proposals and changes, lower the barrier to entry for smaller participants, and incentivize the broader ecosystem to participate in its protocol’s governance, then we’re likely to see a completely transformative system of decentralized autonomous decision making.

AUTHOR(S)