U been up all night chugging Red Bulls and screaming at Rust for 6 days straight. Now it’s time to launch on Mainnet.

“So I just ship and they’ll come… Right?”

You tab over to your new LiquidChadDex discord server.

It’s uncomfortably quiet.

Uh oh. It’s been 2 hours… 3 hours… 5… 10…

“Where dem homies???”

God ended his work on Day 7, so that’s when u’ll begin.

Want 1 Million users? Done.

1 Billion TVL? Piece of cake ser.

Roll up your sleeves, crack your knuckles, ‘n get ready.

Cuz if u gonna ponzi, at least do it right.

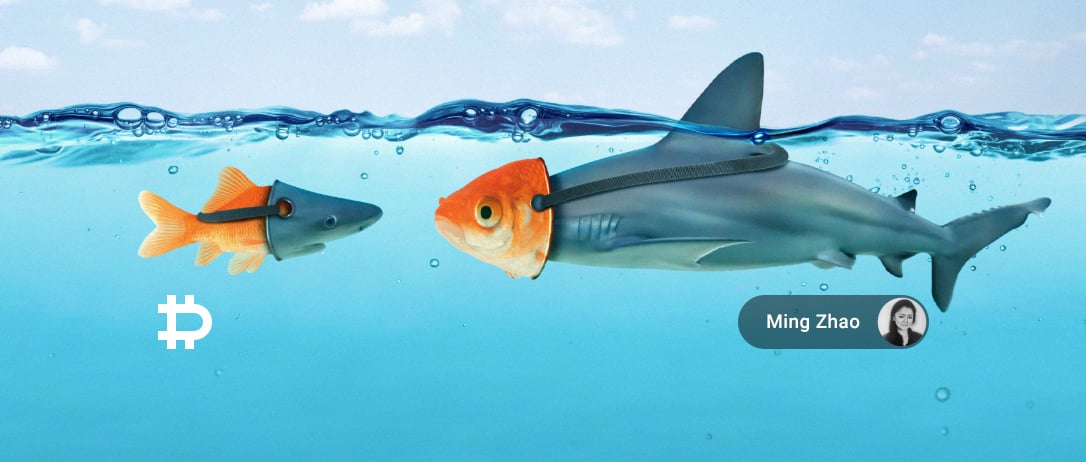

1. Juice up wash trading at all costs (树上开花 part 1)

Start off by paying all your users more wash-trading rewards than what they bleed out in trading fees:

e.g. Let ‘em buy at 40K, sell at 39.9K, get +0.2K rewards… buy at 40K, sell at 39.9K, get +0.2K rewards… Repeat.

When the masses catch on, now you switch up the game.

Move to a cat-and-mouse structure so that only half your users gain more in rewards than they bleed: i.e. the half who out-wash-trades the other half, thereby earning higher rebate tiers. Meanwhile the other half who sadly did not wash-trade quite enough this epoch nets more transaction fees than rewards. By the next trading epoch they’ll learn their lesson and be incentivized to trade even more to compete for the higher rewards.

Now u just sit back and watch as ur `volume per user` numbers shoots through the roof. Keep saying #WAGMI on discord tho. Even to those bottom-half users.

2. Build your own army of imaginary traders (树上开花 part 2)

Organic user acquisition too hard? Why bother. Just make 1000 imaginary frens with 1000 unique wallets and press TRADE. Fren #1 buys 69 BTCPERPs. Fren #2 sells 69 BTCPERPs. Fren #3 buys 50 ETHPERPs. Fren #4 sells 50 ETHPERPs… etc.

They’re anon anyways so who’s gonna find out.

Top 3 benefits of this method:

- You’re 100% delta-hedged cuz any 2 trade cancels each other out so this is 100% sustainable.

- All slippage & transaction fees you get to recognize as additional revenue. Cuz ur the Dex duh.

- You can scale up infinitely and combinatorically, making it harder and harder for investors and outside users to figure it out. So with an army of 100 frens there are C(100,2) = 4950 uniquely offsetting trading pairs… With an army of 1000 that’s 499,500! Chainalysis not gonna catch on I promise.

3. Bootstrapping an AMM pool is too hard so just build a vAMM instead (无中生有)

Why compete with Uniswap when u can just set K = 69696969. Some hella *deep* pool right here. Nevermind that users can’t get their funds back out later… we’ll revisit this problem benefit in just a sec… see #7.

4. BYOA (bring your own arbitrage)… to seduce arbitragers to come do your dirty laundry (借刀杀人)

After you’ve got yourself a decently deep pool, whether real or imaginary virtual, time to attract the whales aka “arbitragers.” 90% of market volumes come from these 10% whales. To catch their eye, your Dex better load up on juicy arbitrage.

Don’t got enough arbs? Make your own!

Every time your price matches the rest of the market’s just have a trustworthy friend (see #2) stir up some trouble and move your price off the mark. Some speedy whale is bound to come in and chew through xy=k to bring it back to equilibrium. The deeper your pool (the bigger you set K, see #3) the more volume said whale gotta drop on your Dex to realign the market.

Your trustworthy friend here (aka you) unfortunately does take a PNL hit… but just think how much your valuation multiples are gonna balloon when investors see your volume KPIs!!! Short-term gains for long-term sacrifice! Er, maybe it’s the other way around…?

5. Dilute old users to acquire new users (李代桃僵)

Speaking of sacrifice… when it comes down to old vs new, always rug the old. See, new users have 100% lifetime value left in them whereas old users already got milked – of some, maybe even most – of that value.

The sacrificial ritual is simple: keep printing those incentive tokens!!

Someone complimented your project on discord? Airdrop.

It’s your #1 power user’s birthday? Airdrop.

Taylor Swift got dumped again. Know what’ll woo her? Airdrop.

6. Call everything by its opposite name to obfuscate things u don’t wanna explain (混水摸魚)

What is impermanent loss?

Well it’s a lotta things, but impermanent ain’t one.

Hot tip: confused users are great users.

7. Finger-trap users so they can’t get out after getting in (上屋抽梯)

Ok so technically there’s one way to get out: twiddle-dumb needs to convince twiddle-dumber to take his place.

Examples: (1) Olympus DAO, (2) Perpetual protocol.

In both cases, a massive pullout leads to massive, immediate and unstoppable price dislocation. Because vAMMs got no actual liquidity pools underpinning their microstructure, any closing position dislocates the market… until another trader swoops in to catch the falling knife *arbitrage*. But now how’ll twiddle-dumber unwind??

Give it a minute. Twiddle-dumbest will show.

8. Get a hot but otherwise useless head of thirst trapping marketing (美人計)

Beauty is in the eye of the beholder… unless you’re hiring a head of marketing!

Some SIMPle rules to live by:

- Clothing ~ less is more

- Twitter followers~ more is more.

9. Release an NFT that has nothing to do with your Dex but SEIZE THE HYPE TRAIN while it lasts (顺手牵羊)

U got grand plans to take over the world, but don’t forget to appropriate any opportunity, however small, and avail yourself to any profit, however slight. Time is infinite and you can afford to get distracted because it’s 2022 and ADHD is cool now.

10. Definitely do NOT let your investors know you are using these strategies (瞒天过海)

This one’s obvious: what if your investor decides to quit investing ‘n compete against you tomorrow???

A fren today =/= a fren tomorrow.

Never leak ur alpha!

AUTHOR(S)