Traditional options are only growing more popular. 2022 witnessed record numbers of zero-day S&P options trading. A single day in November saw about 1.5 million trades, over double the amount in January and nearly quadruple the amount in early 2020.

Crypto options, while having risen in popularity in recent years, have not yet become normalized in the minds of most traders.

A recent five-day average of options volume including CBOE, NASDAQ, NYSE, MIAX, and BOX options was 37,001,379, compared with only 8.9 million ETH contracts and 778,000 BTC contracts on Deribit for the entire month of November.

If bitcoin is poised to become the next global reserve asset, it is puzzling that the number of options contracts traded on top of it is about two orders of magnitude less than the number of zero-day S&P option trades.

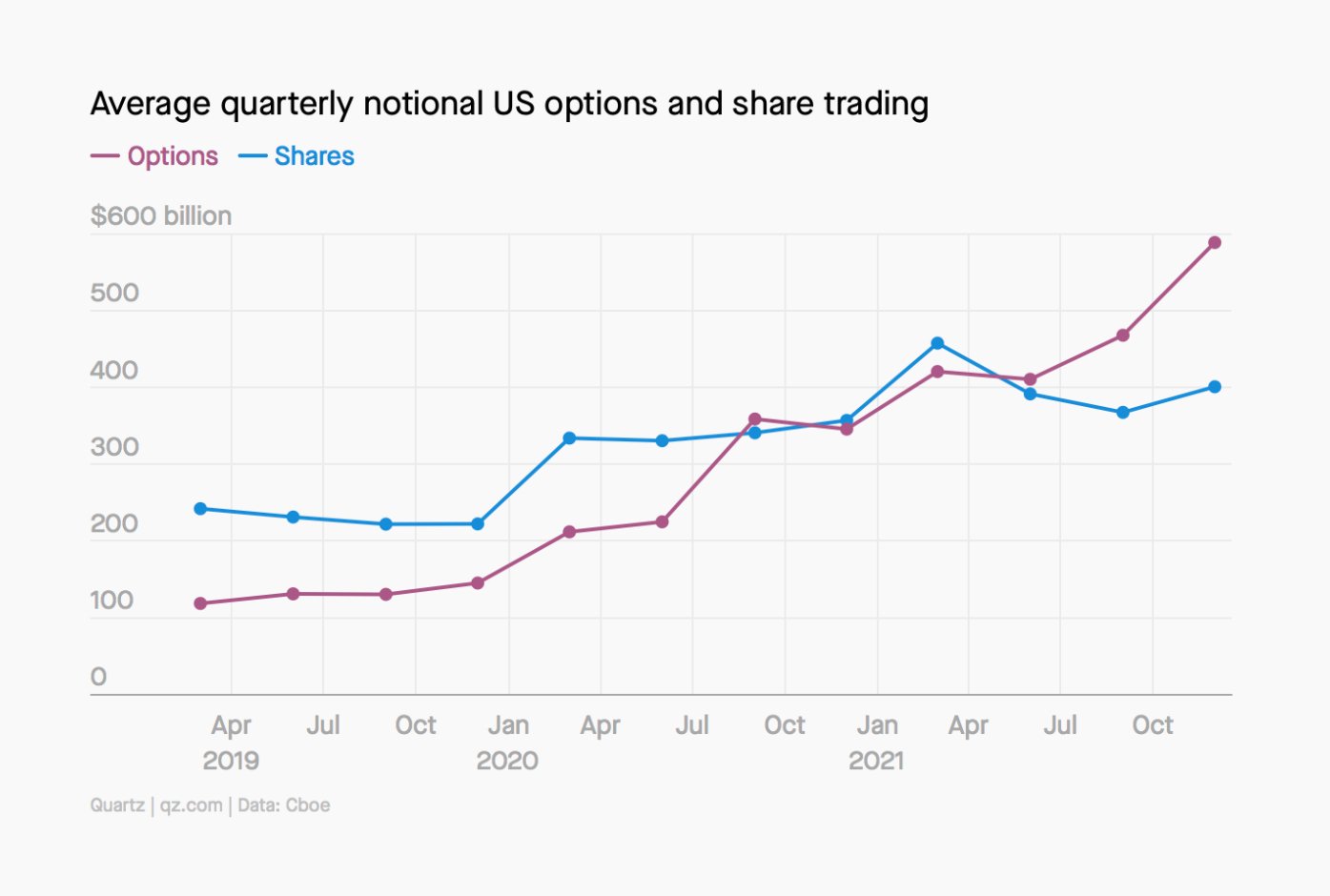

Contrast crypto’s small options market size with that of traditional market single-stock options, which exceeded stocks in daily notional value in 2021 (see Figure 1).

Figure 1. Average quarterly notional U.S. options and share trading.

Meanwhile, BTC’s daily spot trading volume reached $31.06 billion as of November 2022, according to The Block. During the same month, Deribit’s 24-hour BTC option volume was $460 million, two orders of magnitude less than BTC’s spot volume.

Qualitatively, the ratio of equity options over equity shares is far greater than the ratio of BTC options over BTC spot trades.

It is not obvious why traditional options should be much more popular than crypto options. In this article, we offer three plausible explanations for the disparity.

Reason One: Traditional Options are More Established

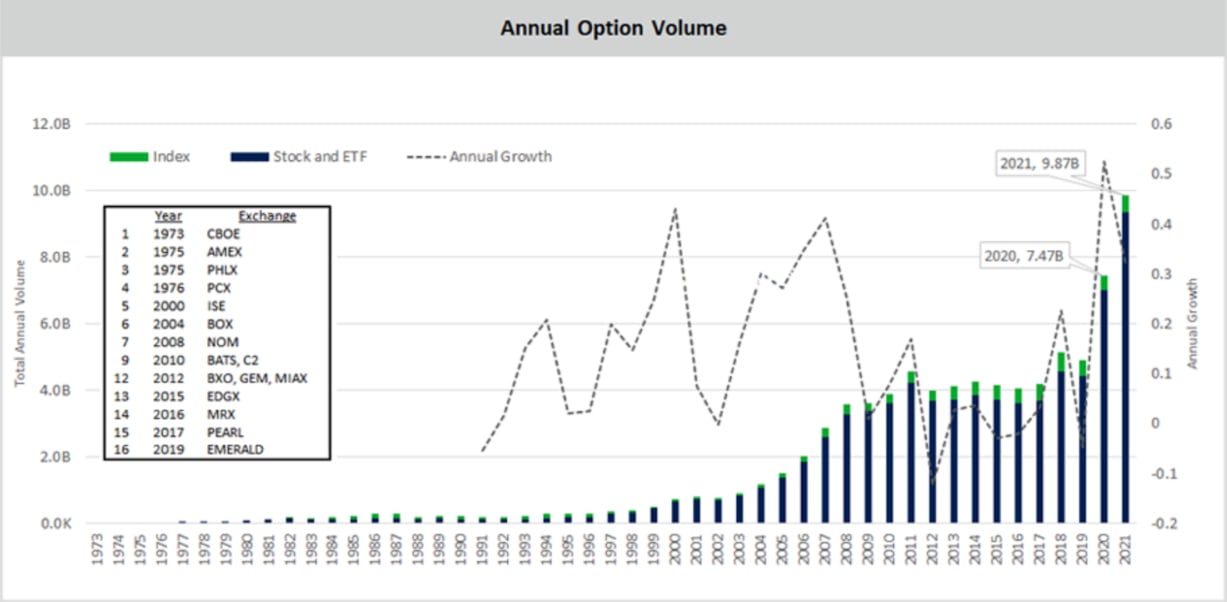

Although options have been with us for thousands of years, the form of traditional options that traders are familiar with was established in 1973 with the founding of the Chicago Board of Options Exchange. In the years leading up to CBOE’s formation, trading options were not a user-friendly process, and so the market for them was stagnant. Even after its formation, the market for trading options did not grow significantly for about two decades. Only in 1999 did trading options begin to increase in popularity (see Figure 2).

Figure 1. Average quarterly notional U.S. options and share trading.

The same year that CBOE was founded, Fisher Black and Myron Scholes came up with the famous Black Scholes Pricing Model for calculating the price of an option. This gave otherwise unknowledgeable investors psychological security in entering the options market.

Crypto options, on the other hand, are just a few years old. Cryptocurrencies were invented in 2008 with Satoshi Nakamoto’s white paper, so it stands to reason that higher-order financial instruments have taken some time to be developed. It will also take time for cryptocurrency enthusiasts to become comfortable enough to trade in crypto-based financial instruments.

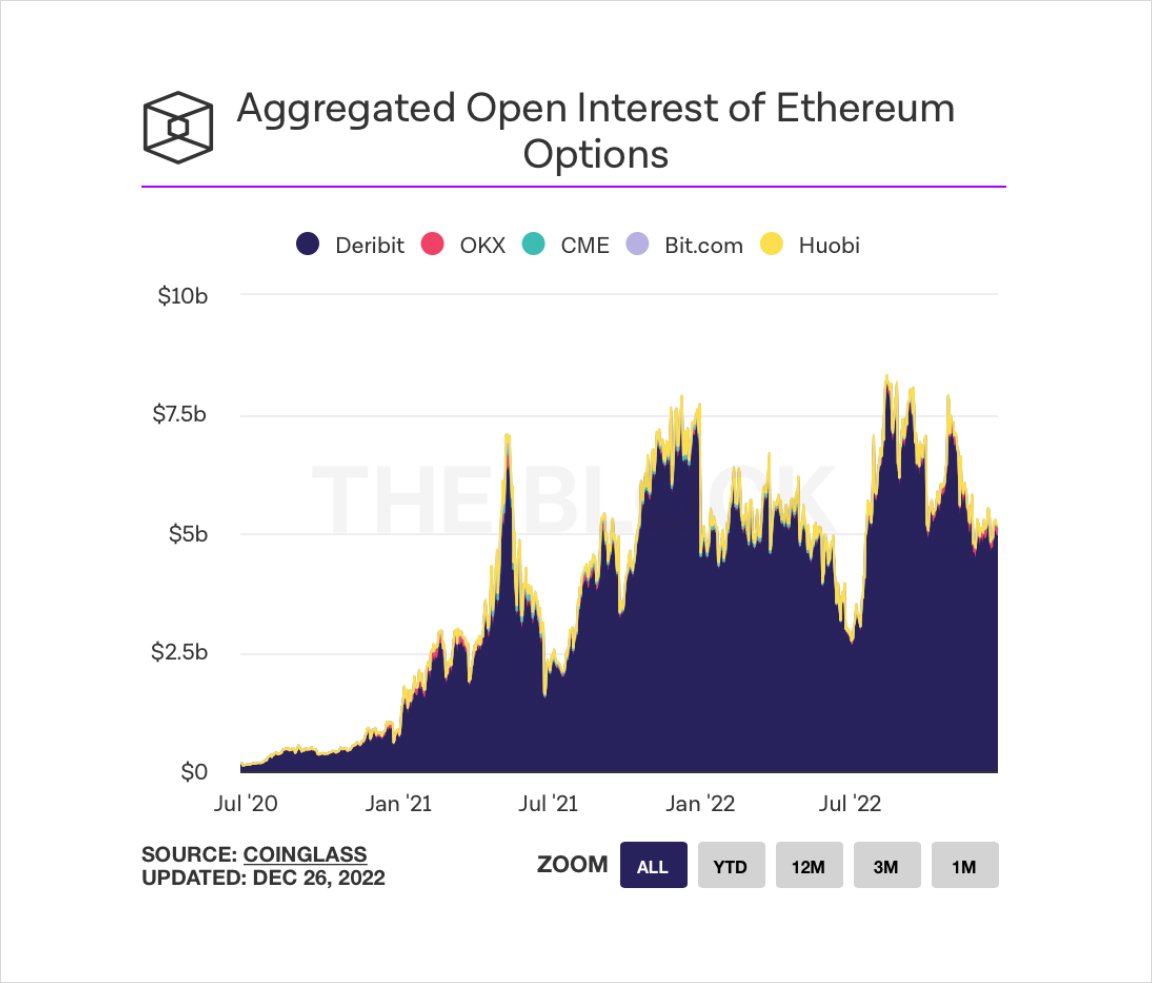

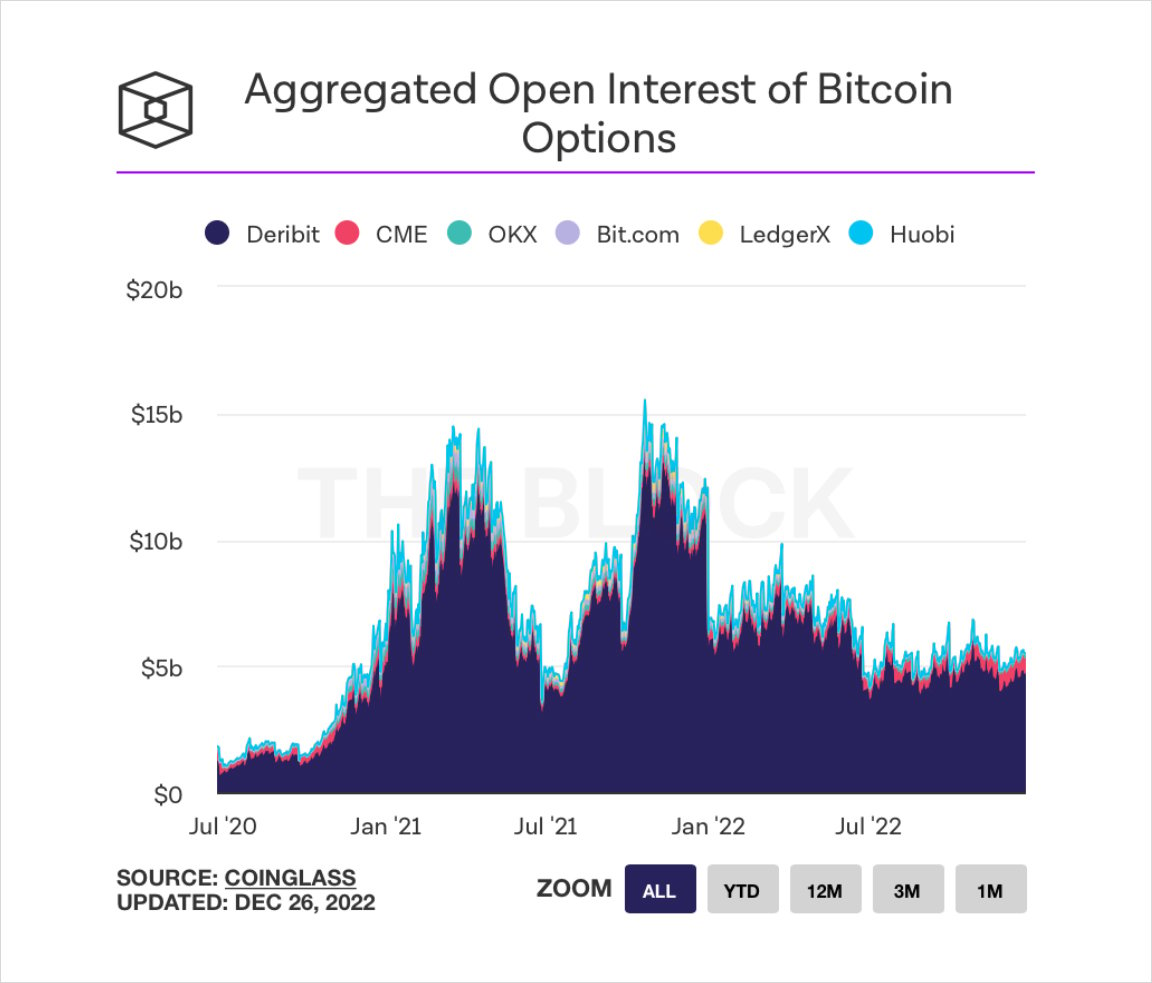

Similar to traditional options’ early years, aggregated open interest in crypto options is small (see Figures 3 and 4) but primed for exponential growth as exchanges continue to innovate and make options trading more user-friendly.

Figures 3 & 4. Aggregated open interest of BTC (top) and ETH (bottom) options from July 2020 through July 2022.

Because traditional options have been around for so long, exchanges have had ample time to innovate and better satisfy customer needs.

The ecosystem of traditional options trading platforms is mature and robust. For example, TD Ameritrade was founded in 1975 and so has had ample time to earn the trust of the public. They offer a wide range of products, professional educational tools, and analytics.

Widely praised competitors to TD Ameritrade include E*TRADE, Fidelity, Merrill Edge, and Interactive Brokers IBKR Lite.

Platforms for trading cryptocurrency options are both younger and fewer in number than their traditional counterparts. Deribit is the leader of the pack, and was founded in 2016.

In short, one reason that traditional options are more prominent than crypto options is that the former has had more time to become normalized in the minds of traders.

Reason Two: Differences in Market Dynamics

Options are fundamentally a tool that traders use to hedge risk. For example, a trader will purchase a put option to acquire the right to sell the underlying asset at a fixed price within an established time interval. This is a useful strategy when dealing with both volatile assets and a market whose trades can take days to settle. Trade settlements in traditional finance can take up to two days, by which time a volatile asset’s price could have swung wildly.

Crypto markets do not suffer from such delays: trades on crypto exchanges are settled instantly.

Furthermore, a crypto trader typically has a private wallet that he uses for peer-to-peer transactions. Such trades also take very little time. Therefore, a crypto trader with a significant fraction of his crypto portfolio on his own wallet has less of a need for hedging strategies than traditional finance traders.

In particular, 2022 saw a mass exodus of BTC from exchanges to private wallets. By December, exchanges possessed less than 12% of all BTC in circulation (see Figure 5).

Figure 5. 2022 witnessed a mass exodus of BTC from exchanges.

Moreover, the amount of ‘illiquid’ supply of BTC–the amount held in self-custody–has been rising aggressively (see Figure 6).

Figure 6. The amount of BTC held in self-custody has increased dramatically in 2022.

Those who self-custody BTC are quite unlike those who have spare cash in the bank. The former tend to adopt the ‘HODL’ strategy and aim to hold their BTC for years at a time, while those with cash prefer to put their cash to work in order to beat inflation. This discrepancy is another reason that traditional options are more popular than crypto options relative to their respective markets.

Reason Three: Prime Brokerages

Prime brokerages have long been a centerpiece in traditional finance, servicing institutional traders and hedge funds by handling trades, managing custody, and offering advisory services.

The crypto ecosystem’s demand for prime brokerages is currently greater than the supply, though this is changing. For example, crypto traders may need a brokerage to facilitate trades across a number of platforms simultaneously as a hedge against any particular exchange’s illiquidity.

Because there is not yet a robust legal framework around crypto, many traders are afraid to invest in crypto options and other investment vehicles in the space. A prime brokerage service can offer traders the security and insurance that they need in order to engage in large-scale crypto trading.

Fortunately, crypto prime brokerages are now emerging. In fact, some are offering services that go beyond what the traditional prime brokerage ecosystem tends to provide. For example, one particular brokerage offers clients the ability to automatically scan the crypto market for arbitrage opportunities.

As more crypto prime brokerages enter the space, expect traders to feel more comfortable purchasing crypto derivative products.

Conclusion

Relative to their respective markets, traditional options continue to be more popular than crypto options. This is largely due to the fact that traditional options have been around longer, and that they provide greater relative risk reduction than crypto options. As the crypto ecosystem’s legal framework, user-friendliness, and quality of services mature, crypto options will dramatically increase in trade volume and market capitalization.

Nevertheless, crypto options have some advantages over traditional options. For example, because crypto is more volatile than traditional markets, trading crypto options is a straightforward way to solve for crypto volatility. Relatedly, crypto options are a way for traders to profit from crypto’s unique volatility. Finally, as mentioned above, crypto markets are open 24/7, unlike their traditional counterparts.

Deribit is the world’s leading cryptocurrency derivatives platform. Through Deribit, all types of traders make use of these exciting new markets, whether experienced or inexperienced, aggressive or conservative. We are proud to have 97% of ETH options market share and 90% of BTC options market share. We also offer educational content for traders who wish to learn about crypto, derivatives, and the mechanics of trading. One of the best places to begin is to follow our free options course (with Telegram Support) by our course creator @Cryptarbitrage.

Find the Free Options Course here.

AUTHOR(S)