Summary: We are changing our trading strategy from a range bound market to another potential breakout that sees Bitcoin trading above 40,000 in December with any rally likely capped at 45,000. A cost efficient strategy would be positioning for this move through call spreads as volatility has remained relatively high and the upside opportunity appears attractive. While people are debating on TV if and when a Bitcoin ETF is coming, $2.8 billion is being moved into crypto this month alone! Somebody is voting with their wallet.

Analysis

The pressure is building – another breakout looms. The Bitcoin price action resembles a volleyball held underwater; it can pop higher at any moment as this rally is still unfinished. Various ETF issuers regularly appear on TV, spreading the message that a Bitcoin ETF is inevitable. This will keep the momentum high.

For the last week, we suggested that strangles (selling out-of-the-money puts and out-of-the-money calls) were the right strategy if a small risk-off event would occur. This risk-off event could have been a US government shutdown that could have caused a repricing in the expectation that a US-listed Bitcoin ETF would be approved by the SEC. A government shutdown could have pushed any approval date into the distant future, resulting in a decline in Bitcoin prices. The upside into year-end would have been capped.

But the shutdown was averted, and the expectations for a January 2024 approval continue to build up. As the US stock market has also woken up to our Christmas Santa Claus rally, Bitcoin has additional support from other risk assets.

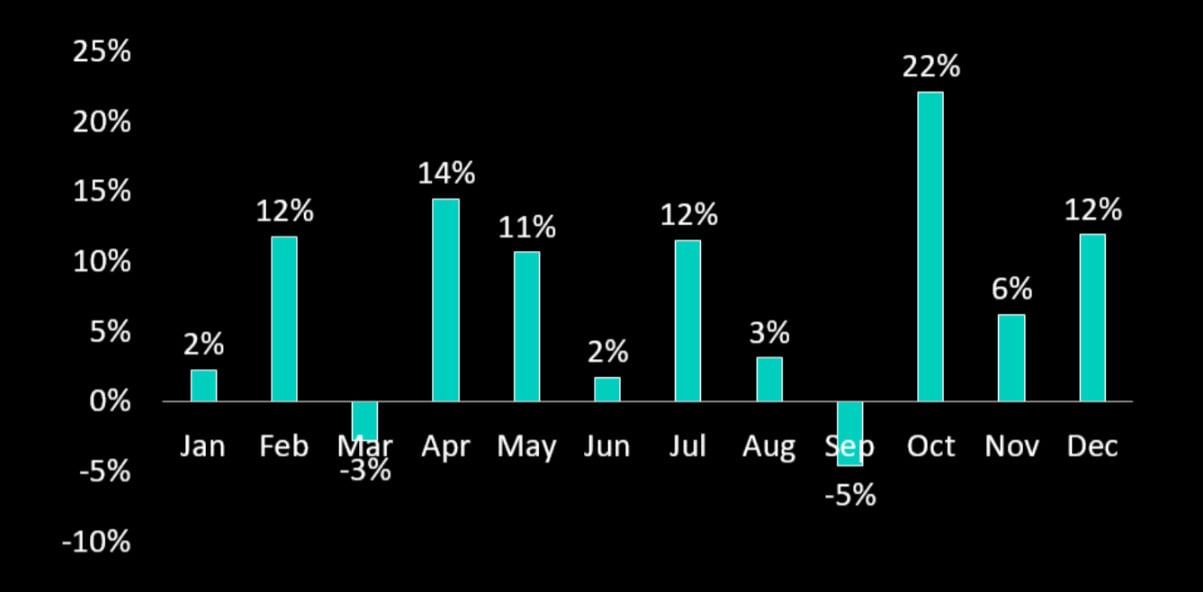

During the last eight years, Bitcoin has returned +12%, on average, during the month of December.

As the market structure also supports another push higher into December, we suggest switching from strangles (selling puts and calls) into buying call spreads, notably buying the call with Dec 29 expiry with a strike level of 40,000 and selling the 45,000 calls with the same expiry.

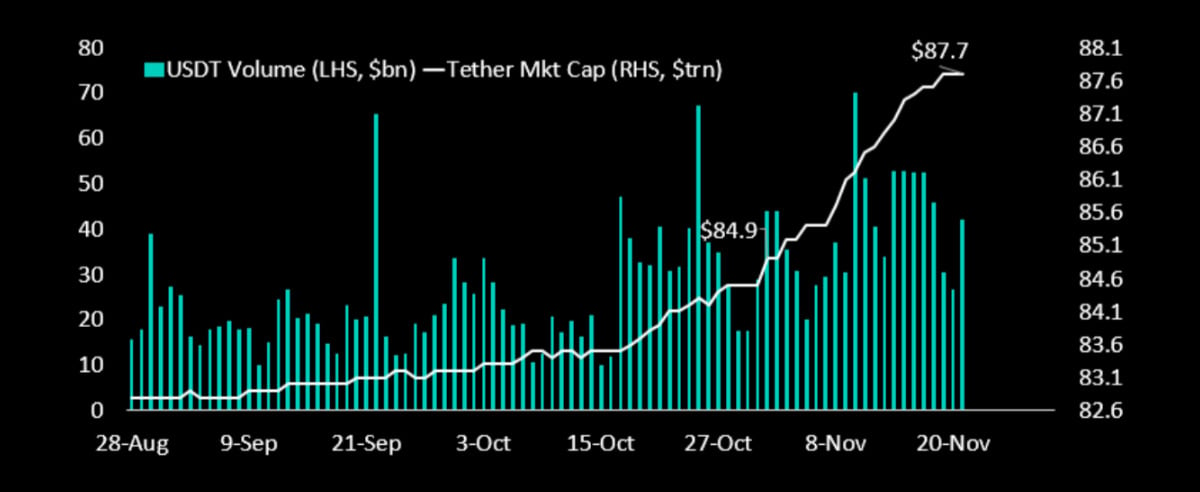

Previously, we pointed out that the increase in Tether’s USDT market capitalization signals a conversion of fiat into stablecoins, and it would ultimately be detected as new inflows into crypto. Tether’s market cap has increased by $2.8 billion in November alone. This shows that institutional players that are paramount in facilitating those flows (as Tether only deals in minimum $100,000 clips) are deploying billions into crypto ahead of any potential BlackRock Bitcoin ETF launch.

Think about it. While people are debating on TV if and when a Bitcoin ETF is coming, $2.8 billion is being moved into crypto this month alone! Somebody is voting with their wallet.

The crypto market capitalization is approaching $1.5 trillion again, and it was our theory that once crypto’s market capitalization had reached one trillion dollars, institutional players and TradeFi hedge funds suddenly had to get involved with this new asset class. There is also no coincidence with TradeFi billionaire hedge fund managers returning from hibernation during the last few weeks, making a solid investment case for Bitcoin in institutional investors’ portfolios.

While we have seen a material shift during the last three weeks when trading volume in Ethereum has increased relative to Bitcoin, Bitcoin dominance has moved up again, signaling that traders should continue to focus on Bitcoin – and not necessarily on Altcoins. While a cherry-picked altcoin like Solana has rallied strongly during the last few weeks, most altcoins are still far behind Bitcoin’s performance in 2023. Large investors will also have trouble navigating the lack of liquidity that most altcoins face, while Bitcoin trades 20 billion to 30 billion dollars daily.

Based on our analysis, a break above the 38,000 technical resistance level could cause a sharp rally to 40,000. And while Bitcoin currently struggles with the 37,000 level, this is not critical level for technical analysts. Instead the clearance of the 35,000 resistance has opened the door to 40,000 with another minor resistance at 42,500 and then a strong resistance awaits at 45,000. However, we see very little chance for the rally to go beyond 45,000 this year – next year is a different story, of course.

Therefore, we are changing our trading strategy from a range bound market to another potential breakout that sees Bitcoin trading above 40,000 in December with any rally likely capped at 45,000. A cost efficient strategy would be positioning for this move through call spreads as volatility has remained relatively high and the upside opportunity appears attractive.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)