Summary: Three macro events of the last week set risk assets – stocks and crypto – up for a sizeable rally into year-end. This is also the first week when higher beta crypto assets outperformed Bitcoin and could signal that a massive rally is in the cards. We encourage our readers to re-read two insights we wrote in October to determine if they have the correct upside exposure in their trading books. On average, Bitcoin tends to rally by +23% during the pre-Christmas period (November + December).

Analysis

Three macro events of the last week are setting risk assets – stocks and crypto – up for a sizeable rally into year-end. All three events signal that interest rates have peaked for this cycle and that longer-dated bond yields should trade lower over the next year. Long-duration assets, such as shares of recently gone public (IPO) technology shares and crypto assets are the primary beneficiaries. This is also the first week when higher beta crypto assets outperformed Bitcoin and could signal that a massive rally is in the cards.

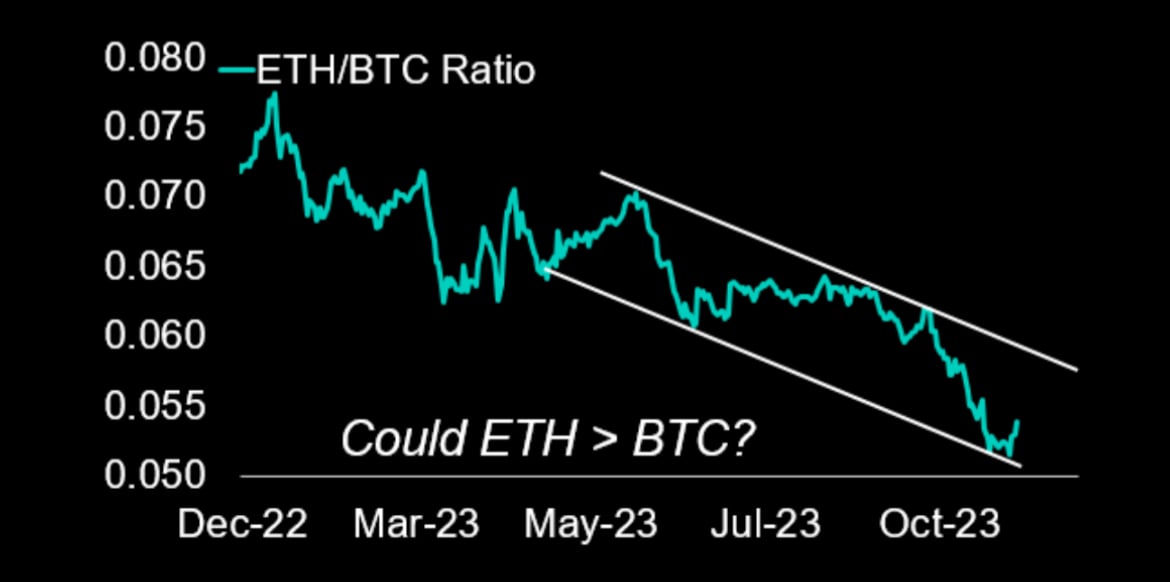

While Bitcoin is up +2.8% during the last week, Ethereum is up +5.5%, Ripple Labs XRP +13.5%, and Solana is up +28.3% on the back of the Solana Breakpoint but likely more importantly due to the strong tailwinds of liquidity that those three macro events are signaling.

First, the US Treasury Department is slowing the pace of issuing longer-dated debt – this is a slight reversal from the early July 2023 announcement, which caused 10-year bond yields to spike above 5.0%. Instead, the Treasury Department will issue more two- and five-year notes, which signals that the Treasury expects interest rates to decrease over the next few quarters.

Second, Fed Chair Powell was very dovish during the post-FOMC meeting press conference and opened the door to the possibility that inflation could also surprise on the downside. For the first time, Powell spoke about inflation risk being symmetric. He mentioned this twice, and it sounded like a victory lap in the Fed’s endeavor to bring inflation down. This would signal the possibility of rate cuts for 2024, but it is increasingly evident that there will be no more rate hikes for this cycle. The last rate hike was in July 2023. Powell also said that he does not see a recession. Overall, this FOMC press conference was very bullish for risk assets.

Third, Friday’s data release of the US Nonfarm payrolls report disappointed and signals a weakening labor market. This will also prevent the Fed from adding additional hikes, especially as Powell mentioned that we have not seen the effects of the previous hikes entirely play out, which tend to hit the economy with a lag.

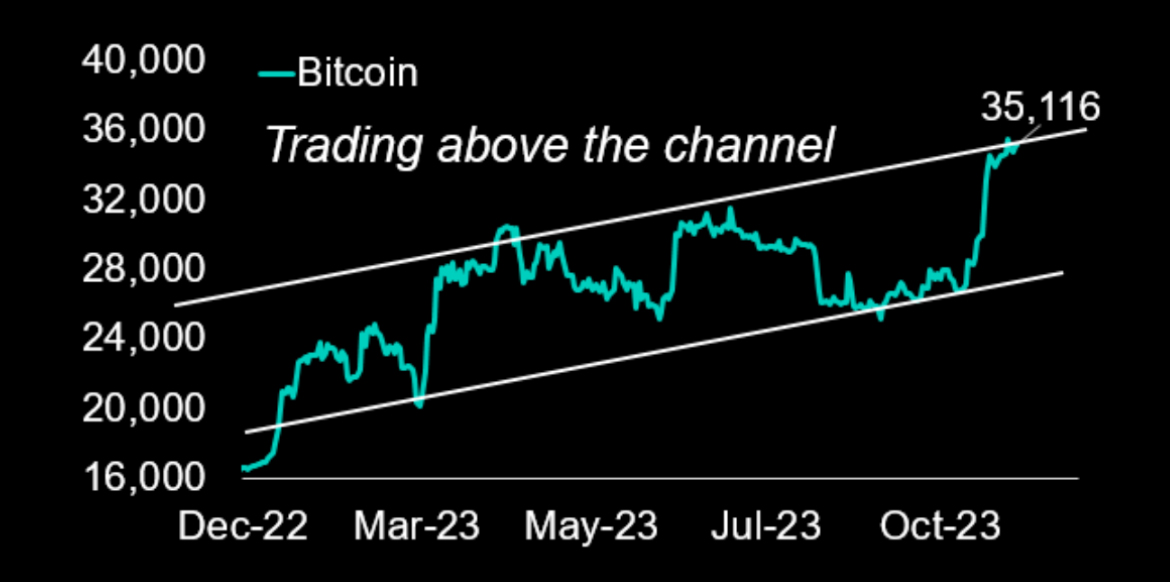

In one of our recent reports (Echoes of 2017: CME Bitcoin Futures Launch Hints at +288% Returns!), we compared the current momentum driven by the BlackRock Bitcoin ETF application to the 2017 episode when the CME announced the launch of the Bitcoin Futures. Bitcoin prices continued to stay ‘overbought’ – based on the relative strength index (RSI) – from the announcement until the actual launch. Hence, it was too early to take profits. We also showed that once Bitcoin is trading in ‘overbought’ territory (RSI >70%), that prices tend to continue to rally, and we cautioned traders to take profit. It appears premature to cut any exposure before any US-listed Bitcoin ETF actually starts trading.

In our analysis titled ‘Buy the Fed’s Pause but Sell the Fed’s First Rate Cut‘ we showed that when the Fed concluded their interest rates hiking cycle in January 2019 after several hikes in 2018, Bitcoin prices exploded during the first half of 2019 and rallied almost by +400%. While we do not expect a rally of this magnitude, we suggested that Bitcoin could significantly advance in 2023 and 2024.

Bitcoin has historically experienced strong rallies in November and December and this year might not be any different. On average, Bitcoin tends to rally by +23% during those two months. With the macro tailwind plus the potential approval of a BlackRock Bitcoin ETF, we struggle to see why Bitcoin would trade lower. We are not worried by any overbought conditions. With beta crypto assets outperforming, the crypto rally might not only be focused on Bitcoin but could be broad-based. This is very bullish for crypto into year-end.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)