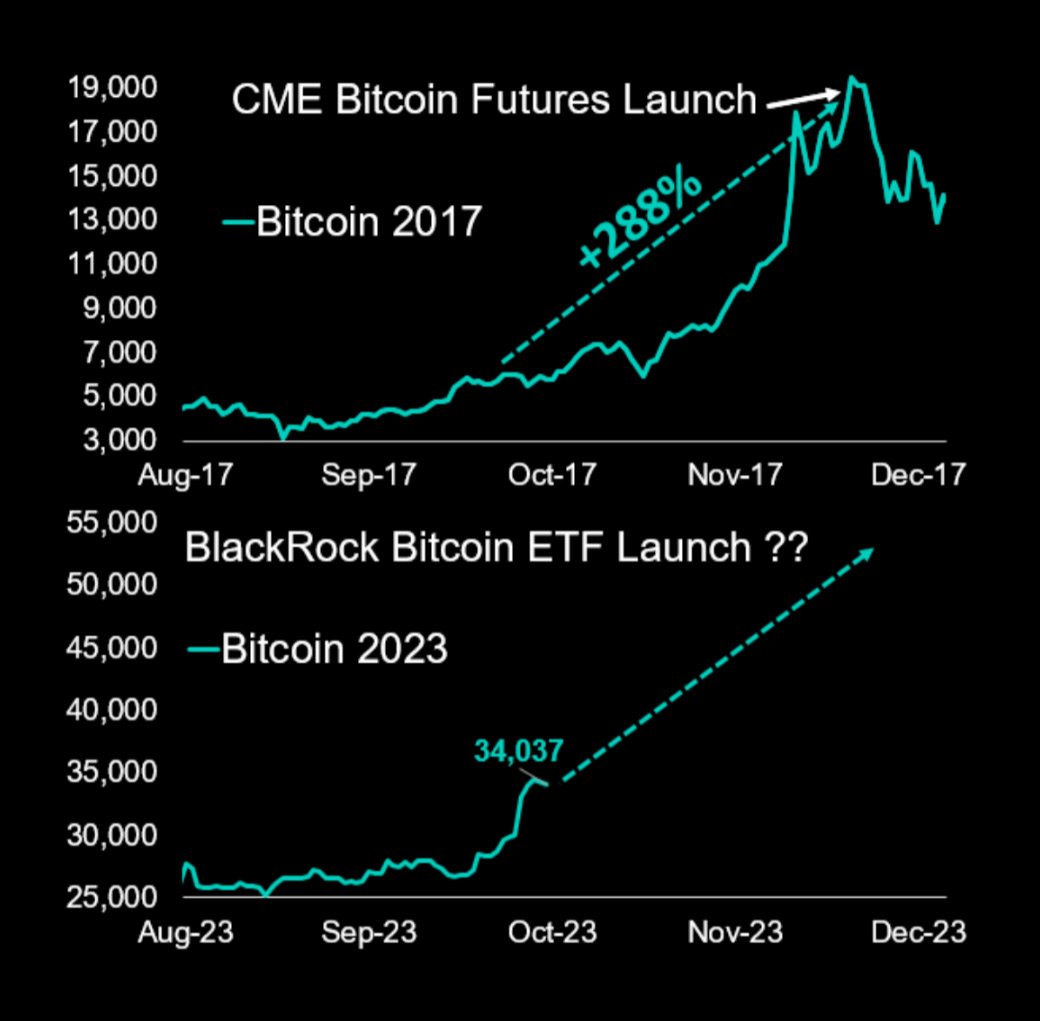

Summary: The anticipation of the Bitcoin Futures created a massive wave of TradeFi adoption expectations and caused Bitcoin to rise by +288% from when the CME announced the upcoming launch until the futures started trading. With an RSI of 89%, Bitcoin was overbought earlier this week but the historical comparison shows that Bitcoin rose +52% over the next sixty days when Bitcoin was similarly overbought as currently. Overbought situations tend to attract more Bitcoin buyers.

Analysis

Bitcoin is overbought! Should traders take profit?

Earlier this week, Bitcoin’s perp funding rate increased to +39% annualized and at- the-money implied volatility levels exploded as some traders scrambled to hedge their positions while others experienced FOMO. But can markets rally higher?

Let’s look at the situation in 2017 which might be analogous to the current one:

On October 30, 2017, the Chicago Mercantile Exchange (CME) announced its intention to launch the Bitcoin Future in Q4 of that year. Bitcoin traded at 6,767 at the time and while Bitcoin was overbought as measured by the relative strength index (RSI) which printed 79%, prices continued to climb higher over the next few weeks – and months.

The RSI aims to determine the strength and weakness of an asset, and it is widely believed that a reading below 30% signals that a stock, a currency, or a cryptocurrency is oversold, while a reading above 70% signals overbought. Most market participants believe that a period of consolidation is ahead when the signal is above 70% – overbought – as happens frequently in the stock market. But the stock market has natural sellers, like pension funds who are often seen as value investors that rotate constantly out of expensive into cheap stocks and have the time to wait it out when they are premature with their decision.

Not in the crypto market, nobody has time here, and value investors are hard to find.

Indeed, the Bitcoin market is very different as higher prices attract more buyers and Bitcoin tends to rise even further. By November 30, 2017, Bitcoin had climbed to 10,975 with an RSI of 84%, when the CME announced that Bitcoin Futures would start trading on Monday, December 18, 2017. Bitcoin rose further to 19,497 on December 14 and the RSI began to fall to 75%. The anticipation of the Bitcoin Futures created a massive wave of TradeFi adoption expectations and caused Bitcoin to rise by +288% in less than three months.

While the Bitcoin ETF by BlackRock (and others) is also highly anticipated, the narrative appears to mimic the CME Bitcoin Future launch. This is why we could argue that Bitcoin might continue to rally until the US-listed Bitcoin spot ETF starts trading, and any announcement of the launch date might cause a parabolic price rise.

During the last few days, we have seen the impact as Bitcoin rallied +10% on a sketchy approval announcement – imagine what will happen when the real SEC approval is released into the market.

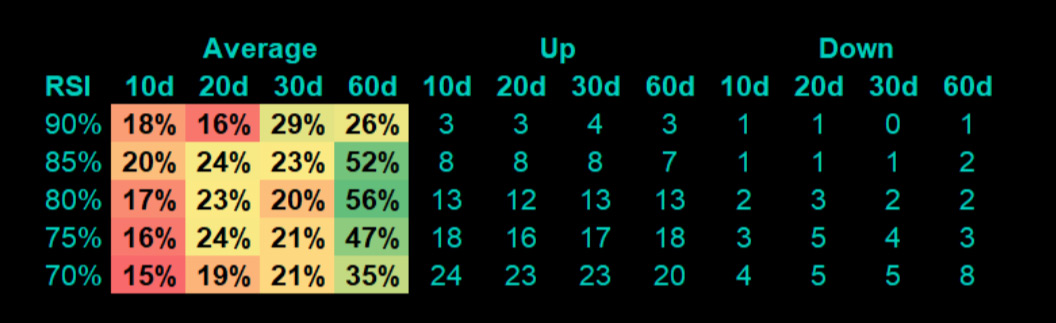

The table below shows Bitcoin returns when Bitcoin’s RSI climbs above a certain threshold for the first time in a month. For example, when Bitcoin’s RSI rose above 90%, Bitcoin was up by +18% over the next ten days and +26% over the next 60 days. Since 2016, we have had four events, with three showing positive returns and only one showing a negative return after 60 days.

Earlier this week, Bitcoin’s RSI climbed to 89%. This would make the ‘85% RSI’ bracket the most relevant, according to the table (below). The historical comparison shows that this has occurred nine times with eight of those times prices being higher. Bitcoin rose by +20% ten days later and +52% sixty days later, on average. These are still very good odds that suggests Bitcoin could climb higher during the next few weeks and months.

So any profit-taking at current prices or because the SEC suddenly announces a Bitcoin ETF that would start trading two-to-three months later appears pre- mature based on the 2017 CME Bitcoin Future analog AND also because an overbought situation appears to favor the odds that Bitcoin would rise even further.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)