In this week’s edition of Option Flows, Tony Stewart is commenting on the market movement and how the reduction in GBTC selling has impacted.

As anticipated, it took only a modest reduction in GBTC outflows (in isolation) to red-flag the bulls and force under-allocated Funds to buy Calls.

Apparent short-cover of BTC March OTM Calls followed by aggressive Feb Call buying from Funds+Fast money.

Overwriter observing.

2) Mixed OI data suggest that BTC Mar75k x1800 ($125k premium) and Mar 50k x1055 ($1.1m premium) perhaps short-covering Calls from higher Spot or structure.

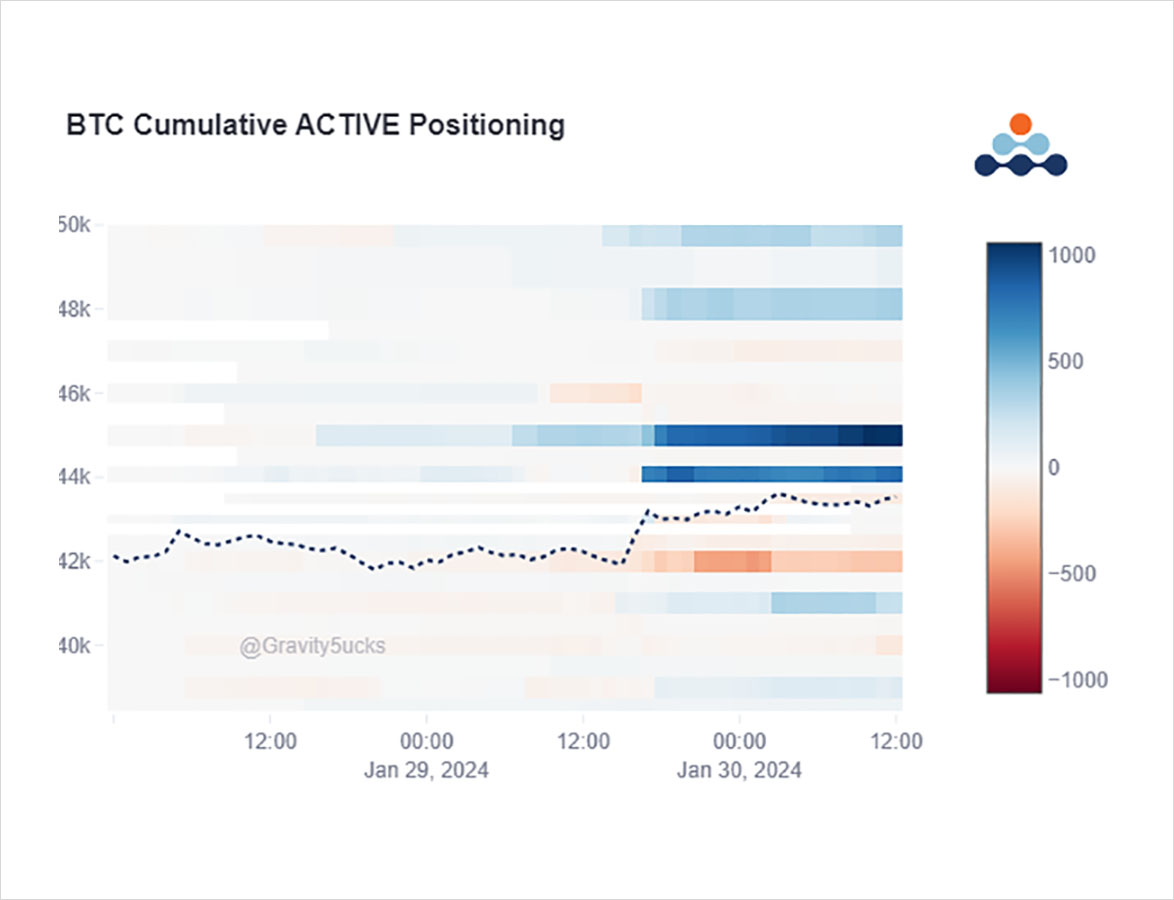

But buyers of Feb 43-48k Strike range were certainly net-adding exposure.

Only a Feb2 42-44k Strangle seller opposed Vol.

3) This hasn’t helped out LPs according to data that shows dealers short BTC Gamma and long ETH Gamma – the latter from the large Call-Overwriter who is clearly monitoring ETH Spot moves but has yet to flinch with any roll-up/cover plans.

So ETH Vol premium has retraced to flat.

View Twitter thread.

AUTHOR(S)