In this week’s edition of Option Flows, Tony Stewart is commenting on the latest market movements.

BTC Option buyers getting as chopped up as Spot, with reflexive 65k+ Call buyers on rallies, ~59k Put buyers on the lows; neither productive yet.

Vol drift exacerbates frustration.

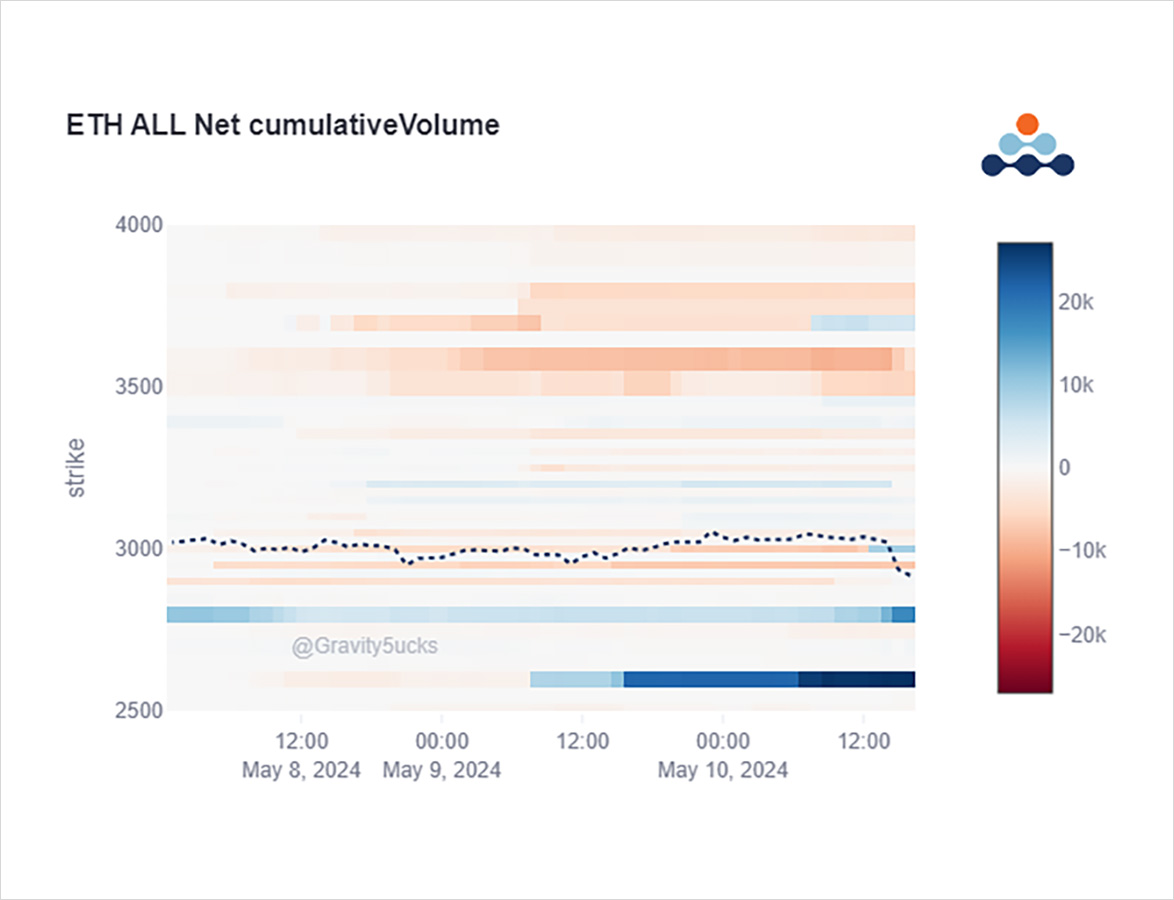

But a buyer today of ETH 3k Puts is already ITM, and an accumulator of 2.6k Puts is ominous.

2) The 60-65k range is so far contained, although challenging those lows as I write.

Within this, IV (Dvol proxy) continues to drift lower, applying pain to longs, and presenting opportunities to those looking to initiate long optionality, as some have done, but not benefited.

3) ETH Spot’s underperformance is frustrating holder sentiment, as Alts bounce.

Despite ETH’s 10% IV premium, this perhaps has led to a couple of ETH Put purchases over the last 24 hours.

ETH 2.6k Put accumulated ($1.5m spent), and just now ETH 3k Put ($2m).

Protection or a play?

View Twitter thread.

AUTHOR(S)