In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

After weeks of rolling-up Calls and MSTR BTC buying, a pause created a vacuum pull-back to 91k.

For 1+ entity this changed the game; unloading Dec29 90k,97k+100k Calls =~$25m.

Buyers of Dec 92k Straddles +100k Call stepped in.

Then (coincidence?!?) ~$15m spent on Dec 92k Puts.

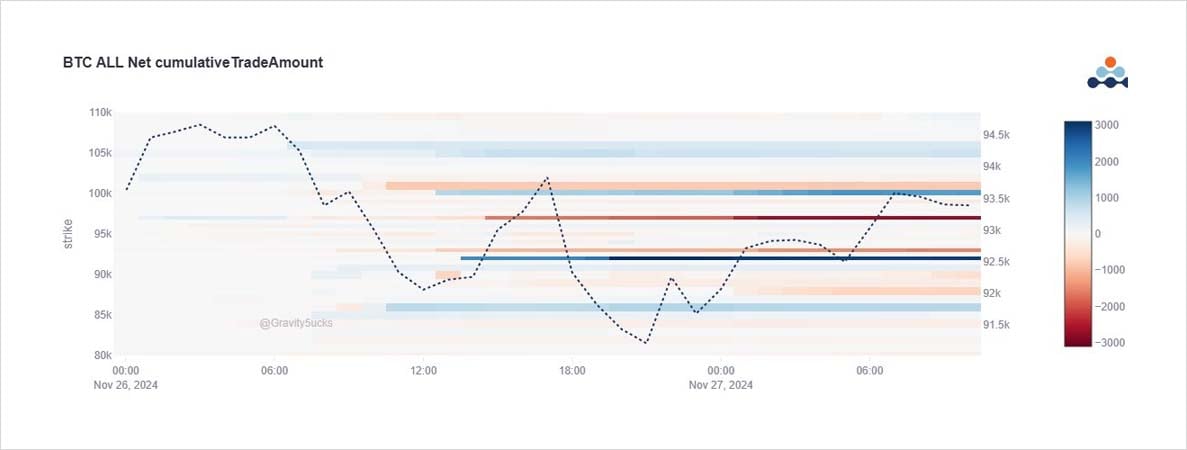

2) Chart shows:

First hedge: Dec 86-101k RR bought for the Puts.

First TP-unwind Dec 90k Calls sold.

Then dumping on DSOB of Dec 97+100k Calls.

As IV drops, buyers of Dec 90+92k Straddles, +Dec 100k Calls.

Dec 92k Puts bought 2k+

More Dec 97k Calls block sold during US+APAC time.

3) It’s difficult to show the intraday move in IV from the dumping of Dec29 Calls which took Dec29 IV down 5% and created a temporary valley in the Dec29 maturity, before buyers stepped in to level the contours.

But what can be seen clearly is the monumental 1-day shift in Skew.

View Twitter thread.

AUTHOR(S)