Trade Strategy: Bear Call Spread

View: Moderately Bearish View on BTC

- Sell 1x BTC-17MAR24-72,500-C @ $400

- Buy 1x BTC-17MAR24-74,000-C @ $250

Target: Spot level < $72,500

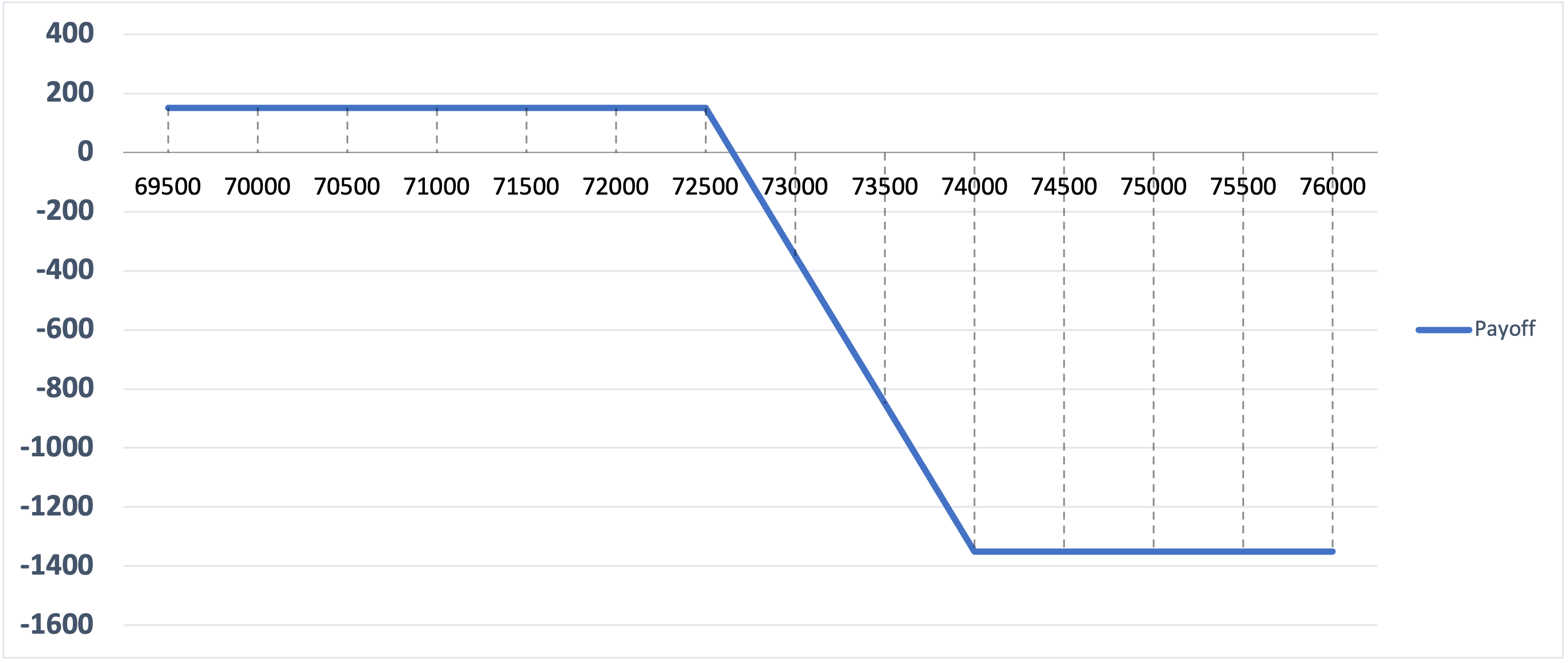

Payoff chart at Expiry

- Net Credit of Strategy: $150/BTC

Why are we taking this trade?

Following its ascent to new all-time highs, BTC has begun to exhibit significant retracements and has breached a 4-hour support level. A fresh supply zone or resistance zone has materialized on the 4-hour chart, approximately around the 72400 levels.

In light of these recent developments in BTC’s price action, the bear call spread strategy emerges as an enticing opportunity to leverage potential gains. This strategic approach serves to confine losses to the disparity between the strike prices and the net credit received. For instance, within our current scenario, this would equate to $1350 ($72,500 – $74,000 – $150).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)