Trade Strategy: Call Ladder

View: Moderately Bullish View on BTC

- Buy 1x BTC-15MAR24-72000-C @ $1300

- Sell 1x BTC-15MAR24-74000-C @ $900

- Sell 1x BTC-15MAR24-78000-C @ $400

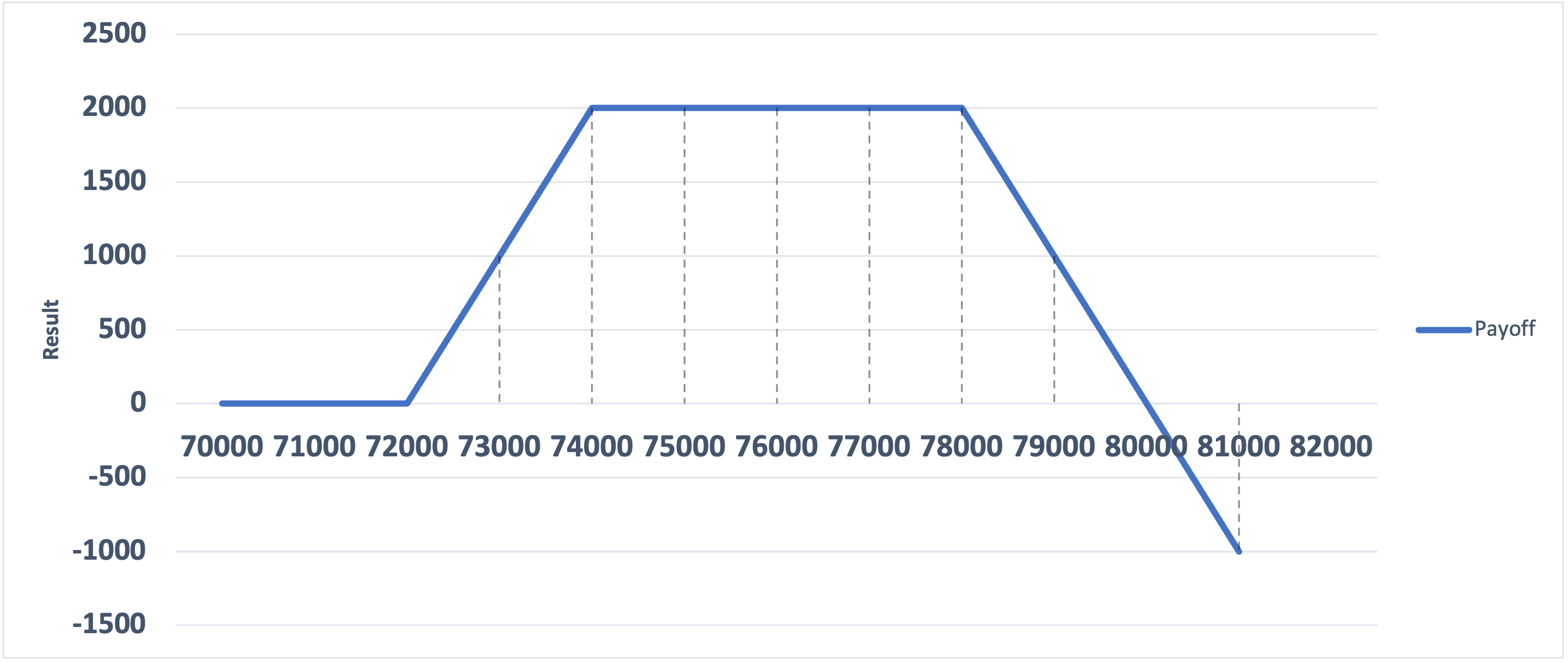

Target: Spot level > $74,000 & < $78,000

Payoff chart at Expiry

Max Profit: $2000/BTC

Net Debit: $0/BTC

Why are we taking this trade?

BTC is currently forming higher lows on its daily chart and has demonstrated resilience since March 6th, recently achieving a new all-time high. Anticipating further upward momentum, I foresee BTC ascending to new peaks in the coming days, possibly reaching $74,000. To leverage this potential move, a 1 x 1 x 1 call ladder strategy presents an appealing opportunity.

Notably, there is significant open interest at both $74,000 and $78,000, suggesting these levels could serve as points of resistance, potentially maximizing profits within this range.

It’s important to note that while the initial debit of this strategy is $0, losses are possible. However, a sudden surge in volatility leading to a substantial upward movement wouldn’t be advantageous due to the position’s net short call exposure.

If the underlying price reaches $76,000 within the next two days, it may be prudent to consider closing the position to secure potential gains.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & create combo (Call Ladder).

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)