View on market

I expect BTC to face more selling pressure due to the current resistance it’s encountering, intensified by negative flows in spot BTC ETFs. For traders aiming to play this market, the Put Ratio spread strategy might be a good option to explore.

Put Ratio Spread

The proposed strategy is a Put Ratio Spread Strategy. A Put ratio spread involves buying a put option that is OTM, and then selling two (or more) of the same option type (Put) of the same expiry, further OTM.

You might consider executing this strategy if you expect BTC prices to fall further from the current levels.

Trade Structure

(OTM Put) Buy 1x BTC-27APR24-$61,000-P @ $215

(OTM Put) Sell 2x BTC-27APR24-$59,000-P @ $100

Target: Spot level > $59,000

Payouts

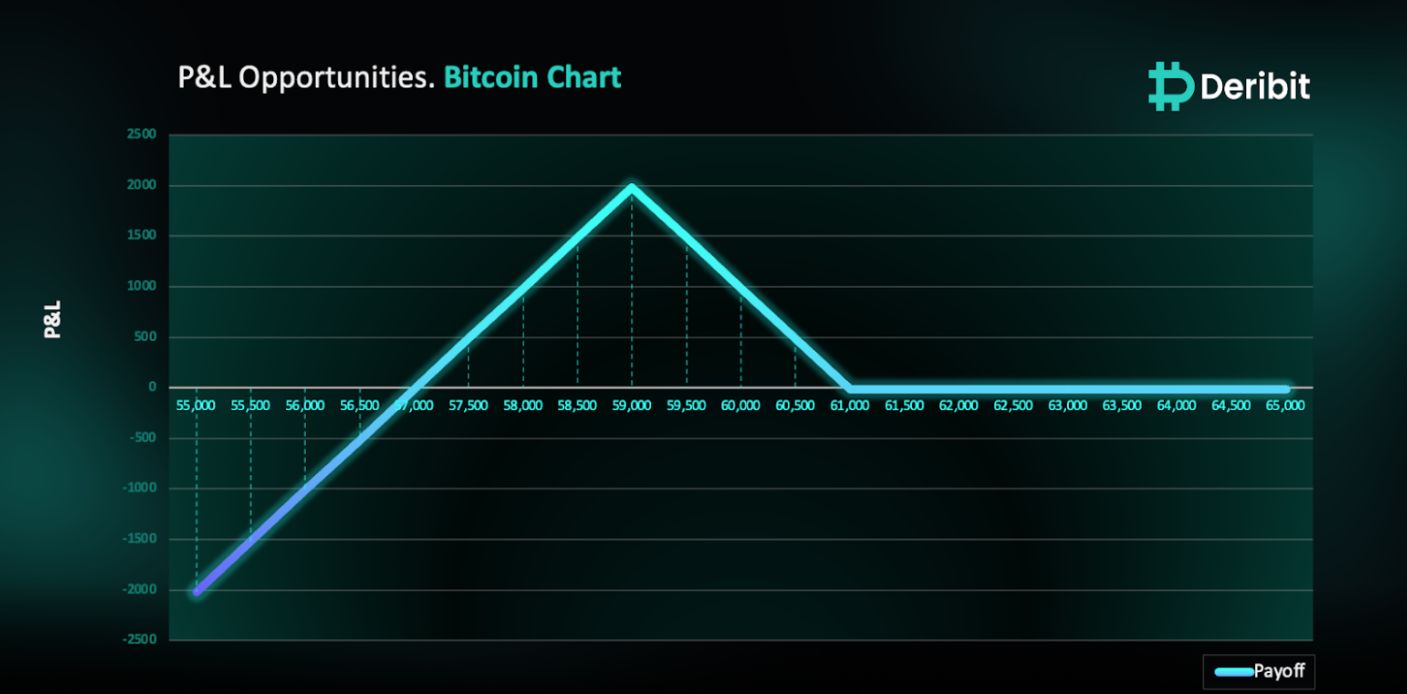

Maximum Profit: $1,985/BTC

Debit of Strategy: $15/BTC

Why are we taking this trade?

Today’s insights present a more assertive take compared to our previous analysis because Bitcoin has displayed reactions around the initial resistance/supply zone mentioned in past Insight’s, indicating selling pressure underneath. This was definitely influenced by negative flows from US BTC Spot ETFs.

Looking at the 4-hour chart, I noticed BTC prices faced rejection from dropping below the $59,000 pivot points. Consequently, I expect Bitcoin to continue its decline and seek support around the critical $59,000 pivot point. This level is significant for Bitcoin, having previously pushed prices up to a high of $73,800. This support zone might temporarily stop Bitcoin’s downward trend, giving traders an opportunity to maximize the gains from the suggested strategy.

Hence, I recommend a put ratio spread strategy to benefit from potential price declines amidst market volatility.

To execute this approach, traders can purchase a put option with a higher strike price (e.g., $61,000) while simultaneously selling double the quantity of puts at a lower strike price (e.g., $59,000).

If the Bitcoin price is at $59,000 when the options expire on April 27th, traders will achieve maximum profit from this strategy.

It’s important to note that while the initial debit of this strategy is $15, losses beyond the initial debit are possible due to the position’s net short put exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)