View on market

BTC appears poised for upward movement, supported by factors like RSI hitting 40% and 50% Fibonacci retracement, signaling potential for gains. Grayscale’s GBTC recording inflows after a prolonged outflow streak and weaker U.S. jobs data hint at continued momentum. Technical analysis also suggests potential for BTC to rally further, making a call ratio spread strategy favorable for traders.

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call ratio spread involves buying a call option that is OTM, and then selling two (or more) of the same option type (Call) of the same expiry, further OTM.

You may consider taking this trade if your perspective aligns with a sideways to bullish outlook on BTC.

Trade Structure

(OTM Call) Buy 1x BTC-10MAY24-$70,000-C @ $199

(OTM Call) Sell 2x BTC-10MAY24-$72,000-C @ $96

Target: Spot level < $72,000

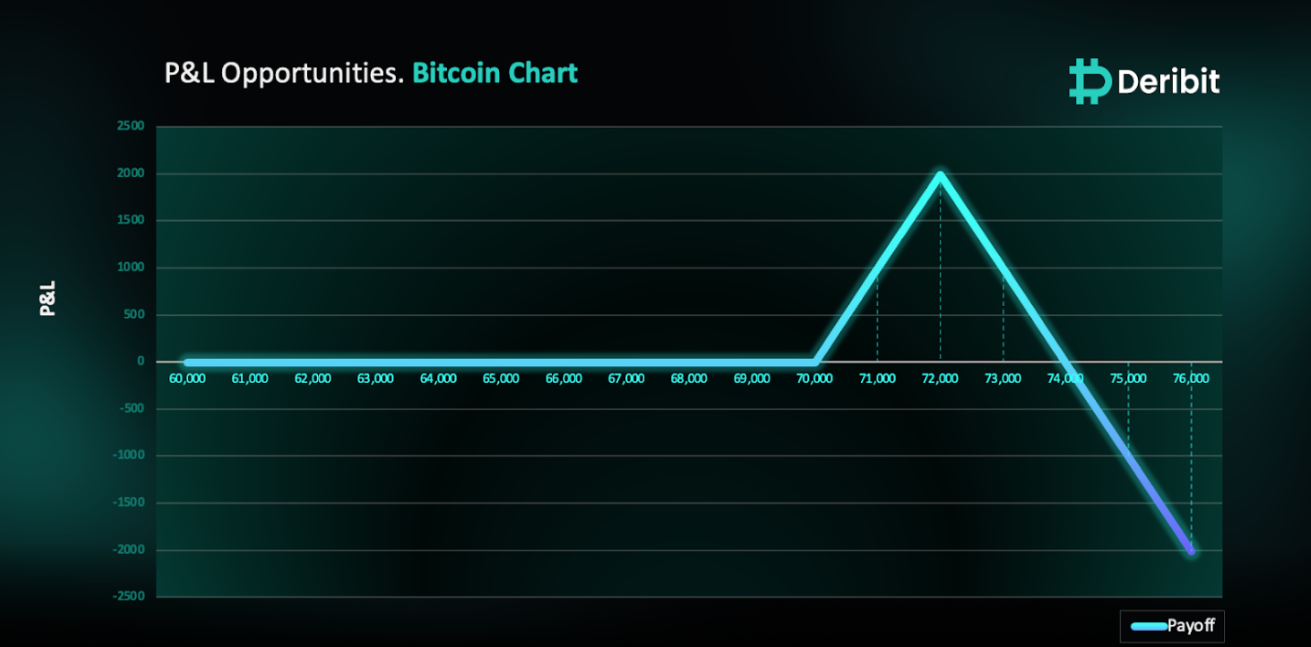

Payouts

Maximum Profit: $1,993/BTC

Net Debit of Strategy: $7/BTC

Why are we taking this trade?

In my previous Insights, I anticipated Bitcoin to maintain a sideways to upward trajectory, supported by several factors, for eg – BTC’s RSI hitting 40%, historically associated with rally attempts, along with a 50% Fibonacci retracement, indicated a favorable room for upside price potential. Additionally, the observation of Higher Lows reinforced our bullish outlook, resulting in profitable outcomes for traders who opted for Bull put spread strategy.

Recent developments further bolster the case for a sustained rally. Grayscale’s GBTC spot Bitcoin ETF recorded $63 million in inflows, marking the end of a 78-day outflow streak. Moreover, weaker-than-expected U.S. jobs data has contributed to a decline in dollar strength, increasing the likelihood of a rate cut in September. These factors collectively indicate potential continued upward momentum in the market.

Source: GBTC daily flow, Farside Investors.

In addition to the aforementioned macroeconomic factors, my technical analysis supports the continuation of the rally. Higher highs have emerged on the BTC price chart, as depicted in the attached 4-hour BTC price chart. Presently, we find ourselves trading near the flip zone, which previously served as a support area and since its breach during last week’s sell-off, it has now transformed into a resistance level. However, the lack of significant rejections from this price zone suggests a potential imminent breakthrough.

Given these technical indicators, it’s plausible to anticipate BTC to advance further from current levels, with potential resistance anticipated around the $72,000 mark. Traders interested in capitalizing on this perspective might consider employing a call ratio spread strategy.

To implement this strategy, traders can buy a higher strike call option (e.g., $70,000) and simultaneously sell calls in double quantity (2x) of a higher strike price (e.g., $72,000).

If Bitcoin is at $72,000 when the options expire on May 10th, traders will be at maximum profit from the strategy.

It’s important to note that while the initial debit of this strategy is $7, losses beyond the initial debit are possible due to the position’s net short call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)