Trade Strategy: Bull Put Spread

View: Moderately Bullish View on BTC

- Sell 1x BTC-15MAR24-71,500-P @ $350

- Buy 1x BTC-15MAR24-70,500-P @ $200

Target: Spot level > $71,500

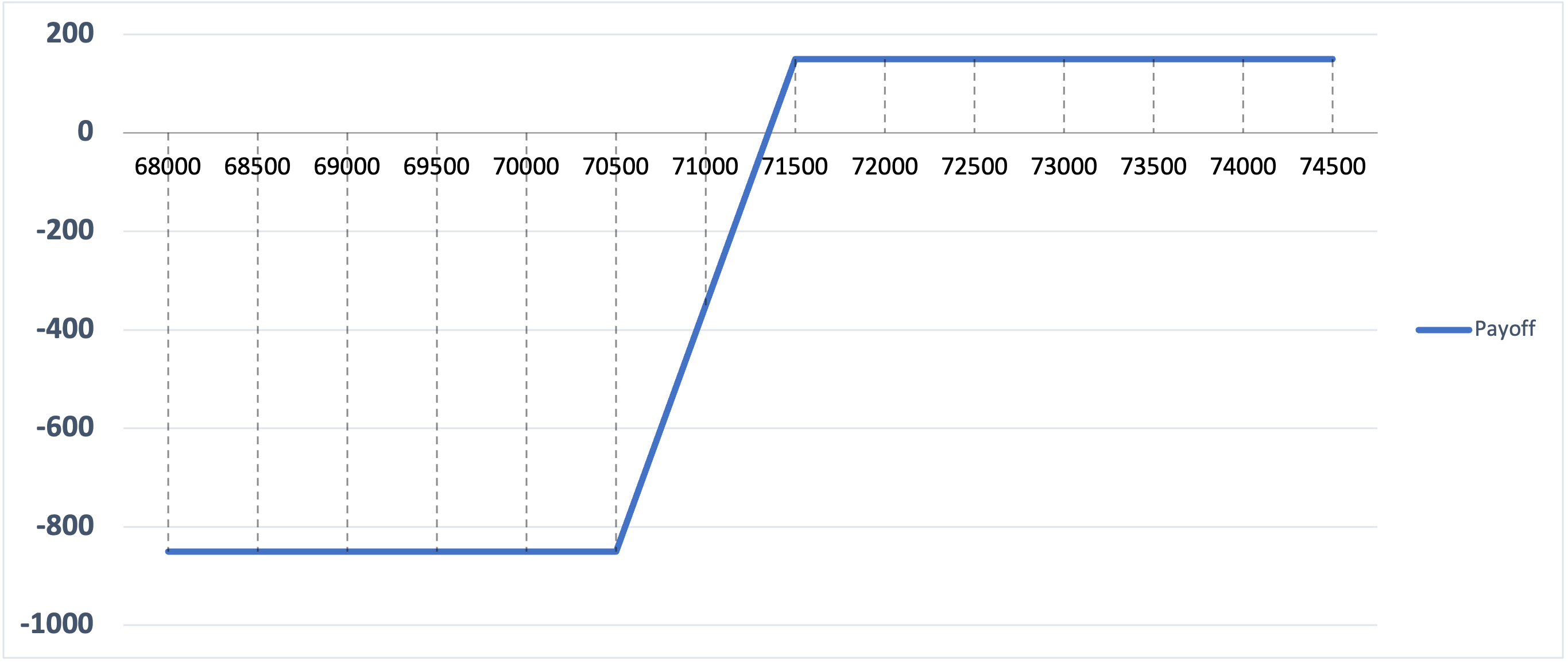

Payoff chart at Expiry

- Net Credit of Strategy: $150/BTC

Why are we taking this trade?

On examining the 4-hour chart of BTC, it becomes evident that there are numerous demand zones and support areas being respected consistently during minor retracements. Currently, there are no significant signs of retracement or breaches of these support levels, with BTC maintaining its proximity to all-time highs.

With this continued upward momentum in mind, the bull put spread strategy emerges as an appealing option to capitalize on potential gains. This strategy limits losses to the difference between the strike prices and the net credit received. For instance, in our scenario, this would amount to $850 ($71,500 – $70,500 – $150).

Furthermore, it’s noteworthy that substantial open interest exists on call options above $76,000. This indicates that BTC potentially has more room to the upside, thereby offering opportunities to optimize profits beyond the $71,500 mark.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)