View on market

Bitcoin shows signs of retracement following a breakout from symmetrical triangle pattern, with the $62,000 demand zone pivotal for potential pause in the sell-off, here’s a trading approach for traders.

Put Ratio Spread

The proposed strategy is a Put Ratio Spread Strategy. A Put ratio spread involves buying a put option that is OTM, and then selling two (or more) of the same option type (Put) of the same expiry, further OTM.

You might consider executing this strategy if your short-term outlook on BTC is bearish.

Trade Structure

(OTM Put) Buy 1x BTC-12APR24-$64,000-P @ $160

(OTM Put) Sell 2x BTC-12APR24-$62,000-P @ $78

Target: Spot level > $62,000

Payouts

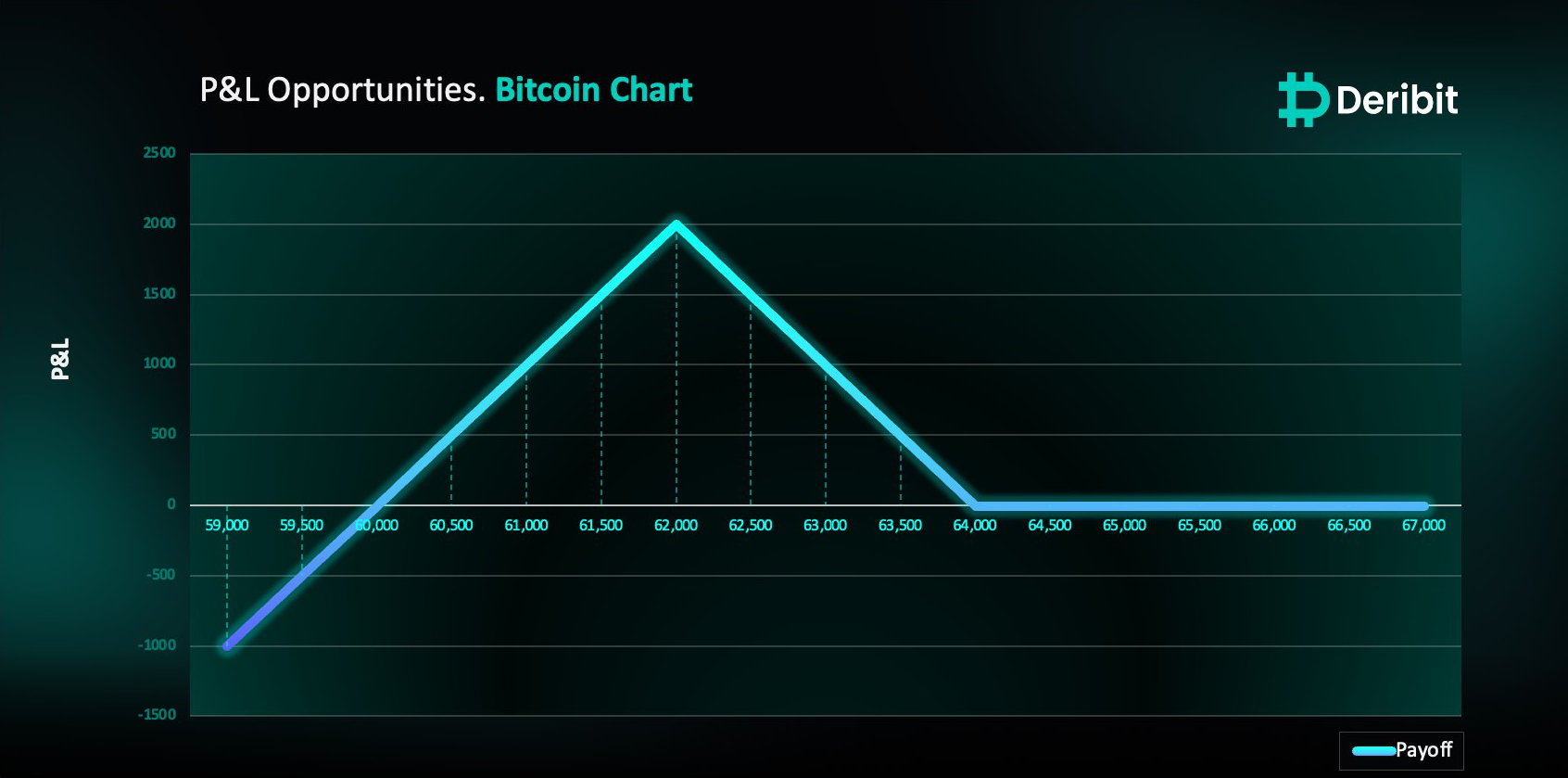

Maximum Profit: $1,996/BTC

Debit of Strategy: $4/BTC

Why are we taking this trade?

Bitcoin has displayed notable retracements following its breakout from the symmetrical triangle pattern. Additionally, on the 1-hour timeframe, the demand zone that facilitated the breakout failed to hold during yesterday’s market sell-off and is now serving as resistance to BTC’s upward movement, further aided by Bitcoin ETF outflows.

The next significant demand zone is around $62,000, which holds significant importance for BTC as it was responsible to propel prices to reach a high of $73,800. This demand zone might serve as a potential pause in the BTC sell-off, enabling participants to capitalize on gains using the suggested strategy.

Hence, traders can utilize a put ratio spread strategy to benefit from potential price declines amidst market volatility.

To execute this approach, traders can purchase a put option with a higher strike price (e.g., $64,000) while simultaneously selling double the quantity of puts at a lower strike price (e.g., $62,000).

If the Bitcoin price is at $62,000 when the options expire on April 12th, traders will achieve maximum profit from this strategy.

It’s important to note that while the initial debit of this strategy is $4, losses beyond the initial debit are possible due to the position’s net short put exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)