The Option Wizard assists you in finding the optimal option strategy based on your price prediction. This guide explains how the Option Wizard works. We’ll first provide a short introduction to option strategies and option pricing.

You can find the Option Wizard here. Alternatively, you can add the tool as a component by clicking ‘Add component’ on your Deribit trading page, and then selecting Option Wizard in the dropdown menu.

Options and strategies

An option is a versatile investment and trading instrument. Whether you predict a currency or asset will rise, fall, or remain stable, options allow you to capitalise on any expectation. You can also decide how much risk you want to take. For nearly every expectation and risk level, a strategy is available, sometimes using a combination of bought and written call and put options.

Choosing a good option strategy can be challenging, especially for less experienced option traders. This choice is more difficult if you are not familiar with the different available option strategies and don’t have your own systems set up to calculate which options will be the most profitable in a given situation. However, even more advanced traders can save time by using software tools to make calculations for them.

Option pricing

The price of an option consists of intrinsic value and extrinsic value. The intrinsic value is defined as the difference between the market price of the underlying asset and the strike price of the option, or how far in-the-money the option is. The extrinsic value, which is the part of the option price above the intrinsic value, is affected by several factors:

- Remaining lifespan of the option (this is why extrinsic value is also known as time value)

- Volatility of the underlying asset (or more specifically, the market’s expectation of future volatility, also known as implied volatility)

- Implied interest of futures

Option traders use mathematical models to value options, which take these influences into account. The most well-known of these is the Black-Scholes model, which allows for the calculation of a theoretical option price. Even though these models are not perfect, they allow for better comparisons between options, and give traders a mathematical framework to make well-founded investment decisions. Not all traders have the time or desire to build complicated systems, or study mathematical models though, and they simply want to know what the best course of action is given their price prediction for a particular market.

Option Wizard

Deribit now offers the Option Wizard to make it easier for individual investors to use options to express their view on the market. This tool provides you with an optimal option strategy based on your market expectations in a matter of seconds. You have full control over the strategy requirements: you determine your risk, the predicted price, and the timeframe for the prediction. The Option Wizard uses real-time prices from the option markets on Deribit, ensuring the most accurate estimate of your results.

Please note! The Option Wizard assumes you have basic knowledge of options. If you are not yet familiar with the workings and risks of purchased and written call or put options, we advise you to first consult the Deribit Options Course here.

Using the Option Wizard

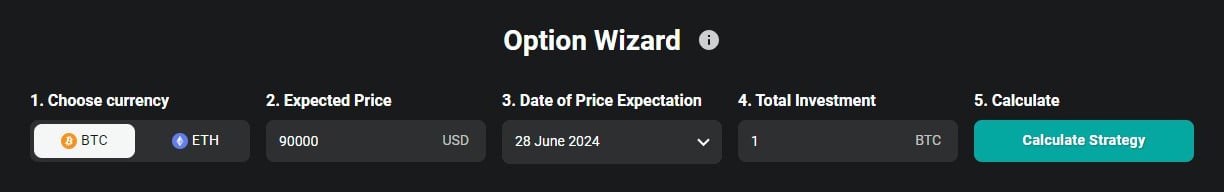

If you want the Option Wizard to calculate a strategy, you must provide four pieces of information.

These are:

- The currency for which you want to calculate an option strategy.

- Your price expectation for this currency.

- The date for which your price expectation applies.

- The maximum amount you want to invest in this option strategy.

Please note! If you provide a market expectation that has an extremely low probability of occurring, you may see some unusual strategy suggestions. For example, if you predict that the price will increase 200% by tomorrow (a very low probability event), the Option Wizard will likely suggest buying as many of the cheapest available call options for tomorrow as you can buy with your total investment. As they will be very cheap, the quantity suggested may be far larger than the number of options it’s possible to purchase in a single order.

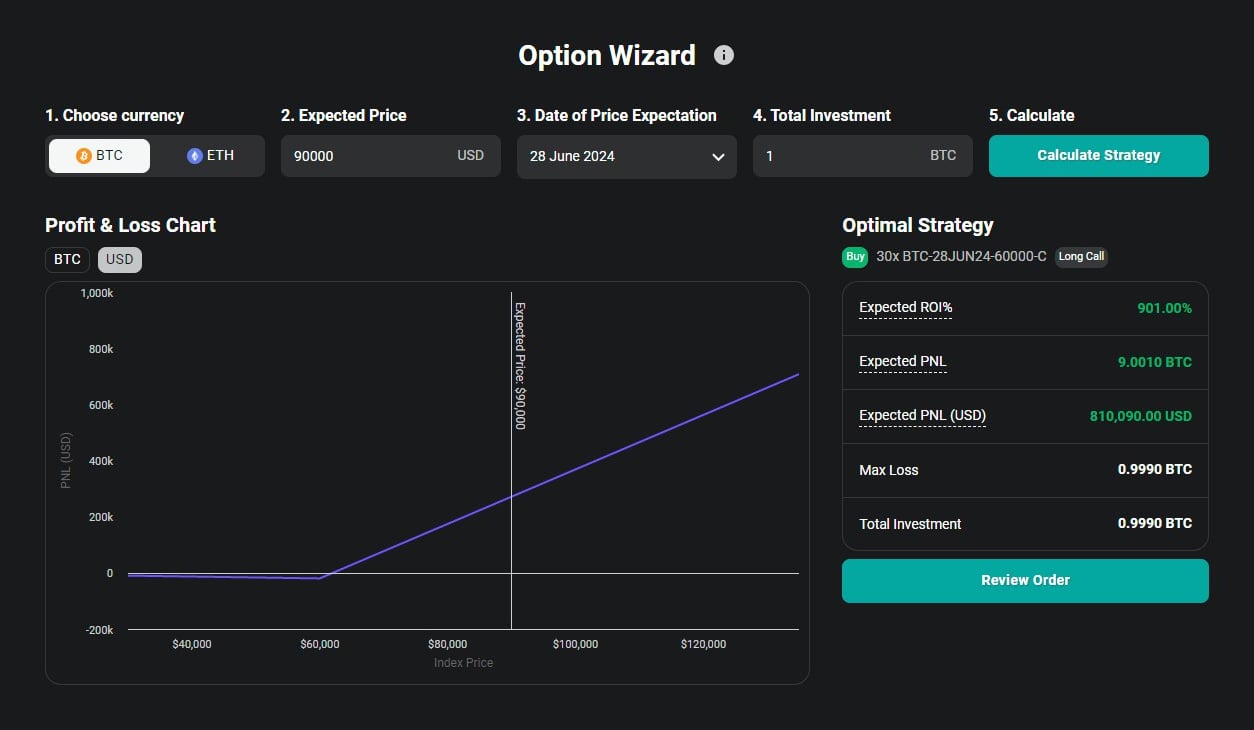

Optimal option strategy

After calculating the potential profit of each option, the Option Wizard selects one option strategy, which has the highest expected return. For the selected strategy, the Option Wizard provides you with an estimate of:

- Expected profit (assuming your prediction is correct).

- Return in %.

- Maximum loss.

Graph

The graph shows the payoff (profit and loss) of the strategy for various underlying prices, with the predicted underlying price that you entered highlighted with a vertical line. The point where the profit/loss line crosses the horizontal axis is the break-even point of the strategy.

Place an order

When you want to trade a strategy, you can begin by clicking the “Review Order” button. The order form will then popup, and you can confirm the details of the order before clicking “Confirm Order”.

Please note! The initial calculation of the option strategies does not take into account the available balance of your account. You need to check in advance whether the purchase of the entire strategy fits within your financial capabilities.

Interpreting the outcomes of the Option Wizard

It is important to correctly interpret the results when using the Option Wizard. The Option Wizard calculates the optimal strategy based on real-time prices which are of course subject to change as time passes and as the market moves. The profit, return, and maximum loss estimates are all based on the current option prices. If the option price changes between strategy calculations, or if you manually edit the Limit Price of the order, the values for each of those estimates would also change.

The Option Wizard does not have the ability to determine the probability of a prediction occuring. The tool will take your prediction and the current option prices, and tell you what strategy would be most profitable in the event that your prediction is precisely correct. However, the Option Wizard does not provide any assessment regarding the likelihood of your prediction being accurate.

The calculation of the option strategies does not take into account the composition of your portfolio, or the available funds in your account. You need to determine whether the use of an option strategy fits with your personal situation.

Give the Option Wizard a try here.

AUTHOR(S)