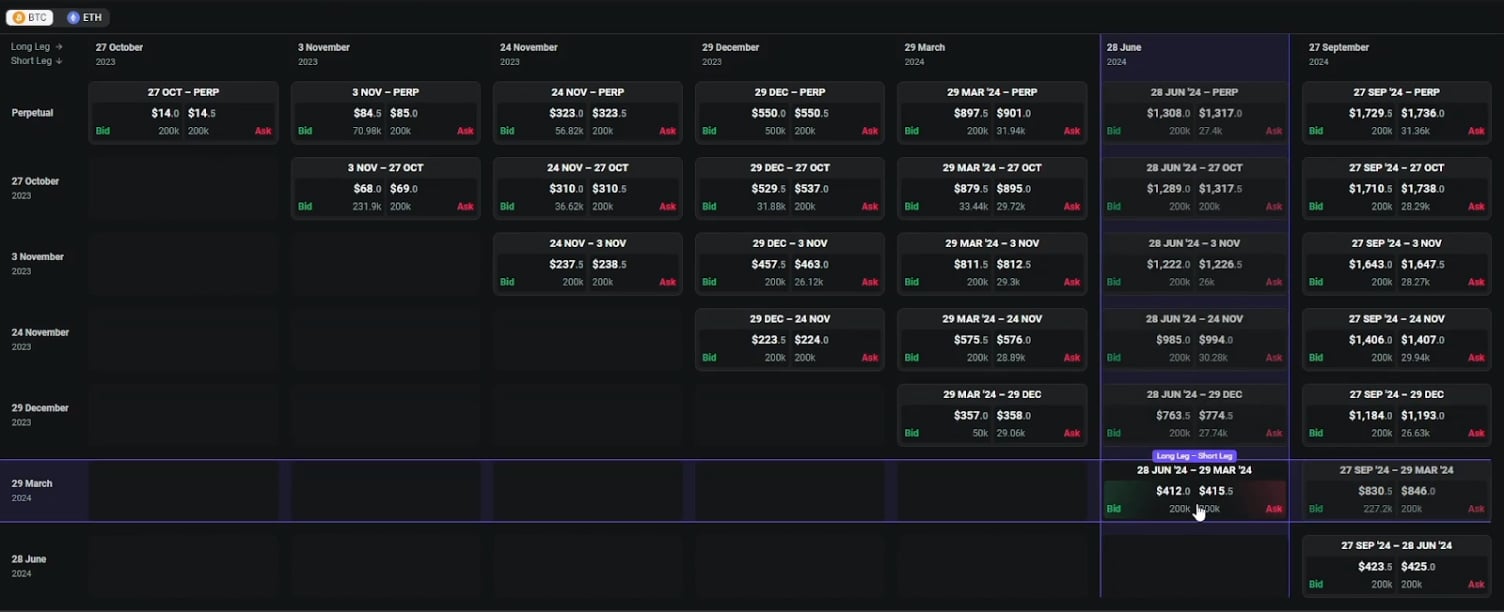

The futures spreads matrix allows traders to find and trade futures spreads with ease. It shows all of the available futures spreads for the chosen currency in a grid layout.

The futures spreads matrix can now be found in the menu at the top of the screen, or visit directly here.

A futures spread allows a trader to trade two different futures contracts (including the perpetual) in opposite directions simultaneously. This allows traders to trade futures spreads or roll futures positions without having to trade each leg separately in the individual order books.

Whenever we trade a futures spread, we are buying one of the futures and selling the other. In the futures spread matrix, there is a list of the available futures across the top, and down the side. From the point of view of the buyer of the spread, the columns represent the long leg (the future that will be bought), and the rows represent the short leg (the future that will be sold).

With the exception of the perpetual, which does not have an expiry date, the columns represent the future with the longest time to expiry, and the rows represent the future with the shortest time to expiry.

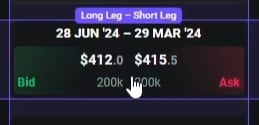

Let’s say that we want to trade the spread between the March ’24 future, and the June ’24 future. In this case we look in the June ’24 column, and follow it down until we reach the March ‘24 row.

There we can see the current best bid of 412, and the current best ask of 415.5. We can also see the size of the best bid and ask.

Placing a trade

To actually trade this spread, in either direction, we can click anywhere in this frame. This will bring up the order book for this futures spread.

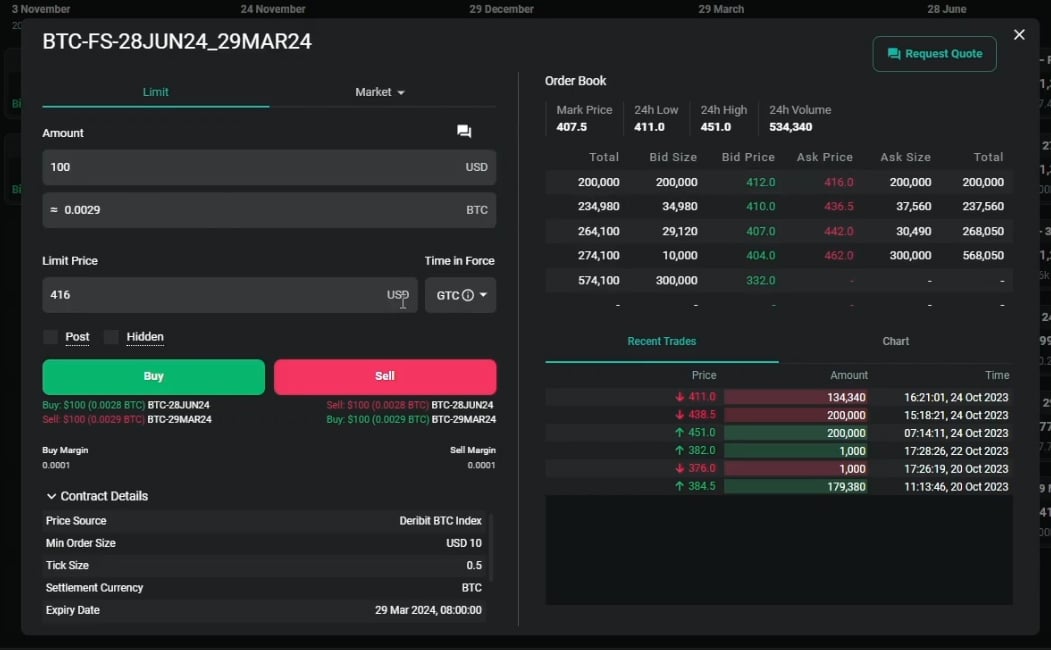

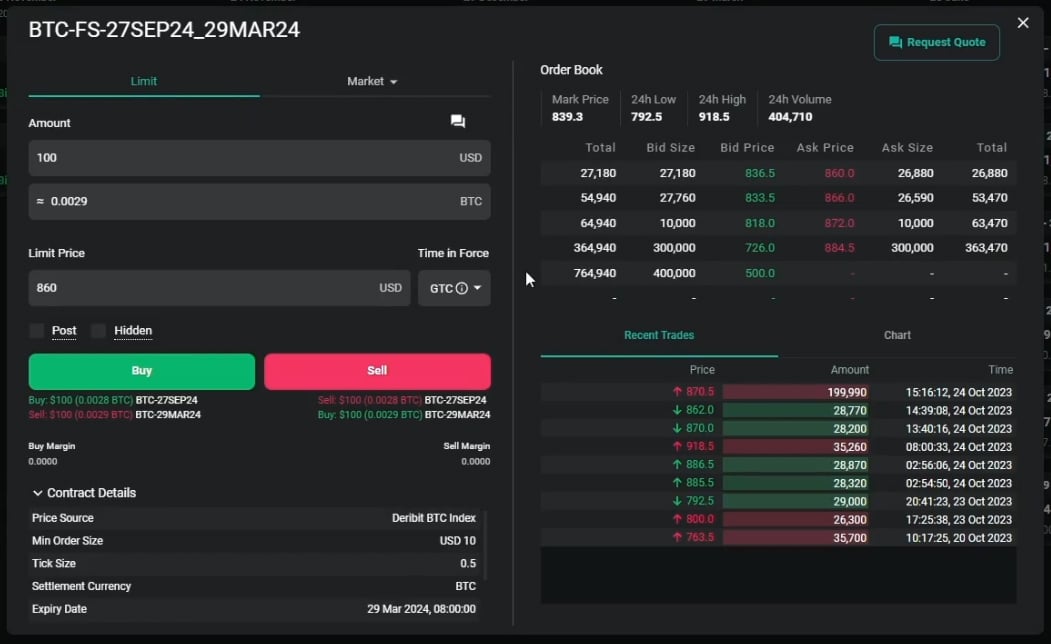

The order form is on the left, and the order book, with the various bids and asks, is on the right.

If we want an immediate fill, we can trade into one of the orders resting in the order book. Or if we prefer, we can leave a limit order at our chosen price.

For this example, let’s assume that we want to buy this spread, which we may want to do if we expect the spread between these two futures to increase. As we can see under the Buy button, this will result in us both buying the June future, and selling the March future. If we use a position size of $100, we will simultaneously buy $100 of the June future, and sell $100 of the March future.

To get an immediate fill, we will buy into the best ask of 416. So with a quantity of 100, and a limit price of 416, let’s buy into the best ask.

Once our order is filled, we can see both of our positions in the positions table. We are now long $100 of the June future, and short $100 of the March future.

Closing individual legs

Even though we executed our transaction using a single order, the positions are separate, just as they would be if we had traded each leg separately. We are still free to trade them separately now if we wish.

For example, let’s say we no longer wish to be long the June future. To close this leg, we can simply sell this position back into the market. So, let’s sell $100 of the June future to close our long in the June future.

Once the June position is closed, the only position that remains is the short in the March future.

Rolling a futures position with a futures spread

It is also possible to use a futures spread to roll a futures position from one future to another. We are currently short the March future, but let’s say we want to roll this position to the September future instead. We may want to do this to roll a cash and carry position for example, or the March future may be about to expire and we still want to have a short futures position.

Regardless of our reasoning, to achieve our goal of rolling the position to the September future, we need to buy back the March future, and sell the September future. The September/March futures spread will help us do exactly that.

We want to buy the March future, and sell the September future. This combination can be seen under the Sell button, so we will be selling this spread. Let’s just sell directly into the best bid to get an immediate fill.

Once our order has been filled, we can see the result in the position table. Our position in the March future has been rolled to the September future, just as we wanted.

Why futures spreads

Futures spreads offer a convenient way to trade two futures with a single order. The futures spread order books also often benefit from better liquidity than trading in the individual order books. And the futures spreads matrix offers a simple way to view all of the futures spreads at once, and find the one you want.

AUTHOR(S)